DRCT Stock Price has been on a rocket ship and I called it three weeks ago.

What did I call?

I called the retrace and the bounce. Take a look below at the proof!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! DRCT Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

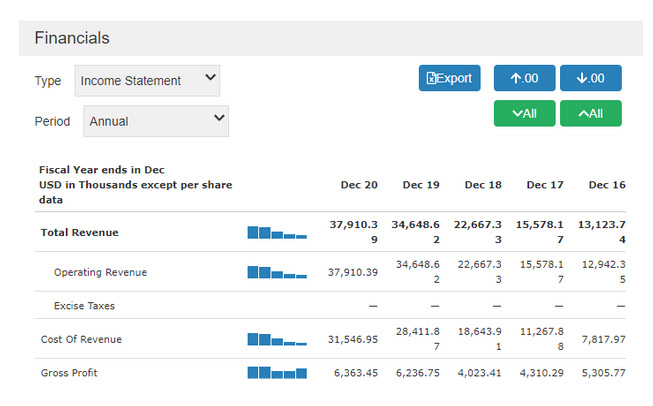

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Direct Digital Company Information

Company Name: Direct Digital Holdings Inc.

Ticker: DRCT

Exchange: NASDAQ

Website: https://directdigitalholdings.com/

Direct Digital Company Summary:

Direct Digital Holdings, Inc. is a full-service programmatic advertising platform that focuses on providing advertising technology. Moreover, data-driven campaign optimization and other solutions to underserved markets on both the buy- and sell-side of the digital advertising ecosystem.

It has offerings across multiple industry verticals such as travel, healthcare, education and financial services. Also offering consumer products with an emphasis on small- and mid-sized businesses transitioning into digital with digital media budgets.

The company was founded by Mark D. Walker and Keith W. Smith in June 2018 and is headquartered in Houston, TX.

DRCT stock price is due to News?

March 9, 2022 /PRNewswire via COMTEX/ — HOUSTON, March 9, 2022 /PRNewswire/ — Direct Digital Holdings (Nasdaq: DRCT) today announced that its buy-side advertising platform, Orange142, has once again been named digital agency of record for the Pigeon Forge Department of Tourism. This new 5-year agreement builds on Orange142’s nearly 25-year relationship with Pigeon Forge. The town of 7,000 residents saw an economic impact of over $2 billion from tourism in 2021, marking a 100 percent increase in Pigeon Forge’s overall tourism tax base over the last 5 years. The plan for the next 5 years is to drive incremental uptick in the region’s new visitor base, party size, party spend and length-of-stay, as well as targeted initiatives to increase tourism from key markets including Chicago, Washington DC, Indianapolis and Tampa Bay.

