Netlist NLST is ready to take off?

Netlist NLST is ready to take off is a loaded question and it depends on a few factors. However, before we get into the details of whether it can be profitable in 2022, let’s take a look at a quick overview to get you familiar.

Company Name: Netlist, Inc.

Ticker: NLST

Exchange: OTC

Website: www.netlist.com

Netlist NLST company summary:

Netlist provides high-performance solid state drives and modular memory solutions to enterprise customers in diverse industries. The Company’s NVMe™ SSDs in various capacities and form factors and the line of custom and specialty memory products bring industry-leading performance to server and storage appliance customers and cloud service providers.

Netlist licenses its portfolio of intellectual property including patents, in server memory, hybrid memory and storage class memory, to companies that implement Netlist’s technology.

Netlist NLST in the news:

In October 2021 the Court issued summary judgment in favor of Netlist and against Samsung for material breach of various obligations under the Joint Development and License Agreement (JDLA), which the parties executed in November 2015.

In the summary judgment Order, the Court also held that Netlist properly terminated the JDLA, a remedy which leaves Samsung without a license to Netlist’s patents. That ruling, however, limited the damages phase of the case to issues of direct damages. The case now moves to the post-trial phase over the next couple of months.

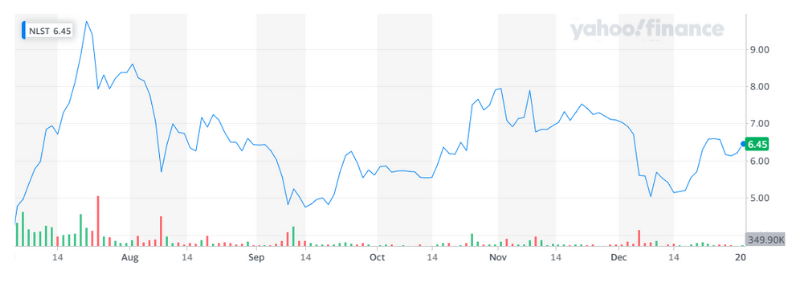

Netlist, Inc. 1 Month Chart

Netlist, Inc. 5 Day Chart

Netlist, Inc. NLST Technical Analysis

I like NLST if it can break $6.60 and maintain a consolidation pattern above that PPS.

It has reversed it’s bearish trend but it could be a head fake it has difficulty at the $6.60 PPS. Trade with stop losses.

Curaleaf Holdings CURLF bounce?

Curaleaf Holdings CURLF is looking poised for a great run, put it on your watchlist today! Let’s take a closer look at CURLF.

Company Name: Curaleaf Holdings

Ticker: CURLF

Exchange: OTC

Website: https://ir.curaleaf.com

Curaleaf Holdings CURLF Company Summary:

Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) (“Curaleaf”) is a leading international provider of consumer products in cannabis with a mission to improve lives by providing clarity around cannabis and confidence around consumption.

As a high-growth cannabis company known for quality, expertise and reliability, the Company and its brands, including Curaleaf and Select, provide industry-leading service, product selection and accessibility across the medical and adult-use markets.

In the United States, Curaleaf currently operates in 23 states with 117 dispensaries, 25 cultivation sites, and employs over 5,200 team members. Curaleaf International is the largest vertically integrated cannabis company in Europe with a unique supply and distribution network throughout the European market, bringing together pioneering science and research with cutting-edge cultivation, extraction and production.

Why do I like CURLF?

Dec. 28, 2021 Curaleaf Holdings, Inc. announced that it has entered into a definitive agreement to acquire Bloom Dispensaries (“Bloom”), a vertically integrated, single state cannabis operator in Arizona in an all cash transaction valued at approximately US$211 million. The Transaction is expected to close in January 2022, subject to customary approvals and conditions.

