Back in 2011, as part of this interview conducted by Rockstone Research, mining analyst Stephan Bogner asked the interviewee, geologist David Mathewson, what drove him to become a part of the then young gold exploration company Gold Standard Ventures Corp (NYSEMKT:GSV). Bogner highlighted Mathewson’s career to that point – something we’ll look at in more detail shortly – as justification for the suggestion that a tiny explorer, worth just a few million dollars and with nothing in the way of confirmed resources at that point, wasn’t really worthy of the geologist’s time and attention.

When you’re one of the most respected geologists in the world, in other words, why devote your attention to a tiny player in the space?

Mathewson answered as follows:

“Successful exploration is all about applying effective and often new ideas, basically geological concepts, in entrepreneurial ways… public junior exploration companies provide the best vehicles to do exactly what needs to be done to be successful.”

This year, Gold Standard Ventures hit a market capitalization of more than $600 million. The development of the projects that account for the vast majority of this valuation, the Railroad-Pinion district and the North Bullion and Bald Mountain discoveries, was spearheaded by Mathewson during his time at the company.

Prior to his time at Gold Standard Ventures, Mathewson accrued more than thirty years’ worth of experience as a geologist in the gold sector, with the vast majority of this time spent in senior exploration positions at gold mining giant Newmont Mining Corp (NYSE:NEM). He served as Head of Exploration in Nevada for the company, and is credited with some of the major discoveries across the Carlin Trend and the Great Basin – two of the most resource rich gold areas in the world.

So, why are we talking about him here?

Well, a company called Dataram Corp (NASDAQ:DRAM) is on the verge of acquiring a company called US Gold Corp. Dataram is a NASDAQ traded technology company that is looking to diversify its operations, and it’s doing so through said acquisition, which management expects that (subject to shareholder approval) will close in between 60-90 days.

US Gold Corp. is a young, currently privately held (but soon to be available on the public markets by way of the just noted acquisition) natural resource miner, with two high-potential projects in Nevada and Wyoming.

The company’s CEO is Edward Karr, a respected investment banker. Its COO is David Rector, a gold industry veteran.

And here’s the most interesting part – VP, Head of Exploration is Mathewson.

What we’re looking at here, then, is a company that is in an almost identical position today, to that of the above-discussed Gold Standard Ventures back when Matheson joined at the turn of the decade. That is, it’s a young company with a couple of promising projects, looking to develop its assets into resources that it can sell to, or use as the basis of JV agreements with, incumbent mining entities.

If successful, and a look at Mathewson’s track record suggests there’s a good chance that under his direction it will be, we’re looking at a huge potential upside from current valuation (for reference, Dataram’s market capitalization as of April 24 is $5.8 million).

With this in mind, then, let’s look at the projects in question.

Two properties comprise the company’s asset portfolio right now. These are the Keystone project, located in Nevada, and the Copper King project, located in southeast Wyoming. The former, Keystone, is the project in which Mathewson has had a hand, and it’s likely going to be the primary value driver for the company going forward – that is, it’s the project on which US Gold Corp. is basing much of its long-term valuation.

As thing stand, however, it’s at an earlier stage of development than Copper King. To put this another way, Keystone is an exploration asset, while Copper King is a near-term production asset.

Copper King is located 20 miles west of Cheyenne, Wyoming’s capital, and most populous city. It’s what’s classed as an advanced exploration and development property, and it falls within the Silver Crown Mining District of the state, a district well known for its mining friendly economics.

Back in 2012, a group called Mine Development Associates (MDA) published a Preliminary Economic Assessment (PEA) detailing the resource and its estimates. As per the PEA, Copper King boasts the following:

- 1,534,000 Measured and Indicated gold equivalent ounces

- 345,000 Inferred gold equivalent ounces

- $159.5 million Net Present Value (NPV) at $1,100/oz. Au and $3.00/lb. Cu

Of course, gold is priced higher than the per oz. price used for this assessment (most recent spot price $1,256 versus the $1,100 used above), meaning the NPV is likely considerably higher than the PEA implies. Copper is down slightly ($2.55 versus the $3.00 used), but the negative impact on NPV that the decline in copper implies should be outweighed by the positive impact on NPV brought about by the rise in gold.

