(MBOT) Microbot Medical Analysis

(MBOT) Microbot Medical goes up 68%, what next?

Microbot Medical shares MBOT skyrocketed 67.3% with heavy volume toward a nine-month high on Monday. News was released that the pre-clinical medical device company announced an agreement with Stryker Corp SYK to develop the first dedicated robotic procedural kits for use in certain neurovascular procedures.

Company Name: (MBOT) Microbot Medical

Ticker: (MBOT)

Exchange: NASDAQ

Website: http://www.microbotmedical.com

Company Summary:

Microbot Medical Inc. (NASDAQ: MBOT) is a pre-clinical medical device company that specializes in transformational micro-robotic technologies, focused primarily on both natural and artificial lumens within the human body. Microbot’s current proprietary technological platforms provide the foundation for the development of a Multi Generation Pipeline Portfolio (MGPP).

Why did MBOT Microbot Medical go up?

Microbot Medical Inc. (Nasdaq: MBOT) announced that it has entered into a strategic collaboration agreement with Stryker, a leading global medical technology company.

The company will collaborate with Stryker’s Neurovascular division to integrate its neurovascular instruments with Microbot’s LIBERTY Robotic System to develop the world’s first dedicated robotic procedural kits for use in certain neurovascular procedures

MBOT 1 Day Chart

MBOT Technical Analysis

(MBOT) pulled back from the open to a low of $7.38 from a high an open of $8.93 constituting a 21% retrace. So is the stock ready to bounce? It ran from the low of $7.38 to a high of $8.50 and the consolidated in that range.

Can it bounce? It will bounce like a basketball if it eclipses $8.50. If it doesn’t it will fail. I like it if it can cruise by $$8.50 in the morning!

Microbot is poised to be a big winner if it can break out of this consolidation pattern. Make sure to always trade with stop losses. Happy trading

(NASDAQ:AVCT) announcement

AVCT

Company Name: American Virtual Cloud Technologies, Inc.

Ticker: (AVCT)

Exchange: NASDAQ

Website: avctechnologies.com kandy.io

Company Summary:

AVCT American Virtual Cloud Technologies, Inc. (“AVCT”; Nasdaq: AVCT) is a premier global IT solutions provider offering a comprehensive bundle of services including unified cloud communications, managed services, cybersecurity, and enhanced connectivity.

Consequently, their mission is to provide global technology solutions with a superior customer experience.

In 2020, American Virtual Cloud Technologies, Inc., acquired Computex Technology Group and Kandy Communications.

Kandy, an AVCtechnologies company, is a cloud-based, real-time communications platform.

Moreover, It offers proprietary UCaaS, CPaaS, CCaaS, Microsoft Teams Direct Routing as a Service, and SIP Trunking as a Service capabilities.

Kandy enables service providers, enterprises, software vendors, systems integrators, partners, and developers to enrich their applications.

Also, it services with real-time contextual communications, providing a more engaging user experience.

Moreover, with Kandy, companies of all sizes and types can quickly embed real-time communications capabilities into their existing applications and business processes.

Why did it go up?

Dec. 15, 2021 (GLOBE NEWSWIRE) — American Virtual Cloud Technologies, Inc.’s (AVCtechnologies) (Nasdaq: AVCT) Kandy Communications business unit (Kandy).

Kandy is also a global leader in secure and intelligent cloud communications, today announced that full Public Switched Telephone Network (PSTN) replacement services.

Kandy is now available in Brazil and China, bringing the total number of countries serviced by Kandy’s voice network to 40.

Therefore, you can see the positive results this news can yield.

5 Day Chart

1 Day Chart

Technical Analysis:

Since the news, I like this stock for a quick scalp. It is consolidating in a bullish trend and will have a pretty clean run to resistance at $2.38 which represents a $.20 (8.5%) return per share.

If it haves trouble at $2.38 a trader could exit and take that 8% and run or if it glides past it, you’re in a great position for a run. I like it!

For more articles like this, please visit this featured article HERE.

In closing, remember traders to always trade with stop losses and never try to catch a falling knife!

UPDATE:! 100% Correct, Alex made 5 correct predictions for Petros Pharmaceuticals, Inc. PTPI!

