Pacific Ethanol reinvents itself amidst Covid

Tesla’s anticipated Battery Day is coming up on Tuesday, Sept. 22, and price targets are being raised by analysts.

Top 3 Gold Stocks To Watch in September as Yellow Metals Consolidates

Electric Vehicle Stocks to Watch: Tesla Inc (NASDAQ:TSLA), Nio (NYSE:NIO)

3 Best Lithium Stocks to Watch as The Sector Heats Up

7 Reasons Why You Should Be Watching CB Scientific, Inc. – CBSC

7 Reasons why you should be watching CB Scientific, Inc.: CBSC

CB Scientific, Inc. OTC: CBSC is poised for a possible breakout year! CB Scientific develops and sells Auto Trigger ECG recording devices, called myCam, a low-cost disposable cardiac monitor which provide the physician with a discrete medical device recording technology that improves patient compliance, lowers cost, and is simple to use reducing patient risk by helping physicians to identify cardiac rhythm issues early in the diagnostic screening process. The myCam monitor transmits ECG recordings through a proprietary smartphone app from both Android and iPhone mobile phones. ECG reports can be reviewed and/or printed using the cloud-based software which can be accessed from mobile phones, computers and tablets. The integration of this low-cost disposable device through multiple device platforms help to make the myCam monitor poised for use and growth into global cardiology and hospital markets.

Click here to read the latest news on CBSC

Grand View Research, believes that the worldwide ECG industry presents an exciting opportunity in which the CDC projects revenues to exceed $6.9 billion by 2021.

Could CB Scientific (OTC: CBSC) become a real threat to capture a significant market share from Biotelemetry (NASDAQ: BEAT) and IRHYTHM Technologies, Inc. (NASDAQ: IRTC) with the implementation of its strategic business plan?

Biotelemetry is currently trading at $40 with a market cap of $1.38B. CB Scientific’s CEO, Charles Martin, was the Senior Director of Sales for Biotelemetry from 2014-2018!

IRHYTHM is trading at $215 with a market cap of $6.19B and has gains of 300%+ in the last 52 weeks showing the explosive growth and interest in ECG recording devices segment.

CB Scientific, Inc. is a US-based company currently operating here and internationally, positioning itself to be the vanguard for several advanced healthcare opportunities through strategic acquisitions and partnerships. They have acquired an innovative heart-monitoring intellectual property which is the basis of its ‘first’ companies, My-Cardia USA, and My-Cardia China. CBSC is expanding nationally into monitoring, testing facilities and services, and has agreements to accelerate this expansion. CB Scientific is also expanding its product portfolio and technology capabilities through internal activities and through agreements with third-party product developers and manufacturers

There are many reasons why Wall Street should be paying attention to this blossoming medical device company, but the following seven should be enough to adequately convey the tremendous potential which CB Scientific presents to savvy investors.

Top SEVEN reasons savvy investors keep a watchful eye on CB Scientific, Inc. OTC: CBSC:

- CB Scientific acquired My-Cardia USA and the my-Cam device, an innovative heart-monitoring intellectual property which provides patients a discrete, small footprint medical device recording technology that improves patient compliance, lowers cost, is simple to use, reducing patient risk by helping physicians to identify cardiac rhythm issues earlier in the diagnostic screening process.

- ECG recording devices is a multibillion-dollar industry, both domestically and internationally.

- CB Scientific has positioned itself to become a significant player internationally, in the rapidly growing field of Remote Cardiac Monitoring through its integrated my-Cam technology approach through multiple device platforms and related business approach.

- The management and significant shareholders acquired control of a publicly trading company which will provide the proper vehicle to execute their plans for long-term international growth.

- Investors should strongly consider CBSC because of their appetite for acquisitions, as displayed by the purchase of My-Cardia. Along with this is the ultimate possibility that CBSC itself could become a desirable buyout target as a result of its international market reach and involvement with major companies in the field.

- CB Scientific’s management has extensive expertise in this field and the ability to deliver results based on 30+ years of direct experience in all aspects of this specific market, both domestically and internationally

- Lastly, unlike many smaller companies in the medical and pharmaceutical field, which live and die on the hopes for FDA approval for their products, CBSC already has FDA 510K and CE certification for its products and is currently working to achieve FDA certification in China now called National Medical Products Administration (NMPA).

Why CBSC could be headed towards significant gains – REASON # 1:

CB Scientific has developed a unique device that will provide a more cost-effective solution to the Ambulatory ECG Service Market both domestically and internationally.

