Full Disclaimer COEP

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $120,000 from Coeptis Therapeutics for profiling COEP. We own ZERO shares in COEP.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign.

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Full Disclaimer – Northern Superior Resources SUP

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive owned by King Tide Media has been hired by Northern Superior Resources Inc. for a period beginning on March 20th, 2023 to publicly disseminate information about (SUP) via website and email. We have been compensated up to $50,000 USD to profile SUP.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign.

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Remember Malartic? Why Northern Superior Could Be one of the Best Gold Plays Of 2023!

Gold investors have been waiting a long time for a shot at another Malartic and we believe we just struck gold with Northern Superior Resources (TSX-V: SUP) (OTCQX: NSUPF)!

Malartic was a big gold discovery in the province of Quebec which became a mine and the company owning it ended up being acquired for total considerations of C$3.9 billion! Of course, not all mining developers are as rewarding, but when a company is successful in that sector, the reward for investors can be astonishing.

For those investors who missed out on the 1000%++ returns that we have seen repeatedly in that industry, sit back and keep reading because we believe (TSX-V:SUP) (OTCQX: NSUPF) could be just as interesting and its value is currently only C$60M.

What do you get when you combine one of the largest consolidated gold discoveries in Quebec’s rich history and a rapidly rising gold price driven by global economy in a tailspin, possibly, even stronger gains?

Before we get into the 3 catalysts that could make Northern Superior Resources one of the best gold plays of 2023, let’s go over the basics…

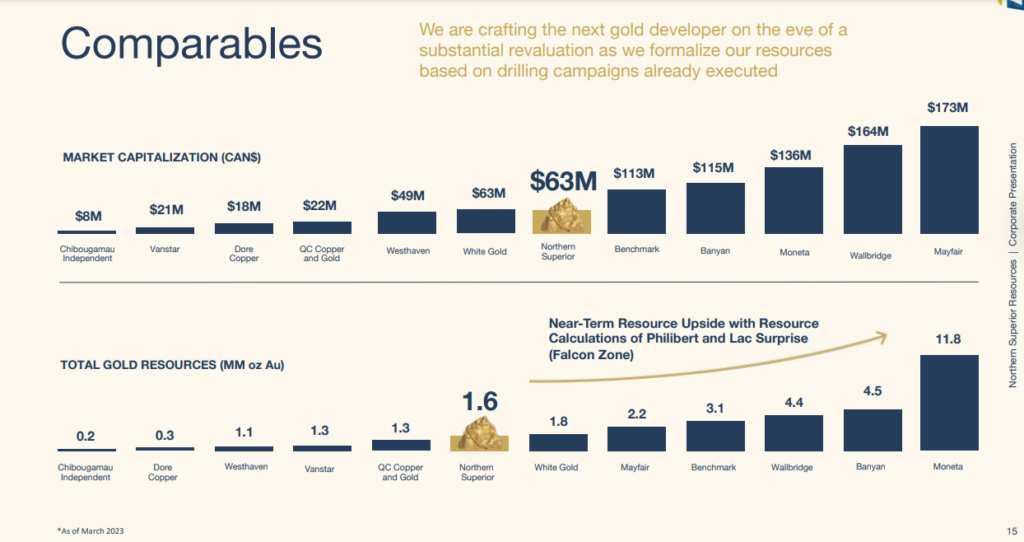

This company owns several deposits near each other and has been making headlines with its impressive drill results from the Philibert gold property in Quebec, where it has delineated of gold near surface over a 3-kilometre strike length.

Those deposits, including Philibert, are located in the rapidly emerging Chibougamau gold camp, which hosts the world-class Nelligan deposit. Nelligan was the “Discovery of the year[1]” in 2019. Many believe that the area, The Chibougamau Gold Camp, has the potential to be the next Malartic, as ounces grow and reach a level similar to one of the largest operating gold mines in Canada.

But that’s not all. Northern Superior also has a stellar executive team that has decades of experience in discovering and developing gold projects in Canada and abroad. The team includes Mr. Victor Cantore, Executive Chairman, a seasoned executive whose most recent win has been to take Amex Exploration from C$0.07 to more than C$3.50 per share in less than 2 years. This team is seriously invested. All in all, the insiders own more than 30% of the company and recently took down almost 20% of the $5M equity financing.

And if that’s not enough to convince you to take a look at Northern Superior, consider this: Northern Superior is well-positioned to benefit from the rising gold prices driven by stagflation. Stagflation is a scenario where inflation rises while economic growth slows down, creating a perfect storm for gold demand. As more investors seek a safe haven from currency devaluation and market volatility, central banks around the world keep buying and gold prices are already soaring to new heights.

BREAKING NEWS

TORONTO, ON / ACCESSWIRE / June 6, 2023 / Northern Superior Resources Inc. (“Northern Superior” or the “Company”) (TSXV:SUP) (OTCQX:NSUPF) is pleased to report the final assay results for nine holes completed on the Falcon Gold Zone (“FGZ“) on its large (20km x 15km) 100% owned Lac Surprise property, located within the Chibougamau gold camp, Québec.

Let’s do a quick summary on Northern Superior Resources (TSXV: SUP) :

Company Name: Northern Superior Resources

Ticker: (TSXV: SUP)

Exchange: TSX

Website: https://nsuperior.com

Northern Superior Resources Company Summary:

Northern Superior is a gold exploration company focused on the Chibougamau Gold Camp in Québec, Canada. The Company has consolidated the largest land package in the region, with total land holdings currently exceeding 62,000 hectares. The main properties include Philibert, Lac Surprise, Chevrier and Croteau Est. Northern Superior also owns significant exploration assets in Northern Ontario highlighted by the district scale TPK Project. The Company has indicated its intention to spin off the TPK Project, which could provide immediate benefit for shareholders.

