Remark Holdings – Company Snapshot

Company Name: Remark Holdings

Ticker: MARK

Exchange: NASDAQ

Website: https://www.remarkholdings.com/

Industry: AI (Artificial Intelligence)

Company Summary: Remark Holdings (NASDAQ: MARK) primarily focuses on the development and deployment of artificial-intelligence-based solutions for businesses and software developers in many industries. Additionally, the company owns and operates digital media properties that deliver relevant, dynamic content. The company is headquartered in Las Vegas, Nevada, with additional operations in Los Angeles, California and in Beijing, Shanghai, Chengdu and Hangzhou, China.

MARK’s three target markets:

Retail Intelligence & Customer Analytics Solution

Fintech Risk Analysis & Lead Acquisition Solutions

Workplace & Public safety management system

Technical Summary

It is bullish and concerning all at the same time, LOL!

Wow, this one blew past 300% gains intraday which is really impressive! Since then it has pulled back but you would expect that with such an incredible run. Take a look at the descending chanell intraday, not too concerning but worth noting.

I like this one, keep an eye on it, If you would like to find a reason to be excited for the finish of the day in regards to Remark, take a look at the chart below.

It has beat the last two bottoms and now trying to close above the top line, which would be the third new, higher, bottom from thee pullback. Happy trading!

Greenpro Capital Group – Company Snapshot

Company Name: Greenpro Capital Group

Ticker:GRNQ

Exchange: NASDAQ

Website: https://www.greenprocapital.com/home/

Industry: Incubator

Company Summary:

GRNQ, Assists Emerging Growth Businesses and High Net-Worth Individuals to Capitalize Value and Maximize Wealth globally.

GRNQ’s four target markets:

Corporate Advisory – Withtheir successful case and proven result in solving complex corporate issues, they are determined to offer the best advice and support on all aspects of their clients’ requirements to maximize their corporate value.

Wealth Management Services entail the following areas of expertise:

– Private and Family Trusts

– Private Investment Company Setup

– Foundation & Family Office Setup

– Wealth Planning & Management Advisory

– Escrow Custodian Services

Incubation Centre – They specialize in consulting and growth of incubated companies.

FinTech (Financial Technology) – GreenPro is committed to provide the best FinTech services to their clients to ensure their sustainable growth in the New Finance Era. There services are:

-Accounting Intelligence (A.I.)

-Business Intelligence (B.I.)

-Creditability Intelligence (C.I.)

-Debt Financing Intelligence (D.I.)

-Equity Financing Intelligence (E.I.)

-Financial Intelligence (F.I.)

Technical Summary

What goes up must come down and based on that adage and the chart, it appears GRNQ is on it’s way down, down, down!

There is a chance for this to rebound if it can stay above the support at $1.31 on the pull backs and can break the last high at $1.50. I would be interested in trading this beast only if those two factors are checked off the old to do list. Keep an eye on this one.

Conclusion

(NASDAQ: GRNQ) sharesleaped 122% to $1.8895 after GRNQ announced that its incubated company Angkasa-X was admitted successfully as an ITU-R member. Next they will be filing for application to launch its Low Earth Orbit satellites. This is great news and I like the stock for the mid to long term moves but be very careful swing and day traders!

Bakkt Holdings, Inc. – Company Snapshot

Company Name: Bakkt Holdings, Inc

Ticker: BKKT

Exchange: NYSE

Website: https://www.bakkt.com/

Industry: Cryptocurrency exchange

Company Summary:

BKKT, is a rocketship after announcing a partnership with Mastercard (MA) & Fiserv (FISV) to offer crypto debit and credit cards, making it easier for consumers to pay using digital coins.

BKKT’s three target markets:

Consumers – Aggregate, manage, and spend digital assets like cryptocurrency, rewards, and gift cards

Businesses – Enable your customers to earn or trade crypto, plus redeem and pay with loyalty points via the Bakkt platform

Institutions – Our platform offers a monthly bitcoin futures contract to bring trust and transparency to the digital asset ecosystem. Our products provide greater regulatory clarity, better price discovery, and more effective risk management for financial institutions around the world.

