Mainz Biomed MYNZ develops market-ready molecular genetic diagnostic solutions for life-threatening conditions. So, our traders have the ability to invest and feel good about helping the world while simultaneously investing!

The Company’s flagship product is ColoAlert, an accurate, non-invasive, and easy-to-use early detection diagnostic test for colorectal cancer.

The top 4 reasons Mainz Biomed B.V. (NASDAQ: MYNZ) is primed for a Massive breakout!

#1 MYNZ is Undervalued

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing!

#3 Mainz Biomed Is Generating Revenue

#4 Philanthropic Investing feels good

Before we go over the top 4 reasons, let’s get acquainted with Mainz Biomed.

Company Name: Mainz BioMed

Ticker: MYNZ

Exchange: NASDAQ

Website: https://mainzbiomed.com/investors/

Mainz Biomed MYNZ Company Summary:

Mainz Biomed develops market-ready molecular genetic diagnostic solutions for life-threatening conditions. The Company’s flagship product is ColoAlert, an accurate, non-invasive, and easy-to-use early detection diagnostic test for colorectal cancer.

ColoAlert is currently marketed across Europe with an FDA clinical study and submission process intended to be launched in the first half of 2022 for U.S. regulatory approval.

Mainz Biomed’s product candidate portfolio includes PancAlert, an early-stage pancreatic cancer screening test based on Real-Time Polymerase Chain Reaction-based (PCR) multiplex detection of molecular-genetic biomarkers in stool samples, and the GenoStick technology, a platform being developed to detect pathogens on a molecular genetic basis.

[thrive_leads id=’9846′]

Why did it go up over 30% in just 21 trading days?

DECEMBER 7th, 2021

At-home Colorectal Cancer Diagnostic Test Now Available Online in Germany

Mainz Biomed announced the launch of ColoAlert.de, an ecommerce store providing Germans direct access to its ColoAlert colorectal cancer (CRC) screening test. German residents unable to obtain timely CRC screening via in-person physician visits, will be able to order ColoAlert directly to their home and receive highly accurate results within a maximum of nine working days. For more Info HERE

DECEMBER 14th, 2021

Mainz to co-brand ColoAlert with GANZIMMUN Diagnostics, one of the largest stool analysis labs in Germany with their 5,500 labs.Mainz Biomed announced a partnership with leading diagnostics laboratory GANZIMMUN Diagnostics AG (GD), one of Europe’s leading laboratories for preventive and complementary medicine, for the commercialization in Germany of ColoAlert, Mainz’s unique, highly efficacious, and easy-to-use detection test for colorectal cancer. For More Info HERE

Now that we have a good understanding of why MYNZ is up 30%, let’s go over the top 4 reasons Mainz Biomed could be ready for a massive breakout!

#1 MYNZ is Undervalued

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing!

#3 Mainz Biomed B.V. Is Generating Revenue

#4 Philanthropic Investing feels good

#1 MYNZ is in a Multi-Billion Dollar Industry

Mainz Biomed has a Market Cap of $121 Million but when you look at other companies that are in the space, you can see the value in this diamond in the rough. I am very excited to see this kind of potential priced at such a low PPS and with a very small float at 12 Million shares outstanding.

Furthermore, Mainz plans on starting the FDA process shortly after their public listing. Recent FDA guidance recommends colorectal cancer screening for everyone over the age of 45, which translates to a market potential of over 52 million tests per year. 1 Can you imagine what will happen to the price per share of MYNZ when they get approved? Let’s look at one of their competitors to see what actually did happen!