Without further ado, the 3 catalysts that could make Northern Superior Resources the gold play of 2023:

- #1 The next Canadian Malartic

- #2 The Executive Team

- #3 Stagflation and Its Effect on Gold Prices.

Don’t miss this chance to consider Northern Superior While it is on the ground floor of one of the most exciting gold stories in Canada. Northern Superior Resources is a rare gem that could shine brighter than many others.

#1 The next Canadian Malartic

Attention, investors! This is your chance to consider getting involved on the ground floor of a once-in-a-lifetime opportunity where central banks keep buying gold, combined with an oppertunity to getting a do-over on Malartic. Why is that significant? The company that owned Malartic was sold for C3.9 billion! Northern Superior Resources Inc. is a junior exploration company that is poised to possibly become the next Canadian Malartic. How will they do that? It is simple, they have consolidated the area and continue to rapidly increase the size of those deposits. By owning all of those nearby deposits, Northern Superior is rapidly reaching a critical geological level where the camp could become a single large mining operation. This matters as viable ounces are worth significantly more than unviable ounces, hence the consolidation strategy.

If you’re looking for a golden opportunity to invest in one of Canada’s largest and most exciting gold companies, look no further than Northern Superior Resources Inc. Northern Superior is consolidating the Chibougamau Gold Camp in Quebec, a region that has produced over 6 million ounces of gold historically. The company has discovered or acquired several impressive gold projects, including the Lac Surprise project, which is adjacent to IAMGOLD’s Nelligan project, which was the “Discovery of the Year” in 2019, and hosts a total of 5.5 million ounces[2] of gold.

Northern Superior Resources Inc. also has district scale exploration potential in Ontario, where it owns 100% of the TPK project, the largest till anomaly in North America, something that is sure to get the attention of any geologist. The TPK project has shown exceptional gold and diamond results, with drill intercepts of up to 25.9 grams of Gold per tonne over 13.5 meters and a boulder carrying 727 grams of Gold per tonne. The company recently obtained its drilling permit for this asset and has indicated its intention of spinning out this asset into a new company to accelerate its development. If TPK were to repeat historical exploration success, directly or indirectly, the shareholders of Northern Superior would greatly benefit.

Northern Superior Resources Inc. is led by a seasoned management team with decades of experience in the mining industry. Let’s take a closer look at their team.

Executive Team

Victor Cantore is the Executive Chairman of Northern Superior Resources with over 25 years of experience in the mining industry, having worked as an investment advisor, head of institutional trading and a corporate finance specialist. He has been instrumental in raising funds and negotiating deals for several mining companies, including Amex Exploration, where he serves as the President and CEO. It is worth mentioning again that he took Amex Exploration from C$0.07 to more than $3.50 in less than 2 years!

Cantore is passionate about creating value for shareholders and stakeholders, while adhering to the highest standards of environmental and social responsibility. He believes that Northern Superior Resources has the potential to become one of Canada’s premier gold producers. He is committed to advancing the projects to the next level.

Simon Marcotte is one of the most accomplished and visionary leaders in the Canadian mining industry. He has a proven track record of creating value for shareholders through his involvement in several successful exploration and development projects across various commodities. Marcotte has over 25 years of experience in the mining sector, starting his career as a Chartered Financial Analyst with CIBC World Markets, Sprott and Cormark Securities.

In 2018, Marcotte was instrumental in launching Arena Minerals Inc., a lithium exploration company with assets in Argentina. He facilitated strategic investments from Ganfeng, the world’s largest lithium producers, and also from Lithium Americas Corp. Most important to investors, he was instrumental in the price appreciation from $.05 – $.75! Arena was finally acquired by Lithium Americas Corp. in 2023.

In 2020, Marcotte founded Royal Fox Gold Inc., where he served as President and CEO until November 2022, when he orchestrated a merger with Northern Superior Resources and was appointed President and CEO of Northern Superior Resources thereafter.

Marcotte is also the founder of Black Swan Graphene Inc., a graphene manufacturing company based on a proprietary technology developed by Thomas Swan & Co. Ltd., a leading chemical company based in England. The shares of Black Swan Graphene just recently went up by 400%.

Michael Gentile is one of the most successful investors in the mining sector in Canada. He has built a fortune by identifying undervalued and overlooked opportunities in the natural resources industry; after his latest capital injection in the company, he now owns 16% of Northern Superior.

Michael, a former fund manager, has developed a reputation as a savvy and visionary investor who could spot opportunities that others missed. He invested in companies that had strong fundamentals, low valuation, high-quality assets, and growth potential. He also looked for companies that were undervalued by the market or had catalysts for appreciation.

Some of his most notable investments include:

- K92: One of the most successful mining companies in recent years; Michael acquired a major stake in the company in 2017 between C$0.45 and C$1.00. K92 now trades around C$6.00 but reached more than C$10.00 last year!

- Arizona Metals: Michael first invested in Arizona Metals around C$0.18. A little more than a year later, the stock traded at more than C$6.00 per share.

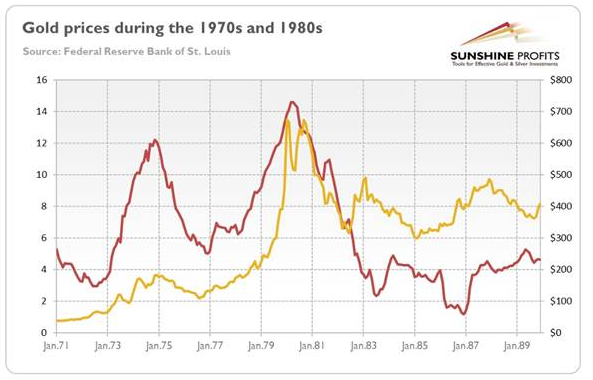

Stagflation’s Effect on Gold Prices

Gold investors have been waiting for this moment for almost 30 years, stagflation is upon us. The world is facing a serious economic dynamic. Stagflation, a situation where inflation is high and growth is slow, is absolute catnip for gold prices. Stagflation was once thought to be impossible by economists, but it happened in the 1970s, when an oil shock triggered a recession and soaring prices. This time, a step back in globalization, triggered by tension with China, and military activities in eastern Europe, are taking us down the same path.