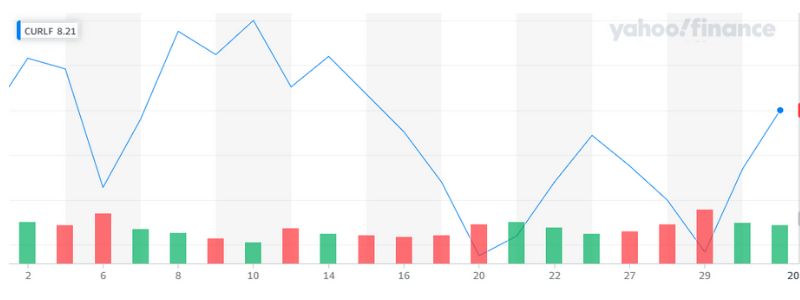

Consequently, Now that I covered the news, let’s look at CURLF 1 Month Chart

CURLF 5 Day Chart

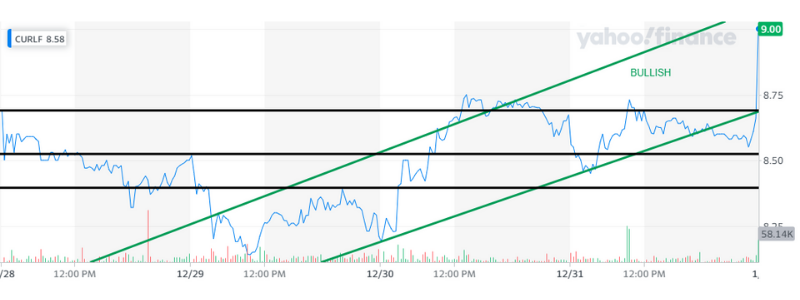

Curaleaf Holdings CURLF Technical Analysis

Curaleaf Holdings has reversed it’s bearish trend with plenty of confirmation. The acquisition of Bloom Dispensaries by Curaleaf Holdings, Inc. is a big deal. The market is reacting to it in a positive way.

Beyond the Bloom Dispensaries deal, the 1 Month chart shows a clear reversal and the 5 day confirms it as well. Put it on your watchlist today, I like this stock! If you trade this stock, place stop losses at $8.75 to protect your investment!

Humbl HMBL poised for another early year run?

Humbl HMBL last year at this time went on a 1,000% explosive run, is it poised for another early year run? Let’s take a closer look at this

Company Name: HUMBL, Inc

Ticker: (HMBL)

Exchange: OTC

Website: https://www.humblpay.com/investors

Humbl HMBL Company Summary:

Monster Creative a subsidiary

Founded by award-winning industry veterans Doug Brandt and Kevin Childress, Monster Creative is a creative advertising agency with a focus on entertainment. They have created campaigns for top-grossing Hollywood movies, as well as those for streaming platforms.

About HUMBL, Inc.

HUMBL is a consumer blockchain company working to simplify blockchain use cases in areas such as mobile payments, ticketing, NFTs and real estate.

Why did Humbl HMBL Company Summary: reverse the bearish trend?

There is not any news of late in regards to HUMBL, below you will find the latest release. This stock has a large investor base and I believe this base cumulative believes the stock is undervalued here and that brought about the reversal.

Dec. 21, 2021 Monster Creative, a HUMBL, Inc. (OTCMKT: HMBL) company, announced today that it has won two awards at the 2021 Clio Awards, as well as one nomination.

Since 1959, The Clio Awards program has recognized innovation and excellence in advertising, design, and communications.

HMBL 1 Year Chart

HUMBL, HMBL, Technical Analysis

HUMBL had it’s first resistance point at $.25 and exploded past it on the last day of the 2021. Possibly, setting up an explosive run in 2022! The next resistance point was at $.28 and it also limped past that PPS on Friday.

I like this stock! I love the stock if it can beat $.30. It is the ultimate bounce play with two reversals, double confirmation, in an explosive sector. The NFT, crypto currency, sector is going to be hotter than a summer day in July. Put it on your watchlist today!