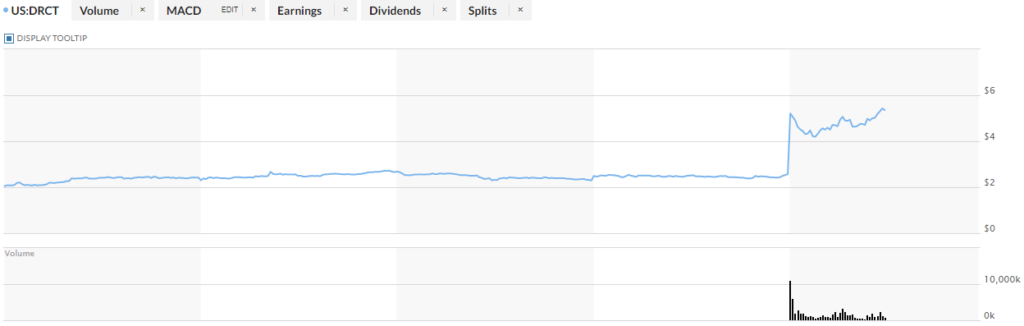

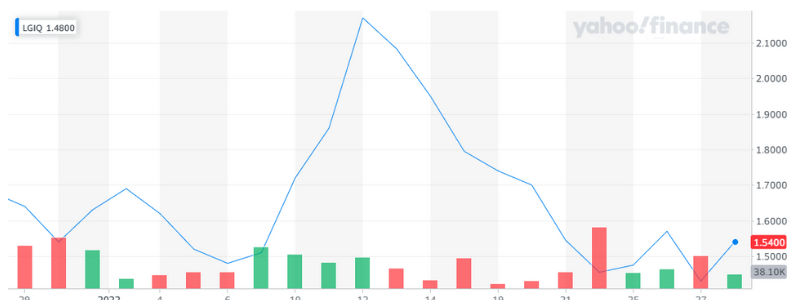

DRCT 5 Day Chart

DRCT Stock Price Technical Analysis:

I wrote about DRCT about a month ago and said, “This NASDAQ trending stock is neutral right now. What does that mean? It means it is risky! I would wait for the stock to decide what it’s next move could be, hence neutral. It might go in drive and it might go in reverse. So the prudent move is to wait and see, time it and make your move!” HERE is the article

Boy oh boy, sometimes I scare myself, LOL. If you would have traded this stock back on March 10th you would have lost around 30%, from $3 to $2.

So I helped you avoid the drop from $3 to $2 but if you did place it on your watchlist and “wait and see, time it and make your move!” then you could be up over 50%.

Congrats to our subscribers who played DRCT.

Once again my name is Alex and I’m so glad you took the time to read this far. I would love to have you be apart of our growing family of traders.

I always like giving tid bits of knowledge that I have learned from my mentors, so here goes. As a reminder to all of the traders out there to leave your emotions at the door and never, ever, try to catch a falling safe. Simply let it crash to the ground and then, walk over and pick up the money. That is a reference to bounce plays LOL.

I strive to find breakout stock alerts and deliver them before the market finds out. I’m the original OG trend setter of trending stocks! If you want stocks delivered to your inbox, no hassle, no research with this massive community of traders, sign up below.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies.

Tom Furukawa – Chief Executive Officer 26+ years of senior level management experience for some of the world’s most successful companies including: IBM Tivoli, Yahoo!, Kelley Blue Book, The Enthusiast Network, The Rubicon Project, Enstigo, ZEFR and the Ad Exchange Group. Brings deep experience in development and product management for advertising and digital media technologies. Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A.

Brent Suen – President, Chairman and Director 27+ years of experience in the investment banking industry. Began his career in merger arbitrage at Bear Stearns as the firm’s youngest hire. Founded Axis Trading Corp in 1993 and sold it to a division of Softbank in 1996. Worked in Asia for 17 years advising Ecommerce and Software as a Service companies on M&A. Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink.

Steven Hartman – Chief Product Officer 25+ years experience in enterprise software and marketing at major tech companies, including: Yahoo!, IBM, Acxiom, Kenshoo, The Rubicon Project, and Siebel Systems. Served as VP of global marketing at Kenshoo and VP of marketing at Viglink. Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media.

Joshua Jacobs – Independent Director Pioneer in the programmatic media-buying industry. Led innovative technology companies on a global scale. Serves as independent director of Maven. Co-led fundraising, acquisition and integration of four media companies. Former CEO of Accuen and a president of Omnicom Media. Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

Lea Hickman – Independent Director 30+ years leading product teams to deliver world-class products. VP Product Management at Adobe where she led the product management for all design, web and interactive tools including Dreamweaver, Flash, Indesign and Illustrator. Led the strategy of Creative Cloud, which transformed Adobe into a SaaS company.

Look at this chart, it looks like it could b

Look at this chart, it looks like it could b

Buzztime has been moving uphill since September, and in last 45 days had some significant jumps. In mid September NTN was trading around $1.60pps and by end of January had hit highs above $5.20pps

Buzztime has been moving uphill since September, and in last 45 days had some significant jumps. In mid September NTN was trading around $1.60pps and by end of January had hit highs above $5.20pps