Gryphon Digital Mining, Inc. (NASDAQ: GRYP) stands at the forefront of the cryptocurrency mining sector, heralding the advent of innovative methodologies poised to revolutionize the industry. At a juncture where the digital currency market is escalating in significance and profitability, Gryphon emerges as a beacon of opportunity for investors. Currently, with its stock priced at $1.40 and projections by Alpha Transform indicating a target price of $3.37, Gryphon represents a compelling investment prospect, suggesting a potential surge in value exceeding 140%. This buoyant sentiment regarding Gryphon’s prospects is well-grounded, supported by a confluence of pivotal factors anticipated to propel its growth trajectory.

Recent developments have further bolstered Gryphon’s position, with the company announcing a stock repurchase program, signaling a robust vote of confidence in its strategic direction and a commitment to shareholder value enhancement. This initiative, which permits the buyback of up to {1} $5 million in common stock, underscores Gryphon’s steadfast dedication to capital management and long-term value creation. Moreover, the completion of a machine upgrade program ahead of schedule is set to augment operational efficiency significantly, reinforcing the company’s status as a low-cost producer of bitcoin and a leader in bitcoin efficiency charts.

The stock chart analysis for Gryphon Digital Mining reveals a pattern that seasoned investors might interpret as a prime setup for a substantial rebound, considering the company’s historical volatility and pronounced price per share fluctuations within brief intervals. This pattern, coupled with the recent strategic maneuvers, presents a narrative of a company on an upward trajectory, poised for potential breakthroughs in value appreciation.

In summary, Gryphon Digital Mining, Inc. is navigating a transformative phase, marked by strategic initiatives that enhance its investment appeal. The company’s proactive approach to stock capital management through its buyback program, its operational advancements, and the favorable analysis of its stock performance collectively paint a picture of a company with a promising future, offering investors a chance to partake in its anticipated success. As the digital currency landscape continues to evolve, Gryphon’s pioneering spirit and commitment to innovation and sustainability are likely to remain integral to its narrative of growth and industry leadership.

Here is our last article on GRYP, take a look at more insightful research on Gryphon.

#1 Impressive Growth Trajectory:

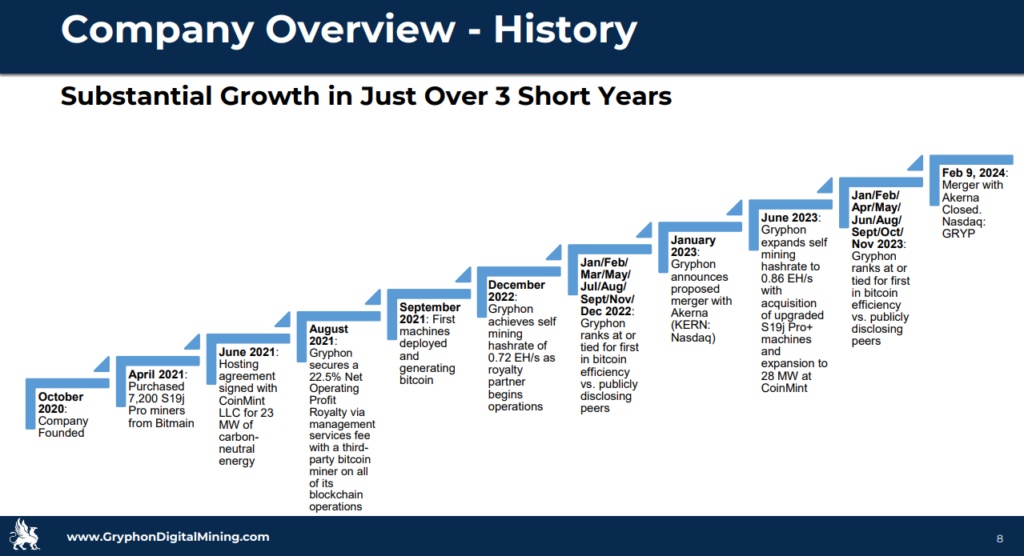

Gryphon’s ascent in the digital mining sector is a testament to its robust growth trajectory, marked by a steadfast expansion over the last four years. This period has seen Gryphon not only survive but thrive, showcasing an exceptional capacity for resilience and adaptability in an industry characterized by rapid evolution and change. The company’s journey is punctuated by a series of strategic maneuvers that have fortified its position as a powerhouse within the digital mining domain.