CB Scientific, Inc. is leveraging its technology to deliver a combination of cost and diagnostic quality advantages that the market needs now and in the future; through its subsidiaries, it specializes in the design, development, and manufacture of life science analytical tools and devices, laboratory services, personal analytical kits and devices.

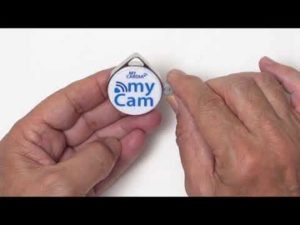

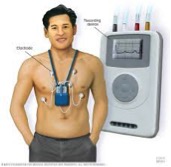

My-Cardia’s myCam monitor provides a 24 hour, 7-day-a-week monitoring service based on a small device which fits in the palm of your hand and is far less cumbersome to wear than the industry standard harness monitoring system found below.

CB Scientific’s myCam monitor, has a discrete small footprint, can be activated by the patient when feeling symptoms as well as Auto Trigger ECG recording when detected by the device. The industry standard harness monitor will capture data for only a few days and then you must return the recorder to your doctor’s office to have it scanned and analyzed. The myCam device is worn by the patient for up to 30 days. That capability alone over the traditional harness monitor can increase diagnostic yield in an industry worth BILLIONS. The monitor can record both patient-activated ECGs as well as asymptomatic events detected by the on-board analysis algorithm. The ability for the doctor to receive information near real-time from the myCam device via the patient, coupled with the price point, is very beneficial. Moreover, the low-cost disposable device which integrates and transmits through multiple device platforms to include Android and iOS smartphones are other features that set the my-Cam approach apart from most competitors.

ECG reports can be reviewed, edited, and/or printed using the My-Cardia cloud-based software which can be accessed from mobile phones both Android and iPhone, computers and tablets allows for easy and convenient access for the physician during the monitoring period from virtually anywhere.

A Summary of why myCam, powered by CB Scientific, could be a significant player in the Ambulatory ECG transmission Market:

- Disposable and/or reusable device which streamlines the logistical component of any service offering.

- Easier for the patient (throw it away after use) and more cost effective for the service provider (no device recovery or preventative maintenance costs).

- FDA & CE reviewed ECG algorithm that demonstrates efficacy in detecting ambulatory ECG events (Tachycardia, Bradycardia, Atrial Fibrillation, and Pause)

- 30-day battery life

- Smart Lead on/off status reduces false positive recordings

- Existing integration with mobile device apps and platforms like IOS, Android and WeChat position the technology for global distribution.

- Data transmission via patient’s existing mobile device.

- Existing FDA and CE clearance to market and pending NMDA clearance.

- Cloud-based Microsoft Azure reporting and patient management platform provides global access to data, scalability, hardware redundancy and low-cost infrastructure.

Why CBSC could be headed towards incredible gains – REASON # 2:

The total international market for ECG recording devices is estimated to exceed $6.9B by 2021.

Grand View Research: CDC estimates that the market will be $6.9B worldwide by 2021. In 2019 there were 1,055,000 coronary events, and over 800,000 US deaths recorded in 2017. Moreover, the landscape is changing rapidly with aging populations, chronic diseases, rise of digital health, telemedicine as well as healthcare pressured to lower cost while improving results. My-Cardia enables healthcare providers to focus on improving wellness early on before costly late stage health problems occur. This has positioned My-Cardia powered by CB Scientific to possibly become valued as a billion-dollar-plus health care giant!

Recap of the key points for the worldwide and USA markets:

- $6.9B worldwide by 2021

- In 2019 there were 1,055,000 coronary events and over 800,000 US deaths in 2017

- The market is primed for penetration with an aging populace, chronic diseases, rise of digital health, telemedicine as well as healthcare pressured to lower cost while improving results

CB Scientific is possibly a trader’s dream, and a ground-floor opportunity that could become prime pickings for a buyout! They have designed and developed proprietary technologies with efficiencies over the outdated harness monitor that could help position them as THE BLUE-CHIP company in ECG monitoring.

3 WINNERS – this is a true win-win-win!

- The patients are safer because they will actually wear this small discrete monitor while providing important ECG data, near real-time, with a heart specialist.

- Physicians will become more efficient via the technology, allowing them to help more patients.

