Looking Glass Labs NFTX is looking promising as a trending stock!

I Normally Wait To Point Out The Value Propositions Until Later, But I Can’t Help Myself, Looking Glass Labs NFTX stock is looking incredible.

#1 NFTs, from $100 Million To $40 BILLION, In One Year 1

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE 2

#3 Looking Glass is generating Multiple, Perpetual revenue streams.

#4 People Lie, Numbers Don’t

Looking Glass Labs (NEO:NFTX) has everything I look for in an investment opportunity and a trending stock.

Looking Glass Labs could be your answer for a breakout stock, I researched Looking Glass Labs stock and believe with their excellent executive team and expertise they could be an answer to the noisy market. We are all awaiting the corporate leaders of this vertical to establish themselves and it is possible that LGL is a front runner.

Looking Glass Labs (NEO: NFTX) is a new public company in the red hot sector of NFTs and the metaverse and I couldn’t be more excited! Hi, I’m Alexander Goldman, and for those that know me I have been following the NFT stocks very closely.

The average gains of over my last three picks have been phenomenal, in fact I’ve strung together consecutive winners yielding 186% increases in about one month. I say that because, well, you’re only as good as your last trade.

I’m excited, so let’s go over why I spent the last month researching Looking Glass Labs stock. Then, we can go over the macros before we get into the specifics.

Company Name: Looking Glass Labs, Inc.

Ticker: NEO: NFTX

Exchange: NEO

Website: https://www.lgl.io/investors

Investor Deck: Here

Company Summary:

Looking Glass Labs a leading Web3 platform specializing in non-fungible token (“NFT”) architecture, immersive metaverse environments, play-to-earn tokenization and virtual asset royalty streams.

The company is a full service digital agency with a wealth of experience in creating and issuing NFTs in exchange for cryptocurrencies on the blockchain. Their team also provides full service support to brands, artists, and communities who require technical, legal, promotional, or creative assistance.

[thrive_leads id=’18026′]

Looking Glass Lab’s Brands

House of Kibaa (HoK) is a digital studio at the forefront of technologies in the blockchain, NFT and metaverse sectors. HoK designs and curates a next-generation metaverse for 3D assets, allowing functional art and collectibles to exist simultaneously across different NFT blockchain environments.

Looking Glass Labs

With a wealth of experience in NFTs and cryptocurrencies, LGL both creates and issues NFT collections as well as provides a full range of support services to third party clients. Additionally, through the Company’s NFT royalty streams LGL earns a share of value each time NFTs change hands within certain ecosystems.

What is a NFT and why should you pay attention?

I’m going to give you two definitions, the first definition is filled with jargon and then I will do my best to explain the second one in lay terms.

Non-fungible tokens or NFTs are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.

Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency.

This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can be used as a medium for commercial transactions.

Let’s try to break that down for us simple folk.

Non-fungible tokens are called NFTs for short and they are unique, like a digital Mona Lisa and completely different from the dollar. There was only one Mona Lisa made and it carries a very real monetary value.

On the contrary, as us Americans are finding out, when you own a fungible currency, like the dollar, you can print, print, print and continue printing which in turn debases the value.

NFTs typically represent real-world objects and collections including artwork, memorabilia, music , virtual/in-game items, videos, etc. Below is an NFT from the Bored Ape Yacht Club collection:

Just like NFTs, and really any product or service, it boils down to supply and demand. The more desirable your NFT is, the more its worth.

The only way to acquire an NFT is with a cryptocurrency via the blockchain. Without boring you, here are the cliff notes on crypto.

There is a large segment of the population that doesn’t trust governments or centralized power. They are not big fans of fiat currency (fungible) otherwise government run banks, like the Fed.

So crypto developed as a necessity to put the power back in the hands of the people.

Cryptocurrency trades on something called the blockchain and there is a large amount of interest to see if it can disrupt the global finance mechanism.

Most people, unless you’ve been living under a rock, have definitely heard of blockchain and it is simply the backbone of where cryptocurrencies trade. We are in the first lap of a marathon, like the advent of the internet. It is truly exciting times for investors, for the people and

So to summarize, in the simplest terms, NFTs transform digital works of art and other collectibles into one-of-a-kind, secure, verifiable assets that are easy to purchase and sell on the blockchain with crypto.