Company Name: Petros Pharmaceuticals, Inc.

Ticker: (PTPI)

Company Summary:

Petros Pharmaceuticals is committed to the goal of becoming a world-leading specialized men’s health company by identifying, developing, acquiring, and commercializing innovative therapeutics for men’s health issues, including, but not limited to, erectile dysfunction, endothelial dysfunction, psychosexual and psychosocial ailments, Peyronie’s disease, hormone health, and substance use disorders.

Why is it red HOT?

Petros reported positive over-the-counter (OTC) draft label comprehension study results for its erectile dysfunction (ED) Drug STENDRA® (avanafil). This Pivotal Label Comprehension Study was designed to assess comprehension of a draft STENDRA® Drug Facts Label intended for OTC use.

What did the say, “The label comprehension study is a key component of our plans to help expand access for STENDRA beyond the prescription model, and to make

The first “potentially the first prescription-grade ED medication to become available over-the-counter in the United States.” EVER?!?

Alex wrote on Monday 12/13/21 a 5 Day Technical Analysis based on this chart below:

The Predictions

“It’s been gapping up and pulling back for the last 4 days and it looks like it is still bullish but it is possibly about to go bearish! Let’s take a close look at the 1 day.” “It’s very simple, can it beat $4.38? Yes, then I would wait for a pull back and then swing trade it for a quick scalp. If it can’t, I would expect a pullback then consolidation and then a run! Overall, I love the stock because of the news. The first OTC ED med, say what!?!?”

Let’s look at each prediction

Prediction #1 “about to go bearish”

“It’s been gapping up and pulling back for the last 4 days and it looks like it is still bullish but it is possibly about to go bearish “It’s very simple, can it beat $4.38? If it can’t, I would expect a pullback then consolidation and then a run!

Let’s look at where it is around lunch on Wednesday 12/15/21

WOW Alex called prediction 1 with a 38% pullback

Prediction #2 “I would expect a pullback then consolidation”

“If it can’t, I would expect a pullback then consolidation and then a run!” You can see in the above chart the consolidation call! This is not fortune telling, the chart is like a book and if you know how to read the language it is written in, it makes total sense!

As you can see from the above chart it most definitely consolidated. Let’s see what happened after consolidation!

Alex Goldman Prediction #3: “RUN“

“I would expect a pullback then consolidation and then a run!“

As you can see from the above chart it ran MINUTES after the article was finished and gave our subscribers a chance at 28% & 43% RUNS.

Alex Goldman Prediction #4: “It is about to run”

Alex wrote a follow up Article HERE Wednesday last week Dated 12/15/21 updating our subscribers

Alex wrote on midday Wednesday 12/15 “It is about to run! It is bullish and I like it! Put it on your watchlist and Let’s make some money!!!!”

Alex Goldman Prediction #5: “SCALP”

“wait for confirmation of a reversal and get ready for a quick scalp.“

Alerted our EXCLUSIVE subscribers via email yesterday 12/20/21.

You can sign up below

Alex wrote in the email on Monday 12/20 “It is now in a bearish trend for the 1 day but still bullish overall. My recommendation is to wait for confirmation of a reversal and get ready for a quick scalp.”

SCREENSHOT PROOF FROM OUR EMAIL HERE

OK it is official, Alex really really knows the movement and nuances of this chart! He called yet another massive gain today at 49%

What is Alex’s next prediction for PTPI?

Sign up for our newsletter below, IT’S FREE and you could win $250!

UPDATE: Alex believes Petros Pharma (PTPI) is ready to BOUNCE, PAY ATTENTION!

Company Name: Petros Pharmaceuticals, Inc.

Ticker: (PTPI)

Company Summary:

Petros Pharmaceuticals is committed to the goal of becoming a world-leading specialized men’s health company by identifying, developing, acquiring, and commercializing innovative therapeutics for men’s health issues, including, but not limited to, erectile dysfunction, endothelial dysfunction, psychosexual and psychosocial ailments, Peyronie’s disease, hormone health, and substance use disorders.