What does this mean for investors? It means that they need to protect their wealth from the eroding effects of inflation. There is simply no better way to do that than by investing in gold, and this is why gold is already making new highs.

Gold has a long history of being a safe haven asset in times of turmoil. Gold preserves its purchasing power over time, unlike paper money that loses value as central banks print more of it. Gold also has a negative correlation with stocks and bonds, meaning that it tends to rise when they fall. Gold is therefore an ideal hedge against stagflation and market volatility.

But not all gold investments are created equal. Some are more risky and costly than others. That’s why we recommend taking a look at Northern Superior Resources, a company backed by a team with a proven track record of success.

Northern Superior Resources has a portfolio of high-quality projects in Canada, one of the most stable and mining-friendly jurisdictions in the world. The company has a strong management team with decades of experience in the industry. The company also has a low-cost structure and a healthy balance sheet, with no debt and ample cash.

In Closing – Northern Superior Resources Inc. has a diversified portfolio of gold in Ontario and Québec. The company’s value driver is its recent consolidation effort to put all of those deposits under one roof, opening the door to a single mining operation, and therefore increasing the value of those deposits. The flagship project, at least for the time being, is the Philibert Project, which has already seen more than 77,000 metres of drilling, a large part paid for by the Quebec Government, and is now about to publish a resource calculation. On its website, the Company is clear that it expects this resource publication to establish Philibert as a pillar in the Chibougamau camp. Philibert is only 9km away from Nelligan, so everyone will be quick to combine the size of those 2 deposits together and see the real value of this camp. The company also owns the Ti-pa-haa-kaa-ning (TPK) gold property, which has shown significant mineralization in several drill holes and the company indicated its intention to proceed to a spin out, which could also be an important catalyst for investors.

Northern Superior Resources Inc. is committed to creating value for its shareholders by advancing its projects to the next stage of development. The company has a strong financial position, having recently raised $5M with strong participation from insiders. The company also has a loyal shareholder base including several large institutional investors.

Don’t miss this opportunity to invest in one of the best gold exploration stories in the market. Northern Superior Resources offers you a chance to profit from the coming gold boom while protecting your wealth from stagflation.

Remember, just on of these catalysts could make SUP explode but there are three catalysts: #1 The Next Canadian Malartic #2 The Executive Team #3 Stagflation and Its Effect on Gold Prices.

Don’t miss this chance to take a look at one of the most exciting gold stories in Canada. Northern Superior Resources is a rare gem that could shine brighter than many others.

Act now before it’s too late.

Disclaimer

This Article contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions are intended to identify forward-looking statements. Should one or more of these risks and uncertainties occur or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. This article is not intended to be a solicitation to buy or sell securities and readers are cautioned to consult their own financial advisors before doing so.

Small Cap Exclusive owned by King Tide Media has been hired by Northern Superior Resources Inc. for a period beginning on March 20th, 2023 to publicly disseminate information about (SUP) via website and email. We have been compensated up to $50,000 USD to profile SUP. Full Disclaimer

Now or Never: NLST Added Another 21% Late Friday Gains +244% YTD

In the last hour of the trading week last week, Friday April 21, 2023, the stock price of our favorite long-term play, (OTC: NLST) Netlist, Inc., shot up over 31% off the day’s lows, hitting a high of $4.21 on the day.

On what began as a relatively slow day of trading, NLST’s spike in share price would’ve seemed to have come out of nowhere. However, for us, and for those of you who’ve been following us for YEARS now, were pretty sure why. And, we weren’t at all surprised…

Rather, we felt vindicated because we FIRST alerted you all to NLST all the way back in 2021-2022 and we’ve been posting updates about it ever since.

See Exhibit 1-6

July 07, 2021: smallcapexclusive.com/netlist-inc-nlst-stock-soars-140-in-a-month-more-to-come/

July 21, 2021: https://smallcapexclusive.com/netlist-inc-nlst-stock-rockets-1100-ytd-will-it-hit-20/

August 11, 2021: smallcapexclusive.com/will-netlist-inc-otcmktsnlst-stock-come-back-after-the-recent-fall/

January 2, 2022: smallcapexclusive.com/netlist-nlst-is-ready-to-take-off/

February 22, 2022: smallcapexclusive.com/netlist-nlst-stock-price-is-consolidated-and-ready-for-a-run/

April 4, 2022: smallcapexclusive.com/netlist-nlst-stock-price-is-consolidated-and-ready-for-a-run/

The Catalyst

So, what caused the 30% pop late last week? Enter tech giant Samsung.

Netlist sued Samsung in 2021, alleging Samsung memory products used in cloud-computing servers and other data-intensive technology infringe its patents.

Netlist said its innovations increase the power efficiency of memory modules and allow users to “derive useful information from vast amounts of data in a shorter period of time.”

A Netlist attorney told the jury that Samsung took its patented module technology after the companies had collaborated on another project, according to a court transcript and were asking the jury for $404 million in damages.

Samsung had argued that the patents were invalid and that its technology worked in a different way than Netlist’s inventions.

The case is Netlist Inc v. Samsung Electronics Co, U.S. District Court for the Eastern District of Texas, No. 2:21-cv-00463.

With that valuable piece of context in mind, and over an hour after markets closed last week, it was announced that Samsung was hit with a $303 million jury verdict computer-memory patent lawsuit that the tech company had been trying to keep quiet.

