The Small Cap’s research report on LiTHOS Technology (CSE:LITS) (LITSF:OTC US) highlights the possible mid-term and long-term benefits from the press release issued by LiTHOS Technology (CSE:LITS) today. Also, we will cover the THREE catalysts beyond this acquisition that positions LiTHOS as possibly one of the most lucrative investments in the mining sector.

To any investor who is looking for a possible lucrative mid-term to long-term investment, turn your eyes to LiTHOS Technology (CSE:LITS) (LITSF:OTC US)

Below is the press release from today.

LiTHOS TECHNOLOGY LLC SIGNS TERM SHEET WITH SAND SPIRIT LLC TO SCOPE AND CONSTRUCT ‘CRIMSON TIDE’ LITHIUM HYDROXIDE PILOT PRODUCTION FACILITY IN ALABAMA

- LiTHOS will own and operate the Crimson Tide production facility.

- The ‘Crimson Tide’ Hydroxide facility will selectively pre-treat raw continental brines, concentrate lithium chloride with DLE, and upgrade the concentrate into a final battery grade product of lithium hydroxide monohydrate.

- Facility is strategically located next to Mercedes-Benz US International, Inc., Honda Manufacturing of Alabama, LLC, Hyundai Motor Manufacturing Alabama, LLC. The Alabama site is Hyundai’s first U.S. manufacturing plant and ranks as the state’s third-largest industrial employer tied with Merceds-Benz.

- In regional proximity to the Smackover brine reservoir and all major U.S automobile Manufacturers including Tesla, G.M, and Ford.

- The complex consists of 3 buildings that are 6,000, 7,000, and 42,000 sq. ft. each and are all located in Bessemer, Alabama.

- This facility seeks to enhance LiTHOS’ capacity to conduct multiple simultaneous customer pre-treatment, and DLE demonstration programs.

(i) Storage of raw, intermediate, and processed brines;

(ii) Pre-treatment processing systems and operations;

(iii) Lithium chloride (“LiCl“) concentration processing systems and operations; and

(iv) Direct lithium extraction (“DLE“) processing systems and operations;

(v) Lithium chloride treatment and refining activities (“Refining“) into LiOH H2O.

Ancillary equipment and services will include all operations necessary for the completion of a successful lithium pre-treatment processing, LiCl concentration, DLE, and Refining operations including power, reagent, and water supply.

Scott Taylor CEO of LiTHOS stated: “The Crimson Tide facility will be the first Lithium Hydroxide Monohydrate (“LiOH-H20”) production facility in the Southeastern United States. Fortunately, we found a phenomenal partner in Sand Spirit who bring engineering expertise, a large complex, and the necessary environmental permits to produce LiOH-H20. We can be nimble and quickly get this facility producing LiOH-H20. The facility is strategically located next to the Smackover which is the most prospective lithium enriched brine reservoir in the US. ExxonMobil (NYSE:XOM), Standard Lithium (NYSE:SLI), Galvanic Energy, TerraVolta, and Vital Energy, Inc. (NYSE: VTLE) are all actively developing Smackover lithium projects which present production offtake opportunities for the Crimson Tide facility. The Crimson Tide facility will leverage a license to LiTHOS’s patent-pending pre-treatment to LiOH-H20 process.”

LiTHOS TECHNOLOGY (LITS) (LITSF:OTC)

Let’s take a moment and look at the press release for the engagement of Sand Spirit LLC to develop and construct the Crimson Tide Facility!

VANCOUVER, BC , Sept. 6, 2023 /PRNewswire/ – LiTHOS Energy Ltd. (the “Company“) (CSE: LITS) is pleased to announce that LiTHOS Technology LLC (“LiTHOS“), a wholly-owned subsidiary of the Company, has signed a non-binding indicative term sheet (this “Term Sheet“) with Sand Spirit LLC (“Sand Spirit“) to develop, construct, own and operate a testing and production facility to handle raw brine and upgrade it into a final yield product of lithium hydroxide monohydrate (“LiOH H2O“), inclusive of, but not limited to, the following key operations (collectively, the “System“) and ancillary equipment and services to be located at Sand Spirit’s Buildings 1, 2 and 3 located in Bessemer, Alabama (the “Site“):

The results of hiring Sand Spirit to develop the Crimson Tide facility could be enormous for LiTHOS.

The CRIMSON TIDE facility should increase the tonnes of lithium hydroxide per year greatly for LiTHOS. LiThOS process is more environmentally friendly and cost-effective than conventional methods of lithium extraction, which involve mining or evaporation ponds. The company also plans to expand its production capacity exponentially by 2025 and Crimson Tide Facility should play a major part in their long-term strategy. If LiTHOS achieves their lofty goals they would become one of the largest lithium hydroxide suppliers in the world. Moreover with a share price of $.80 that could be a massive addition to any traders portfolio.

