SpotLite360 CA:LITE is looking like it could take off, it’s up 100%!

SpotLite 360 CA:LITE is looking strong as it reverses it’s bearish trend for a bullish one, look out! It is already up over 100% and doesn’t look like there will be a stop anytime soon! Before we get started, sign op for our newsletter below, it’s FREE and we are really good!

Company Snapshot:

Company Name: SpotLite IOT Solutions, Inc.

Ticker: CA.LITE

Exchange: Canadian Securities Exchange

Website: https://www.spotlite360.com/

Company Summary:

SpotLite360 CA:LITE is a logistics technology developer unlocking value, opportunities, and efficiencies for all participants in a supply chain. The company endeavors to set new standards of transparency, integrity, and sustainability in the pharmaceutical, healthcare, and agriculture industries. Its flagship SaaS solution has been engineered to seamlessly track the movement of a product by integrating with systems of all major stakeholders in a supply chain ranging from the raw materials to the hands of the end consumer. Spotlite360 Technologies was founded on September 23, 2014 and is headquartered in Vancouver, Canada.

Latest news for Spotlite360

Feb. 03, 2022

Entered into an agreement with Control Union (“Control Union”) in which the parties will produce, develop, market and deliver an exclusive global hemp supply chain certification. The initial certification will leverage partnerships with seed genetic companies, hemp farmers and hemp extraction/processing companies to develop a seed, to product, to consumer supply chain best practices. Control Union, a Peterson Control Union Company, will help author the standard and will audit companies against this standard to guarantee consistent product quality, chain of custody, proof of origin, environmentally sound practices, sustainable sourcing and prove of ESG (“Environmental, Social, Governance”) initiatives. The standard will leverage SpotLite360 Technologies and its unique supply chain focused tracing and tracking capabilities, leveraging RFID and IoT (“Internet of Things”) technologies to ensure real time data and visibility throughout the entire partner ecosystem.

5 Day Chart

Technical Analysis:

The stock looks insanely good, it is BULLISH and I like it! That was easy and quick

Exicure XCUR has been on fire lately, up almost 50% in 5 days.

Exicure XCUR has been on fire lately, up almost 50% in 5 days after a massive amount of volume being injected into this little well known stock. The stock has been crashing for the last 6 months. I have written a full report on XCUR that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Exicure XCUR has some very bad press, check it out “UPCOMING DEADLINE ALERT: The Schall Law Firm Encourages Investors in Exicure, Inc. with Losses of $100,000 to Contact the Firm” Before we get started, let’s review some basic information on this company.

Exicure XCUR Company Summary

Company Name: LimitExicure

Ticker: XCUR

Exchange: NASDAQ

Exicure, Inc. Company Summary

Exicure, Inc. is a development-stage biotechnology company developing therapeutics for neurology and rare genetic disorders based on its proprietary spherical nucleic acid (SNA™) technology. Exicure’s proprietary SNA architecture is designed to unlock the potential of therapeutic oligonucleotides in a wide range of cells and tissues. Exicure’s lead programs address neuroscience diseases and genetic disorders. Exicure is based in Chicago, IL.

SNA constructs overcome one of the most difficult obstacles to nucleic acid therapeutics: safe and effective delivery into cells and tissues. SNA constructs exhibit unparalleled transfection efficiency into numerous cell and tissue types, including the skin, without carriers or transfection agents.

SNA™ technology originated in the lab of Professor Chad A. Mirkin at the Northwestern University International Institute for Nanotechnology.

XCUR News

NEW YORK, NY / ACCESSWIRE / December 16, 2021 / Bronstein, Gewirtz & Grossman, LLC notifies investors that a class action lawsuit has been filed against Exicure, Inc. (“Exicure” or the “Company”) (NASDAQ:XCUR) and certain of its officers, on behalf of shareholders who purchased or otherwise acquired Exicure securities between March 11, 2021 and November 15, 2021, inclusive (the “Class Period”).

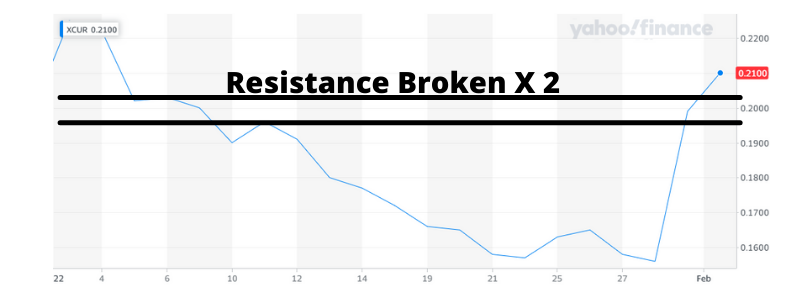

XCUR 1 Month Chart

XCUR Technical Analysis

Why stocks go up baffles me, but this one has broken two resistance points and looks strong and BULLISH. I think its worth putting on your watchlist.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Zynga ZNGA purchased for $12B

Zynga ZNGA purchased for $12B by Take-Two Interactive. ZNGA gaps up 46% with heavy trading volume this morning. Let’s take a closer look at Zynga.

