Talon Metals TLOFF 50% gains today

Talon Metals TLOFF is up 50% after due to a massive amount of volume being injected into this little well known stock. I have written a full report on TLOFF that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Talon Metals announced today, “Tesla TSLA recently signed its first nickel supply deal in the United States, selecting Talon Metals Corp’s Tamarack mine project in Minnesota in a bid to make the electric vehicle (EV) battery metal in a sustainable way.” However, before we get started, let’s review some basic information on this company.

Talon Metals TLOFF Company Summary

Company Name: Talon Metals, Inc

Ticker: TLOFF

Exchange: OTC

Website: www.talonmetals.com/

Talon Metals, Inc . Company Summary

Talon is a TSX-listed base metals company in a joint venture with Rio Tinto on the high-grade Tamarack Nickel Project located in central Minnesota. Talon currently owns a 51% interest in the Tamarack Project and has the right to increase its interest by 9% to 60%.

Also, The Tamarack Nickel Project comprises a large land position (18km of strike length) with numerous high-grade intercepts outside the current resource area. Talon is focused on expanding its current high-grade nickel mineralization resource prepared in accordance with NI 43-101.

Therefore, identifying additional high-grade nickel mineralization; and developing a responsible processing capability in the United States. In July 2021, Talon entered into an MOU with the United Steelworkers whereby the parties outlined a number of ways that they will work with, and support, one another.

Moreover, Talon has a well-qualified exploration and mine management team with extensive experience in project management.

TLOFF News

January 10, 2022

Talon has entered into an agreement with Tesla TSLA for the supply and purchase of nickel concentrate to be produced from the Tamarack Nickel Project in Aitkin County, Minnesota. The execution of the agreement follows an extensive and detailed due diligence period performed by Tesla TSLA and lengthy negotiations between the parties. HERE

December 16, 2021

TLOFF provided an update on the Tamarack Nickel-Copper-Cobalt Project (“Tamarack Nickel Project“), located in central Minnesota. HERE

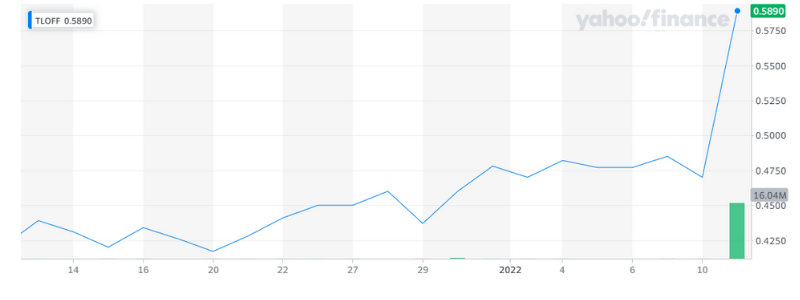

Talon Metals 1 Month Chart

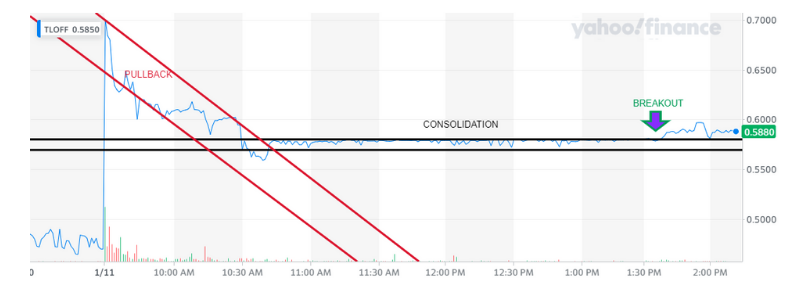

Talon’s 1 Day Chart

TLOFF Technical Analysis

What a day for TLOFF, the news couldn’t have been better. They are working with Wall Street’s darling, Tesla.

Moreover, Talon Metals TLOFF released the announcement that they landed TSLA as a client! Hence, today was huge and the stock responded with a massive amount of volume and a PPS increase of 50%.

I would expect a huge jump, the news was incredible that Talon Metals released today. The interest was huge and the stock responded with a massive amount of volume and a PPS increase of 50%. TLOFF skyrocketed and the run is not over!

Therefore, TLOFF will consolidate and then run again. Put it on your watchlist.

Also, Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Could Canoo (GOEV) Be The Next TESLA??

Company Snapshot:

Company Name: Canoo Inc.

Ticker: GOEV

Exchange: NASDAQ

Website: www.canoo.com

Industry:

Company Summary:

Canoo’s mission is to bring EVs to Everyone. The company has developed breakthrough electric vehicles that are reinventing the automotive landscape with bold innovations in design, pioneering technologies, and a unique business model that spans the full lifecycle of the vehicle. Distinguished by its experienced team from leading technology and automotive companies – Canoo has designed a modular electric platform purpose-built to deliver maximum vehicle interior space that is customizable across all owners in the vehicle lifecycle to support a wide range of vehicle applications for consumers and businesses. Canoo has offices in California and Texas.