Investors have witnessed Gryphon’s unwavering commitment to growth, underpinned by a consistent upward trend in performance metrics. The company’s ability to navigate through the complexities of market fluctuations has instilled a sense of reliability and confidence among stakeholders. Gryphon’s growth narrative is replete with instances of overcoming obstacles that would have stymied lesser entities, further cementing its status as an industry stalwart.

The company’s growth is not just a reflection of market conditions but also of its intrinsic strengths—innovative approaches to mining technology, astute market analysis, and judicious investment decisions. Gryphon’s proactive stance on adopting new technologies and its agility in responding to market dynamics have been central to its growth story. These attributes have enabled Gryphon to capitalize on opportunities and mitigate risks effectively, even when faced with adverse market conditions.

Gryphon’s impressive growth trajectory is also a function of its visionary leadership, which has consistently demonstrated foresight and strategic planning. The leadership’s ability to anticipate industry trends and position the company advantageously has been pivotal in Gryphon’s journey. This forward-thinking approach has allowed Gryphon to not just keep pace with the industry but often set the pace, leading to a trailblazing path of growth and success.

In conclusion, Gryphon’s impressive growth trajectory over the past four years is a clear indicator of its resilience, adaptability, and strategic acumen. The company has not only established itself as a formidable player in the digital mining industry but has also set a benchmark for others to follow. Its proven ability to deliver results, even in challenging market conditions, offers a reassuring narrative for investors and stakeholders alike, promising a continued upward trajectory in the years to come.

#2 Market Volatility and Opportunity:

The cryptocurrency market is characterized by its dynamic and unpredictable nature, where swift changes in value can occur, presenting a landscape rife with both potential gains and losses for investors. Within this context, Gryphon distinguishes itself by adopting an environmentally responsible approach to cryptocurrency mining. This strategy not only sets Gryphon apart from its competitors but also serves as a buffer against the market’s fluctuations. By prioritizing eco-friendly practices, Gryphon offers investors a more stable investment avenue in an otherwise volatile sector.

Gryphon’s commitment to sustainability is not merely a corporate responsibility initiative but a core aspect of its business model, which resonates with a growing segment of investors who are keen on supporting companies with green credentials. This alignment with environmental values provides Gryphon with a competitive edge, as it appeals to both the eco-conscious investor and those looking for a measure of stability in the turbulent crypto market. Gryphon’s operations, which are designed to minimize environmental impact, reflect a forward-thinking approach that anticipates the increasing importance of sustainable practices in business.

Moreover, Gryphon’s innovative mining solutions demonstrate that environmental consideration need not come at the expense of profitability. The company’s ability to navigate the complexities of the cryptocurrency market while adhering to its eco-friendly ethos is a testament to its robust operational framework. Gryphon’s resilience in the face of market volatility is bolstered by its sustainable mining methods, which are likely to attract investors who are cautious about the high-risk nature of the cryptocurrency sector.

In essence, Gryphon’s unique positioning within the cryptocurrency market serves as a dual advantage. It not only mitigates the inherent risks associated with market volatility but also capitalizes on the opportunities that arise from being a green pioneer in the industry. As Gryphon continues to pursue sustainable growth, it remains focused on creating long-term value for its investors, ensuring that its environmental principles go hand-in-hand with financial success. In doing so, Gryphon stands out as a beacon of stability and innovation in a sector known for its rapid and often unpredictable shifts.

#3 Machine Upgrades and Operational Enhancements:

Gryphon Digital Mining’s recent completion of its machine upgrade program, as announced earlier this week, marks a significant milestone in the company’s commitment to operational excellence and technological leadership in the digital mining industry. The early completion of this program not only demonstrates Gryphon’s proactive and forward-thinking strategy but also solidifies its position as a trailblazer in the adoption of cutting-edge mining technologies. By integrating the latest Bitmain S21 200 TH/s miners into their operations, Gryphon has significantly enhanced its hashing power by an estimated 23 PH/s, while simultaneously improving its average fleet efficiency to an impressive 28.5 J/T[1]. Press Release

This strategic enhancement of Gryphon’s mining infrastructure is a testament to its dedication to maintaining a competitive edge in a rapidly evolving market. The upgrade is expected to bolster Gryphon’s operational efficiency, reducing the cost of bitcoin production and potentially increasing the overall profitability of the company. Such advancements are crucial differentiators for Gryphon, setting it apart from competitors and underscoring its relentless pursuit of innovation and growth.

The deployment of the new mining equipment is a clear indicator of Gryphon’s commitment to sustainability and efficiency. With the mining industry facing increasing scrutiny over energy consumption, Gryphon’s move towards more energy-efficient machines aligns with its goal of pursuing a negative carbon strategy and contributing to the clean energy grid. This approach not only enhances Gryphon’s environmental stewardship but also appeals to environmentally conscious investors and customers who prioritize green initiatives.