Why did it go up over 100%?

reported positive over-the-counter (OTC) draft label comprehension study results for its erectile dysfunction (ED) Drug STENDRA® (avanafil). This Pivotal Label Comprehension Study was designed to assess comprehension of a draft STENDRA® Drug Facts Label intended for OTC use. This study is a key component in the Company’s plans to engage in discussions with the FDA to expand the product’s access through application for a possible OTC pathway. Early study indicators show positive label comprehension outcomes in the study, which has encouraged the Company to initiate the next step, a Self-Selection Study, as it continues to build the case for the FDA for OTC access to STENDRA.

“The label comprehension study is a key component of our plans to help expand access for STENDRA beyond the prescription model, and to make

The first “potentially the first prescription-grade ED medication to become available over-the-counter in the United States.” EVER?!?

I’m a big fan of this company and the recent news it released. Let’s take a look at the chart.

I wrote on Monday 12/13/21 a 5 Day Technical Analysis:

“It’s been gapping up and pulling back for the last 4 days and it looks like it is still bullish but it is possibly about to go bearish! Let’s take a close look at the 1 day.”

Yes, I was right it went BEARISH!

I wrote on Monday 12/13/21 a 1 Day Technical Analysis:

“It’s very simple, can it beat $4.38? Yes, then I would wait for a pull back and then swing trade it for a quick scalp. If it can’t, I would expect a pullback then consolidation and then a run! Overall, I love the stock because of the news. The first OTC ED med, say what!?!?”

Let’s look at where it is around lunch on Wednesday 12/15/21

WOW I called it, it didn’t break $4.38 and it did PULLBACK 38%!

Called it AGAIN, Now it is consolidating!

Alex Goldman Prediction:

It is about to run! It is bullish and I like it! Put it on your watchlist and Let’s make some money!!!!

Petros Pharma (PTPI) to launch an OTC Erectile dysfunction pill?

Company Name: Petros Pharmaceuticals, Inc.

Ticker: (PTPI)

Exchange: NASDAQ

Website: https://STENDRA.com/.

Company Summary:

Petros Pharmaceuticals is committed to the goal of becoming a world-leading specialized men’s health company by identifying, developing, acquiring, and commercializing innovative therapeutics for men’s health issues, including, but not limited to, erectile dysfunction, endothelial dysfunction, psychosexual and psychosocial ailments, Peyronie’s disease, hormone health, and substance use disorders.

Why did it go up over 100%?

Petros Pharmaceuticals, Inc. (“Petros” or “the Company”) (Nasdaq: PTPI), a leading provider of therapeutics for men’s health, today reports positive over-the-counter (OTC) draft label comprehension study results for its erectile dysfunction (ED) Drug STENDRA® (avanafil). This Pivotal Label Comprehension Study was designed to assess comprehension of a draft STENDRA® Drug Facts Label intended for OTC use. This study is a key component in the Company’s plans to engage in discussions with the FDA to expand the product’s access through application for a possible OTC pathway. Early study indicators show positive label comprehension outcomes in the study, which has encouraged the Company to initiate the next step, a Self-Selection Study, as it continues to build the case for the FDA for OTC access to STENDRA.

“The label comprehension study is a key component of our plans to help expand access for STENDRA beyond the prescription model, and to make STENDRA potentially the first prescription-grade ED medication to become available over-the-counter in the United States. While the process of gathering data to be shared with the U.S. Food and Drug Administration (FDA) continues, we are enthusiastic about our progress toward providing new hope for the millions of men suffering from this condition,” commented Fady Boctor, Petros’s President and Chief Commercial Officer.

The first “potentially the first prescription-grade ED medication to become available over-the-counter in the United States.” EVER?!?

I’m a big fan of this company and the recent news it released. Let’s take a look at the chart.

5 Day Technical Analysis:

It’s been gapping up and pulling back for the last 4 days and it looks like it is still bullish but it is possibly about to go bearish! Let’s tak a close look at the 1 day.

1 Day CHart Technical Analysis

It’s very simple, can it beat $4.38? Yes, then I would wait for a pull back and then swing trade it for a quick scalp. If it can’t, I would expect a pullback then consolidation and then a run! Overall, I love the stock because of the news. The first OTC ED med, say what!?!?

Tantech Holdings Ltd (NASDAQ: TANH) develops driverless street sweepers!