Canoo’s charts look incredible:

The 1 day chart above reveals resistance at $12.50 PPS, so make sure it’s clear of it before entering a position Friday.

As you can see from the 6 month chart above, we have hit a 6 month high with 100% gains in 14 weeks, so nice and steady!

UPDATE: Investors invested in GOEV, that’s putting your money where your mouth is!

NASDAQ reports “Over the last year, we can see that the biggest insider purchase was by insider Daniel Hennessy for US$5.0m worth of shares, at about US$10.00 per share.”

Why is it up 100% over the last 14 weeks?

This company is REAL and making serious moves!

In Arkansas Business, they state, “Electric automaker Canoo Inc. announced late Monday that it will move its headquarters to northwest Arkansas, pledging to employ more than 500 people in Benton and Washington counties.”

There is another EV manufacturer you may have heard of, Tesla, current share price of $1,116 per share!

So you have a EV manufacturer making good on manufacturing plants and the possibility that it could be 10% of Tesla and BOOM , $111 per share price up $100+/- from today’s price! That is wealth and there is attention being paid with this gem.

Summary

We like this stock! Fundamentals are good and technicals are solid as well. $5M of shares purchased at $10 is also really good because it is undervalued at $12 so there is lots of room for a nice long term play,

Happy trading!

UPDATE:4 Reasons LGIQ Continues To Run Higher, Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

Here are 4 exciting reasons to stop what you are doing and read this short research article on Logiq, Inc. (NEO-LGIQ) (OTCQX-LGIQ)

- Logiq’s News is explosive!

- They have an experienced leadership team

- The stock is Highly Undervalued

- The stock is ready for another possible big move!

Before we get into the those 4 exciting reasons to put LGIQ on your watchlist, let’s do a quick update on the news!

Jan. 27, 2022

Announced it has completed the transfer of its AppLogiq assets into Lovarra (OTC: LOVA), a fully reporting U.S. public company.

The transfer completes the previously announced separation of Logiq’s DataLogiq and AppLogiq businesses into two publicly traded companies. The AppLogiq assets include CreateApp™, an award-winning software-as-a-service (SaaS) platform that enables small and medium-sized businesses worldwide to easily create and deploy a native mobile app for their business. AppLogiq also includes platforms for mobile payments and delivery services designed for emerging markets, as well as licenses of its technologies to industry partners.

Jan 13, 2022

Preannounced Q4 revenues of $12.3 million, coming in well above our November estimate of $8.8 million. Although company did not give the breakdown between AppLogiq and DataLogiq, we believe both businesses had a strong quarter. For one, we know that DataLogiq had great results in providing Medicare sales leads and is even working to expand the sales leads business, investigating adding call center capabilities. In addition, the company announced it had achieved gross margins in excess of 34% for the quarter. These results show year over year revenue growth of 87% and a doubling of gross margin dollars.

For the year Logiq will report revenues of approximately $36.5 million a decline of 3.7% and a double of its gross margin to approximately 30.6% versus 16.8% in 2020. As a result we are raising 2021 numbers as well as 2022. For 2022 we are increasing to $44 million in sales while keeping the loss the same. We will revisit estimates when the financials for the spin out are released.

Nov. 08, 2021

Has been invited to present at the ROTH 10th Annual Technology Event being held virtually on November 17-18.

Logiq president, Brent Suen, scheduled to present and participate in one-on-one meetings with institutional analysts and investors at the conference.

Management will discuss the company’s recently announced plan to separate AppLogiq™ and DataLogiq™ into two publicly traded companies to capitalize on their respective growth opportunities in the rapidly evolving global e-commerce and fintech landscape.

Preannounced Q4 revenues of $12.3 million, Now, That Is Incredible News!

Company Name: Logiq

Ticker: {NEO: LGIQ} (OTCQX: LGIQ)

Company Summary: Let’s start with the fancy jargon, “Logiq is a global provider of marketing solutions for Ecommerce, m-commerce (mobile commerce), and fintech solutions.”

Now let us break down in layman terms what all of that mumbo jumbo really means.

Logiq is BIG, really big, in fact they are reaching into the WORLD market. They are in ASIA, In North America and everywhere in between.

They offer solutions to small and medium sized companies who are trying to sell you something online. For example, all those advertisements following you around Facebook, Instagram and even news articles, that is Logiq and their competitors.

M-commerce (mobile commerce) is a fancy term for an app (application) on your phone (mobile) that gives the user the ability to make a small business website on their phone! Yes you can make a full website on your phone in the waiting room of your doctor’s office. Pretty cool!

Fintech Solutions, the “Fin” in Fintech stands for financial. The “tech” in Fintech stands for technology. So, they offer solutions in the financial sector via technology.