- CB Scientific, and their investors, could produce incredible profits by helping humanity and, dare I say, IMPROVE THE QUALITY OF LIFE!

The success of any medical device company relies on their two customers: providers and patients. CB Scientific’s emphasis on cost, usability, patient compliance, results, quality of life, health & wellness bodes well for this growth company. Also, healthcare demographics such as aging population, chronic diseases related to heart disease, plus technology and healthcare delivery such as digital health and telemedicine are factors in the current market that are note-worthy.

Why CBSC could be headed towards incredible gains -REASON #3:

CB Scientific has positioned itself to become a significant factor internationally, with FDA and other regulatory approvals.

They are ready to scale and penetrate the market with the announcement that the US Food & Drug Administration (FDA) 510(k) approved My-Cam. Also, CB Scientific has CE and other international certifications completed which allows them to sell into multiple international markets. CB Scientific is in the pending approval stage with China, whose population is over 1.6 billion and have positioned themselves for penetration in the other Asian markets.

Thailand and Malaysia already have obtained regulatory approval and are ready for import.

The Singapore market is approved but awaiting import approval.

For further research please review below:

www.mycardia.com.my Malaysia

www.mycardiathailand.com Thailand

Why CBSC could be headed towards incredible gains – REASON #4:

The current management and significant shareholders acquired control of an existing public company which should provide the proper vehicle to execute their plans for long-term international growth.

CB Scientific divested away from the THC and CBD Testing Products and Lab Services business to focus on the Ambulatory Cardiac Monitoring space. This strategic move should help to set the stage to emphasize why they are now poised for a breakout year. CB Scientific made an announcement to this effect on 7/13/2020, in a public disclosure of Entry into Material Definitive Agreement, “CB Scientific, Inc. (CBSC) is pleased to announce that it has concluded negotiations and entered into an agreement with certain secured investors and controlling shareholders of Prevent Healthcare International Corporation (PHCIC), a private British Columbia, Canada corporation involved in the development, sale and service of an innovative arrhythmia diagnostic and heart monitoring intellectual property and related products.”

The acquisition of a publicly traded company provides insight into its possible strategy. Historically, most companies execute an acquisition of this nature to raise capital for R&D, acquisitions and mergers, marketing, investor awareness and many other reasons. However, based on the strategic penetration via the FDA approvals in Asia, it appears this could be a capital raise to penetrate a less competitive Asian marketplace.

Why CBSC could be headed towards incredible gains -REASON #5:

Their appetite for acquisitions and the possibility of a buyout

Investors should take a look at CBSC because of their appetite for acquisition displayed by the purchase of the My-Cardia technology, as well as the ultimate possibility that CBSC itself could become a desirable buyout target as a result of its international market reach and involvement with major companies in the field.

Why CBSC could be headed towards incredible gains – REASON #6:

The management team, is headed by their current CEO, who was Senior Director of Sales at Biotelemetry Inc., which has a current market cap of $1.38B.

Charles (Chip) Martin has held positions in sales, marketing, and executive management in the non-invasive Ambulatory ECG marketplace for more than 35 years. His extensive experience includes working in direct product capital equipment and software sales both domestically and internationally, management and direction of IDTF remote cardiac monitoring services, and oversite of international distributor networks in Europe, Asia, and the Middle East. From 2014 to 2018, Chip worked as the Senior Director of Global Sales for Biotelemetry Inc. a widely recognized leading provider of remote cardiac monitoring diagnostic services in the US that is publicly traded on the NASDAQ exchange (BEAT). He held the position of SVP of Sales and Marketing for My-Cardia (USA) Inc. from 2018 to 2019 and was promoted to CEO and President of Prevent Health Care International Corporation in August 2019, assuming the same role for CB Scientific Inc. today.

Robert Kelley has extensive experience with high-growth companies from VC-backed high-technology startups to large public corporations in roles including founder, CTO/VP Engineering, EVP Strategic Marketing, Corporate Development. He has led multiple first-mover product teams developing novel enterprise technologies from high-performance computers, broadband networks, and storage, to enterprise software from manufacturing/ERP, financial/accounting, and data warehousing/BI. His graduate studies and teaching include Computer Science, Linguistics and Artificial Intelligence, Marketing and Analytics. Rob is a Chartered Financial Analyst (CFA). Rob uses analytics and his technology experience to inform marketing strategy, evaluate emerging technologies, and understand economic value for customers.