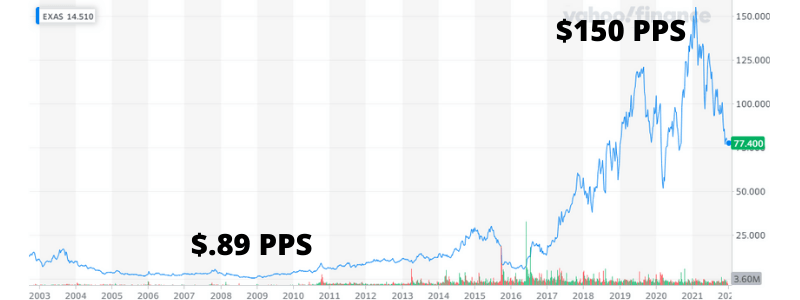

Take a look at Mainz Biomed’s competitor Exact Sciences Corporation NASDAQ

Today, the top non-invasive colorectal screening test technology is manufactured by Exact Sciences (NASDAQ:EXAS), which is a perfect success story that Mainz BioMed is currently seeking to recreate. EXAS is valued at $17 BILLION and trades at $78 PPS! Could you imagine if MYNZ is trading at those PPS in the near future? That would be almost 700% gains, like turning $10,000 into $80,000.

I do apologize, I tend to get excited about companies that are showing massive potential in a philanthropic industry. Invest and possibly make money while saving lives, it’s the cornerstone of the capitalism that Adam Smith promoted. Not this crony Capitalism!

Did you see the EXAS’ share price back in 08’ it fell to less than one dollar. Essentially, investors were basically saying Exact was worthless.But in June 2009, an announcement of a mutual collaboration and licensing agreement between Exact Sciences and the Mayo Clinic turned the company’s fortunes around.

However, it was in 2014 when the FDA approved Cologuard for use as a non-invasive colorectal cancer screening test, and the test’s inclusion in multiple national guidelines that truly made the stock take off.

Hmm… Isn’t Mainz seeking FDA approval! See the correlation? I do and you should too.

For investors of EXAS who got in as recently as mid-2016 have already seen their investment grow nearly 20x in just over 5 years. Today it’s worth nearly $17 billion USD.

20x Returns, that $10,000 would be $200,000

Here is the kicker, Mainz Biomed’s ColoAlert is designed to be easier to administer than Exact Sciences ColoGuard, more accurate than FIT, and much less invasive than a colonoscopy. This is truly cutting edge medical testing at a fraction of the PPS of Exact Science.

MYNZ other competitor is Genescopy a privately help company making some moves

The reason I mention Geneoscopy is because this story is relevant, take a look at the investment level, $100M++!

Geneoscopy Inc. is a life sciences company focused on the development of diagnostic tests for gastrointestinal health, announced November 17th the closing of a Series B financing, raising a total of $105 million through a combination of debt and equity.

The round is led by previous investors Lightchain Capital and NT Investments. Other investors in the round include Morningside Ventures, Labcorp, Cultivation Capital, BioGenerator Ventures, and Innovatus Capital Partners. HERE

That is an example of just how large this industry is and how much money is available to fund it. It’s cancer and it has affected almost everyone in one way or the other.

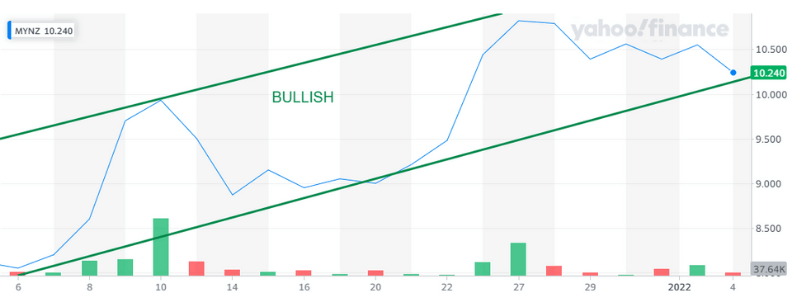

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing!

MYNZ 1 Month Chart Technical Analysis

As you can see the trend is very Bullish and has consolidated since the December 21st-December 28th run. The 30% run last month that started December 6th was very controlled and on moderate volume.

Next, let’s look at the 5 day chart to see what is happening lately.