However, and as longtime readers of this blog should know, the company that WON the lawsuit was none other than Netlist Inc, NLST.

April 21, 2023 5:19pm

Samsung hit with $303 million jury verdict in computer-memory patent lawsuit

(Reuters) – Computer-memory company Netlist Inc convinced a federal jury in Texas on Friday to award it more than $303 million for Samsung Electronics Co’s infringement of several patents related to improvements in data processing.

The Jury determined that Samsung’s “memory modules” for high-performance computing willfully infringed all five patents that Netlist accused the Korean tech giant of violating.

Please Read The Full Article: https://finance.yahoo.com/news/samsung-hit-303-million-jury-211918301.html

First of all, I can’t believe that the title of the news story left was written in the negative “Samsung hit with $303 million jury verdict” and left out the all important fact of WHICH COMPANY WON the lawsuit, when it very easily could’ve been included. These are the kinds of “half truths” that you will not find in my writing.

To cover the WHOLE TRUTH, the title should’ve been something like this:

“‘David VS Goliath:’ Netlist Inc. Awarded with $303 million jury verdict from Samsung in tech patent lawsuit”

You see how my hypothetical title gives MORE information than the actual title about the event?… This way, the title gives the context of the court case between the nimble Netlist and goliath that is Samsung. But, more importantly, it identifies the winner of the lawsuit.

Anyway, I apologize for the tangent. Getting back to NLST…

Why NLST Is A Long-Term Play

While their victory over Samsung was the catalyst behind the 30% pop late last Friday, the court case itself has been an ever present obstacle keeping NLST from moving higher. However, and in SPITE of the court case, NLST had still tallied up TRIPLE DIGIT GAINS of 244% YTD (year to date.)

Now, those are the types of gains that gave us the green light to tell literally everyone, including our own mothers’, about this long term play because, as many of you know, the essence of long term technical analysis is: higher highs; higher lows.

If you see a series of higher highs and higher lows in at least a quarter (3 months) of trading then you’re probably looking at a really solid long-term play to invest in.

Well, since the end of January 2023, we’ve seen a series of higher highs and higher lows for NLST. Share price appears to have found support at around $3.50, which is a level that has acted as resistance in the past. Put simply, higher highs; higher lows.

Why now?

For a tech giant like Samsung, a lawsuit such as the one with NLST is like a hiccup; uncomfortable for a moment but a totally normal part of the human experience. So, to Samsung, the $303 Million hit was just the cost of doing nefarious business… For Netlist, on the other hand, the lawsuit was like an all consuming black hole of time and money.

In other words, with the jury verdict determined, NLST can start turning more of its resources and attention back to what it does BEST. Back to doing what NOT EVEN SAMSUNG could do.. Which is exactly why Samsung infringed on NLST’s patents in the first place…

Ladies and gents, think about that for 2 seconds…

Netlist does something so complex and so much BETTER than Samsung that the tech giant felt it was necessary to WILLFULLY INFRINGE on several of NLST’s patents!

THAT is why it’s now or never for the shares of NLST… Because they’ve overcome the primary obstacle stopping them from being a household name like Nvidia or Oracle.

The only thing that can stop NLST now is… Not much…

That said, for those of you who are new here or who’ve missed the original alert AND its subsequent FIVE updates then we HIGHLY recommend that you get up to date as soon as possible (links above) because, if the last 30 minutes of trading last week is any indicator of what a post jury verdict Netlist looks like then the NLST train to greener pastures is leaving the station.

All aboard!

Disclaimer

Disclaimer

Small Cap Exclusive, owned by King Tide Media, has not been hired to publicly disseminate information about NLST via website, email, or SMS. King Tide Media has not been compensated to profile NFTG. A member of Small Cap Exclusive does own shares in NLST, purchased in the open market.

Why NASDAQ: AMPG Is An ‘Under The Radar’ Juggernaut You NEED To Know About

After combing the NASDAQ exchange for weeks, we think we found a true juggernaut in the Communication Equipment Industry. The kicker… As of April 20, 2023, it’s trading at around the low low price $3.20 per share. The Company is Amplitech Group Inc. (NASDAQ: AMPG) and we think you NEED to know about this one BEFORE it becomes a household name.

Alright, without further adieu, let’s get started.

Company Details

- Stock Details

- Ticker Symbol: AMPG

- Exchange: NASDAQ

- Location: United States

- Founded: 2002

- Industry: Communication Equipment

- Sector: Technology

- Employees: 34

- CEO Mr. Fawad A. Maqbool

- Website: https://www.amplitechinc.com/

AmpliTech designs, develops, and manufactures custom and standard state‐of‐the‐art RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover the frequency range from 50 kHz to 40 GHz Eventually, offering designs up to 100 GHz. AmpliTech also provides consulting services to help with any microwave components or systems design problems.Our growth has come about because we can provide complex, custom solutions. Therefore, AmpliTech is committed to providing immediate responses to any custom requirements that are presented to us. AmpliTech, Inc. has developed and supplied LNAs to Fortune 500 companies, the Military and Government Agencies such as:

- Lockheed Martin

- NASA

- L3 Communications

- Boeing

- Northrop Grumman

- Raytheon

- Government of Israel

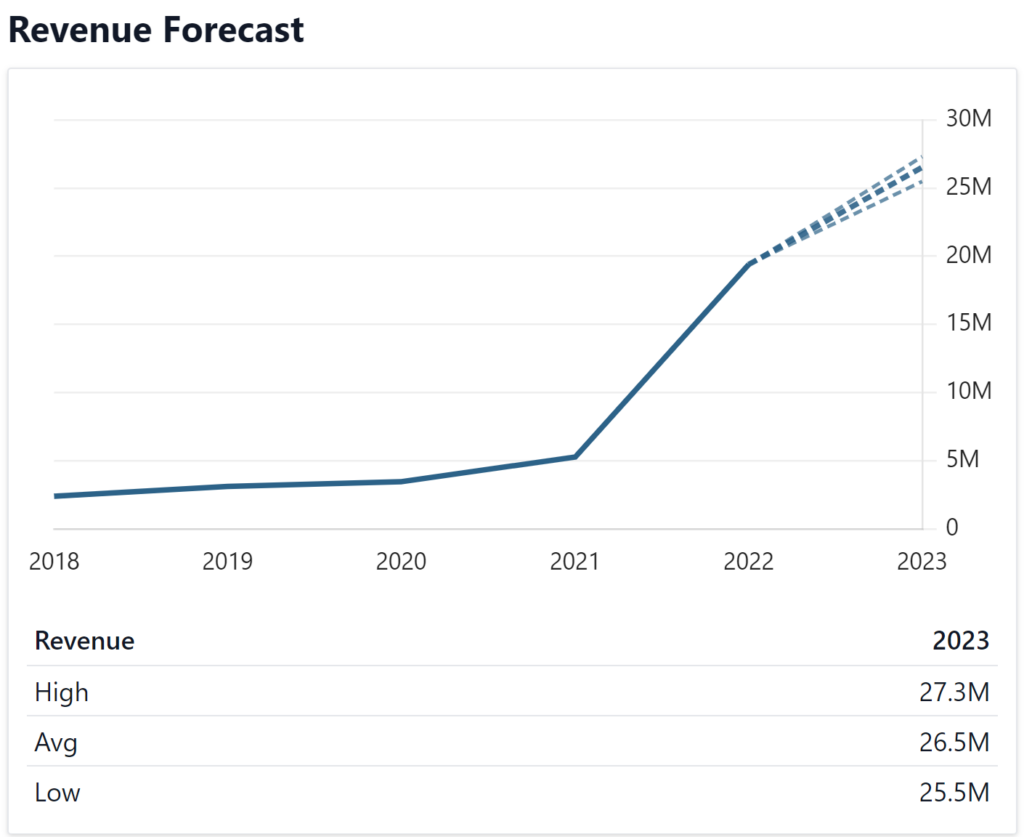

Think this sounds like any one of the other hundreds of small-cap companies trying to make a name for themselves without any financial backing, eh?… Well, think again because AMPG has a market cap of $30.72 million. The enterprise value is $21.76 million. In fact, in the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses. Meaning, Their FY 2022 results BEAT Revenue Guidance and Reports Record 267% YoY!

BUT THAT’S NOT ALL!

AMPG Highlights

Fundamentals:

- Financial Position: AMPG has a current ratio of 12.08, with a Debt / Equity ratio of 0.16.

- Income Statement: In the last 12 months, AMPG had revenue of $19.39 million

- Balance Sheet: The company has $13.54 million in cash and $4.67 million in debt, giving a net cash position of $8.87 million

2022 Earnings:

- In the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses.

- AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

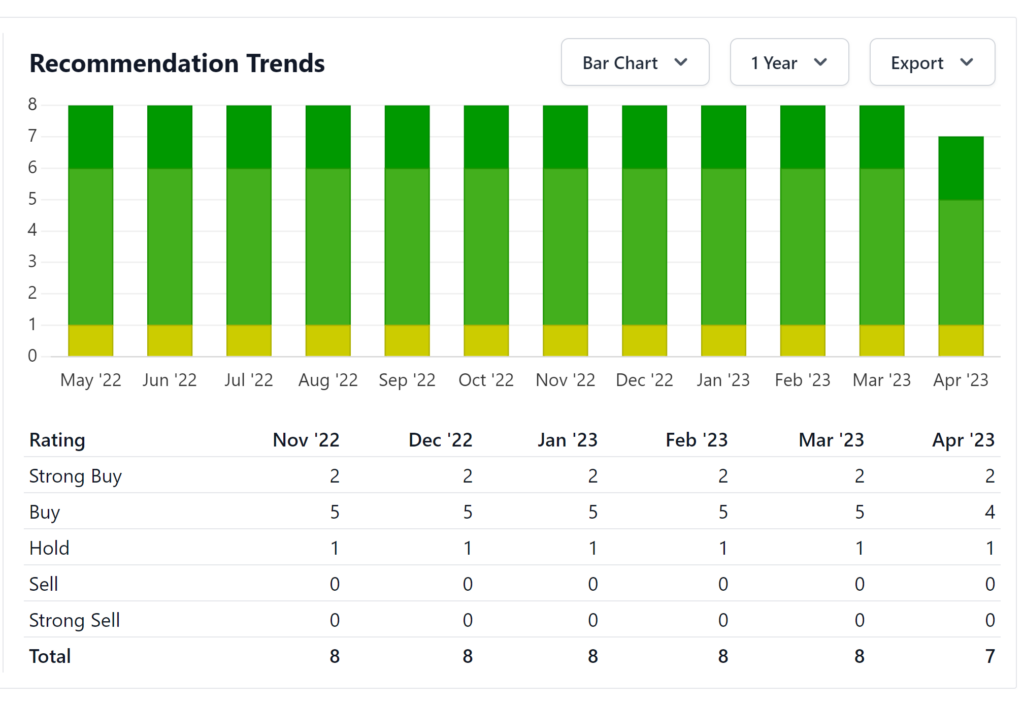

Analyst Forecast:

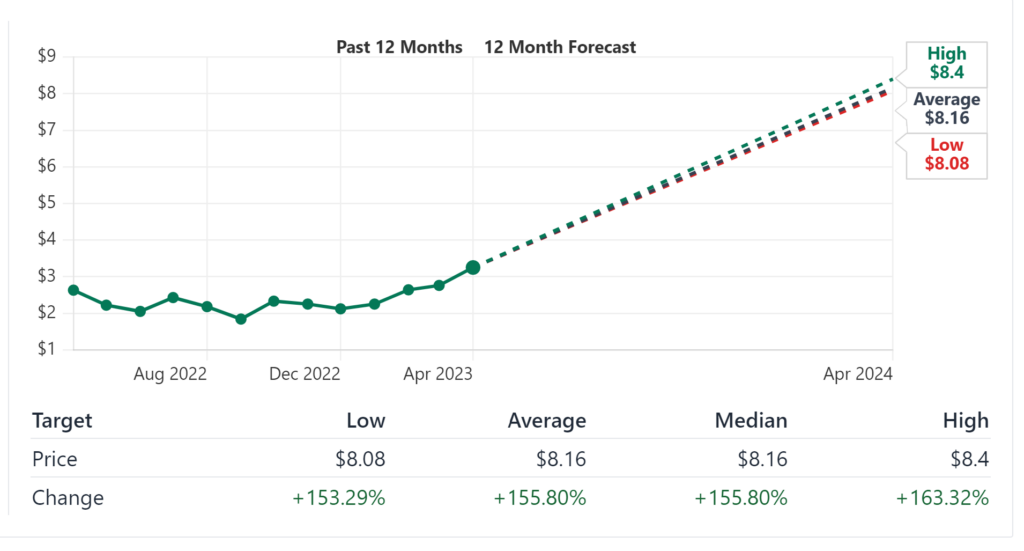

- The consensus rating for AMPG from 7 stock analysts is “Buy”.

- This means that analysts believe this stock is likely to outperform the market over the next twelve months.

Stock Price Forecast:

- According to 7 stock analysts, the average 12-month stock price forecast for AMPG stock is $8.16, which predicts an increase of 155.80%.

- The lowest target is $8.08 and the highest is $8.4.

- On average, analysts rate AMPG stock as a buy.

Share Statistics:

- Float: AMPG has 9.63 million shares outstanding with a low float of only 6.75 million shares

- Short Interest: The latest short interest is 89,377, so 0.93% of the outstanding shares have been sold short.

Continue reading to get our FULL BREAKDOWN of AMPG’s Highlights.

AMPG Fundamentals

- Financial Position: AMPG has a current ratio of 12.08, with a Debt / Equity ratio of 0.16.

- Balance Sheet: The company has $13.54 million in cash and $4.67 million in debt, giving a net cash position of $8.87 million

- Income Statement: In the last 12 months, AMPG had revenue of $19.39 million

The current ratio, also known as the working capital ratio, measures the capability of a business to meet its short-term obligations that are due within a year. The ratio considers the weight of total current assets versus total current liabilities. It indicates the financial health of a company and how it can maximize the liquidity of its current assets to settle debt and payables. The current ratio formula (below) can be used to easily measure a company’s liquidity.

So, if a currently has a current ratio of 2, then it can easily settle each dollar on loan or accounts payable twice. A rate of more than 1 suggests financial well-being for the company. Well, Financial Position: AMPG has a current ratio of 12.08. Meaning, it can easily settle each dollar on loan or accounts payable 12 times over.

That said, a very high current ratio may indicate that a company has excess cash in hand. Well, after looking into it, AMPG does have cash in hand… A lot of cash in hand… $13.54 MILLION to be exact.

Saving the best for last, In the last 12 months, AMPG had revenue of $19.39 MILLION. Let’s take a closer look at how great a year it’s been for this company.

2022 Earnings

In the last 12 months, AMPG had revenue of $19.39 million and -$677,107 in losses.

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

March 31, 2023:

2022 Annual Revenue increases nearly 3x to $19.4M, Gross Profit increases nearly 7-fold, Gross Margin almost doubles

AmpliTech Reports FY 2022 Results; Beats Revenue Guidance and Reports Record 267% YoY Annual Revenue Increase to $19.4 Million

- Gross Profit Increases nearly 7-fold, Gross Margin Expands 2,150 basis points to 46.0%

- 2022 Annual Revenue increases nearly 3x to $19.4M, Gross Profit increases nearly 7-fold, Gross Margin almost doubles

Full Year 2022 Highlights

- Revenue increased 267% to $19,394,000 in FY’22 compared to $5,275,000 in FY’21.

- FY’ 22 gross profit grew to $8,925,000, an almost 7-fold increase from FY’ 21 gross profit of $1,293,000. The gross profit margin increased by 2150 basis points to 46.0% compared to 24.5% a year ago.

- FY’22 net loss was $677,000 compared to a FY’21 net loss of $4,759,000, a positive swing of approximately $4.1 million. The net loss includes a one-time revenue earnout of approximately $816,000 as a result of Spectrum’s beating sales expectations for the years 2021 and 2022. It is important to note that without this earnout payment, the Company would have been profitable.

- As of December 31, 2022, cash and equivalents totaled $13,290,000 and working capital was $20,331,000, which is sufficient capital for AmpliTech to fund all of its strategic growth initiatives.

- AmpliTech experienced great success at trade shows such as Satellite 2022, IMS 2022, the AOC 2022, and the APS March Meeting 2022 , achieving positive customer engagement and setting company records at each event for the number of meetings with new and existing customers.

- Customers have begun to sample AGMDC’s new MMIC chip products which have received very positive praise and feedback.

Forward-Looking Update

- MMIC chips, or ICs, have been released to customers for testing and are expected to begin generating revenue in Q2 2023.

- Management expects sustained profitability going into 2023.

- Team is increasing sales exposure through enhanced strategic partnerships with sales representatives and distributors globally.