James E. Ott (Jim) has held several senior leadership positions in his twenty-eight-year career in the Ambulatory ECG and Clinical Research Trials arena. Upon earning his Master of Science in Biomedical Engineering at Marquette University in 1991, Jim joined Biomedical System in St. Louis, MO in 1992 as a Product Manager where he coordinated the design, development and marketing efforts of their cardiac diagnostic software platform lines. In this role he facilitated regulatory submissions and regulatory inspection for the product line to include the creation of multiple Original Equipment Manufacturer (OEM) channels with major medical device manufacturers both domestically and internationally. He was promoted in 2000 to President of Biomedical Systems Cardiology Division where he managed all aspects of their Independent Diagnostic Testing Facility (IDTF) to include international direct and distributor capital equipment sales, IDTF cardiology lab staffing, technology, sales and marketing, customer service, and reimbursement and regulatory activities. During this time he managed the design, development, and implementation of the company’s internet based Holter data and report transfer platform (Data Exchange), their internet based Holter analysis platform (MyHolter.com) and their Mobile Cardiac Telemetry (MCT) platform – the TruVue® Wireless ECG Monitoring System. Jim was an integral part of successful US patent submissions and granted approvals for all three of these applications in 2004, 2005 and 2013 where he is listed as one of the inventors.

Zig Lambo was the founder of CB Scientific’s original predecessor company in 1987 and helped to take if public in 1996. He has over 40 years of experience dealing with startup companies, mergers and acquisitions, corporate finance and regulatory compliance activities in the resource and technology sectors. He holds engineering and MBA degrees.

Why CBSC could be headed towards incredible gains, REASON #7:

CBSC already has FDA 510K and CE certification for its products

Unlike many smaller companies in the medical and pharmaceutical field, which live and die on the hopes for FDA approval for their products, CBSC already has FDA 510K and CE certification for its products. CB Scientific has obtained a CE and other international certifications completed which allows them to sell into multiple international markets: Singapore, Malaysia, and Thailand. They are ready to start importing to Malaysia and Thailand. Could there be other distribution deals on the horizon? It is safe to say, that with Charles Martin at the helm and his pedigree with BioTelemetry Inc., it seems unlikely that CB Scientific went through all of this work raising capital and FDA approval without a strategic game plan to penetrate Asia.

A condensed overview of the Top 7 Reasons why CBSC could be headed towards incredible gains!

- CB Scientific has developed a unique device technology that will provide a more cost-effective solution to the Ambulatory ECG Service Market both domestically and internationally.

- ECG recording devices, domestically & internationally, are estimated to exceed $6.9B by 2021.

- CB Scientific has positioned itself to become a significant factor Internationally with FDA and other regulatory approvals

- Via the regulatory approvals in Asia, it appears this could be a capital raise to penetrate a less competitive Asian marketplace. CB Scientific has a demonstrated appetite for strategic partnerships and acquisitions and the possibility of a buyout

- Talent drives a company. Their current CEO was Senior Director of Sales at Biotelemetry which has a current market cap of $1.38B

- CBSC already has FDA 510K and CE certification for its products

Fellow traders – we are watching this stock closely, and we encourage a strong look at OTC: CBSC.

For Further Information, please review:

Disclaimer :This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on CBSC (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS. By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, CB Scientific, Inc. Small Cap Exclusive has been hired by CB Scientific, Inc. for a period beginning on September 3, 2020 to publicly disseminate information about (CBSC) via website and email. We have been compensated $25,000. We will update any changes to our compensation.Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. CB Scientific, Inc. is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Five Reasons to Put Clarity Gold on the Top of Your Watchlist

Top FIVE Reasons Clarity Gold Corp. (CSE: CLAR) Could be the Biggest Mover in 2020!

Once in a while as an investor, the stars align perfectly, we all remember our war stories, hitting it big, investing in Tesla when it was trading at $200 or investing in Wheaton Precious Metals when it was way undervalued at $10. Also, we remember those moments, where we felt it in our gut, to invest in a stock and we allow fear to take hold and we never acted on it. Today, we are overly excited to bring you, quite possibly, your chance at redemption!