UPDATE:4 Reasons LGIQ Continues To Run Higher, Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

Here are 4 exciting reasons to stop what you are doing and read this short research article on Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

- Logiq’s News is explosive!

- They have an experienced leadership team

- The stock is Highly Undervalued

- The stock is ready for another possible big move!

Before we get into the those 4 exciting reasons to put LGIQ on your watchlist, let’s do a quick update on the news!

Jan. 27, 2022

Announced it has completed the transfer of its AppLogiq assets into Lovarra (OTC: LOVA), a fully reporting U.S. public company.

The transfer completes the previously announced separation of Logiq’s DataLogiq and AppLogiq businesses into two publicly traded companies. The AppLogiq assets include CreateApp™, an award-winning software-as-a-service (SaaS) platform that enables small and medium-sized businesses worldwide to easily create and deploy a native mobile app for their business. AppLogiq also includes platforms for mobile payments and delivery services designed for emerging markets, as well as licenses of its technologies to industry partners.

Jan 13, 2022

Preannounced Q4 revenues of $12.3 million, coming in well above our November estimate of $8.8 million. Although company did not give the breakdown between AppLogiq and DataLogiq, we believe both businesses had a strong quarter. For one, we know that DataLogiq had great results in providing Medicare sales leads and is even working to expand the sales leads business, investigating adding call center capabilities. In addition, the company announced it had achieved gross margins in excess of 34% for the quarter. These results show year over year revenue growth of 87% and a doubling of gross margin dollars.

For the year Logiq will report revenues of approximately $36.5 million a decline of 3.7% and a double of its gross margin to approximately 30.6% versus 16.8% in 2020. As a result we are raising 2021 numbers as well as 2022. For 2022 we are increasing to $44 million in sales while keeping the loss the same. We will revisit estimates when the financials for the spin out are released.

Nov. 08, 2021

Has been invited to present at the ROTH 10th Annual Technology Event being held virtually on November 17-18.

Logiq president, Brent Suen, scheduled to present and participate in one-on-one meetings with institutional analysts and investors at the conference.

Management will discuss the company’s recently announced plan to separate AppLogiq™ and DataLogiq™ into two publicly traded companies to capitalize on their respective growth opportunities in the rapidly evolving global e-commerce and fintech landscape.

Preannounced Q4 revenues of $12.3 million, Now, That Is Incredible News!

Company Name: Logiq

Ticker: {NEO: LGIQ} (OTCQX: LGIQ)

Company Summary: Let’s start with the fancy jargon, “Logiq is a global provider of marketing solutions for Ecommerce, m-commerce (mobile commerce), and fintech solutions.”

Now let us break down in layman terms what all of that mumbo jumbo really means.

Logiq is BIG, really big, in fact they are reaching into the WORLD market. They are in ASIA, In North America and everywhere in between.

They offer solutions to small and medium sized companies who are trying to sell you something online. For example, all those advertisements following you around Facebook, Instagram and even news articles, that is Logiq and their competitors.

M-commerce (mobile commerce) is a fancy term for an app (application) on your phone (mobile) that gives the user the ability to make a small business website on their phone! Yes you can make a full website on your phone in the waiting room of your doctor’s office. Pretty cool!

Fintech Solutions, the “Fin” in Fintech stands for financial. The “tech” in Fintech stands for technology. So, they offer solutions in the financial sector via technology.

Logiq has all the right building blocks for an explosive play! TAKE A LOOK NOW!

There are 4 Key Units Driving Logiq’s Impressive Financial Numbers!

Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ), operates four key units:

1. DataLogiq – Here comes the Jargon, “is designed for ad generation and Ecommerce marketing solution” Ok, ad generation is found below, it is found on sports illustrated and is an ad

This ad is following me around because my dog is a jack A$# that doesnt listen and I’ve been searching for services and products so I don’t murder him. So the advertisement found above, understands that I have a jerk for a dog and will continue to show me things to buy.

E-commerce, means any attempt to buy and sell goods or services (commerce) online (e). Any platform that is found online, including websites (native) & Facebook (social media) that has an advertisement on it, is considered an e-commerce platform.

DataLogiq is a technology that allows small to medium size businesses to gain access to data (statistics) to help decide what platform (facebook) to run advertisements on to capture conversions (a purchase).

2. AppLogiq – which is a platform-as-a-service (PaaS) solution for SMBs to deploy native mobile apps for their businesses that come complete with mobile payments.

Wowzers, that is a lot of fancy words! PaaS platform as a service is fancy talk for an app (platform) as a service, self explanatory, the app offers a service.

Example, if you know a millennial, they have photo editing applications on their phone, so they can look completely different on instagram, LOL. The app (platform), offers a service (photo editing).

The service that AppLogiq offers is the ability to build a website on your phone with the AppLogiq app. It comes complete with the ability to accept payment right from your very own small business website built with your smartphone.

3. Fixel – delivers AI-driven engagement segmentation by analyzing user interactions on a company’s website, fixel learns consumer behavior and then delivers the data the company needs to create valuable audiences.

Let me break that down for you, when a person goes to a website they use a tracking pixel, similar to a jealous husband that puts a GPS tracker in his wife’s car.

The company, like the jealous husband, can follow your patterns of buying things. This information is then run through artificial intelligence to create audiences (larger groups) based on the data.

Best example, the more you use Netflix, the more the (AI) can predict what you will WANT to watch next. Yes it can sound creepy but it is also very convenient.

So they can market to more people just like that user. Hence, more data, more efficiency and more buyers.

4. Pay&GoLogiq – this unit handles credit and payment points, payments using QR codes, and powers the company’s AtoZ Go food delivery service.

This one is written in almost common language. Here is a little more clarification, all ecommerce stores need to process payments via credit card on their website, Logiq offers that solution.

FOUR Exciting reasons to stop what you are doing and read this short research article on Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ)

The News is explosive!

Oct. 12, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include Semcasting’s advanced consumer and B2B title targeting capabilities.

Commonly referred to as data onboarding, Semcasting’s solution will allow LDM clients to easily take their offline customer data, including in-store receipts or home addresses, and translate it into targetable data for online marketing.

Sept. 23, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include geofencing-based targeting.

Unlike traditional geotargeting that restricts digital ads to audiences in a particular zip code, city, state, or country, geofencing is a custom-defined area that can outline the boundaries around a particular store, mall, or other physical venues. The technology enables geofencing by using the latitude and longitude coordinates of a consumer digital device, such as a connected TV, smartphone, tablet or PC, to determine their location.

Sept. 13, 2021 Logiq creates a partnership that creates an avenue to bring digital wallet and payment services to 50 million Indonesians. Mobiquity Pay, one of the world’s largest digital wallets from Comviva, will now power Logiq’s (NEO-LGIQ) (OTCQX-LGIQ) PayLogic digital wallet in the country.

On June 21 2021, Logiq (NEO-LGIQ) (OTCQX-LGIQ) announced the closing of its IPO offering of 1,976,434 units of securities in Canada at C$3.00 for gross proceeds of C$5.9 million and began trading in Canada on the NEO exchange to expand its reach up north.

The Asia-Pacific region is one of the fastest growing in the world and Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is focusing efforts there as a result of the huge opportunities it presents for the company. On July 21, 2021, the company expanded its Logiq (NEO-LGIQ) (OTCQX-LGIQ) digital marketing platform to include direct-media buying across the APAC region.