FOUR REASONS Looking Glass Labs Could Be Worth Putting On Your Watchlist

#1 NFTs, from $100 Million To $40 BILLION, In One Year 1

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE 2

#3 Looking Glass is generating Multiple, Perpetual revenue streams.

#4 People Lie, Numbers Don’t

Before we go over the top 4 reasons I love Looking Glass Labs, let’s look at one of their latest press releases and why it could be a breakout stock alert.

Feb 3, 2022

Looking Glass Labs stock NFTX is now listed on the NEO Exchange. LGL is available for trading under the symbol NFTX.

With a wealth of experience in NFTs and cryptocurrencies, LGL creates and issues NFT collections and provides a full range of support services to brands, artists and communities who require technical, legal, promotional or creative assistance. Additionally, through the Company’s NFT royalty streams, LGL earns a share of value each time NFTs change hands within certain ecosystems. The Company’s wholly owned subsidiary, House of Kibaa (“HoK”), is a digital studio that designs and curates a metaverse for 3D assets.

Jan 25 2022 – Looking Glass Labs’ GenX NFT Collection by House of Kibaa “Verified” on the LooksRare NFT Marketplace Click Here

LGL announced that the GenX NFT collection issued by the Company’s flagship studio, House of Kibaa, has been authenticated by the LooksRare NFT marketplace, thereby making it one of the first NFT collections to receive “Verified” status.

Jan 18 2022 – Looking Glass Labs’ Live-Action NFT Series “GenZeroes” Featured in Deadline Hollywood

As NFT Trading Volumes Clear $23 Billion in 20211, the Use Cases for NFTs in Areas such as Entertainment are Beginning to Attract Mainstream Industry Attention such as Deadline Hollywood’s Coverage of GenZeroes

December 21 – Looking Glass Labs’ GenX NFT Collection by House of Kibaa “Verified” on the LooksRare NFT Marketplace

During LookRare’s First Week Post-Launch, the New NFT Marketplace Facilitated over USD 3.2 Billion of Trading Volume, More Than Double the Trading Volume of OpenSea During the Same Period

Dec 2021-Looking Glass Labs Announces Strong Financial Results for the First Fiscal Quarter of 2022.

$5.7 Million of Total Comprehensive Income was Generated by the Company on Revenues of $6.5 Million for the Period Ended October 31, 2021

December 2021 – Looking Glass Labs is ready to monetize the Metaverse with 3D ready assets

Now, 3D Asset NFTs may not look like a thing yet but they are steadily gaining ground as Metaverse ecosystems continue to emerge and Web3 technologies are the basis for interactions within such ecosystems. LGL, the Canadian NFT architecture agency, has created new 3D assets for the popular NFT collections Gutter Cat Gang and Bored Ape Yacht Club. HERE

Tons More Press HERE

Most new listings, in fact, not many companies are ready to go to market in early stage development, while LGL is poised to possibly be an early industry leader.

Let’s take a look at how the market has responded to Looking Glass Labs stock NFTX in the first two weeks of being public.

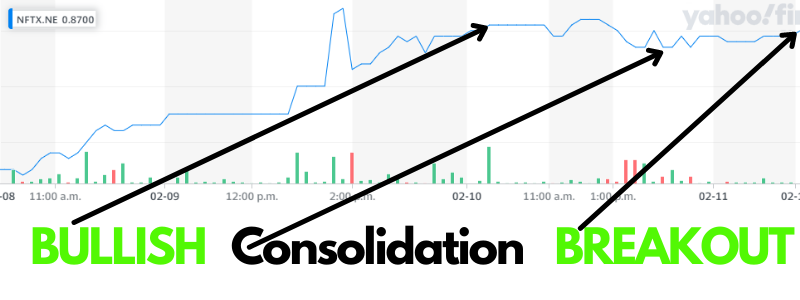

Technical Analysis with Alexander Goldman

What do I think of Looking Glass Labs ticker NFTX?

It had a controlled and sustained a nice BULLISH run and then consolidated. I believe it has JUST broke out and is ready for another positive run.

The Looking Glass Labs stock NFTX is showing all the indicators of a stable and profitable investment at this point.

Without further ado, I present my FOUR REASONS Looking Glass Labs (NEO:NFTX) Could Be Worth Putting On Your Watchlist

#1 NFT Industry went from $100 Million To $40 BILLION, In One Year

This Is Just The Beginning for NFTs & Looking Glass Labs, take a look at the growth projections below.