[caption id="attachment_8883" align="alignleft" width="300"] CLAR gold stock[/caption]

CLAR gold stock[/caption]

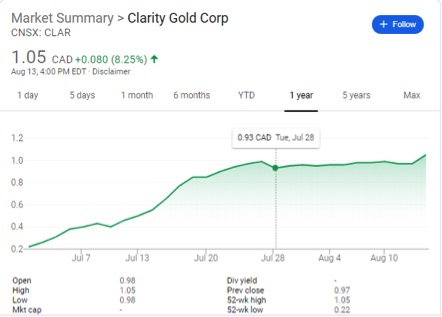

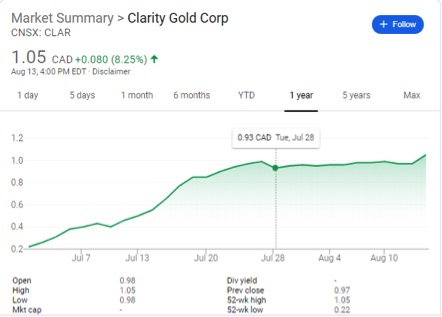

We have been watching Clarity Gold for months as it has had an incredible rise from just $.22 cad to $1.05 cad in a little over just one month. That is 377% gains and upon further research, we can see exactly why this company has a rocket ship trajectory. Normally, a company has a few, maybe three, really incredible talking points of why it could be an incredible investment. Not with Clarity, we have FIVE exciting attributes that make us believe that Clarity Gold Corp. (CSE: CLAR) could very well be a great pick in 2020!

- Technical traders, the chart is one of the best we have seen in a long time!

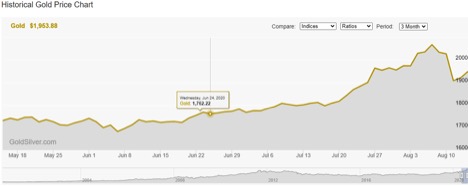

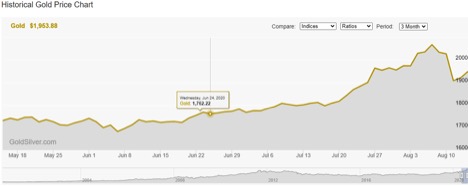

- Gold is at $2000!

- Their holdings are showing incredible promise for not only gold, but copper and molybdenum.

- Fundamental traders say the management team is the Who’s Who of exploration!

- As we all know, the old adage, what have you done for me lately, their deal flow is the envy of the industry.

The Chart is a trader’s dream!

There is no need for a technical analysis of this chart, even a child, could see that this could be headed to the moon. However, it is worth noting, the news they have released which created this bullish trend line.

On June 26, 2020, Clarity Gold Corp. completed its initial public offering, resulting in 16.95 million common shares outstanding That is a very tiny float for a company this size. This is a truly a ground floor opportunity with possibly massive potential.

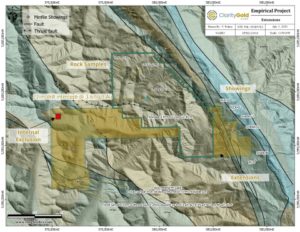

On July 6, 2020, they announced the acquisition of two gold projects and the expansion of the Empirical Project. A week later, on July 15, 2020, Clarity announced that they mobilized field crews to the Tiber and Gretna Green projects. Following that announcement, they issued press stating the mobilization of an exploratory team to the empirical project on July 22, 2020.

All of this news could be pointing toward a huge announcement. Consequently, the stock has been on an absolute rampage ever since the initial public offering. We cannot wait to see what’s on the horizon for Clarity Gold Corp.

Gold Just Hit $2,000, an ALL-TIME record HIGH!

The exploration of gold, is possibly, the hottest sector to invest in at the moment. Not only is $2000 an ounce a record high, it was trading at just $400 per ounce in 2005. That is 400% growth with no end in sight. Take into account, the current global pandemic, civil unrest and lack of confidence in fiat currency, gold is position to take over the world.

Peter Schiff and Jim Rickards just said could gold go to $15,000?

Gold pushed above its all-time record price last week. Where does it go from here? Featured on Kitco News Bugs Peter Schiff and Jim Rickards appeared to talk about gold’s trajectory and the possibility of $15,000 in the future.

Peter was shocked that gold took this long to break through.

“A lot has happened in the last decade. We’ve certainly printed a lot of money.”

Peter said the Federal Reserve has moved into a policy from which it can never extricate itself.

Rickards brought up something commodity trader Jim Rogers told him several years ago. Gold is going to the moon, but nothing goes to the moon without a 50% correction along the way. Between gold’s high in 2011 and its low in 2015, it fell about 50%.