Company Name: Tantech Holdings Ltd

Ticker: (TANH)

Exchange: NASDAQ

Website: http://ir.tantech.cn

Company Summary:

For the past decade, Tantech has been a highly specialized high-tech enterprise producing, researching and developing bamboo charcoal-based products with an established domestic and international sales and distribution network. Since 2017, when the Company acquired 70% of Shangchi Automobile, a vehicle manufacturer based in Zhangjiagang City, Jiangsu Province, it has manufactured and sold vehicles. The Company established two new subsidiaries, Lishui Smart New Energy Automobile Co., Ltd. and Zhejiang Shangchi New Energy Automobile Co., Ltd., in November 2020, to produce and sell street sweepers and other electric vehicles.

Why did it go up over 100%?

LISHUI, China, Dec. 13, 2021 /PRNewswire/ — Tantech Holdings Ltd (NASDAQ: TANH) (“Tantech” or the “Company”), a clean energy company in China, today announced that its subsidiary, Lishui Smart New Energy Automobile Co., Ltd., received a milestone order for twelve of its highly innovative SC-120A driverless and autonomous street sweepers. The customer is a real estate development and property management company, managing industrial parks and other properties in China. This represents the first order since the recent completion of the final phase of factory testing and standard factory quality control reviews. The Company separately announced the successful development of its third generation of driverless and autonomous sweeper with enhanced features, including expanded route and memory capabilities, additional sensors and improved further improved navigation and positioning accuracy.

Our opinion:

Pretty cool, driverless street sweepers! Autonomous vehicles are going to be the norm in the future and they just sold 12, pretty big news!

1 Day

1 Day Technical Analysis:

I like it, the news is great with driverless street sweepers. The chart is solid, my only caveat is, wait until it breaks $.63 in my opinion. Hopefully it gaps up this morning and breaks through.

5 Day

5 Day Technical Analysis:

It’s a bullish trend line, hopefully the volume will continue. Keep an eye on the news feed, that drives volume. Again, the $.63 PPS is an important target for this morning and it would be nice to see it glide right by it. Happy trading!

Discussing Omicron, Facebook & SAND with Alexander Goldman

A fireside introduction, without the fire, use your imagination!

I’m not a fortune teller, although I’ve been accused of it, I am a simple man that can read stock charts, read people and read a little of Spanlgish. My name is Alexander Goldman but my friends call me Alex, let’s discuss the topics of the day.

Omicron, shall we drink?

Since the breakout variant Omicron has dominated the news, the Dow Jones Industrial Average has plummeted 2,000 points in two weeks. This market disturbance represents a 6% correction in just 10 trading days.

Yesterday Moderna (MRNA) CEO Stephane Bancel told the Financial Times that the company’s current COVID-19 vaccine would likely see a “material drop” in effectiveness against Omicron, but that more data was still needed on the variant.

Let’s have a coffee, maybe with some Jameson Whiskey, & discuss, shall we?

The good news is, there are incredible opportunities in tragedies. Take a look above, remember the late/early spring of 2020? We rang in the New Year with grandiose visions of a Great Gatsby kinda 2020 and then boom, Covid!

The market overreacted and share prices plummeted, then the market DOUBLED in 18 months. The truth is, I’m not drinking because of sorrow, I’m celebrating the opportunities on the horizon.

Remember the song Gangster’s paradise by Coolio? Well, a trader’s paradise is volatility! Shorters went nuts in the winter of 2020 & the longs went bananas in the Spring. So, everyone come the fu@k down and double dip for god’s sake. Play the short and play the long and then go play some golf.

META, the social media giant formerly known as Facebook

Today Reuters writes, “Facebook risks missing the point of metaverse – and a coming shift in consumers’ behaviour – if it fails to permit digital ownership, according to some of the virtual world’s pioneers.

The social media giant (FB.O) made waves last month by changing its name to Meta Platforms and announcing a focus on the buzzy “metaverse”.

However, with few details beyond the rebrand, metaverse participants doubt it is ready to embrace the spirit driving creativity and profit in the space.

“What Facebook is doing with meta…is a ‘fake metaverse,’ unless they actually have a real description as to how we can truly own it,” said Yat Siu, chairman and co-founder of Animoca Brands, an investor in and builder of metaverse platforms, speaking on a panel at the Reuters Next conference.”