Full Earnings Report: https://finance.yahoo.com/news/amplitech-reports-fy-2022-results-130000549.html

Now, I know what you’re thinking. The past is the past. What is AMPG going to do for me in the future?… Well, let’s see what the analyst’s forecast for the future of AMPG.

Stock Price Forecast

As if that’s not a good enough projection, according to 7 stock analysts, the average 12-month stock price forecast for AMPG stock is $8.16, which predicts an increase of 155.80%. The lowest target is $8.08 and the highest is $8.4. On average, analysts rate AMPG stock as a buy. In fact, a couple of firms have already initiated coverage of AMPG with more expected to do so as this one continues to move higher.

Analyst Forecast

The consensus rating for AMPG from stock analysts is “Buy.” This means that analysts believe this stock is likely to outperform the market over the next twelve months.

The average analyst rating for AMPG stock from 7 stock analysts is “Buy”. This means that analysts believe this stock is likely to outperform the market over the next twelve months.

February 2, 2022

Analyst Firm: Small Cap Consumer Research

Rating: Buy

Target: $5.00

July 7, 2021

Analyst Firm: Maxim Group

Rating: Buy

Target: $10

If the forecasters think AMPG is worth adding to their watchlist then we should too, right? But, what about actually buying the stock for themselves? Let’s take a look…

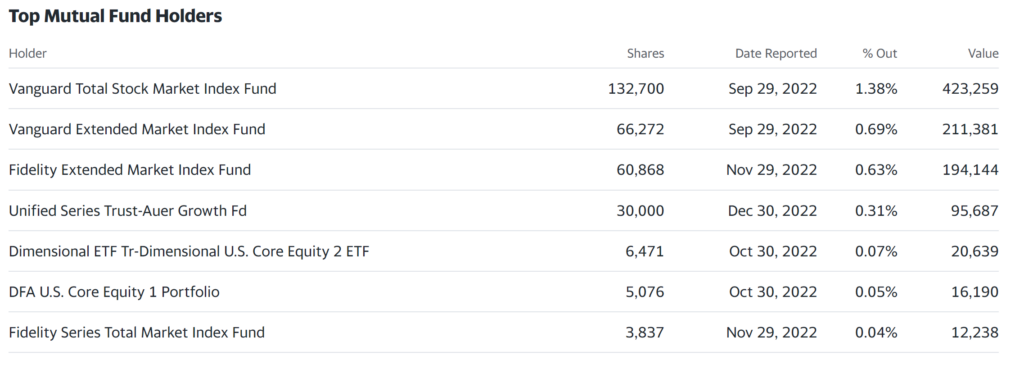

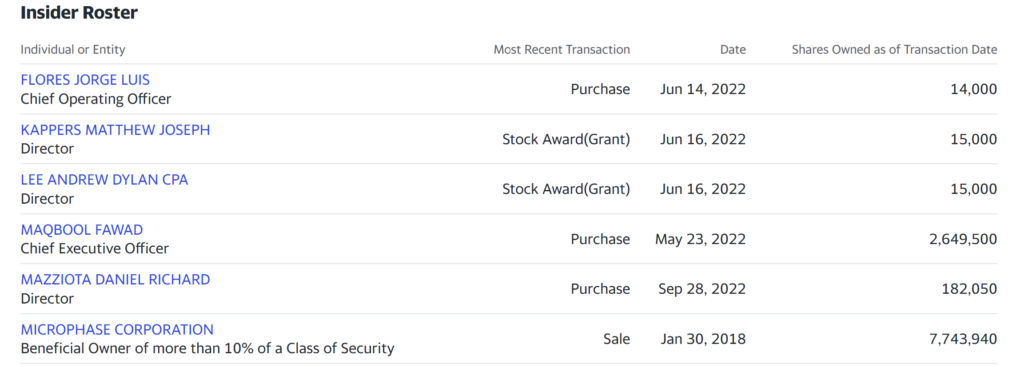

Insider Holdings

AMPG has 9.63 million shares outstanding with a low float of only 6.75 million shares with a meager short interest of less than 1% sold short. Of their shares, 32.99% are held by insiders, 8.68% is held by 16 different institutional investors, totalling to a little under 13% of the float.

Recent News

April 17, 2023

AmpliTech Group’s Division, Spectrum Semiconductor Materials, Inks Distribution Deal with NGK Electronic Devices, a Leading Global Semiconductor Manufacturer

AmpliTech to Become NGK’s First US Distributor of Their RF Microwave Package Products

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG) a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, and a worldwide distributor of packages and lids for integrated circuit assembly, as well as a designer of complete 5G/6G systems, is proud to announce its partnership with NGK Electronic Devices, a powerhouse in the semiconductor packaging industry, to become their US distributor for NGK’s state-of-the-art RF Microwave products. This partnership marks NGK’s first distribution agreement with a US partner, presenting a significant opportunity for both parties.

Full Article: https://finance.yahoo.com/news/amplitech-group-division-spectrum-semiconductor-133000902.html

March 30, 2023

AmpliTech Records a New Benchmark at Satellite 2023 Show in Washington, D.C.

McapMediaWire – AmpliTech Group, Inc. (NASDAQ: AMPG), a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks, as well as a worldwide distributor of packages and lids for integrated circuit assembly, is excited to announce an unprecedented achievement at the Satellite 2023 show held in Washington, D.C. The company recorded more than 100 meetings with executives in the satellite communications (Satcom) space – a new record for the prestigious event. Among the attendees were multiple Fortune 100 companies, top-tier research institutions, and exciting startups driving the next generation of connectivity.

