Asensus Surgical (ASXC) Stock Sees Sell-Off At Higher Level: A Good Buy Now?

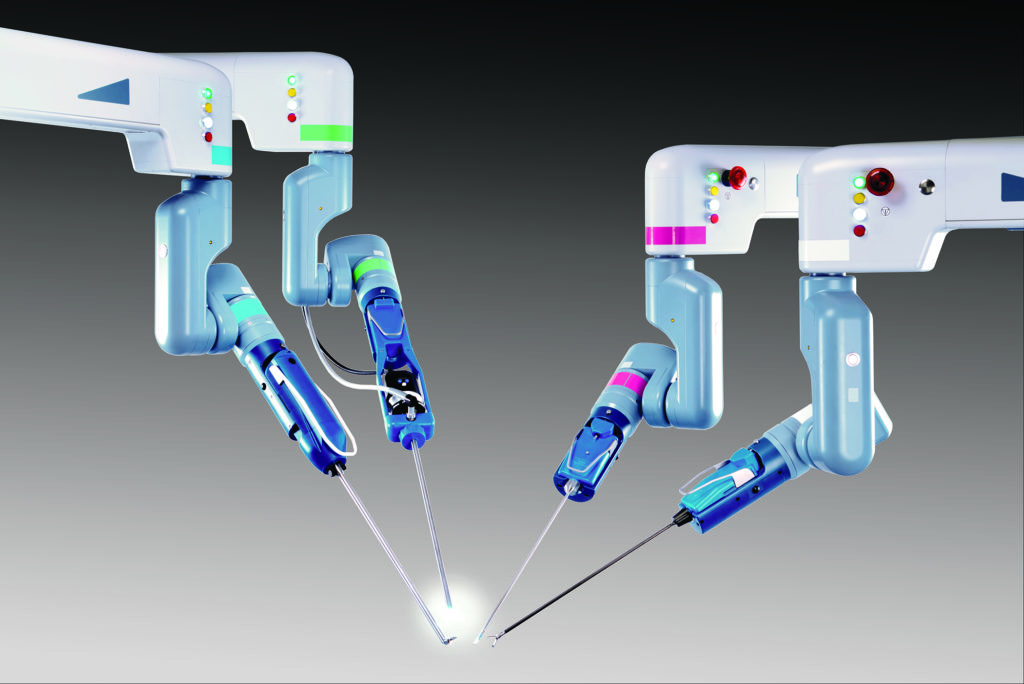

The robotic surgery industry has grown at a fairly impressive clip over the course of the past few years and nowadays investors are becoming increasingly interested in this particular sector. One of the companies that could be of interest to such investors is Asensus Surgical (NYSEAMERICAN:ASXC), which is currently one of the notable players in the sector thanks to its main product Senhance System.

The product is meant for providing assistance during surgeries. However, if anyone is looking to analyze the Asensus stock then it is necessary to recognize that the situation may be a bit more complex. The most important thing to note that in addition to providing assistance for surgical procedures, Senhance System is also meant for cutting costs.

On the other hand, it is also necessary to remember that the Asensus stock had been caught up in the meme stock frenzy earlier this year and rallied hard as retail investors from Reddit piled on to the stock in a big way. As a matter of fact, the stock rallied by as much as 900% at the beginning of the year in a matter of few months.

However, such gains don’t last in general and it didn’t for the Asensus stock. The company’s product is ideal for laparoscopic surgeries since it is one type of surgery that has proven to be ideal for robotic solutions. Robotic surgery is expensive but Asensus has designed Senhance System in such a way that it can reduce costs by utilizing reusable standard instruments.

HUMBL Inc (HMBL) Stock Finds $1 Support And Moving Higher: A Bullish Sign?

Earlier this year, the HUMBL Inc (OTCMKTS:HMBL) stock emerged as one of the major gainers from among penny stocks this year. In recent times, the HUMBL stock has made much steadier progress but yesterday it was back in action and jumped by as much as 9.5% after the company made a major announcement.

The company revealed yesterday that Brian Foote, its Chief Executive Officer, decided to retire as many as 9350 shares of the company’s Series B Preferred stock that is owned by him. However, it is perhaps more important for investors to keep in mind that those shares are equivalent to as many as 93,500,000 shares of the company’s common stock.

Considering the reduction of the number of common stocks to such a degree, it came as no surprise that the HUMBL stock experienced a surge yesterday. At the time the request was submitted by the company, the market value of those shares stood at $100,000,000.