Haters are gonna hate & ainters are gonna aint, shall we discuss?

Is Yat Siu hating? Time will tell. On one hand, it’s Facebook and let’s face it, we might not like it, but they are profit geniuses. On the other hand, they became a juggernaut on the back of monetizing consumer data & being accused of centralizing political power, not decentralizing the power structure which the crypto/metaverse gang preaches. Can FB truly embrace decentralization in the name of profit, we will see.

Don’t bring SAND to the beach, what about a META beach?

What is SAND.X?

Truth be told, I didn’t know anything about SAND until I reached out to a trusted advisor about the MetaVerse and I asked, “If you were to invest in the meta verse? How and where?” He responds, “SAND”

I proceeded to research this stock called SAND and to my surprise, I couldn’t find it on the OTC, NASDAQ or Big Board! Do you know why? It’s a cryptocurrency and I got excited! Admit it, everyone who didn’t invest in Bitcoin a few years ago feels like they missed THE boat, and I feel the same way. So, SAND feels like a do over, another chance at Bitcoin.

As my Ex Girlfriend used to say, We OOOOOO!

Is it too late?

Emma Newberry writes for Motley Fool and she alludes to it here, “there’s a lot of uncertainty about how the metaverse will develop and whether Sandbox can maintain that price.”

That is the 7 day chart ^ and it would appear that she is right, or is she?

Tune in next week to hear a stock trader’s opinion on the SAND chart, by the way I don’t know shit about crypto currencies!

Can You Name the $15 Million Stock with Eyes on a $35 Billion Market

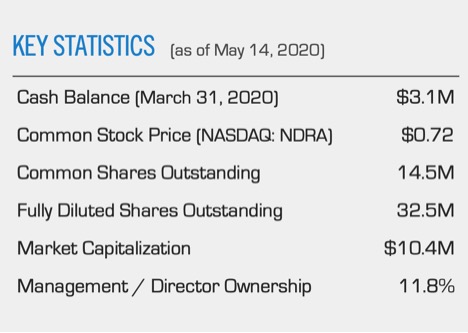

Long-term success on Wall Street is all about getting ahead of the story everyone else will be chasing months or even weeks down the road. That’s why Endra Life Sciences Inc. (NASDAQ-NDRA) has my attention now.

Look at NDRA today and it’s more potential than powerhouse. The company doesn’t even make room for revenue on its quarterly pre-revenue reports yet. It hasn’t sold anything. The profitability that institutional investors demand is probably years away.

On paper, all it has to back up its $15 million market cap is $3 million in cash, miscellaneous other assets and a whole lot of talent and ideas. Big ideas. Many patents were collected over the last five years, 5 others overseas and dozens of others around the world.

Those ideas and the talent to turn them into commercial reality are the important thing about NDRA right now. All in all, they’re why the analysts who know this little company best say it will be worth $5.00 to $6.00 under the right conditions.

The firm with the most bearish take on NDRA just raised its target to $2.75 and left the door open to additional upgrades beyond. That’s pretty big talk for a stock that was trading at $0.65 at the time . . . and even now, after a blockbuster 65% run, remains within sight of a lowly $1.

THE BILLION-DOLLAR OPPORTUNITY

What have the analysts figured out that the market can’t see? Putting the dots together starts with four simple letters: N A S H.

It stands for Non-Alcoholic Steato Hepatitis. It means fat builds up in the liver (steatosis) and starts causing inflammation. In effect, it’s a form of self-inflicted hepatitis. In extreme cases, scarring and cirrhosis follow. It resembles alcoholic liver disease, only without the liquor.

And it’s a silent health epidemic that we know affects 20 million Americans and probably up to 80 million more people carry the fatty markers without knowing. Do the math and it kills more people than coronavirus . . . but because it’s progressive, the longer you have it, the worse your odds get.

NASH is now the top reason people need liver transplants today. Bigger than hepatitis. It can even cause cancer. While there’s no cure right now, Big Pharma has already spent BILLIONS ($1 billion from Gilead alone, and even then, that drug failed) trying to ring that bell. There are literally dozens of hopeful drugs in the clinic now. Most will fizzle out on the road but those that finally make it all the way to FDA approval will share a $35 billion sales jackpot.

