Friday Feb 3rd, All eyes on MDJH our low float momentum play!

Pull up MDJH now, super low float momentum play for Friday, tomorrow, Feb 3rd.

The float is super low at 1.4M shares!

This stock has a history of 100% gains with very low volume.

MDJH should be very active in the morning, so be ready!

The definition of a momentum play is:

when you buy a stock because the stock is moving big and you are hoping to scalp a quick gain if the move continues.

We think this is going to be “moving big” at the morning bell.

Remember, this stock moves very fast on a few trades.

So be ready tomorrow morning!

We have identified 2 catalysts revealing the hidden potential with MDJH.

Before we go over the catalysts, let’s do a quick summary on MDJM Ltd (NASDAQ: MDJH)

MDJM Ltd Company Summary

Company Name: MDJM Ltd

Ticker: MDJH

Exchange: NASDAQ

Website: http://ir.mdjmjh.com/

MDJM Ltd Growing Systems Company Summary:

Founded in 2002 and headquartered in Tianjin, China, Mingda Tianjin is an emerging, integrated real estate services company in China.

We primarily provide primary real estate agency services to our real estate developer clients, and provide, on an as-needed basis, real estate consulting services, and independent training services.

MDJH Has Two Catalysts That Could Send It To The Moon Tomorrow

#1 Low Float

#2 Small amount of volume makes it explode

LOW supply & HIGH Demand = Massive PPS Increases, it’s simple math!

Stock MDJH has ONLY 1.4M shares in the float.

Our last two alerts traded 1M shares each, that would almost be the WHOLE FLOAT!

Our subscribers have an amazing opportunity!

What do we mean by, “our subscribers have an amazing opportunity!”?

We love low float stocks because of their ability to MOVE.

They provide great upside opportunities for day traders.

What is a “low float stock”?

Low float stocks are those with a low number of shares. Floating stock is calculated by subtracting closely-held shares and restricted stock from a firm’s total outstanding shares. Closely-held shares are those owned by insiders, major shareholders, and employees.

MDJH has only 1.4M shares in the float.

While the average NASDAQ float we normally feature is 10M shares, 10X higher!

This stock has very little supply of shares in the market and our subscribers normally create a large amount of demand.

Remember, LOW supply & HIGH Demand = Massive PPS Increases, it’s simple math!

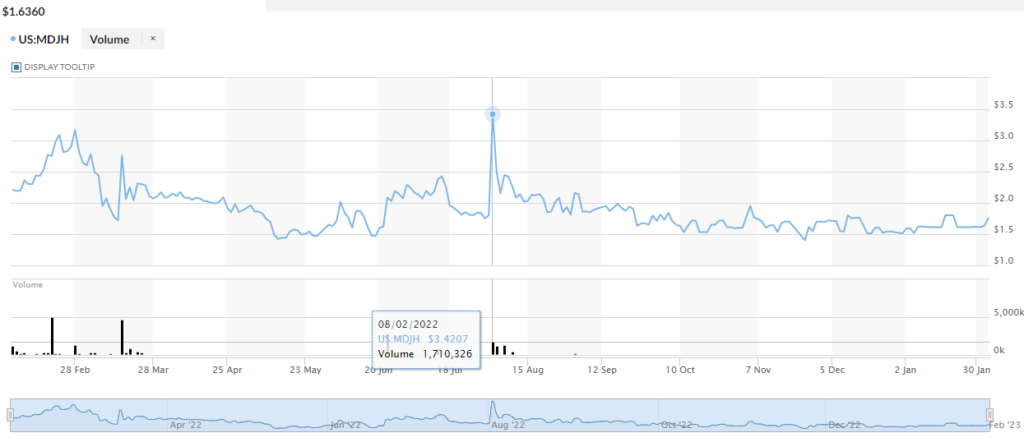

On August 2nd of last year MDJH traded around our average volume of 1.7M shares and went up almost 100%!

That day went like this, someone invested $10,000 and had $20,000 in just a few hours.

Again, our average alerts trade 1-2M shares

The last time MDJH had that kind of volume was in August and went up almost 100%!

Let’s Recap The Two Catalysts That Could Send It To The Moon Tomorrow

#1 Low Float

#2 Small amount of volume makes it explode

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has not been compensated for profiling MDJH. We own ZERO shares in MDJH.

FLGC Stock: Flora Growth (NASDAQ:FLGC) Gains Momentum On Revenue Growth: Will It Sustain?

A stock that has managed to come onto the surface following a strong move over the course of the past few days is FLGC stock. Flora Growth Corp (NASDAQ:FLGC), which is involved in the outdoor cultivation, manufacturing, and distribution of cannabis products, was in the news earlier on in the week.