“OK, that’s your 50% retracement. Now, that’s the bottom. Now it’s going up and the sky’s the limit.”

Peter said, “We’ve now formed a very solid base between $1,200 and $1,500.”

“Now I think we’ve broken out of that range. I think we’ve taken out the highs. I think it’s another leg of the bull market. I don’t think there’re going to be any significant pullbacks from here. I mean, there’ll be pullbacks, but I don’t think they’re going to be very significant. I think if you’re waiting for a big drop to buy gold, you’re going to wait a long time.”

Rickards agreed, saying the retracement is over. Peter said waiting to buy gold in hope of a higher price is foolish.

“The world is going to be full of people who are waiting to buy gold and who are broke because they didn’t just bite the bullet and buy it.”

Peter said ultimately the world is going to sever its relationship with the dollar. It will go off the dollar standard and back on the gold standard.

“And I think this is going to be a more precipitous drop in the dollar’s value than it was in the 70s, so we could see something equally impressive in the price of gold.”

Rickards was willing to put a number on how high he thinks gold could go. He projected $15,000 gold by 2025. He extrapolated some data to make his point. And he showed that given the M1 money supply in dollars, euros, pounds, yen and yuan – if you divide it by the official amount of gold, you get about $15,000 per ounce.

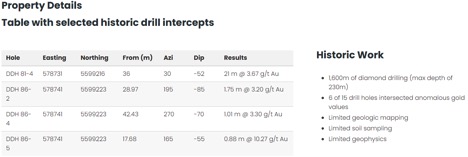

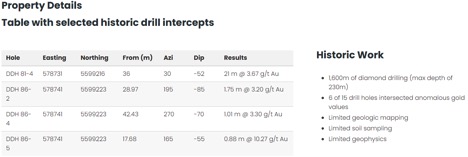

Could these projects be the reason why the market is so interested in Clarity Gold?

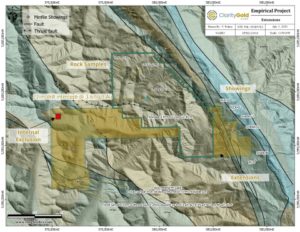

Clarity Gold has three projects they are currently exploring:

- Tyber – as described on their website, “Contains a number of separate but apparently related quartz vein systems hosted in shear and fracture zones”.

- Gretna Green – One historic selected sample assayed 00 grams per tonne gold, 51.43 grams per tonne silverand 17.8 per cent copper (Minister of Mines Annual Report 1921).

- Empirical Project – GOLD and more gold, this is the most promising holding, so we are going to focus on this project.

Empirical Project

Target Commodities: Gold, Copper, and Molybdenum

Project Area: 10,518 Ha

Ownership:

- 5,117 Ha 100% Clarity Gold Corp.

- 5,401 Ha option to earn 100%

Location: 12km south of Lillooet, British Columbia, Canada

For those of our fellow investors that are familiar with our work digging up hidden gems, pardon the pun, you are aware that this is not the first time we featured a gold exploration company. Upon reviewing the news and website, we became excited for the historical drill intercepts found on the Empirical Project. The above image was captured from Clarity Gold’s website and to give you a crash course on gold exploration, under the results column you will notice 21m @ 3.67 g/t Au which in lay terms, represents the mineralization density, in even more lay terms, how much GOLD is in the ground. Research shows that 1.5-5 g/t Au represents medium grade, which is good! Anything over 5 g/t AU represents high grade mineralization, that is even better! The fact that the Empirical Project has had a 10.27 g/t Au is possibly why they are attracting so much attention. The management team has been very successful in projects exploring for gold, silver and copper and they have built their reputations by pulling together historic data and furthering advancing this work.

The management team is a fundamental trader’s dream!

James Rogers | Director, CEO

James is a resource professional and entrepreneur active in the exploration and mining sector for over 13 years, and has developed projects in the Americas, Europe, and Africa. Mr. Rogers is the Principal of Longford Exploration Services. Since 2017, James and his teams have identified and vended over 90 resource properties to public and private companies.

Andrew Male | Director

Mr. Male is an experienced Director & Executive Officer of public and private companies in the resource and investment sectors. A former Founder and CEO of a TSX Venture Exchange Top 50 Company Ranked 9th, Mr. Male guided the company through the initial financing phases, project acquisitions, deployment of exploration programs, development financing, transitioning mining assets from greenfield to brownfield and the acquisition of adjacent producers and eventual sale to Private Equity.