Is it any wonder Wall Street goes nuts on the faintest whiff of progress toward a NASH cure? But if you’re curious about where tiny little NDRA fits into the story and how it hopes to compete with just about every ambitious drug company around, stop wondering.

NDRA isn’t racing the giants to a cure. That’s a fool’s game. Instead, management did a little reading between the lines and realized that they can help by coming up with better ways to detect NASH in its early stages.

Detection is essential. And it’s difficult. “Early detection is one of the biggest challenges” because by the time you notice the symptoms, you’re really sick.

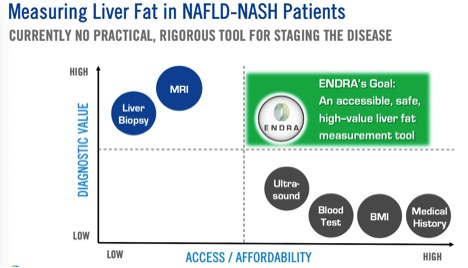

Right now there are really only two ways to test for NASH: 1) a liver biopsy and 2) a full MRI to peek inside the body. The biopsy is invasive and uncomfortable. The MRI is expensive and relies on increasingly irreplaceable helium to run the magnets.

Between Option A and Option B, there’s no easy way to screen for who has NASH and who doesn’t. When you’re looking at a silent and lethal epidemic, it’s a good idea to run as many tests as you can . . . tens of millions just to identify all the people who have the condition now.

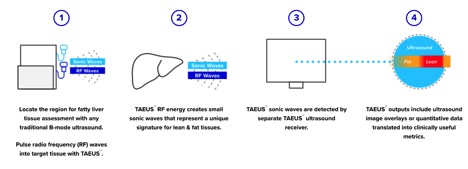

So NDRA came up with Option C. and differentiate fat from lean tissues.

THE NDRA ALTERNATIVE

Because fat is the problem, recognizing it on the scanner is all it takes. You’ve got NASH or you don’t. Follow-up tests can gauge progress or remission once those new drugs hit the market, telling doctors when to prescribe a pill or how to evaluate its effects.

NDRA’s system is proprietary. Only their machines know how to decode the waves and find the fat. The procedure doesn’t require gigantic magnets or rare helium. The machine costs 1/50 of an MRI suite.

And hospitals don’t have to buy an all-new imaging suite to run the test. This system TAEUS sits next to the existing ultrasound and plugs right in.

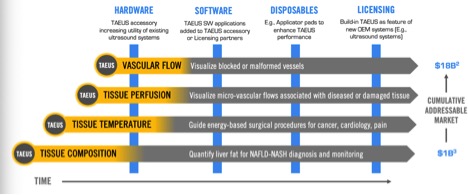

Say there are 20,000 radiology labs in the developed world that do ultrasound screens now. NDRA can ultimately gross $1 billion selling them each a $50,000 TAEUS unit. That’s not a bad windfall at all for a company that’s currently valued at $15 million, right? For little NDRA to trade at even 1X that “base addressable market” opportunity, it would need to unlock truly massive upside . . . which would in turn give shareholders who got in early plenty to cheer.

From there, the accounting really adds up. The system can also map temperature in the body to help guide laser- and heat-based surgical procedures. It can track blood flow down to the microscopic level. Ultimately TAEUS has the potential to spot blockages to diagnose and assist treatment of a wide range of conditions. And throughout, NDRA has made sure to keep building in ways to sell disposable equipment and charge licensing fees to people who have already built the machine.

Remember, tens of millions of people in America alone (not even counting the rest of the world) probably have NASH and need to get a definitive diagnosis. Biopsies cost $1,500 apiece. An MRI scan is running close to double that . . . and that’s when the machines are actually working and slots are available! Even if the disposables only cost a few dollars per procedure, we’re looking at real money here.

All in all, management suspects there’s $18 billion to chase. At that point, the multiplier gets vast. Again, NASH is a big problem and big money: here’s a report suggesting that just selling the genetic markers that say you MIGHT get the disease is going to be worth $2 billion a year very soon. People with the markers will still need physical confirmation. That’s where NDRA comes in.