However, in this regard, it is perhaps also necessary for investors to keep in mind that the HUMBL CEO had earlier retired as many as 551,669,335 pre-split common shares in the company. Those shares had actually come from the share float as in November last year. On the other hand, any prospective investor needs to note that in recent months HUMBL has come into considerable focus due to the growth of its mobile payments business. The service has gained considerable traction on an international scale over the past months.

Netlist Inc (NLST) Stock Soars 140% in a Month: More to Come?

There are thousands of investors who are highly interested in micro-cap stocks and it is not surprising considering the enormous gains these stocks can often generate. One of the stocks from that category that has made an enormous run up the charts in recent days is that of Netlist Inc (OTCMKTS:NLST).

Over the course of the past month alone, the stock has managed to record gains of as much as 140% and in light of such gains, it might be a good idea to look into Netlist Inc a bit more closely. One of the more important things to point out with regards to the rally in the Netlist stock is the fact that the trading volumes have also gone up considerably as more and more investors piled on to it.

The powerful run could also be an indication of the fact that there might be important developments in the near future and that is another reason why investors need to keep a keen eye on Netlist.

The fortunes of the company actually changed last year after the United States Patent Trial and Appeal Board upheld the validity of one of the company’s patents for application in memory modules of DDR servers. At the time, many thought the stock was going to correct sharply but that never happened and the Netlist stock continued to move up. In this situation, it is going to be interesting to see if the Netlist stock can continue to hold on to its momentum over the coming days.

Dark Pulse Inc (DPLS) Stock Skyrocketed 625% in a Month: Still a Good Buy?

Investors are always on the lookout for stocks that can generate considerable returns within a few weeks and if you are looking for such a stock at this point, it could be a good move to take a look at the Dark Pulse Inc (OTCMKTS:DPLS) stock.

The stock continued to be in focus among investors on Tuesday and managed to record gains of as much as 37%. However, the real story lies in the fact that yesterday’s gains took the Dark Pulse stock’s gains over the past month to a staggering 625%. There was no news about the company yesterday and hence, it might be a good move to take a look at an announcement from the laser sensing systems company last week.

At the time, the company announced that it inked a letter of intent by way of which it was going to acquire the drone-based company TerraData Unmanned PLCC. The company is capable of providing a wide range of services including 3D modeled mapping that could be deployed in a range of industries.

In this regard, it is also necessary to keep in mind that the services from TerraData also help in underwater inspection work. Some of the other services could also be vital when it comes to tackling concerns related to public safety across air, water, and earth. Hence, it is no surprise that the acquisition has led to a certain degree of excitement among investors with regards to the Dark Pulse stock.

Northwest Biotherapeutics (NWBO) Stock Moves in a Range: What to do Now?

The Northwest Biotherapeutics Inc (OTCMKTS:NWBO) stock did not have a great time in the markets last week but investors would be hoping for it to make a quick rebound this week.

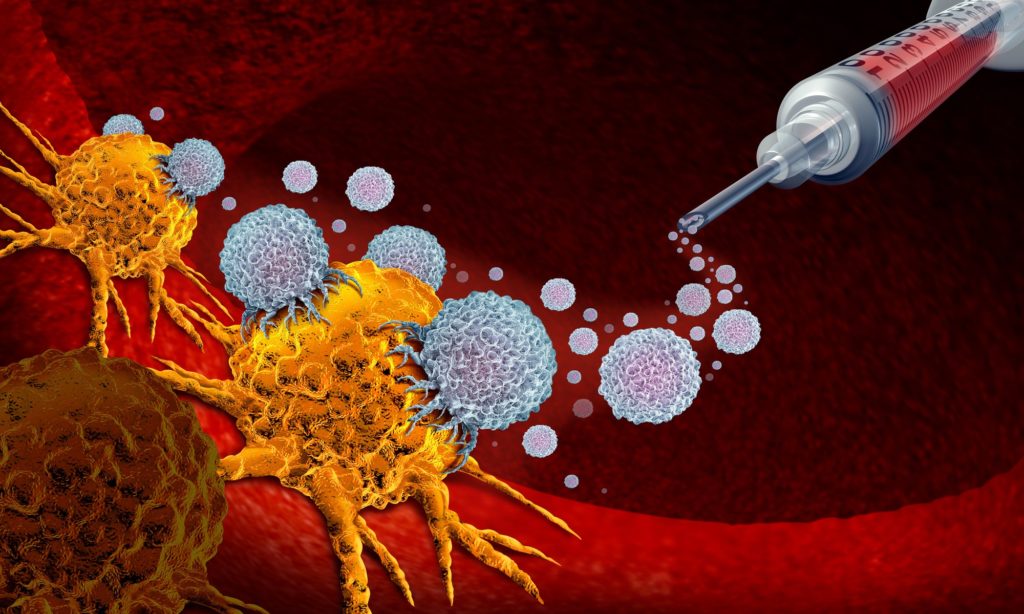

Although there was no fresh news with regards to Northwest, the stock declined by as much as 10% and it might be worthwhile for investors to perhaps take a look at some of the developments from the recent past in order to get a better idea about the company. Last month there had been considerable optimism about the stock following speculation from investors that the company was all set to get a major breakthrough in the Phase III trial of its product DCVax®-L. The product is meant for treating some of the variants of cancers that are most resistant to treatments.

