Camber Energy, Inc. (NYSE American:CEI) is a diversified energy company that operates in the oil and gas sector, as well as the power solutions market. Today, they announced the acquisition of Viking Energy Group, Inc.

August 1, 2023

Announced today the completion of its previously announced acquisition of Viking Energy Group, Inc. (“Viking”), pursuant to which Camber acquired all of the issued and outstanding securities of Viking not already owned by Camber. Effective August 1, 2023, Viking became a wholly-owned subsidiary of Camber, and Viking’s securities ceased trading on the OTC:QB. Camber remains as the sole publicly-traded entity.

Viking brings to Camber a long-standing custom energy and power solutions business, along with a portfolio of diverse, ready-for-market technologies in the clean energy, carbon-capture, waste treatment and utility sectors. Most importantly, Viking brings an exemplary team of professionals, extensive industry relationships and additional opportunities for growth.

“We sincerely appreciate the patience and support of our stakeholders for affording us the opportunity to finally close this merger, and in no way do we view the acquisition as a ‘finish line’ of any kind. Rather this is merely an early, albeit significant, step within our comprehensive plan to transform this organization into what we firmly believe will be a revolutionary and profitable participant in the energy industry,” commented James Doris, President & CEO of Camber.

Additional Details:

Additional details regarding Camber’s acquisition of Viking will be included in, and the description above is qualified in its entirety by, Camber’s Current Report on Form 8-K filed with the Securities and Exchange Commission (“SEC”), which, once filed, will be available under “investors” – “SEC filings” at www.camber.energy. Given the transaction closed in the third quarter, the financial statements Camber intends to file on form 10-Q for the quarter ended June 30, 2023 (the “2nd Quarter 10-Q”) will not include a consolidation of Viking’s financial statements at the Camber level. Rather, the 2nd Quarter 10-Q will account for Camber’s previous investments in Viking under the equity method of accounting, consistent with previously filed financial reports.

Now, let’s go over some of the basics before we get into some very exciting news that all traders should be very interested in.

Corporate Name: Camber Energy, Inc.

Ticker: CEI

Stock Exchange: NYSE

(NYSE American:CEI) Summary:

Camber Energy, Inc. (NYSE American:CEI) is a diversified energy company that operates in the oil and gas sector, as well as the power solutions market. Camber owns minority and non-operated working interests in oil and gas wells in Texas, which provide steady cash flow and potential growth opportunities. Camber also provides custom energy and power solutions to commercial and industrial clients in North America, through its majority-owned subsidiary, Viking Energy Group, Inc. Camber is committed to delivering value to its shareholders, customers and partners by leveraging its expertise, innovation and technology.

Camber Energy is a company with a vision for the future of energy. Camber is actively pursuing new projects and acquisitions that align with its strategy of diversifying its portfolio and expanding its market presence. Camber is also focused on enhancing its operational efficiency, financial performance and corporate governance. Camber has recently achieved several milestones, such as:

– Regaining compliance with the NYSE American’s continued listing standards regarding stockholders’ equity

– Receiving approval from its shareholders for the merger with Viking Energy Group

– Obtaining a notice of allowance for an additional patent covering transmission line ground fault prevention systems

Now that we covered the basics, let’s go over the sizzle on theis steak.

Top 3 Catalysts that could send CEI to the moon!

1. The one month chart is great!

2. The news was absolutely incredible this year!

3. This stock has went up almost 50% in ONE DAY two different times this month!

Now, lets go over the top 3 reasons Camber Energy, Inc. (NYSE American:CEI) could go parabolic tomorrow.

1. The one month chart is great!

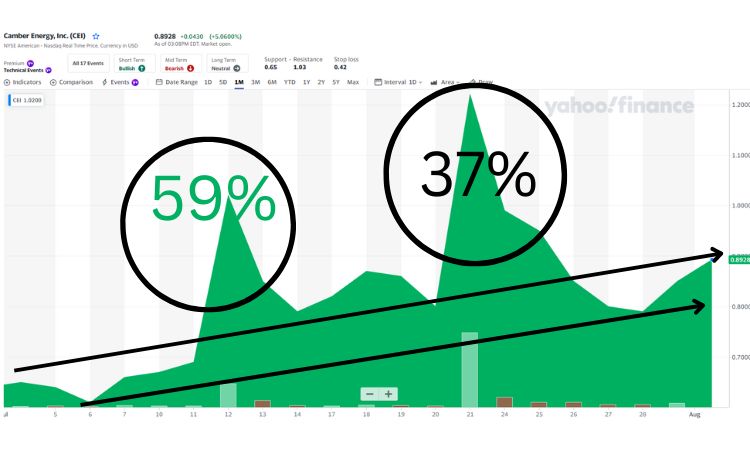

Even Stevie Wonder could see this has a repeating pattern of explosive moves followed with even MORE explosive moves. On July 11th it closed at $.69 and one day later it hit a high of $1.10 representing a 59% gain!