Furthermore, the upgrade aligns with Gryphon’s strategic vision of long-term success and shareholder value creation. The company’s ability to execute such significant operational enhancements ahead of schedule reflects a highly efficient and capable management team. This efficiency is likely to instill confidence in investors, as it suggests that Gryphon is well-equipped to navigate the challenges and opportunities of the digital mining landscape.

In conclusion, Gryphon Digital Mining’s recent machine upgrades are a pivotal development in its journey towards operational excellence and sustainability. The company’s ability to stay ahead of technological trends and its commitment to efficiency and environmental responsibility are key differentiators that position Gryphon for continued success in the digital mining sector[2].

#4 Robust Financial Framework and Share Buyback Program:

The fifth catalyst is GRYP’s robust financial framework and transparent business model serve as the third catalyst. Gryphon Digital Mining, Inc. stands at the forefront of the digital currency mining industry, offering stock investors a unique investment opportunity backed by a robust financial framework and a transparent business model.

As the cryptocurrency market continues to mature, Gryphon Digital Mining distinguishes itself by prioritizing sustainability and efficiency in its operations. The company’s financial structure is designed to withstand market volatility, ensuring stability and long-term growth potential for its investors.

With an open-book approach to its business dealings, Gryphon Digital Mining fosters trust and confidence among stakeholders, demonstrating a commitment to ethical practices in an often opaque industry. For investors looking to diversify their portfolios with a forward-thinking and financially sound enterprise, Gryphon Digital Mining presents a compelling option.

Gryphon’s financial architecture stands as a paragon of stability and resilience, particularly noteworthy in an era where market fluctuations are the norm. The company’s substantial equity, coupled with a prudent approach to debt management, lays a solid foundation that can weather economic storms. This robustness is further underscored by the strategic allocation of capital towards a $5 million share repurchase program, a move that not only exemplifies Gryphon’s confidence in its own financial health but also signals a proactive stance in capital management.

Such a program is indicative of a surplus of liquid assets, allowing Gryphon to buy back shares without compromising its operational capabilities or investment potential. It’s a clear indicator of a surplus in cash reserves, reflecting a financial structure that is not only strong but also agile, capable of making bold moves without jeopardizing its core financial strategies. This agility is crucial in a volatile market, where the ability to pivot and adapt can be the difference between growth and stagnation.

Moreover, the repurchase scheme serves as a reaffirmation of Gryphon’s unwavering commitment to enhancing shareholder value. By reducing the number of shares outstanding, the company effectively increases the value of the remaining shares, potentially leading to an appreciation in share price and a more favorable equity position for shareholders. This strategy is a testament to Gryphon’s forward-thinking financial planning and its dedication to delivering long-term shareholder returns.

The implementation of such a scheme is not taken lightly; it requires a deep understanding of market trends, shareholder expectations, and the company’s long-term strategic goals. Gryphon’s ability to execute this plan speaks volumes about its financial acumen and the expertise of its management team. It demonstrates a level of financial insight that is attuned to both current market conditions and future prospects, ensuring that every financial decision is made with precision and foresight.

In essence, Gryphon’s financial structure is not just robust; it is dynamic, responsive, and strategically aligned with its overarching mission to build and sustain shareholder wealth. The $5 million share repurchase scheme is a reflection of this, embodying the company’s financial strength and its proactive approach to capital management. It is a financial structure that is built not just for today, but for the future, ready to capitalize on opportunities and navigate challenges with equal adeptness.

#5 Strategic Partnerships and Technological Innovations:

Gryphon, a forward-thinking entity in the digital mining domain, has meticulously established strategic partnerships with leading technology corporations. These alliances are not merely collaborations but a fusion of pioneering visions, where Gryphon has positioned itself at the forefront of innovation. By aligning with industry giants, Gryphon has gained access to cutting-edge mining equipment and advanced software systems, which are integral to its core operations. The synergy created through these partnerships has resulted in a remarkable amplification of Gryphon’s operational capabilities, significantly boosting its efficiency and output.

The strategic alliances have also fostered an environment of shared expertise and resources, enabling Gryphon to leverage the collective intelligence and technological prowess of its partners. This collaborative approach has catalyzed the development of revolutionary mining solutions, propelling Gryphon to new heights of productivity. The partnerships are a clear reflection of Gryphon’s dedication to remaining at the helm of the digital mining industry, constantly seeking out innovative methods to refine its processes.