Theo Van Der Linde | Director

Theo Van Der Linde is a Chartered Accountant with 20 years extensive experience in finance, reporting, regulatory requirements, public company administration, equity markets and financing of publicly traded companies. He has served as a CFO & Director for a number of TSX Venture Exchange and Canadian Securities Exchange (CSE) listed companies over the past several years. Industry experience includes financial services, manufacturing, oil & gas, mining and retail industries.

Ian Graham | Advisor

Mr. Graham has over 20 years of experience in the development and exploration of mineral projects, corporate transactions, project evaluations, and exploration.

Mr. Graham’s experience is mostly at major mining companies, namely Rio Tinto and Anglo American, including as Chief Geologist with the Project Generation Group at Rio Tinto. He has been involved with evaluation and pre-development work on several projects in Canada and abroad, including Resolution Copper (Arizona, USA), Diavik Diamond Mine (Northwest Territories, Canada), Eagle Nickel (Michigan, USA), Lakeview Nickel (Minnesota, USA) and Bunder Diamonds (India).

Clarity is exploring 3 different projects, what is next for the management team?

The management team at clarity gold has a pedigree of being at the right place at the right time. In their combined 50+ years of exploration and hundreds of projects it is very possible that the three projects they are currently working on is just the tip of the iceberg! They have built their careers on identifying profitable projects through geophysics, historical data, proprietary mining techniques and a dedication to the next project!

In conclusion, we are very optimistic in regards to the future for Clarity Gold Corp.

- Gold is at historic highs!

- In June of this year Clarity Gold Corp (CSE: CLAR) had its IPO where it went from $.22 cad to over $1.00 cad, this is a ground floor opportunity

- The chart shows a bullish trendline that could be positioning for a break out.

- The historical drilling records reveal a high potential for mineralization of Gold!

- The management team has over 50 years combined experience identifying and extracting elements

- Did we mention, Gold just hit 2,000 an ounce? Jim Rickards just announced that he believes gold could go to $15,000 an ounce.

Upon completion of our research we are extremely excited to encourage all investors to keep a close eye on Clarity Gold Corp. (CSE: CLAR), put it on your watch list today!

Disclaimer :This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on CLAR (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS. By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Clarity Gold Corp., Inc. Small Cap Exclusive has been hired by Clarity Gold Corp for a period beginning on August 10, 2020 to publicly disseminate information about (CLAR) via website and email. We have been compensated $25,000. We will update any changes to our compensation.Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. Clarity Gold Corp. is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Five Reasons to Put Clarity Gold on the Top of Your Watchlist

Top FIVE Reasons Clarity Gold Corp. (CSE: CLAR) Could be the Biggest Mover in 2020!

Once in a while as an investor, the stars align perfectly, we all remember our war stories, hitting it big, investing in Tesla when it was trading at $200 or investing in Wheaton Precious Metals when it was way undervalued at $10. Also, we remember those moments, where we felt it in our gut, to invest in a stock and we allow fear to take hold and we never acted on it. Today, we are overly excited to bring you, quite possibly, your chance at redemption!

[caption id="attachment_8883" align="alignleft" width="300"] CLAR gold stock[/caption]

CLAR gold stock[/caption]

We have been watching Clarity Gold for months as it has had an incredible rise from just $.22 cad to $1.05 cad in a little over just one month. That is 377% gains and upon further research, we can see exactly why this company has a rocket ship trajectory. Normally, a company has a few, maybe three, really incredible talking points of why it could be an incredible investment. Not with Clarity, we have FIVE exciting attributes that make us believe that Clarity Gold Corp. (CSE: CLAR) could very well be a great pick in 2020!

- Technical traders, the chart is one of the best we have seen in a long time!

- Gold is at $2000!

- Their holdings are showing incredible promise for not only gold, but copper and molybdenum.

- Fundamental traders say the management team is the Who’s Who of exploration!

- As we all know, the old adage, what have you done for me lately, their deal flow is the envy of the industry.

The Chart is a trader’s dream!

There is no need for a technical analysis of this chart, even a child, could see that this could be headed to the moon. However, it is worth noting, the news they have released which created this bullish trend line.

On June 26, 2020, Clarity Gold Corp. completed its initial public offering, resulting in 16.95 million common shares outstanding That is a very tiny float for a company this size. This is a truly a ground floor opportunity with possibly massive potential.