“Brooklyn, New York, Dec. 17, 2021 (GLOBE NEWSWIRE) — According to a new market research report published by Global Market Estimates, the Global Non-Fungible Tokens Market is projected to grow at a CAGR value of 185.0% from 2021 to 2026.” The full article is here.

Remember back in the day, when you received your Netflix videos in the mail? Look at where we are now! Just like Netflix had a booming start, so are the NFTs, but literally it is just the beginning.

Just back in 2020, the NFT market was $100 million, last year, 2021, $40 Billion! There are huge profit margins in the NFT space and incredible back end royalties in perpetuity. Take a look below at what the major outlets are saying. All Images found on their website, here

A non-fungible token by the artist Beeple sold at Christie’s for over $60 million, making it the most expensive NFT ever sold at auction. Click Here

A set of 101 non-fungible tokens, or NFTs, from the “Bored Ape Yacht Club” collection, which features images of various cartoon apes, sold for $24.4 million in an online sale at Sotheby’s auction house on Thursday, wildly surpassing estimates and offering further proof that the market for NFTs is surging once again. Click Here

William Quigley, a co-founder of stablecoin Tether and a pioneer in the cryptocurrency space, sees the metaverse as a huge economic force that’s going to change people’s lives significantly in coming years. Click Here

The biggest news media outlet is out there drumming up DEMAND, everyone on social media is drumming up demand, all of that equals, you guessed it, DEMAND!

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE

The cryptocurrency market is now worth more than $3 trillion, that is a lot of 00000s.

“The little more than a decade old market for digital assets has already roughly quadrupled from its 2020 year-end value, as investors have gotten more comfortable with established tokens such as Bitcoin and networks like Ethereum and Solana continue to upgrade and attract new functionality. Excitement about the possibilities of decentralized finance and non-fungible tokens is growing, and memecoins like Dogecoin and Shiba Inu continue to attract attention.” Here

In case you have been under a rock, LOOK AT BITCOIN!

Crypto currency is positioning itself as the new currency of the future! Looking Glass Labs is creating the ability to monetize the possible NFT boom via HOK.

#3 Looking Glass (NEO:NFTX) is generating Multiple, Perpetual revenue streams.

Lay Term translation for NFT/Crypto Jargon Below

Asset Design – House of Kibaa (HoK) if you remember is their digital agency, which is essentially a team of digital artists creating non-stop for the metaverse & NFT to be used as currency.

Exclusive Drops – Pretty self explanatory, but it is an attractive aspect of HOK.

Minting as a Service – There are several impressive market forecasts for just this revenue stream,

Royalties – If you have been following me there is only one thing I love more than a short squeeze for massive opportunities, continuity! That is revenue streams that run in perpetuity. Subscription-based models and royalty-based models producing recurring revenue in perpetuity, growth and more importantly VALUATIONS!

Merchandise Sales –

It is a revenue stream but not very exciting to me. Not that apparel is not exciting, they could make a significant amount of revenue per year with their incredible artists producing clothing that represents the youngsters. I guess what I’m trying to say is this, the first 4 revenue streams, individually, are enough to get me excited. They have all 4 under one corporation that I have the opportunity to be a part of via the stock exchange.

What do these 5 revenue streams look like over time?

Remember, when they add their revenue from this year, next year and so on and so forth, they are positioned to significantly increase their strong numbers above.

#4 People Lie, Numbers Don’t

If those numbers didn’t make you get excited, Looking Glass Labs numbers are equally as impressive. Take a look below.

First Drop Revenue – I write for tech all the time and I remember so many publicly traded companies with no revenue or foreseeable revenue trading massive volume. LGL doesn’t need a “what if” idea, they are already proving their worth.

Secondary Revenue monthly Growth – Moreover, they are producing multiple revenue streams which are also positive in financial terms.

Memberships Sold – This is no surprise, I love memberships, ie continuity, for profitability and valuations.

Membership Floor – Continuing the dialogue of continuity, monthly, semi-guaranteed revenue is the golden grail.

After a month of research in regards to Looking Glass Labs, I’m beyond excited and you should be too. Put it on your watchlist!

Let’s Recap The FOUR REASONS Looking Glass Labs stock Could Be The Most Explosive New Listing of 2022!