Furthermore, these alliances underscore Gryphon’s agility in adapting to the ever-evolving technological landscape, ensuring that it remains well-equipped to tackle the challenges of modern digital mining. The company’s proactive stance in forming these strategic connections exemplifies its commitment to excellence and its relentless pursuit of progress within the digital mining arena. Gryphon’s strategic alliances are more than just business arrangements; they are a robust foundation for sustained growth and a beacon of its visionary approach to the future of digital mining. Through these partnerships, Gryphon is not only enhancing its current operations but is also laying the groundwork for the next generation of digital mining advancements. The company’s strategic alliances are a testament to its foresight and its aspiration to redefine the standards of the digital mining sector.

#6 Environmental Sustainability and ESG Principles:

Gryphon’s dedication to environmental stewardship is a defining characteristic that distinguishes it within the digital mining industry. The company’s strategic decision to integrate renewable energy sources into its operations exemplifies its proactive stance on environmental conservation. Gryphon’s operations are designed to minimize ecological impact, reflecting a deep-rooted commitment to preserving natural resources. This commitment extends beyond mere compliance with environmental regulations, as Gryphon actively seeks to exceed standards and lead by example in sustainable practices.

The utilization of green energy not only mitigates Gryphon’s environmental impact but also serves as a testament to its innovative approach to digital mining. Gryphon’s environmental initiatives are a cornerstone of its business model, ensuring that its activities do not compromise the well-being of the planet. The company’s focus on environmental sustainability is not an afterthought but a fundamental aspect of its identity, influencing every decision and action.

Gryphon’s environmental ethos is further reinforced by its adherence to Environmental, Social, and Governance (ESG) principles, which guide its corporate strategy and operational methodologies. By prioritizing these principles, Gryphon demonstrates a clear understanding of the intrinsic link between environmental responsibility and long-term business viability. The company’s ESG-centric approach positions it as a leader in the transition towards a more sustainable future in digital mining.

Investors who prioritize environmental values find Gryphon’s eco-centric approach particularly appealing. The company’s steadfast commitment to reducing its carbon footprint aligns with the growing demand for environmentally responsible investment opportunities. Gryphon’s ability to harmonize profitability with ecological mindfulness resonates with a market that increasingly values sustainability.

In summary, Gryphon’s environmental initiatives are not just differentiators; they are the essence of the company’s progressive vision. Gryphon’s pioneering efforts in sustainable digital mining set a benchmark for the industry, showcasing the potential for technological innovation to coexist with environmental preservation. The company’s unwavering focus on environmental components of its operations underscores its role as a vanguard of eco-friendly practices in the digital mining sector. Gryphon’s approach serves as a blueprint for how companies can thrive economically while fostering a healthier planet for future generations.

In Conclusion

Gryphon Digital Mining, Inc. has recently fortified its position in the cryptocurrency mining industry with strategic machine upgrades, as highlighted in the latest news[1]. These enhancements are a testament to Gryphon’s commitment to operational excellence and technological innovation. The company’s impressive growth trajectory is propelled by its ability to adapt to market volatility, leveraging it as an opportunity for expansion and efficiency gains. The recent acquisition of Bitmain S21 200 TH/s machines is set to significantly boost Gryphon’s hashing power, while also improving energy efficiency—a key differentiator in the sector[2]. This move aligns with Gryphon’s robust financial framework, which supports a proactive share buyback program, reinforcing investor confidence. Strategic partnerships have been instrumental in driving technological advancements, further solidifying Gryphon’s market position. Moreover, the company’s dedication to environmental sustainability and adherence to ESG principles is evident in its pursuit of a negative carbon footprint and the use of 100% renewable energy sources for mining operations[3]. These six catalysts collectively enhance Gryphon’s competitive edge and underscore its readiness to navigate the evolving digital mining landscape with a sustainable and forward-thinking approach.

[1]: https://finance.yahoo.com/news/gryphon-digital-mining-announces-march-110000002.html “”

[2]: https://www.streetinsider.com/Corporate+News/Gryphon+Digital+Mining+%28GRYP%29+Issues+March+2024+Operational+Update/23026808.html “”

[3]: https://www.streetinsider.com/Accesswire/Gryphon+Digital+Mining+Announces+Stock+Repurchase+Program%3B+Machine+Upgrade+Program+Completed+Ahead+of+Schedule/23093718.html “”

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated up to $450,000 from Gryphon Digital Mining, Inc. for profiling (GRYP:NASDAQ) starting March 22nd 2024. We own ZERO shares in (GRYP:NASDAQ) FULL DISCLAIMER