Zynga Inc. ZNGA Company Summary

Company Name: Zynga Inc.

Ticker: ZNGA

Exchange: NASDAQ

Website: www.zynga.com

[thrive_leads id=’9825′]

Zynga Inc. ZNGA Company Summary

Zynga ZNGA is a global leader in interactive entertainment with a mission to connect the world through games.

Therefore with it’s massive global reach in more than 175 countries and regions, Zynga has a diverse portfolio of popular game franchises that have been downloaded more than four billion times. Just on mobile including CSR Racing™, Empires & Puzzles™, FarmVille™, Golf Rival, Hair Challenge™, Harry Potter: Puzzles & Spells™, High Heels!, Dragons!™, Merge Magic!™, Toon Blast™, Toy Blast™, Words With Friends™ and Zynga Poker™.

With Chartboost, a leading mobile advertising and monetization platform, Zynga is an industry-leading next-generation platform with the ability to optimize programmatic advertising and yields at scale.

Founded in 2007, Zynga is headquartered in California with locations in North America, Europe and Asia.

Why did ZNGA go up over 40% overnight?

Jan. 10th 2021

Take-Two to acquire all the outstanding shares of Zynga for a total value of $9.861 per share – $3.50 in cash and $6.361 in shares of Take-Two common stock, implying an enterprise value of $12.7 billion.

Transaction represents a 64% premium to Zynga’s closing share price on January 7, 2022.

Establishes Take-Two as one of the largest publishers of mobile games, the fastest-growing segment of the interactive entertainment industry.

Unifies highly complementary businesses, including Take-Two’s best-in-class portfolio of console and PC games and Zynga’s industry-leading mobile franchises.

Creates one of the largest publicly traded interactive entertainment companies in the world, with $6.1 billion in trailing twelve-month pro-forma Net Bookings for the period ended September 30, 2021.

Consequently, Transaction expected to deliver approximately $100 million of annual cost synergies within the first two years after closing, and more than $500 million of annual Net Bookings opportunities over time.

Take-Two TTWO Company Summary

Company Name: Take-Two Interactive Software, Inc.

Ticker: TTWO

Exchange: NASDAQ

Website: https://www.take2games.com/

Zynga Inc. ZNGA Company Summary

Headquartered in New York City, Take-Two Interactive Software, Inc. is a leading developer, publisher, and marketer of interactive entertainment for consumers around the globe.

We develop and publish products principally through Rockstar Games, 2K, Private Division, and T2 Mobile Games.

Take-Two TTWO products are designed for console systems, personal computers, and mobile, including smartphones and tablets.

Also, they deliver through physical retail, digital download, online platforms, and cloud streaming services. Take-Two TTWO common stock trades on NASDAQ under the symbol TTWO.

ZNGA 3 Month Chart

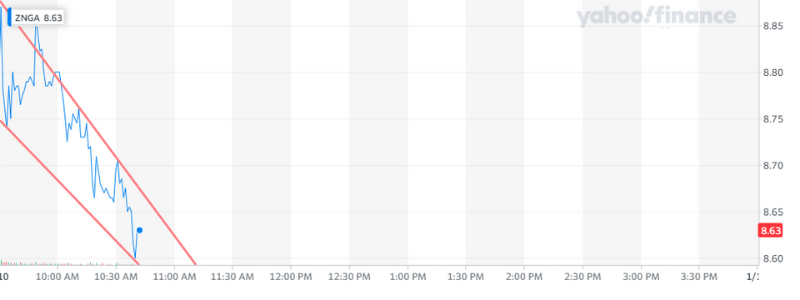

Zynga ZNGA 1 Day Chart

ZNGA Technical Analysis

After the announcement that Take-Two TTWO was acquiring Zynga Inc. ZNGA the stock gapped up with heavy trading volume by over 40%! Meanwhile TTWO suffers in PPS with a massive sell off.

ZNGA is shockingly consolidating after the massive run with a slight pullback. This is a good sign. Therefore, I would like to see it break $8.70 then $8.76 before I would take a position because normally there will be a massive sell off after a huge gap up like this.

