Why is GoldMining (NYSE: GLDG) a strong buy target by these 3 analysts and could it be one of the best stocks of 2023? link

But before we get started, take a look at our last alerts, we are crushing the STREET!

We have 3 catalysts that have catapulted GLDG into the spotlight.

#1 The news is driving massive volume spikes!

#2 The chart is absolutely perfect and could be ready for a monster run.

#3 So many industry authorities issued a a “Buy Rating”

First and foremost, January’s news release is dynamite!

GoldMining Triples Gold Equivalent Inferred Resource Estimate To 1.45Mn Ounces At La Mina Project With La Garrucha Discovery

La Garrucha deposit adds approx. 1.0 million oz AuEq in the Inferred category and 0.2 million oz AuEq in the Indicated category

Updated Mineral Resource estimate inclusive of La Garrucha positions La Mina with 1.15 million oz AuEq Indicated and 1.45 million oz AuEq Inferred resources

The press release reads:

Jan. 23, 2023

Announced an updated Mineral Resource estimate (“MRE”) on its 100% owned La Mina Project located in Colombia.

The MRE includes a maiden resource estimate on the La Garrucha deposit which incorporates drilling completed by 2023.

Alastair Still, CEO of GoldMining, commented, “We are extremely pleased that the Company’s first exploration drilling program at La Mina has identified a significant discovery!”

“This exciting discovery has exceeded our expectations!”

Tim Smith, Vice President, commented, “The updated Mineral Resource estimate at La Garrucha represents an unqualified success for the Company!”

Take a look at this chart!

The next run will test the 3 month high based on technicals.

This should break through based on the technical indicators below:

Barchart was reporting these as triggered:

Short Term Indicators

- 20 – 50 Day MACD Oscillator

- 20 – 100 Day MACD Oscillator

- 20 – 200 Day MACD Oscillator

Medium Term Indicators

- 50 Day Moving Average

- 50 – 100 Day MACD Oscillator

- 50 – 150 Day MACD Oscillator

- 50-200 Day MACD Oscillator

Long Term Indicators

- 100 Day Moving Average

- 150 Day Moving Average

- 200 Day Moving Average

The website also shares its all-important “Trend Seeker” composite indicator is triggered.

Watch these technicals closely this week.

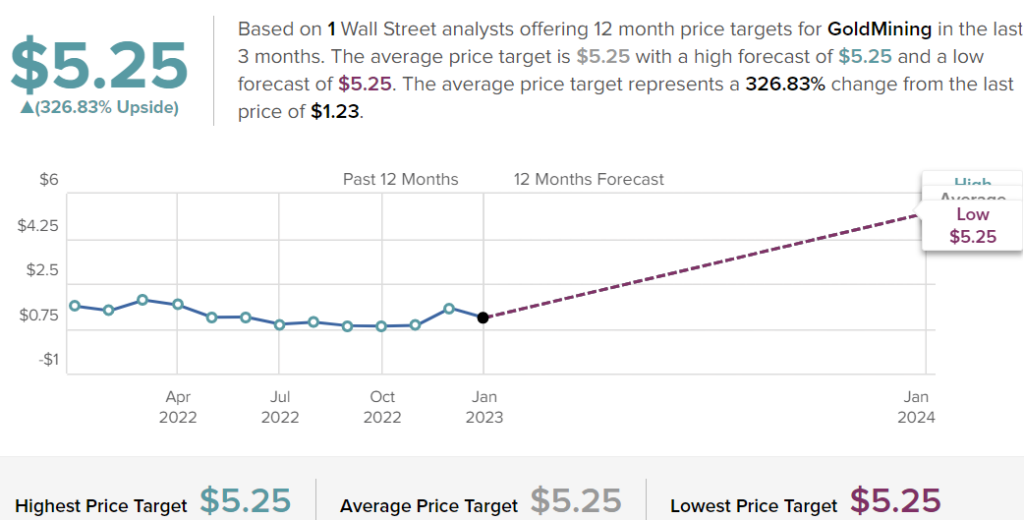

TipRanks Reported $5.25 Target Provides Over 320+% Potential Upside

GLDG is displaying a ton of potential upside to this $5.25 target.

In fact, that’s 320+% potential upside.

Now, I’m not saying this profile is going to surge to $5.25 this week, but the potential upside needs to be noted.

Plus, don’t forget, GLDG has a 52-week high over $2.00 which may also help signal that this NYSE American profile could be undervalued from current levels.

Also, GoldMining (NYSE: GLDG) has yet another strong buy target by these 3 analysts and could it be one of the best stocks of 2023? link

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has been compensated $7,500 from East Coast Media, LLC for profiling GLDG. We own ZERO shares in GLDG.