On July 6, 2020, they announced the acquisition of two gold projects and the expansion of the Empirical Project. A week later, on July 15, 2020, Clarity announced that they mobilized field crews to the Tiber and Gretna Green projects. Following that announcement, they issued press stating the mobilization of an exploratory team to the empirical project on July 22, 2020.

All of this news could be pointing toward a huge announcement. Consequently, the stock has been on an absolute rampage ever since the initial public offering. We cannot wait to see what’s on the horizon for Clarity Gold Corp.

Gold Just Hit $2,000, an ALL-TIME record HIGH!

The exploration of gold, is possibly, the hottest sector to invest in at the moment. Not only is $2000 an ounce a record high, it was trading at just $400 per ounce in 2005. That is 400% growth with no end in sight. Take into account, the current global pandemic, civil unrest and lack of confidence in fiat currency, gold is position to take over the world.

Peter Schiff and Jim Rickards just said could gold go to $15,000?

Gold pushed above its all-time record price last week. Where does it go from here? Featured on Kitco News Bugs Peter Schiff and Jim Rickards appeared to talk about gold’s trajectory and the possibility of $15,000 in the future.

Peter was shocked that gold took this long to break through.

“A lot has happened in the last decade. We’ve certainly printed a lot of money.”

Peter said the Federal Reserve has moved into a policy from which it can never extricate itself.

Rickards brought up something commodity trader Jim Rogers told him several years ago. Gold is going to the moon, but nothing goes to the moon without a 50% correction along the way. Between gold’s high in 2011 and its low in 2015, it fell about 50%.

“OK, that’s your 50% retracement. Now, that’s the bottom. Now it’s going up and the sky’s the limit.”

Peter said, “We’ve now formed a very solid base between $1,200 and $1,500.”

“Now I think we’ve broken out of that range. I think we’ve taken out the highs. I think it’s another leg of the bull market. I don’t think there’re going to be any significant pullbacks from here. I mean, there’ll be pullbacks, but I don’t think they’re going to be very significant. I think if you’re waiting for a big drop to buy gold, you’re going to wait a long time.”

Rickards agreed, saying the retracement is over. Peter said waiting to buy gold in hope of a higher price is foolish.

“The world is going to be full of people who are waiting to buy gold and who are broke because they didn’t just bite the bullet and buy it.”

Peter said ultimately the world is going to sever its relationship with the dollar. It will go off the dollar standard and back on the gold standard.

“And I think this is going to be a more precipitous drop in the dollar’s value than it was in the 70s, so we could see something equally impressive in the price of gold.”

Rickards was willing to put a number on how high he thinks gold could go. He projected $15,000 gold by 2025. He extrapolated some data to make his point. And he showed that given the M1 money supply in dollars, euros, pounds, yen and yuan – if you divide it by the official amount of gold, you get about $15,000 per ounce.

Could these projects be the reason why the market is so interested in Clarity Gold?

Clarity Gold has three projects they are currently exploring:

- Tyber – as described on their website, “Contains a number of separate but apparently related quartz vein systems hosted in shear and fracture zones”.

- Gretna Green – One historic selected sample assayed 00 grams per tonne gold, 51.43 grams per tonne silverand 17.8 per cent copper (Minister of Mines Annual Report 1921).

- Empirical Project – GOLD and more gold, this is the most promising holding, so we are going to focus on this project.

Empirical Project

Target Commodities: Gold, Copper, and Molybdenum

Project Area: 10,518 Ha

Ownership:

- 5,117 Ha 100% Clarity Gold Corp.

- 5,401 Ha option to earn 100%

Location: 12km south of Lillooet, British Columbia, Canada

For those of our fellow investors that are familiar with our work digging up hidden gems, pardon the pun, you are aware that this is not the first time we featured a gold exploration company. Upon reviewing the news and website, we became excited for the historical drill intercepts found on the Empirical Project. The above image was captured from Clarity Gold’s website and to give you a crash course on gold exploration, under the results column you will notice 21m @ 3.67 g/t Au which in lay terms, represents the mineralization density, in even more lay terms, how much GOLD is in the ground. Research shows that 1.5-5 g/t Au represents medium grade, which is good! Anything over 5 g/t AU represents high grade mineralization, that is even better! The fact that the Empirical Project has had a 10.27 g/t Au is possibly why they are attracting so much attention. The management team has been very successful in projects exploring for gold, silver and copper and they have built their reputations by pulling together historic data and furthering advancing this work.