#1 NFTs, from $100 Million To $40 BILLION, In One Year 1

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE 2

3 Looking Glass is generating Multiple, Perpetual revenue streams.

#4 People Lie, Numbers Don’t

Those were my FOUR REASONS Looking Glass Labs stock (NEO:NFTX) Could Be Worth Putting On Your Watchlist, I hope you enjoyed the research. I really like LGL as NFT stock play and a trending stock. Happy Trading and Remember, never try to catch a falling knife! This has been Alex and I bid you a good day.

[thrive_leads id=’18026′]

- https://www.ft.com/content/e95f5ac2-0476-41f4-abd4-8a99faa7737d

- https://www.coindesk.com/business/2021/11/25/grayscale-says-metaverse-is-a-trillion-dollar-market-opportunity/

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, NFTX. Small Cap Exclusive has been hired by Looking Glass Labs stock for a period beginning on February 2, 2021 to publicly disseminate information about (NFTX) via website and email. We have been compensated $100,000 USD. We will update any changes to our compensation. NFT Stock and trending stock.

Read full disclaimer here.

Y-Mabs Theraputics YMAB Stock report, never seen insights by famed stock picker Alexander Goldman

Y-mAbs Therapeutics YMAB stock has been breaking it’s trend with large volume and a 27% change in PPS in 1 day. Wondering why this stock is taking off, take a look. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading stocks for two decades now. I’m now helping traders find big movers now.

What do I mean by big winners?

Stocks that move more than 100% in a month!

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 loswers and 2 winners and they all did what I thought!

The article is HERE

Now, let’s go over some of the basic information on this stock before we get in the technical analysis.

Y-mAbs Therapeutics Inc. Company Information

Company Name: Y-mAbs Therapeutics Inc.

Ticker: YMAB

Exchange: NASDAQ

Website: https://ymabs.com/

Y-mAbs Inc. Company Summary:

Y-mAbs is a commercial-stage clinical biopharmaceutical company focused on the development and commercialization of novel, antibody-based therapeutic products. Used for the treatment of cancer. We have a broad and advanced product pipeline, including pivotal-stage product candidates against a range of targets.

Our mission is to become the world leader in developing better and safer antibody-based oncology products. Also, addressing clear unmet pediatric and adult medical needs. With the right partnerships and collaborations, we envision changing the course of cancer care and its outcomes.

YMAB News

Feb. 11, 2022

Announced that it recently completed a Pre-Biologics License Application (“pre-BLA”) meeting with the U.S. Food and Drug Administration (“FDA”) regarding a potential pathway for FDA approval of omburtamab for the treatment of patients with CNS/leptomeningeal metastases from neuroblastoma. The Company expects to resubmit the BLA for omburtamab by the end of the first quarter 2022.

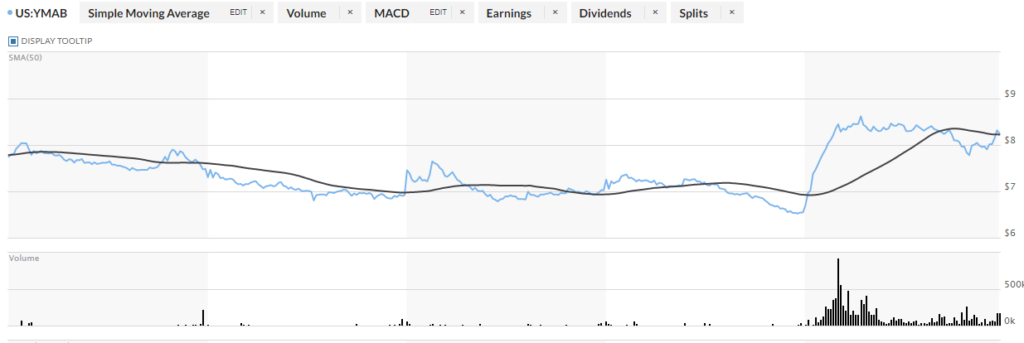

YMAB 5 Day Chart

Y-mAbs Technical Analysis:

The news was great on YMAB ticker and I believe this stock could continue to run. $7.62 is where I put my stop loss, it looks like it should have a great Friday!

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Universal Systems UVSS stock is up over 500%, now what will happen?

Universal Systems UVSS stock has been on a rocket ship to the moon lately. UVSS ticker has had large volume and a 503% change in PPS in 5 days. Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading stocks for two decades now. I’m now helping traders find big movers now.