[thrive_leads id=’9825′]

Curaleaf Holdings CURLF bounce?

Curaleaf Holdings CURLF is looking poised for a great run, put it on your watchlist today! Let’s take a closer look at CURLF.

Company Name: Curaleaf Holdings

Ticker: CURLF

Exchange: OTC

Website: https://ir.curaleaf.com

Curaleaf Holdings CURLF Company Summary:

Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) (“Curaleaf”) is a leading international provider of consumer products in cannabis with a mission to improve lives by providing clarity around cannabis and confidence around consumption.

As a high-growth cannabis company known for quality, expertise and reliability, the Company and its brands, including Curaleaf and Select, provide industry-leading service, product selection and accessibility across the medical and adult-use markets.

In the United States, Curaleaf currently operates in 23 states with 117 dispensaries, 25 cultivation sites, and employs over 5,200 team members. Curaleaf International is the largest vertically integrated cannabis company in Europe with a unique supply and distribution network throughout the European market, bringing together pioneering science and research with cutting-edge cultivation, extraction and production.

Why do I like CURLF?

Dec. 28, 2021 Curaleaf Holdings, Inc. announced that it has entered into a definitive agreement to acquire Bloom Dispensaries (“Bloom”), a vertically integrated, single state cannabis operator in Arizona in an all cash transaction valued at approximately US$211 million. The Transaction is expected to close in January 2022, subject to customary approvals and conditions.

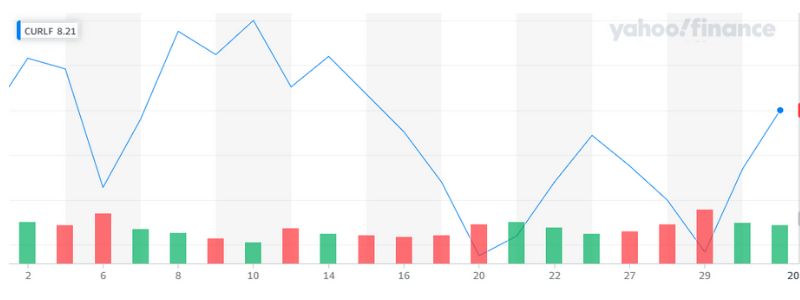

Consequently, Now that I covered the news, let’s look at CURLF 1 Month Chart

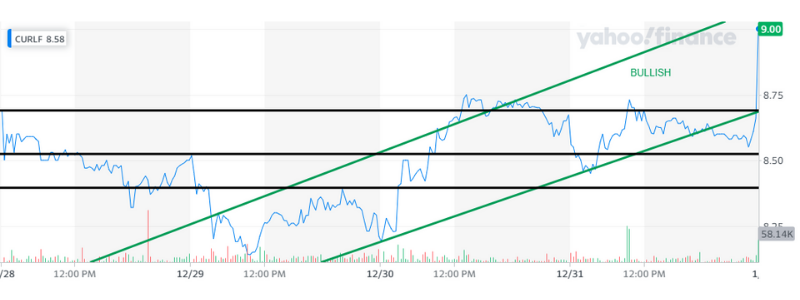

CURLF 5 Day Chart

Curaleaf Holdings CURLF Technical Analysis

Curaleaf Holdings has reversed it’s bearish trend with plenty of confirmation. The acquisition of Bloom Dispensaries by Curaleaf Holdings, Inc. is a big deal. The market is reacting to it in a positive way.

Beyond the Bloom Dispensaries deal, the 1 Month chart shows a clear reversal and the 5 day confirms it as well. Put it on your watchlist today, I like this stock! If you trade this stock, place stop losses at $8.75 to protect your investment!

Humbl HMBL poised for another early year run?

Humbl HMBL last year at this time went on a 1,000% explosive run, is it poised for another early year run? Let’s take a closer look at this

Company Name: HUMBL, Inc

Ticker: (HMBL)

Exchange: OTC

Website: https://www.humblpay.com/investors

Humbl HMBL Company Summary:

Monster Creative a subsidiary

Founded by award-winning industry veterans Doug Brandt and Kevin Childress, Monster Creative is a creative advertising agency with a focus on entertainment. They have created campaigns for top-grossing Hollywood movies, as well as those for streaming platforms.

About HUMBL, Inc.

HUMBL is a consumer blockchain company working to simplify blockchain use cases in areas such as mobile payments, ticketing, NFTs and real estate.

Why did Humbl HMBL Company Summary: reverse the bearish trend?