Flora Growth Corp

Company Name: Flora Growth Corp

Ticker: FLGC

Exchange: NASDAQ

Website: https://www.floragrowth.com

Flora Growth Corp Summary:

Flora is building a connected, design-led collective of plant-based wellness and lifestyle brands designed to deliver the most compelling customer experiences in the world, one community at a time.

As the operator of one of the largest outdoor cannabis cultivation facilities, Flora leverages natural, cost-effective cultivation practices to supply cannabis derivatives to its commercial, house of brands, and life sciences divisions.

Now, let’s analyze the latest news from FLGC stock:-

#1 Expects 100% Topline Growth For Fiscal 2023

On Monday the company announced that it expected its revenues for the fiscal year of 2023 to be in the $90 million to $105 million range. It was a significant new announcement from the company and on the day of the announcement the stock clocked gains of as much as 40%. In this regard, it should also be noted that a survey by FactSet expected the company to post revenues of $95.6 million for the year.

The company included the revenues that were projected from its new acquisition Franchise Global Health, a Germany-based business, in its projections.

FLGC stock reacted bullishly after the news.

#2 Gets Additional 180 Day Extension by Nasdaq to Regain Compliance

Earlier on in the month of January 2023, the company had come into the news once again after it announced that it had got an extension of 180 days from NASDAQ so as to fulfill the $1 minimum bid price requirement that is part of the listing rules of the exchange.

The initial period of 180 days to regain compliance expired back on January 4, 2023. The extension could be construed as a positive development for the company as it tries to stay listed on the exchange.

#3 Acquisition of Franchise Global Health

The acquisition of Franchise Global Health, which had been completed in December last year could well be a cornerstone for the company’s growth.

Thanks to the acquisition the company is going to establish a presence in the fast-growing German market and sell medical cannabis through more than 1200 pharmacies as well as distribution outlets spread across 28 nations. Franchise Global Health generated a gross profit of C$2.8 million and revenues of C$42 million in the nine-month period that ended on September 30, 2022.

After the recent rally, the stock might find resistance at a higher lever, and profit booking may be healthy for now.

Take a look at the CIFR stock, which is flying after a key update.

CIFR Stock: Cipher Mining (NASDAQ:CIFR) Tripled This Year: How Far Can It Go? — Copy

Stocks that bounce back in a big way after having gone through a tough period are almost always of interest to investors and a stock that fits that particular bill is that of CIFR stock.

Last year, the Cipher Mining Inc (NASDAQ:CIFR) stock had gone through a slump but it has managed to go on a remarkable recovery in the New Year and so far in 2023, it has clocked gains of as much as 200%.

Cipher Mining Inc

Company Name: Cipher Mining Inc

Ticker: CIFR

Exchange: NASDAQ

Website: https://www.ciphermining.com

Cipher Mining Inc Summary:

Cipher is an emerging technology company focused on the development and operation of bitcoin mining data centers in the United States. Cipher is dedicated to expanding and strengthening the Bitcoin network’s critical infrastructure.

Together with its diversely talented team and strategic partnerships, Cipher aims to be a market leader in bitcoin mining growth and innovation.

Now, let’s analyze the latest news from CIFR stock:-

#1 January 2023 Operational Update

The company is involved in the development and operation of Bitcoin mining data centers and yesterday, it came into the news cycle after it announced its operations and production update for the month of January 2023. It should be noted that the numbers released by Cipher Mining were unaudited.

The company announced that it mined 343 Bitcoin tokens and sold 314 of those for the month, at the end of which it still held 424 Bitcoin tokens. The hash rate at the end of the month stood at 4.3 EH/s.

The company’s management noted that during the month Cipher continued to broaden its operations from out of Odessa, financed more capital expenditure, and built its Bitcoin inventory. At the start of the month, the company had the mining capability of 9.3 Bitcoin tokens a day but by the end of the month, it stood at 14 Bitcoin tokens a day. That reflected a rise of almost 51% in a matter of one month.

The CIFR stock has reacted positively after the update.

#2 Expands Operations at Odessa Data Center

Back on December 20, 2022, the company had been in the news after it announced that it got more mining rigs that were going to be installed at the Odessa data center that had been opened recently. The self-mining rate of the company was going to go up to 6 EH/s following the move.

#3 Stock Hits Multi-Month High On Solid Momentum

Last year, the stock had gone through a slump but it has managed to go on a remarkable recovery in the New Year and so far in 2023, it has clocked gains of as much as 200%.

The CIFR stock has recorded healthy trading volumes in 2023 so far and has been trading higher than all moving averages including 20-day and 50-day.

Following the recent momentum, the CIFR stock may continue to be an interesting play and we may see buying on every dip for the short term.

Don’t forget to get inside on OPEN stock Here