What do I mean by big winners?

Stocks that move more than 100% in a month!

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 loswers and 2 winners and they all did what I thought!

The article is HERE

Now, let’s go over some of the basic information on this stock before we get in the technical analysis.

AUniversal Systems Inc. Company Information

Company Name: Universal Systems Inc.

Ticker: UVSS

Exchange: OTC

Website: https://www.usicomputer.com/

Universal Systems Inc. Company Summary:

Universal Systems, Inc. started in the PC business in 1989. Since then Universal has evolved into a full service organization, committed to users of high quality computer equipment at cost effective prices. Since its beginnings, Universal’s revenue has consistently increased each year. From production members to sales representatives, the dedicated professionals at Universal work as a team to make this growth a reality, by providing quality products and the highest level of service to every customer. Universal prides itself on excellent service that lets the customer know they are the top priority. Universal is constantly pushing the envelope in technology as well as service, ensuring clients maintain their leadership role in the ever changing computer industry.

UVSS News

Nov 17, 2021

Announced the company has achieved Pink Current status for OTC Markets.

Mr. Andrew Lane, CEO of Universal Systems, Inc./Digital Distro, states, “Our team of internal staff, partners, attorneys, and executive leadership have constantly worked to ensure that all due diligence and transparency were provided and documented. I want to thank the team for their professional and persistent efforts to revive Universal System, Inc. into a now OTC Pink Current company.

UVSS 5 Day Chart

Universal Systems Technical Analysis:

Universal Systems UVSS stock has had seen better days. All key indicators are showing a big pullback. I will be selling in this instance, take the 503% gains, congrats. We strive to bring winners to our subscribers and this one has already won. Don’t get greedy.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Agrify AGFY Stock has officially reversed it’s trend, now what will happen?

Agrify AGFY stock has been breaking it’s trend with large volume and a 26% change in PPS in 5 days. Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading stocks for two decades now. I’m now helping traders find big movers now.

What do I mean by big winners?

Stocks that move more than 100% in a month!

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 loswers and 2 winners and they all did what I thought!

The article is HERE

Now that you know I’m the real deal, let’s go over some of the basic information on this stock before we get in the technical analysis.

Agrify Inc. Company Information

Company Name: Agrify Inc.

Ticker: AGFY

Exchange: NASDAQ

Website: https://www.agrify.com/

Agrify Inc. Company Summary:

Using data, science, and technology, we help cultivators grow smarter, grow better, and grow profitably. As the most vertically integrated solutions provider in the cannabis and hemp industry, we deliver the future of growth with proprietary technology and a comprehensive ecosystem of products and services.

With Precision Extraction and Cascade Sciences recently joining the Agrify AGFY stock, Agrify continues to deliver quality and consistency from cultivation through extraction and post-processing operations. For more information, please visit Precision Extraction, a division of Agrify.

AGFY News

Jan 31, 2022

Pomerantz LLP is investigating claims on behalf of investors of Agrify Corporation trading under the ticker AGFY (“Agrify” or the “Company”) (NASDAQ: AGFY). Such investors are advised to contact Robert S. Willoughby at [email protected] or 888-476-6529, ext. 7980.

The investigation concerns whether Agrify and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

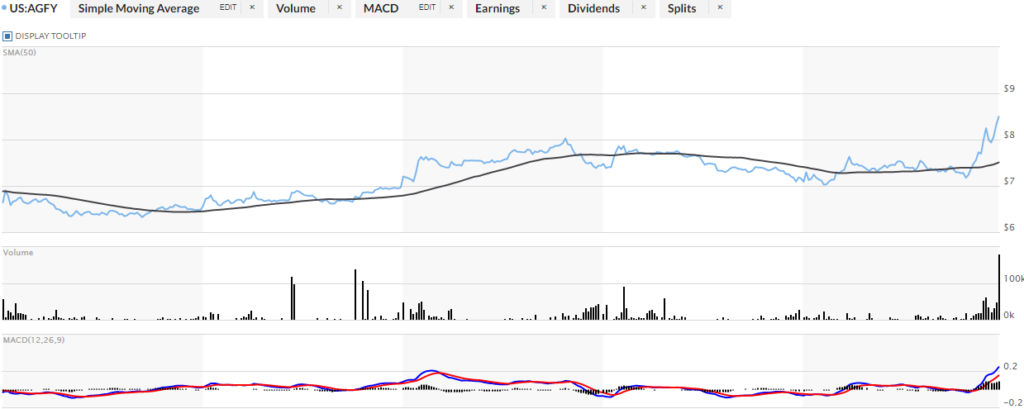

AGFY 5 Day Chart

Agrify Technical Analysis:

AGFY stock continues to perform well, and management is confident about its growth prospects. Its top-line jumped 460% year-over-year in Q3. Moreover, revenues improved 33% on a quarter-over-over-quarter basis.