There is not any news of late in regards to HUMBL, below you will find the latest release. This stock has a large investor base and I believe this base cumulative believes the stock is undervalued here and that brought about the reversal.

Dec. 21, 2021 Monster Creative, a HUMBL, Inc. (OTCMKT: HMBL) company, announced today that it has won two awards at the 2021 Clio Awards, as well as one nomination.

Since 1959, The Clio Awards program has recognized innovation and excellence in advertising, design, and communications.

HMBL 1 Year Chart

HUMBL, HMBL, Technical Analysis

HUMBL had it’s first resistance point at $.25 and exploded past it on the last day of the 2021. Possibly, setting up an explosive run in 2022! The next resistance point was at $.28 and it also limped past that PPS on Friday.

I like this stock! I love the stock if it can beat $.30. It is the ultimate bounce play with two reversals, double confirmation, in an explosive sector. The NFT, crypto currency, sector is going to be hotter than a summer day in July. Put it on your watchlist today!

UPDATE:! 100% Correct, Alex made 5 correct predictions for Petros Pharmaceuticals, Inc. PTPI!

Company Name: Petros Pharmaceuticals, Inc.

Ticker: (PTPI)

Company Summary:

Petros Pharmaceuticals is committed to the goal of becoming a world-leading specialized men’s health company by identifying, developing, acquiring, and commercializing innovative therapeutics for men’s health issues, including, but not limited to, erectile dysfunction, endothelial dysfunction, psychosexual and psychosocial ailments, Peyronie’s disease, hormone health, and substance use disorders.

Why is it red HOT?

Petros reported positive over-the-counter (OTC) draft label comprehension study results for its erectile dysfunction (ED) Drug STENDRA® (avanafil). This Pivotal Label Comprehension Study was designed to assess comprehension of a draft STENDRA® Drug Facts Label intended for OTC use.

What did the say, “The label comprehension study is a key component of our plans to help expand access for STENDRA beyond the prescription model, and to make

The first “potentially the first prescription-grade ED medication to become available over-the-counter in the United States.” EVER?!?

Alex wrote on Monday 12/13/21 a 5 Day Technical Analysis based on this chart below:

The Predictions

“It’s been gapping up and pulling back for the last 4 days and it looks like it is still bullish but it is possibly about to go bearish! Let’s take a close look at the 1 day.” “It’s very simple, can it beat $4.38? Yes, then I would wait for a pull back and then swing trade it for a quick scalp. If it can’t, I would expect a pullback then consolidation and then a run! Overall, I love the stock because of the news. The first OTC ED med, say what!?!?”

Let’s look at each prediction

Prediction #1 “about to go bearish”

“It’s been gapping up and pulling back for the last 4 days and it looks like it is still bullish but it is possibly about to go bearish “It’s very simple, can it beat $4.38? If it can’t, I would expect a pullback then consolidation and then a run!

Let’s look at where it is around lunch on Wednesday 12/15/21

WOW Alex called prediction 1 with a 38% pullback

Prediction #2 “I would expect a pullback then consolidation”

“If it can’t, I would expect a pullback then consolidation and then a run!” You can see in the above chart the consolidation call! This is not fortune telling, the chart is like a book and if you know how to read the language it is written in, it makes total sense!

As you can see from the above chart it most definitely consolidated. Let’s see what happened after consolidation!

Alex Goldman Prediction #3: “RUN“

“I would expect a pullback then consolidation and then a run!“

As you can see from the above chart it ran MINUTES after the article was finished and gave our subscribers a chance at 28% & 43% RUNS.

Alex Goldman Prediction #4: “It is about to run”

Alex wrote a follow up Article HERE Wednesday last week Dated 12/15/21 updating our subscribers

Alex wrote on midday Wednesday 12/15 “It is about to run! It is bullish and I like it! Put it on your watchlist and Let’s make some money!!!!”

Alex Goldman Prediction #5: “SCALP”

“wait for confirmation of a reversal and get ready for a quick scalp.“

Alerted our EXCLUSIVE subscribers via email yesterday 12/20/21.

You can sign up below

Alex wrote in the email on Monday 12/20 “It is now in a bearish trend for the 1 day but still bullish overall. My recommendation is to wait for confirmation of a reversal and get ready for a quick scalp.”

SCREENSHOT PROOF FROM OUR EMAIL HERE

OK it is official, Alex really really knows the movement and nuances of this chart! He called yet another massive gain today at 49%

What is Alex’s next prediction for PTPI?

Sign up for our newsletter below, IT’S FREE and you could win $250!