Many companies have tried and failed to come up with a solution in this regard and hence, speculation regarding the possibility of Northwest getting a breakthrough with DCVax®-L proved to be a major boost. In this regard, it should be noted that the company seemed to have indicated that the top-line data from the Phase III trial was highly positive and that, in turn, led to many investors piling on to the Northwest stock in a big way.

In addition to that, it is also necessary to note that DCVax®-L has also got considerable attention from the mainstream press and that is another factor behind the rising interest in Northwest stock among many investors. The decline last week could well be an anomaly.

Regen BioPharma (RGBP) Stock Extends Jump on Heavy Volume: Are You Excited?

Those who are currently looking into major gainers in the biotech sector in recent days could consider taking a look at the Regen BioPharma Inc (OTCMKTS:RGBP) stock. This past week, the stock was in considerable focus among investors and managed to clock gains of as much as 51% through the week. The stock is up another 38% to $0.031 in the opening session on Tuesday.

The stock had really come into the attention of investors earlier this year in April when the company along with its subsidiary company KLS signed a licensing deal with Oncology Pharma Inc. As part of this agreement, Regen will be able to deploy some of the intellectual properties owned by Oncology Pharma for the development of treatments for pancreatic cancer. The licensing agreement is going to be in place for 15 years.

However, that is not all. There are certain other things that need to be kept in mind with regards to Regen BioPharma as well. At this point in time, the company is working on preparing its filings and eventually making the submissions so that it can get pink current status on the OTC Markets.

Once it gets that designation, the stock is expected to be even more attractive for many investors. The Regen stock has made a powerful move up the charts over the course of recent days and it is believed that it is on track to make similar moves that had been seen in some of the other micro-cap stocks like Tesoro and Enzolytics in recent months.

Marketing Worldwide (MWWC) Stock Keeps On Hitting New Highs: But Why?

Every day thousands of investors look into the possibility of investing in the next big thing from among micro-cap stocks and one of the stocks from that category of stocks to have come into prominence in recent days is that of Marketing Worldwide Corp (OTCMKTS:MWWC).

Investors piled on to the Marketing Worldwide Corp stock in a big way last week and the stock ended up clocking gains of as much as 230%. In light of the massive gains made by the stock last week, it might be a good move for investors to look into the stock a bit more closely. One of the things that ought to be mentioned in relation to the rally in the Marketing Worldwide Corp stock is that the stock has become very popular on the social media platform Twitter.

As is well known, social media chatter has increasingly become a significant factor in triggering strong rallies in micro-cap stocks. On the other hand, it has also emerged that the Marketing Worldwide stock is on the radars of some of the biggest investors in the micro-cap space and that could be another reason why the stock could continue to garner attention from investors this week as well. At this point in time, the stock is one of the most searched stocks online and that reflects the rising interest in it. It seems that the stock is looking to go on a similar run as some of the other major micro-cap gainers like Tesoro and Enzolytics among others.

88 Energy Ltd (EEENF) Stock Break Out Alert: How To Trade This Week?

If you are currently on the lookout for oil and gas stocks then it might be a good move to considering having a look into the 88 Energy Ltd (OTCMKTS:EEENF) stock. The stock was in considerable focus among investors this past Friday and managed to clock gains of 21%.

That took its gains for the previous week to as much as 65%. The rally in the stock on Friday was triggered after the company announced that it repaid all its debt. That said, the announcement to that effect had been made by the company on June 21. As a matter of fact, the stock is actually up 76% in the past 30 days. Another major announcement from 88 Energy was back on June 7 when it revealed that it decided to buy out the rest of the 50% stake held by its joint venture partner in Project Peregrine, an oil field in Alaska.

That transaction cost the company $18 million and the transaction was to be concluded in stock. Later on, on June 21, the company announced that it was all set to sell the oil and gas tax credits from its Alaskan project for $18.7 million. The company announced at the time that it was going to pay off all of its debts worth $16.1 million from the proceeds of the sale. That transaction was completed on Friday. The rest of the money, totaling $2.7 million, is going to be used to boost its cash reserves.