Over the coming twenty-four months, US Gold Corp. intends to execute on a development strategy that should bring with it numerous catalysts, each of which has the potential to induce an upside revaluation for the company as and when they hit press. During 2017, these catalysts include an updating of the PEA (to adjust the above-discussed cost inputs) and the initiation of a permitting strategy. During 2018, management expects to move to advance into a Pre-Feasibility Study (PFS), as well as continue to explore and develop the property to refine estimates (and potentially expand estimates) ahead of permitting.

Beyond this activity, we see a JV announcement, or the offloading of the property to a larger name (which is becoming an increasingly popular exit strategy in the junior gold space, based on the reduction in exploratory activity during the low-gold years) – each of which could initiate a dramatic upside revaluation.

That’s the Copper King project; what about Keystone?

As mentioned, this is the big one for the company. It’s the project Mathewson has identified as potentially being even more valuable than the Railroad resource that underpinned the Gold Standard Ventures $600 million valuation, and it’s the resource we’re looking to as providing numerous development-type catalysts in parallel to the Copper King advances.

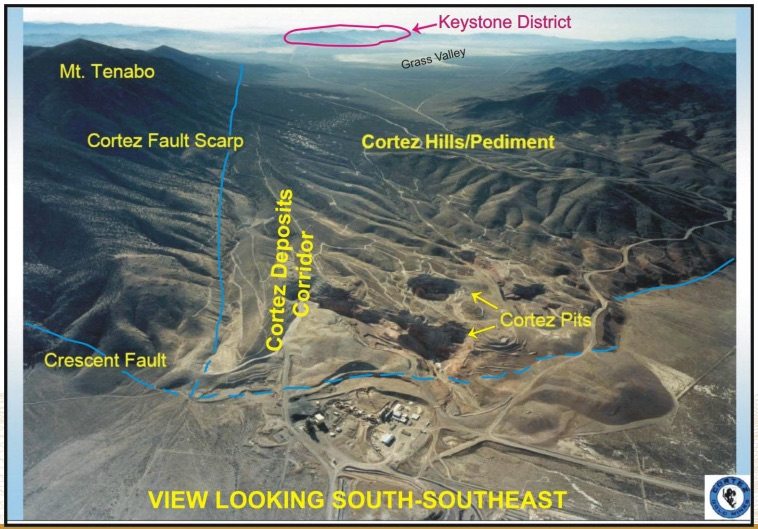

One of the most notable qualities of the project is that it’s located on the Cortez Gold Trend, just 10 miles south of Barrick Gold Corp (USA) (NYSE:ABX)’s Cortez mine – one of the largest mines in the world and one of Barrick’s flagship complexes, with nearly 10 million oz. in proven and probable reserves. The project produces around 1 million oz. annually. The image below illustrates the location of US Gold Corp.’s Keystone project in relation to the Cortez complex.

Mathewson recently discovered and consolidated the project, and US Gold Corp. is banking on the idea that this is his next big discovery, and that it will add to his long list of successful discoveries (and developments) in Nevada across his thirty-five-year career in the state.

The project itself covers more than 15 square miles of mining claims, and based on drilling to date, has been shown to contain high grade, thick intercepts of gold at very shallow depths. This means two things: that the extraction of the shallow resource should be relatively cheap, and that there’s likely more gold below the shallow intercepts.

So what’s next at the project – or in other words, where are the catalysts coming form with relation to Keystone?

The majority of 2017 will be spent surveying the property in an attempt to identify the potentially most rewarding regions, and claims, and to put together some solid estimates as to what the project might hold from a resource perspective. Once surveyed, Mathewson is going to identify initial drill targets (this is his specialty) and with these targets in place, the drilling program will kick off.

Throughout 2018, then, the company is going to execute on the drilling program and prove up its discoveries (and in turn, its estimates) on the back of the drill results.

Just as with Copper King, we expect (and this is supported by management communication) that the exit strategy on this one will be to develop to a point just pre-production, and then offload the project to a larger name, or strike a JV agreement. This helps the company to avoid the costs of a ramping up to production, while maintaining an interest in the gold that its team has worked to prove.

Bottom line: there are plenty of potential catalysts across the coming two years, a respected and experienced management team and one of the industry’s most well known, and highly regarded, geologists/explorers at the helm of the project’s advancement. US Gold Corp. is also debt free, and based on an October 2016 financing that saw the company net just shy of $12 million, is fully funded through end 2017.

This is early stage gold, so it’s not a risk-free exposure. That said, for an investor looking to allocate to the space who is also looking for a quality that puts said allocation ahead of its peers, US Gold Corp., and Mathewson, is the stock to watch.