The stock appears to have reversed it’s trend! As long as the stock can stay above $7.62 it should rebound nicely, I like this one. I’m buying this immediately because of the reversal of trend.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Vimeo VMEO is Close to Break Out of a Key Resistance Point

This is Alexander Goldman, The famed stock picker, I have identified that Vimeo VMEO could be close to a breakout, take a look below. Remember to sign up to our FREE Newsletter below to receive the hottest stock picks before they run.

[thrive_leads id=’14274′]

Vimeo VMEO is setting up to be a possible monster after it breaks through this resistance point, but before let’s go over the basics.

Vimeo Company Snapshot

Company Name: Vimeo Inc.

Ticker: VMEO

Exchange: NASDAQ

Website: https://vimeo.com/

Company Summary:

Vimeo, Inc. provides online video software and services. It also provides professional software, tools and technology for creators and businesses to host, distribute and monetize their videos anywhere. The company was founded in December 2020 and is headquartered in New York, NY.

What is the news?

Vimeo Inc. shares were down 20% to $11.09 in afternoon trading after a wider than expected loss and guidance for slowing revenue growth.

The provider of online video software and services after the bell Wednesday reported fourth-quarter loss per share of 15 cents, wider than FactSet consensus for a loss of 8 cents.

Revenue rose to $106.1 million, beating FactSet consensus for $105.3 million. The growth was driven by an 11% increase in subscribers and 13% growth in average revenue per user, the company said. HERE

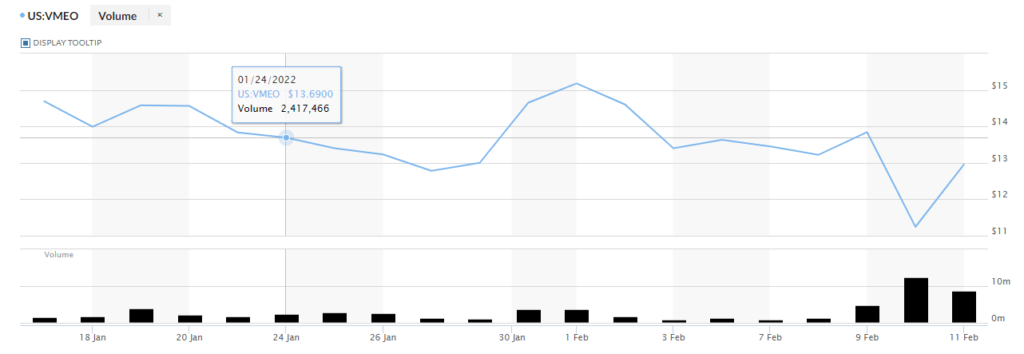

1 Month Chart

Technical Analysis:

After horrible news and a over reaction, VMEO seems to be coming back.$14 is tthe magic number for the PPS for Vimeo VMEO to beat, it is getting close so keep your eye on it. If it beats, it could run, but don’t count on it. The financials looked bad, real bad, so yes it was an over reaction but I don’t thin sentiment will be better than where it was, $14 after that news. Unless, its an over reaction to a over reaction!

[thrive_leads id=’14274′]

MDM Permian MDMP is up over 300%, put it on your watchlist!

MDM Permian MDMP is in a 52 week HIGH and is looking like it really could take off. But before we do, sign up for our amazing FREE newsletter below to get the hottest picks!

[thrive_leads id=’14274′]

Company Snapshot:

Company Name: MDM Permian, Inc

Ticker: MDMP

Exchange: OTC

Website: https://www.mdmpermian.com/

Company Summary:

In today’s Permian Basin landscape of horizontal plays and unconventional setups, MDM Permian MDMP looks to differentiate itself by capturing the best of vertical development and industry leading completion technology. Using decades of conventional play knowledge and state of the art NU-Tech log analytics MDMP stands at the forefront of mid-level Permian operators poised for developmental growth in 2021-22. Through select lease targeting, strategic service provider alliances, and experience of our team we focus on building value in the ground and then capitalizing on it through select drill site development.