LiTHOS is creating a sustainable and profitable lithium industry. The company offers attractive returns on investment, as well as the opportunity to participate in the green energy revolution. LiThos invites interested parties to contact its investor relations team for more information.

LiThOS Technology is a leading company in the field of lithium-ion battery recycling and innovation. LiThOS has developed a proprietary process that can recover up to 95% of the valuable metals from used batteries, such as lithium, cobalt, nickel and manganese. LiThOS also uses these metals to create high-performance cathodes for new batteries, reducing the dependence on mining and improving the environmental impact of the battery industry.

Company Name: LiTHOS Energy Ltd.

Ticker: LITS (LITSF:OTC US)

Exchange: Canadian Stock Exchange (“CSE”) & OTCQB

Website: https://www.lithostechnology.com/

LiTHOS Energy Ltd. Summary

LiTHOS is delivering the standard for environmentally efficient and economically sustainable brine resource development. LiTHOS’ mission is to eliminate the use of evaporation ponds and enable the lithium industry a step-change in sustainable extraction processes.

The unique brine pre-treatment solution was originally engineered in 2016-18 as a modular oil and gas waste water treatment and recycling solution to turn contaminated water produced, flowback water into purified, particle-free and sanitized frac water for beneficial reuse. The robust system is mobile, highly automated and built for continuous operations under harsh conditions in remote locations.

After more than 6 years and $10 million invested, these systems are fully commercialized and operate in the field at scale. Each modular system can process a throughput feed of 10,000 barrels/day or 1,600 m³/day. AcQUA™, is a patent-pending electro-pressure membrane process which optimizes the pre-treatment of raw brines and then rapidly concentrates a lithium chloride with the use of multiple Direct Lithium Extraction, or ‘DLE’, techniques. Further, Aqueous Resources LLC, a wholly-owned subsidiary of LiTHOS, was recently awarded a $1.3 million grant from the DOE and a $250,000 grant from the state of Colorado to accelerate pilot demonstration testing. LiTHOS operates a fully commissioned lab facility and are working with multiple strategic mineral resource owners in Chile, Argentina, and the United States.

AcQUA™ technology avoids the typical challenges faced by chemically-intensive DLE technologies currently in development phase. AcQUA™ enables lithium brine resource operators to deploy economically viable and sustainable field-ready extraction solutions that seek to substantially reduce water consumption by recycling more than 98% of the input brine water, and substantially eliminate the use of evaporation ponds in the pre-treatment and concentration phases of production. AcQUA™ hopes to enable mining operators to implement economically viable and sustainable water reuse plants.

Why should you invest in LiThOS Technology? Here are the top three catalysts that make LiThOS a great opportunity for stock investors:

#1. Growing Market Demand:

The global market for lithium-ion batteries is expected to reach $129.3 billion by 2027, growing at a compound annual growth rate of 18%. The increasing adoption of electric vehicles, renewable energy storage and consumer electronics is driving the demand for batteries and the need for recycling them. LiThOS is well-positioned to capture a significant share of this market with its innovative and cost-effective solutions.

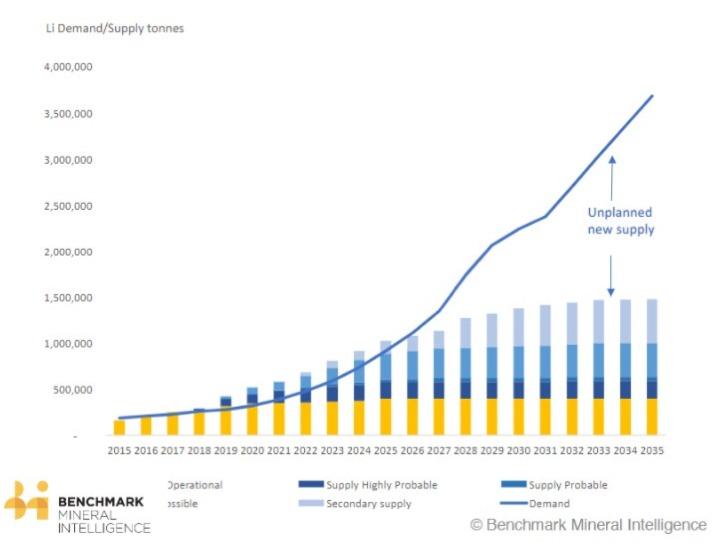

The lithium market is projected to grow from USD 21 billion in 2021 to USD 83BN billion in 2035, according to Benchmark Mineral Intelligence. 1

As you may imagine, not all mines have the same production potential. This is why Benchmark Mineral Intelligence (BMI) made its calculations based on annual production averages for each of the necessary mines lithium-ion cell manufacturing requires.