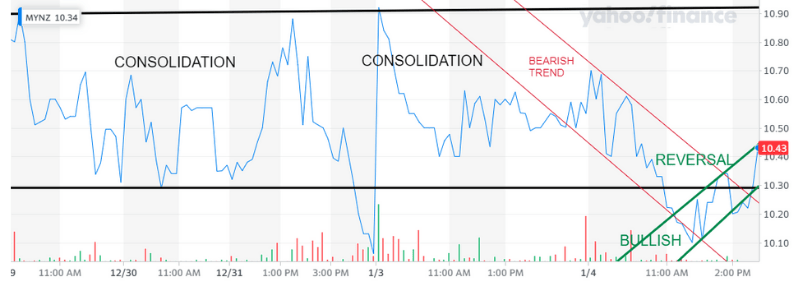

MYNZ 5 Day Chart Technical Analysis

I’ve been waiting on this reversal and I was betting it would happen today and literally in the final hour of trading it happened. I love this chart! As you see from the month chart above a bullish move and then consolidation with a slight bearish lean. Consequently, I’ve been waiting for a confirmation of a reversal. As MYNZ reached $10.43 it confirmed the reversal and this may just take off like a rocket ship.

If you think the stock chart is good, wait until you see why. MYNZ is generating revenue and the street is watching.

#3 Mainz Biomed B.V. Is Generating Revenue

ColoAlert has received CE accreditation and is approved for sale in Europe.1 European sales will provide near-term revenue potential, while they prepare for entry into the US market. Just last month, Mainz Biomed announced the launch of ColoAlert.de, an ecommerce store providing Germans direct access to its ColoAlert colorectal cancer (CRC) screening test.

This is significant, DTC (direct to consumer) test to see if you have cancer which will allow you to catch it early and have a 90% survival rate. However, only about 4 out of 10 colorectal cancers are found at this early stage. When cancer has spread outside the colon or rectum, survival rates are lower.

ColoAlert is designed for profitability, rapid commercial uptake, and broad consumer acceptance. The fact that Mainz Biomed is generating revenue in Europe and will be entering the US market with FDA approval is a massive sign for things to come. Make sure you keep MYNZ on your watchlist because the potential is substantial.

#4 Philanthropic Investing – possibly turn an amazing profit while helping people

It is rare for investors to be able to possibly have a home run return on an investment while helping to alleviate senseless deaths with the 2nd most deadly form of cancer.Colorectal cancer is the 2nd most lethal cancer in the US, but also highly preventable; with early detection providing 5-year survival rates above 90%. However, only about 4 out of 10 colorectal cancers are found at this early stage. When cancer has spread outside the colon or rectum, survival rates are lower.

90% survival rate if detected early, guess what, ColoAlert detects early stage colon cancer. There is a solution and it is ready to come to market in the USA with FDA approval.

Why is Mainz Biomed your cake and icing for investors?

- ColoAlert Holds Potential as a Blockbuster Early Detection Test for Colorectal Cancer. Far less senseless deaths in regards to colon cancer!

- Mainz BioMed protects its intellectual property through trade secrets to control all critical reagents, processes and formulations. Protecting intellectual property is important for market capitalization!

- Mainz Biomed MYNZ is developing proprietary genetic testing methods for pancreatic cancer. Once the distribution channel is developed, offering multiple products creates more than one revenue stream!

- Non-invasive test, which can be taken at home, with rapid response of 92% specificity and 85% sensitivity. Designed to be easier to administer than Exact Science’s ColoGuard, more accurate than FIT, and much less invasive than a colonoscopy. 1

Let’s recap why Mainz Biomed MYNZ could be, THE massive breakout of 2022!

#1 MYNZ is Undervalued

#2 Mainz Biomed B.V. (NASDAQ: MYNZ) Chart Looks Amazing!

#3 Mainz Biomed B.V. Is Generating Revenue

#4 Philanthropic Investing feels good

It is a rare opportunity in this world to have this kind of investment opportunity while also funding the act of saving lives. This is an easy fix, detect the 2nd most dangerous form of cancer early and you have a 90% survival rate. ColoAlert is the answer, we just need to stop what we are doing and place it on your watchlist, today!

Happy Trading and remember, never try to catch a falling knife!

1 https://mainzbiomed.com/investors/

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, MYNZ. Small Cap Exclusive has been hired by Awareness Consulting for a period beginning on January 4, 2021 to publicly disseminate information about (MYNZ) via website and email. We have been compensated $13,500 USD. We will update any changes to our compensation.

Read full disclaimer here.