Limitless Venture Group LVGI is up 98% after due to a massive amount of volume being injected into this little well known stock that has been crashing for the last 6 months. I have written a full report on LVGI that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Limitless Venture Group announced today, “the best revenue year in the history of LVGI and update shareholders on what’s ahead for 2022 and beyond.” However, before we get started, let’s review some basic information on this company.

Limitless Venture Group LVGI Company Summary

Company Name: Limitless Venture Group, Inc

Ticker: LVGI

Exchange: OTC

Website: www.lvginc.com

Limitless Venture Group, Inc. Company Summary

Limitless Venture Group provides its shareholders with access to leading small and medium-sized businesses focused on growth. Leveraging its permanent capital base, disciplined long-term approach, and actionable expertise, LVGI owns controlling interests in its subsidiaries as it partners with management teams to build businesses with the capacity to unlock significant value for its shareholders.

The Company currently has three primary subsidiaries: Rokin, Inc., KetoSports, Inc. and Jasper Benefit Solutions, LLC.

Also, Rokin was founded in 2016 with a mission to provide our customers with the highest quality, technology-driven vaping products available while providing exceptional customer service.

Moreover, KetoSports products flush the body with ketones, raising blood ketone levels within a few minutes.

Also, Jasper Benefit Solutions, LLC (JBS), founded in 2018 with headquarters just outside Nashville, TN, is a Managing General Underwriter (MGU) specializing in risk management services for small to medium self-funded employer “Groups”.

Consequently, Rokin, KetoSports & Jasper Benefit Solutions have benefitted greatly from the management expertise at LVG.

LVGI News

January 11 , 2022

Announced the best revenue year in the history of LVGI and update shareholders on what’s ahead for 2022 and beyond. HERE

December 7, 2021

Announced that it has signed an LOI to acquire 100% of an Oklahoma operating grow facility with both Indoor and outdoor operations, exclusive to LVGI for 60 days from the signing of the LOI. HERE

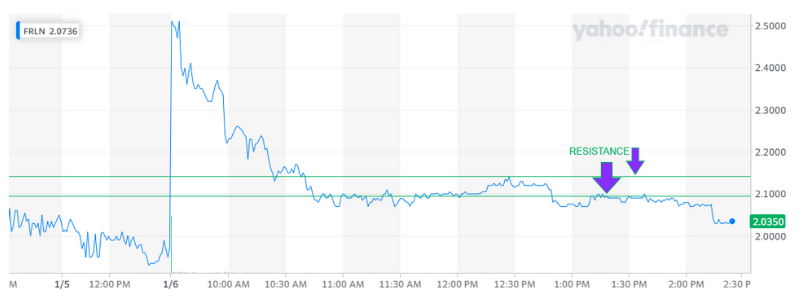

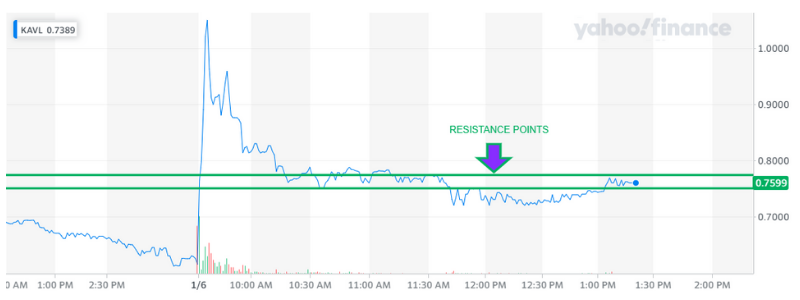

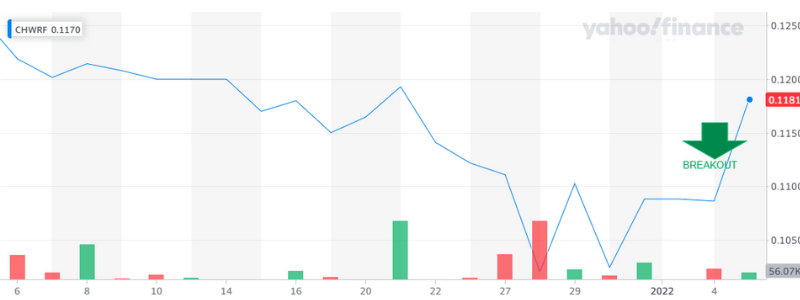

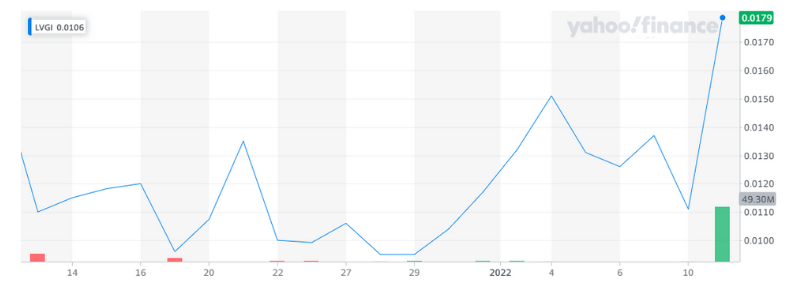

Limitless 1 Month Chart

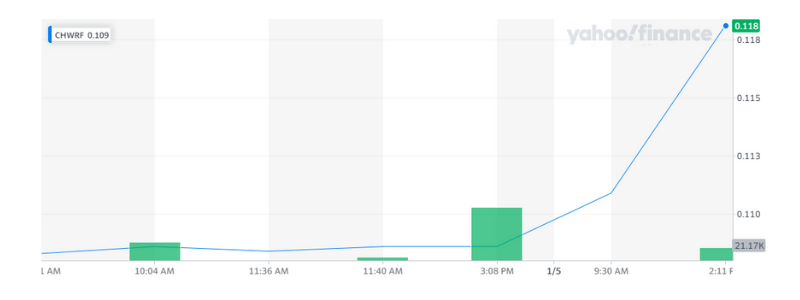

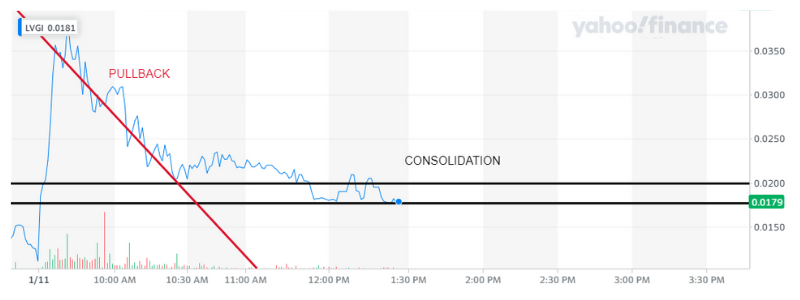

LVGI 1 Day Chart

Limitless Venture Group Technical Analysis

The news was incredible that Limitless Venture Group LVGI released today was huge and the stock responded with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

The real question is, what is it going to do now? Well, it has pulled back as expected but it will now consolidate. Next, it will make a move up or down depending on the indicators within the consolidation. It is too early to determine which way it will move, but it is showing an early tendency to bearish.

I would expect The news was incredible that Limitless Venture Group LVGI released today was huge. The stock responded with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

I would expect, the news was incredible that Limitless Venture Group LVGI released today was huge and the stock responded. Therefore, LVGI opened with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

I am thinking Limitless will continue to drop in PPS until it fully consolidates then it will make a run! Stay tuned traders

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!