According to the company, a lithium mine delivers an average of 45,000 metric tons per year. At that production level, the world would demand 74 new mines by 2035, for a total production of 3,3 million metric tons.

That will complement our current production capacity for the 4 million metric tons of lithium EVs will need by 2035. 2

#2. Competitive Edge: LiThOS has a unique advantage over its competitors in the battery recycling industry. LiThOS is the only company that can produce high-quality cathodes from recycled metals, which can be used to make new batteries with comparable or better performance than those made from virgin materials. LiThOS (LITS) also has a patented technology that can extract lithium from brine, a low-cost and abundant source of lithium. LiThOS’s products are certified by major battery manufacturers and have been tested in various applications.

Currently, most of the world’s lithium reserves are found in continental brines – natural salt water deposits.

Currently 2/3 of the world production of lithium is extracted from brines, a practice that evaporates on average half a million litres of brine per ton of lithium carbonate. For an average mine that’s 40 billion litres of water per year. This is hardly sustainable.

Furthermore, the extraction is chemical intensive, extremely slow, and wastes up to 60% of the lithium resources in place while destroying the land.

However, efforts to increase production from brines have mostly stalled due to environmental and technical problems.

That is a big problem, Lithium brine resource owners need new technology to deliver new production quickly, efficiently, and sustainably. 3

In a free market economy, the bigger the problem, the bigger the revenue.

LiTHOS is positioning itself as an industry leader with cutting edge technology that could be disruptive!

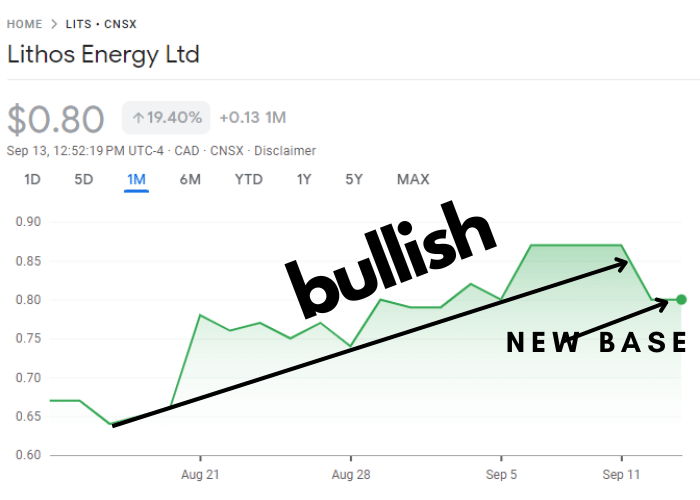

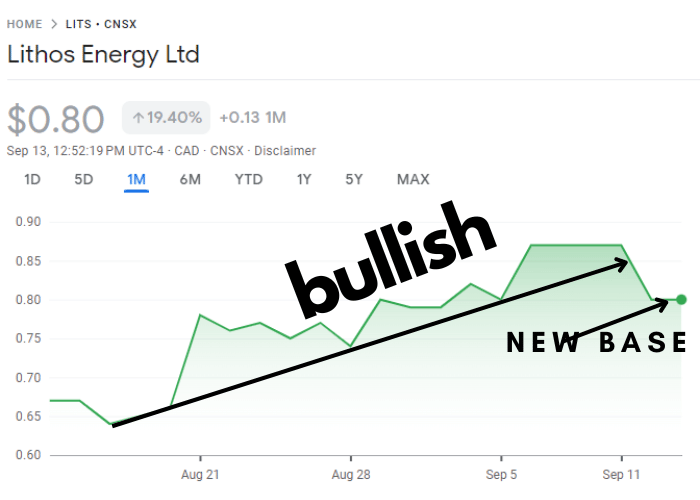

#3. Strong Technical Chart: LiThOS has been

The chart is bullish clearly above with higher lows and higher highs. We believe this chart could be indicator of a very bright future for LiTHOS (LITS).

To close out the research report, LiThOS Technology could be a rare opportunity to invest in a company that may transform the battery industry with its innovative and sustainable solutions. Don’t miss this chance to join LiThOS’s journey to become a global leader in lithium-ion battery recycling and innovation.

Citations:

- “,” ( , 2023).

- “,” ( , 2023).

- 3.“,” ( , 2023).

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $100,000 from Lithos Technology Inc. for profiling (LITS:CNSX)(LITSF:OTC US) for 120 days. We own ZERO shares in LITS.

![]()