Experienced Leadership

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

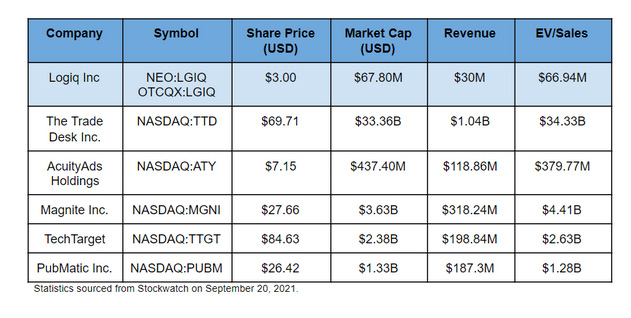

The stock is Highly Undervalued!

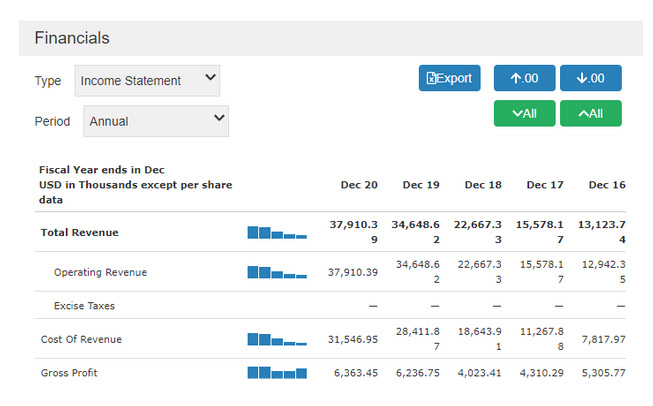

You get a better idea of how impressive the consistent, continued growth is by looking at the growth in the chart below over the last 5 years!

Growing at a CAGR (Compound Annual Growth Rate) of 31% from 2016 to 2020, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is growing fast. Company leaders are now expecting 31% gross margins and revenues between $34-38 million by the end of 2021.

As you can see from the prices above, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) has a lot of room to grow when it comes to price – and with word now starting to get out about this previously under-the-radar company that growth could come quickly.

The stock is ready for another possible BIG MOVE!

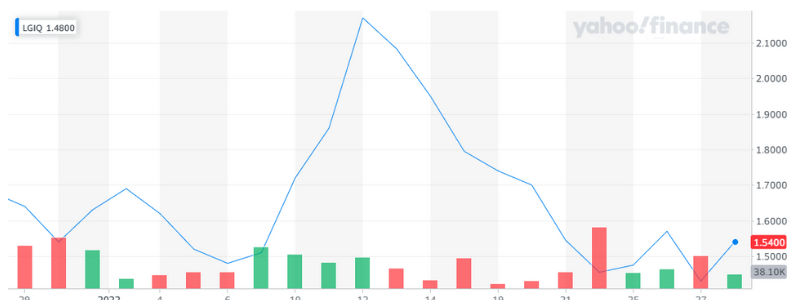

As you can see below this stock has the ability to make some serious moves. In less than four trading days this stock went from $1.45 to over $2.17 yielding 50% gains. More importantly, the stock created a very stable and methodical climb to a whopping 50% GAINS in FOUR trading days! If you had $10,000 invested in about 4 days you could have made $5,000!!!

As one can see from the 1 month chart below, the stock has consolidated and is ready for a possible large run AGAIN.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Logiq should be on your watchlist because of the massive opportunity it has in a very accessible market because:

- The News is explosive

2. Experienced Leadership

3. The stock is Highly Undervalued

4. The stock is possibly ready for another big move!

Happy Trading and remember, never try to catch a falling knife!

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, LGIQ. Small Cap Exclusive has been hired by Civit Digital for a period beginning on October 29, 2021 and by Emerging Markets Consulting for a period beginning October 29, 2021 to publicly disseminate information about (LGIQ) via website and email. We have been compensated $35,000 USD by Civit Digital and $27,500 USD by Emerging Markets Consulting. We will update any changes to our compensation.

Read full disclaimer here.