MDMP in the NEWS

February 08, 2022

Yesterday, MDM Permian MDMP filed a Field Work Update with OTC Markets that has gotten a lot of investor attention.

This release highlights movement on the company’s Lindley ‘A’ Lease wells. The company moved a rig onto one of the wells, and ran pressure tests for holes at shallow depths. The initial results appear to be positive. Additionally, investors like the fact that the company is moving on commercializing the reserves discovered on this property.

According to a study the company did last month, the Lindley property has two reservoirs with approximately 3.6 million barrels of recoverable oil on 640 acres. At a market price of $65 oil, the company calculates these reserves to be worth $568 million.

Additionally, the company is quick to point out that these results are only for two zones. Other proven zones are not included in these numbers.

The recent progress made to commercializing these wells has speculators believing MDM could be close to capitalizing on this property. MDM could ultimately produce the oil itself or contract production with a third party. Regardless, these reserves appear to be ready to be monetized.

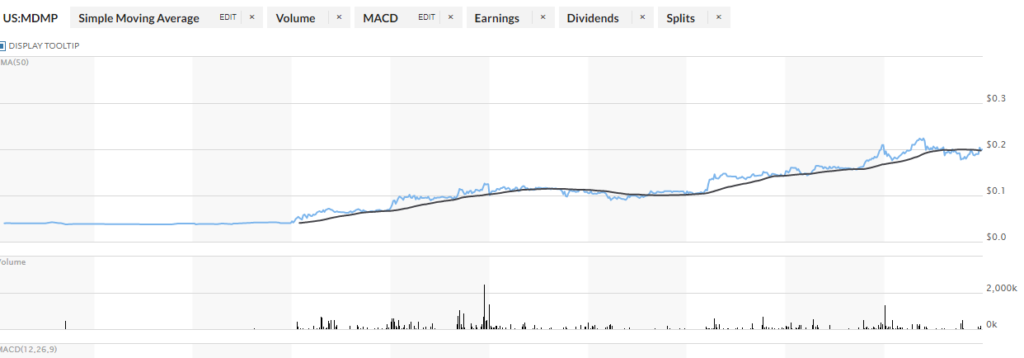

1 Year Chart

Technical Analysis:

MDMP is looking amazing with great news, but it is up a lot, so be careful. This is trending up seems to be stalled under $.24. If it has difficulty again, I would expect it to fall. Happy trading!

[thrive_leads id=’14274′]

Xalles Holdings XALL is looking pretty good, put it on your watchlist!

Xalles Holdings XALL is in a 52 week low but has just broke the trend and is looking like it really could take off. But before we dddo, sign up for our amazing FREE newsletter below to get the hottest picks!

Company Snapshot:

Company Name: Xalles Holdings, Inc

Ticker: XALL

Exchange: OTC

Website: https://xalles.com/

Company Summary:

Xalles Holdings, Inc. operates as a business development company, which is specialized in the payment industry and financial technology. It provides payment solution consulting, auditing and direct investment services. The company was founded by Thomas W. Nash on December 14, 2009 and is headquartered in Washington, DC.

XALL in the NEWS

February 09, 2022

Xalles Holdings XALL plans to expand our reach into the market of NFTs (non-fungible tokens) and cryptocurrency trading solutions.

Vigor Crypto Holdings, a wholly owned subsidiary of Xalles Capital, will analyze and test a variety of bots that are NFTs which trade on broader exchanges and futures markets like the Nasdaq, S&P 500, NYSE/Dow Jones. The goal is to evaluate, purchase and enhance our automated trading and bot portfolio, realizing that the key to success is finding the good system tool to support a good trading strategy.

Xalles Capital is also evaluating holding NFTs for long term investments which can be later sold on the secondary markets for profit. The strategy is that specific NFTs which contain trading bots and other assets and are sold in limited quantities would have a good opportunity to increase in value if the asset contained within the NFT is producing revenue or profits for its owner.

These strategies will complement what the company previously described with its joint venture company GioBot to create new trading bots to support Vigor Crypto and external clients. “NFTs and cryptocurrency trading bots and systems are an exciting part of the fintech ecosystem that Xalles is trying to optimize to drive innovation and profits,” stated Thomas Nash, Chairman and CEO of Xalles Holdings Inc.