SOLVING THE BILLION-DOLLAR PUZZLE

Of course it’s a long way from a $15 million stock with big dreams to the kind of company that can realistically conquer billion-dollar markets. NDRA today reflects reality on the ground today. However, management has done a lot of work paving the road from here to there.

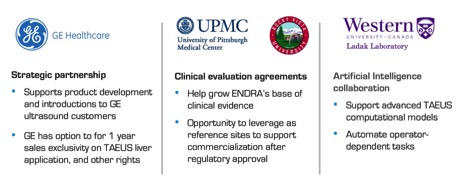

To start, nothing ever happens in healthcare without regulatory approval. NDRA has already gotten clearance in Europe and is now looking to file its 510(k) medical device submission this summer, so the clock is ticking there. If you aren’t familiar with the 510(k) process, it’s a lot faster than what it takes to get a drug approved.

You really just need to prove safety and effectiveness. As long as your system doesn’t hurt people and actually provides the medical benefit you claim it does, the FDA tends to give you the green light to start selling. Historically it takes less than six months, so as long as NDRA makes its 2Q timeline, we can hope to hear back by the end of the year.

But maybe NDRA wants to wait and make sure the application is as strong as possible. A few months ago their research revealed a past FDA decision that might raise the odds of approval as long as they “do it that way.” Getting the data points in line has taken a little more time.

Meanwhile, the Europeans have already signed off on the device. That’s 5,500 hospitals or a $275 million revenue opportunity ($50,000 per TAEUS) that just opened up. Even if nothing happens on other regulatory fronts for months to come, NDRA is now free to start making money. And at this point, any slice of the initial $275 million market will feel mighty good.

Once you get the green light, you still need to convince the doctors they need to lobby hospitals to buy the equipment. NDRA has teamed up with the liver experts at the Medical College of Wisconsin while partnerships with the University of Pittsburgh Medical Center and Rocky Vista University do their share to spread the word. The more data that gets out into the journals, the easier the job gets.

A lot of doctors are probably eager for an efficient NASH testing system, so resistance is probably going to be mild at worst. When potential customers actively want to buy what you’re selling, all you have to do is give them a way to hand you the money.

And that’s the last big piece of the puzzle snapping into place. NDRA isn’t building a vast sales force to approach thousands of hospitals. That takes time and a whole lot of money. Instead, they’ve teamed up with GE Healthcare . . . which sells and supports the ultrasound machines that TAEUS plugs into.

If the ultrasound is the razor and TAEUS is the fancy new blade, NDRA has made a very powerful friend. GE is happy because the added functionality makes the ultrasound more relevant. NDRA gets to virtually “ride along” on the sales conversations. That’s what “facilitating introductions” means in that last link. Do you have an ultrasound machine? Did you buy it from GE? Have you heard that NDRA can leverage your existing machine to detect NASH?

THE BOTTOM LINE

Add it all up, NDRA has a solid shot at getting a lot of those hospitals to upgrade their existing ultrasound machines. Once they all do it, that’s billion-dollar potential, a real company maker.

Look at a company like Exact Sciences, which makes mail-in colon cancer tests. It took the last two years to book $1.3 billion in sales. This year it might do $1.2 billion as well. That once-obscure company is now worth close to $13 billion.

According to that math, NDRA only needs to sell a couple dozen TAEUS systems a year to justify its current market cap. The European hospitals can buy now. Even if NDRA hits 1% penetration of that market, we’re looking at a lot more than “a couple dozen” sales.

Remember, GE is helping. The data is flowing. Awareness around NASH isn’t fading. Doctors are waking up to the depth of the problem they’re facing as liver cancer and transplant numbers hit the red zone.

Day by day, those hospitals will get more receptive. And then “a couple dozen” will look small, at which point NDRA translates its potential into something a lot more substantial . . . and shareholders who saw the future in an obscure $15 million stock will be able to brag that they were early and right.

Disclaimer :This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on NDRA (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS. By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Endra Life Sciences Inc. Small Cap Exclusive has been hired by 1047631 BC LTD for a period beginning on June 18, 2020 to publicly disseminate information about (NDRA) via website and email. We have been compensated $61,000. We will update any changes to our compensation.Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. Endra Life Sciences Inc. is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.