On 7/20, CEI closed at $.80 and one day later it hit a high of $1.27 representing a 37% gain!

Now almost exactly the same duration of time between those moves, it is possibly setting up for another 37% or even better a 59% move.

Camber Energy is obviously bullish from the chart above and we would be surprised if tomorrow is not a solid day of trading for this big board monster!

2. The news was absolutely incredible this year!

August 1, 2023

Announced the completion of its previously announced acquisition of Viking Energy Group, Inc. (“Viking”), pursuant to which Camber acquired all of the issued and outstanding securities of Viking not already owned by Camber. Effective August 1, 2023, Viking became a wholly-owned subsidiary of Camber, and Viking’s securities ceased trading on the OTC:QB. Camber remains as the sole publicly-traded entity.

Viking brings to Camber a long-standing custom energy and power solutions business, along with a portfolio of diverse, ready-for-market technologies in the clean energy, carbon-capture, waste treatment and utility sectors. Most importantly, Viking brings an exemplary team of professionals, extensive industry relationships and additional opportunities for growth.

June 21, 2023

Announced that the NYSE American LLC (the “Exchange”) has accepted the Company’s business plan to regain compliance with the Exchange’s continued listing standards regarding stockholders’ equity, as set forth in Sections 1003(a)(i), (ii) and (iii) of the NYSE American Company Guide.

The Company’s plan of compliance (the “Plan”), submitted by Camber on May 9, 2023 and accepted by the Exchange on June 14, 2023, includes, among other things, consummating the previously-disclosed merger with Viking Energy Group, Inc. (“Viking”), the commercialization of certain of Viking’s existing intellectual property and licenses, and further reducing the number of outstanding shares of Camber’s Series C Redeemable Convertible Preferred Stock.

The Exchange will continue to review the Company on a quarterly basis for compliance with the Plan, and the Company must regain compliance with the Exchange’s continued listed standards on or before April 12, 2024.

Camber Energy is a company that you can trust and invest in. Camber offers a unique combination of stability, growth potential and innovation in the energy industry. Camber’s stock is traded on the NYSE American under the symbol CEI.

March 28, 2023

A stock market research firm specializing in the small cap and microcap sectors, announced today that it has published a new research report on Camber Energy, Inc. (NYSE American:CEI), a diversified energy and power solutions company that is in a pending merger with Viking Energy Group Inc. (OTCQB:VKIN). The report carries a price target. To view the new research report, along with disclosures and disclaimers, or to download the report in its entirety, please visit https://bit.ly/3lKp95P.

Camber Energy is a growth-oriented organization that is leveraging the relationships and expertise of its professionals to build a diversified energy and power solutions company to help service the needs of energy users in North America. Through its majority-owned subsidiary, Camber provides custom energy and power solutions to commercial and industrial clients in North America and owns interests in oil and natural gas assets in the US. The Company’s majority-owned subsidiary also holds an exclusive license in Canada to a patented carbon-capture system, and has a majority interest in other, industry-related companies.

December 16, 2022 /

Announced today an anticipated effective date of December 21, 2022 for its previously-announced 1-for-50 reverse stock split of the Company’s issued and outstanding shares of common stock, par value $0.001 per share, accompanied by a corresponding decrease in the Company’s authorized shares of common stock (the “Reverse Stock Split”). Following effectiveness of the Reverse Stock Split, which the Company expects to occur as of open of the market on December 21, 2022, the number of authorized shares of common stock will be reduced from 1,000,000,000 to 20,000,000.

It is clear from all of the moves Camber is making that they are serious about Investor Relations from the acquisition to the up listing, they seem dedicated to increasing the value of their stock.

3. This stock has went up almost 50% in ONE DAY two different times this month!

The average gain for CEI is 49% over the last breakouts last month. We believe we are on the verge of another massive move, the question is, how big will it be?

In closing, in the Opportunity Research report, analyst Rob Goldman reviews Camber’s pending merger with Viking Energy, the prospective combined companies’ competitive positioning, strategic and operational inflection points, and the potential future impact of these events on the companies and its combined valuation. Take A Look At The Price Target

Now, it’s your turn to start your research on the incredible possible opportunity in front of you right now!

Condensed Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has been compensated up to $8,000 from ACN LLC for profiling CEI. We own ZERO shares in CEI. FULL DISCLAIMER