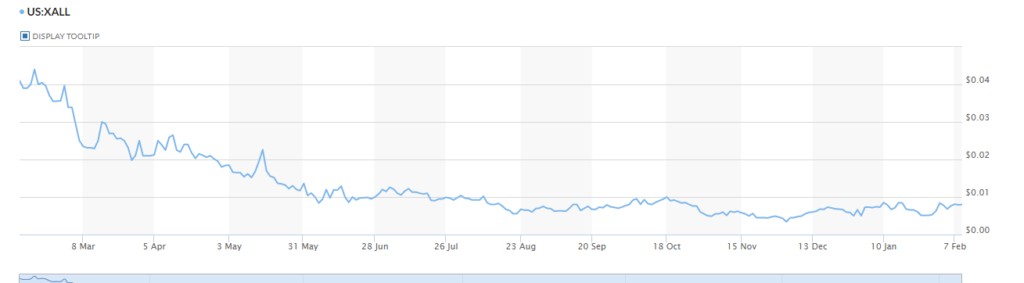

1 Year Chart

Technical Analysis:

Xalles Holdings XALL is looking like it could go either way at this point, it has created a bottom and volume is increasing so It’s possible it will take off. IF, it can break October’s high. IF, not, I expect it to continue down. Happy trading!

Cult Food CA:CULT is up almost 40%, calm before the storm?

Cult Food CA:CULT is looking strong as it reverses it’s bearish trend for a bullish one, look out! It is already up over 40% and doesn’t look like there will be a stop anytime soon! Before we get started, sign op for our newsletter below, it’s FREE and we are really good!

Company Snapshot:

Company Name: CULT Food Science Corp.

Ticker: CA.CULT

Exchange: Canadian Securities Exchange

Website: https://www.cultfoodscience.com/

Company Summary:

CULT Food Science is an innovative platform advancing the future of food with an exclusive focus on cultivated meat, cultured dairy and cell based foods.

The first-of-its-kind in North America, CULT Food Science provides investors with unprecedented exposure to the most innovative startup, private and early stage cultivated meat, cultured dairy and cell based foods companies around the world.

Latest news for Cult Food

Feb. 7, 2022

Cult Food CA:CULT Announced it has again diversified its cell-based food portfolio via a strategic investment into the leading cultured chocolate manufacturer, California Cultured Inc. (“California Cultured“). Based in Davis, California, California Cultured uses cell culture technology to produce cocoa products like cocoa powder, chocolate, and cocoa butter with the goal of creating sustainable and ethical chocolate for consumption around the world.

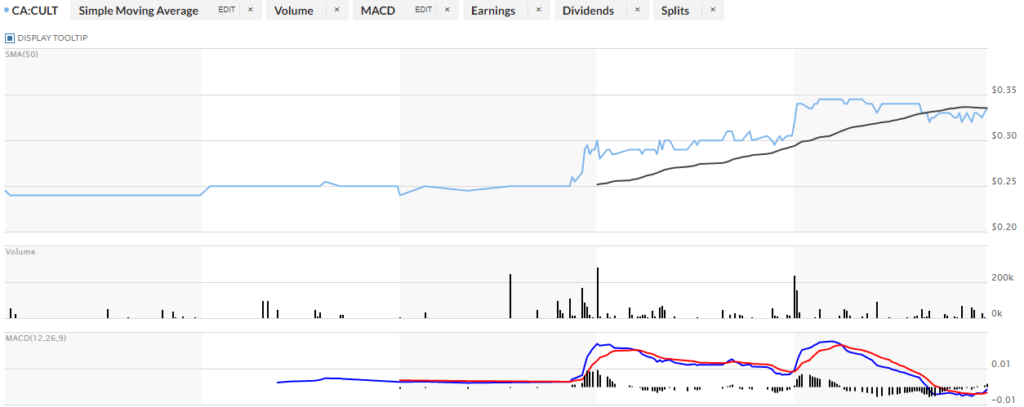

5 Day Chart

Technical Analysis:

The stock looks insanely good, it is BULLISH and I like it! It has been very methodical of late, big run, consolidate, big run consolidate. It appears it’s ready for another big RUN.

[thrive_leads id=’13642′]