Logiq has all the right building blocks for an explosive play! TAKE A LOOK NOW!

There are 4 Key Units Driving Logiq’s Impressive Financial Numbers!

Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ), operates four key units:

1. DataLogiq – Here comes the Jargon, “is designed for ad generation and Ecommerce marketing solution” Ok, ad generation is found below, it is found on sports illustrated and is an ad

This ad is following me around because my dog is a jack A$# that doesnt listen and I’ve been searching for services and products so I don’t murder him. So the advertisement found above, understands that I have a jerk for a dog and will continue to show me things to buy.

E-commerce, means any attempt to buy and sell goods or services (commerce) online (e). Any platform that is found online, including websites (native) & Facebook (social media) that has an advertisement on it, is considered an e-commerce platform.

DataLogiq is a technology that allows small to medium size businesses to gain access to data (statistics) to help decide what platform (facebook) to run advertisements on to capture conversions (a purchase).

2. AppLogiq – which is a platform-as-a-service (PaaS) solution for SMBs to deploy native mobile apps for their businesses that come complete with mobile payments.

Wowzers, that is a lot of fancy words! PaaS platform as a service is fancy talk for an app (platform) as a service, self explanatory, the app offers a service.

Example, if you know a millennial, they have photo editing applications on their phone, so they can look completely different on instagram, LOL. The app (platform), offers a service (photo editing).

The service that AppLogiq offers is the ability to build a website on your phone with the AppLogiq app. It comes complete with the ability to accept payment right from your very own small business website built with your smartphone.

3. Fixel – delivers AI-driven engagement segmentation by analyzing user interactions on a company’s website, fixel learns consumer behavior and then delivers the data the company needs to create valuable audiences.

Let me break that down for you, when a person goes to a website they use a tracking pixel, similar to a jealous husband that puts a GPS tracker in his wife’s car.

The company, like the jealous husband, can follow your patterns of buying things. This information is then run through artificial intelligence to create audiences (larger groups) based on the data.

Best example, the more you use Netflix, the more the (AI) can predict what you will WANT to watch next. Yes it can sound creepy but it is also very convenient.

So they can market to more people just like that user. Hence, more data, more efficiency and more buyers.

4. Pay&GoLogiq – this unit handles credit and payment points, payments using QR codes, and powers the company’s AtoZ Go food delivery service.

This one is written in almost common language. Here is a little more clarification, all ecommerce stores need to process payments via credit card on their website, Logiq offers that solution.

FOUR Exciting reasons to stop what you are doing and read this short research article on Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ)

The News is explosive!

Oct. 12, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include Semcasting’s advanced consumer and B2B title targeting capabilities.

Commonly referred to as data onboarding, Semcasting’s solution will allow LDM clients to easily take their offline customer data, including in-store receipts or home addresses, and translate it into targetable data for online marketing.

Sept. 23, 2021 Logiq, Inc. (NEO-LGIQ)(OTCQX-LGIQ) has expanded its Logiq Digital Marketing™ (LDM) platform to include geofencing-based targeting.

Unlike traditional geotargeting that restricts digital ads to audiences in a particular zip code, city, state, or country, geofencing is a custom-defined area that can outline the boundaries around a particular store, mall, or other physical venues. The technology enables geofencing by using the latitude and longitude coordinates of a consumer digital device, such as a connected TV, smartphone, tablet or PC, to determine their location.

Sept. 13, 2021 Logiq creates a partnership that creates an avenue to bring digital wallet and payment services to 50 million Indonesians. Mobiquity Pay, one of the world’s largest digital wallets from Comviva, will now power Logiq’s (NEO-LGIQ) (OTCQX-LGIQ) PayLogic digital wallet in the country.

On June 21 2021, Logiq (NEO-LGIQ) (OTCQX-LGIQ) announced the closing of its IPO offering of 1,976,434 units of securities in Canada at C$3.00 for gross proceeds of C$5.9 million and began trading in Canada on the NEO exchange to expand its reach up north.

The Asia-Pacific region is one of the fastest growing in the world and Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is focusing efforts there as a result of the huge opportunities it presents for the company. On July 21, 2021, the company expanded its Logiq (NEO-LGIQ) (OTCQX-LGIQ) digital marketing platform to include direct-media buying across the APAC region.

Experienced Leadership

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

The stock is Highly Undervalued!