Full News Article: https://finance.yahoo.com/news/amplitech-records-benchmark-satellite-2023-130000747.html

February 27, 2023

AmpliTech Group, Inc. Discusses Significance of Its State-of-the-Art Radio Frequency Components with The Stock Day Podcast

AmpliTech Group, Inc. (NASDAQ: AMPG),a designer, developer, and manufacturer of state-of-the-art signal-processing components for satellite, 5G, and other communications networks and a worldwide distributor of packages and lids for integrated circuit assembly, is pleased to announce its participation in three upcoming shows, where it will exhibit its latest technological advancements at the Satellite Show in Washington DC, at Booth #2092. AmpliTech Group is also attending the Mobile World Congress (MWC) Show in Barcelona, and the American Physical Society (APS) show in Las Vegas, to participate with key players in the 5G and Quantum Computing industries.

Full News Article: https://finance.yahoo.com/news/amplitech-showcase-latest-product-wins-141500565.html

November 7, 2023

AmpliTech Recognized by Inc. Magazine as Top 10 Most Innovative Telecom Solution to Watch

AmpliTech Group, Inc. (Nasdaq: AMPG) announced that it was recognized by Inc. magazine in its list of “Top 10 Most Innovative Telecom Solution to Watch”

Founder and CEO Fawad Maqbool stated, “It was an honor to work with Inc. Magazine on this article to discuss Amplitech Group and how we currently offer a wide range of products for 5G, Telecom, quantum computing, airline Wi-Fi, and all things wireless, starting from connectorized modules, discrete transistors, MMICs, and packages, to multi-chip modules (MCMs) and systems using multiple disciplines and processes that we see a lack of in the market. All of these products directly enable technologies such as Virtual Reality (VR), Augmented reality (AR), Telemedicine, fully autonomous vehicles, Satellite-to-phone connectivity, the Internet of Things (IoT), Internet in the sky, and much more. AmpliTech is committed to connecting humans like never before in the 21st century.”

Full News Article: https://finance.yahoo.com/news/amplitech-recognized-inc-magazine-top-210000268.html

AMPG Company Background

Developing the communication systems of tomorrow, today.

AmpliTech was founded to address the industry gap for high-performance, ultra-reliable, and extremely efficient radio frequency (RF) devices to power the communication ecosystem of tomorrow. We obsess over pushing boundaries of what can be done to increase connectivity in the sky, in space, and in your homes. The devices AmpliTech designs boast the lowest noise figures and power dissipation across all usage frequencies to offer customers in the military, Satcom, aviation, automotive, and computing industry unparalleled product specifications and user experience. As industry requirements for communication throughput, speed, and endurance grow exponentially, we strive to develop the technologies necessary to power the future of communication.

AmpliTech designs, develops, and manufactures custom leading-edge RF components for the Commercial, SATCOM, Space, and Military markets. These designs cover frequencies from 50 kHz to 44 GHz. AmpliTech also has developed new products for the 5G/6G wireless ecosystem and infrastructure with unparalleled performance. In addition to this rapidly emerging market, AMPG has also developed solutions for Quantum Computing, with cutting edge technology. We continue to blaze trails in our commitment to enable and accelerate the arrival of true 5G/6G architecture and contribute to the U.S. being the leader and first to reach the coveted position of Quantum Supremacy. Our growth has come about because we provide complex, custom solutions that our competitors shy away from. We have consistently provided the industry-leading SATCOM Low Noise Amplifier Solutions for the past 18 years and our new website showcases these products below, with its advanced search engine and listing of stock items. This allows us to provide immediate response to custom requirements, unwavering technical support and timely delivery. We will be continuing our R&D efforts to always be at the forefront of emerging technologies and using our advanced techniques and IP to provide tomorrow’s technology today, and improve everyone’s quality of life. In addition, we have the best assemblers, wirers, and technicians in the industry and can provide contract assembly of customers’ own designs. AmpliTech is in the process of scaling up its proprietary technology and design its own MMICs, subsystems, and other products to address the rapidly emerging, large volume commercial applications in the communications technology space.

AmpliTech, Inc. has a rich history in the design of microwave amplifiers and components, including a wide variety of product lines, from LNA’s (Low Noise Amplifiers) and MPA’s (Medium Power Amplifiers), to broadband telecom amplifiers for the microwave and fiber optic communications firms.

As such. we are defined by our expertise in custom designed amplifiers with special requirements such as military screening and space qualification. To provide for customers dealing with extremely low noise figure applications, we have excelled in the ever-growing cryogenic market as well. In short, all our customers agree that we provide simply the best product and services available in the industry while maintaining lower prices than most of our competitors and we do so in the most emergent of technologies on the industry landscape today. Our success is marked not only by our technical achievements, but also by an extremely respectable customer base which includes giants in the industry such as Motorola, ITT, Harris, Northrop Grumman, Raytheon, L3 Communications, Aeroflex, NASA, NIST and TRW (to name a few). Due to the achievements of its talented staff, AmpliTech has also received numerous Supplier Quality awards, including a Best Technology Award from one of the industry’s leading trade magazines. AmpliTech now trades on the NASDAQ public stock exchange under the ticker symbol AMPG which will help take our products to a broader and more global customer base, bringing cutting-edge technology to the masses and improving everyday quality of life for us all. The following are some of the many advantages that set us apart from our competition:

- Skilled and experienced Management Team

- Proven track record of performance and quality products

- Quantified IP and pending patents

- Virtual sole-source current supplier positions in various areas such as Quantum Computing, Military Avionics Equipment, High-speed SATCOM equipment, Telemetry applications

- Government GSA Award

- Strategic alignment with key vendors and customers to provide next generation products for 5G/6G. Quantum Cloud, High-speed Satellite Internet, IoT commercial markets

- Integration of Microwaves and Life Sciences to provide diagnostic and non-invasive detection systems and treatments for medical applications

- Much more!

Core Competencies

AmpliTech, Inc. offers:

- Standard state-of-the-art RF/Microwave components for the Commercial, SATCOM, Space, & Military

- markets.