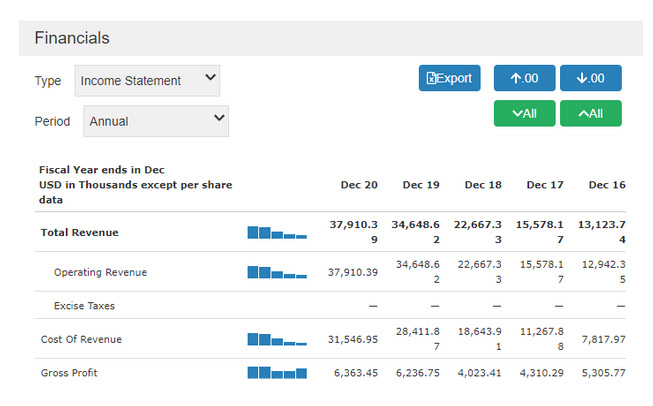

You get a better idea of how impressive the consistent, continued growth is by looking at the growth in the chart below over the last 5 years!

Growing at a CAGR (Compound Annual Growth Rate) of 31% from 2016 to 2020, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) is growing fast. Company leaders are now expecting 31% gross margins and revenues between $34-38 million by the end of 2021.

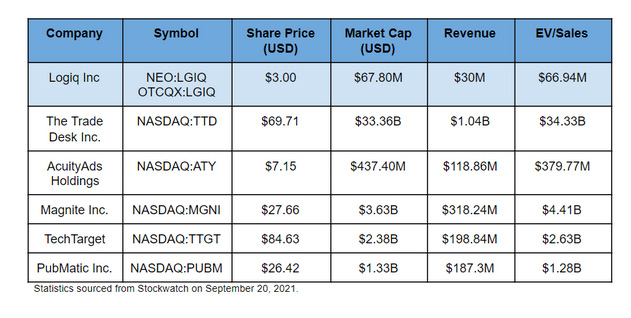

As you can see from the prices above, Logiq Inc. (NEO-LGIQ) (OTCQX-LGIQ) has a lot of room to grow when it comes to price – and with word now starting to get out about this previously under-the-radar company that growth could come quickly.

The stock is ready for another possible BIG MOVE!

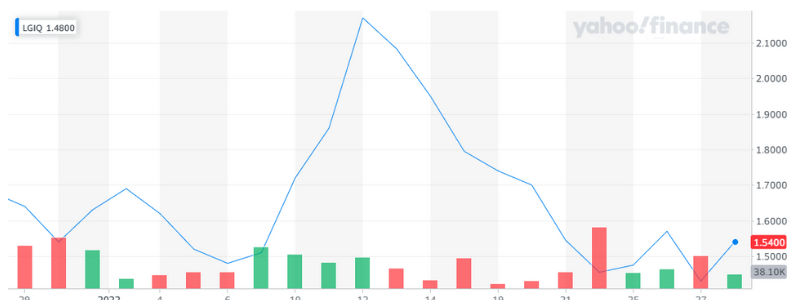

As you can see below this stock has the ability to make some serious moves. In less than four trading days this stock went from $1.45 to over $2.17 yielding 50% gains. More importantly, the stock created a very stable and methodical climb to a whopping 50% GAINS in FOUR trading days! If you had $10,000 invested in about 4 days you could have made $5,000!!!

As one can see from the 1 month chart below, the stock has consolidated and is ready for a possible large run AGAIN.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Look at this chart, it looks like it could bLe setting up for a possible breakout.

Logiq should be on your watchlist because of the massive opportunity it has in a very accessible market because:

- The News is explosive

2. Experienced Leadership

3. The stock is Highly Undervalued

4. The stock is possibly ready for another big move!

Happy Trading and remember, never try to catch a falling knife!

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, LGIQ. Small Cap Exclusive has been hired by Civit Digital for a period beginning on October 29, 2021 and by Emerging Markets Consulting for a period beginning October 29, 2021 to publicly disseminate information about (LGIQ) via website and email. We have been compensated $35,000 USD by Civit Digital and $27,500 USD by Emerging Markets Consulting. We will update any changes to our compensation.

Read full disclaimer here.

SOLO Shares Jump 19% end of day today. Still a Buy?

SOLO Shares jump 19% end of day. Is it still a buy?

Shares of SOLO or Electra Meccanica jumped on Thursday by more than 19% and closed at $9.48pps, after an article was released of Improved Sales Visibility by SeekingAlpha.

Shares of SOLO or Electra Meccanica jumped on Thursday by more than 19% and closed at $9.48pps, after an article was released of Improved Sales Visibility by SeekingAlpha.

Shares of SOLO were already up more than 20% in January as the Electric car market has been on major run since Biden took office.

Electrameccanica Vehicles Corp., a development-stage company, develops, manufactures, and sells electric vehicles in Canada. The company operates in two segments, Electric Vehicles and Custom Build Vehicles. Its flagship product is the SOLO, a single seat vehicle. The company is also developing Super SOLO, a sports car model; and Tofino, an all-electric two-seater roadster. It also develops and manufactures custom built vehicles. The company sells its vehicles online through electrameccanica.com Website, as well as through six retail stores. Electrameccanica Vehicles Corp. was founded in 2015 and is headquartered in Vancouver, Canada.