Best Stocks of 2023: Buy Ratings for GoldMining (NYSE: GLDG)

Why is GoldMining (NYSE: GLDG) a strong buy target by these 3 analysts and could it be one of the best stocks of 2023? link

But before we get started, take a look at our last alerts, we are crushing the STREET!

We have 3 catalysts that have catapulted GLDG into the spotlight.

#1 The news is driving massive volume spikes!

#2 The chart is absolutely perfect and could be ready for a monster run.

#3 So many industry authorities issued a a “Buy Rating”

First and foremost, January’s news release is dynamite!

GoldMining Triples Gold Equivalent Inferred Resource Estimate To 1.45Mn Ounces At La Mina Project With La Garrucha Discovery

La Garrucha deposit adds approx. 1.0 million oz AuEq in the Inferred category and 0.2 million oz AuEq in the Indicated category

Updated Mineral Resource estimate inclusive of La Garrucha positions La Mina with 1.15 million oz AuEq Indicated and 1.45 million oz AuEq Inferred resources

The press release reads:

Jan. 23, 2023

Announced an updated Mineral Resource estimate (“MRE”) on its 100% owned La Mina Project located in Colombia.

The MRE includes a maiden resource estimate on the La Garrucha deposit which incorporates drilling completed by 2023.

Alastair Still, CEO of GoldMining, commented, “We are extremely pleased that the Company’s first exploration drilling program at La Mina has identified a significant discovery!”

“This exciting discovery has exceeded our expectations!”

Tim Smith, Vice President, commented, “The updated Mineral Resource estimate at La Garrucha represents an unqualified success for the Company!”

Take a look at this chart!

The next run will test the 3 month high based on technicals.

This should break through based on the technical indicators below:

Barchart was reporting these as triggered:

Short Term Indicators

- 20 – 50 Day MACD Oscillator

- 20 – 100 Day MACD Oscillator

- 20 – 200 Day MACD Oscillator

Medium Term Indicators

- 50 Day Moving Average

- 50 – 100 Day MACD Oscillator

- 50 – 150 Day MACD Oscillator

- 50-200 Day MACD Oscillator

Long Term Indicators

- 100 Day Moving Average

- 150 Day Moving Average

- 200 Day Moving Average

The website also shares its all-important “Trend Seeker” composite indicator is triggered.

Watch these technicals closely this week.

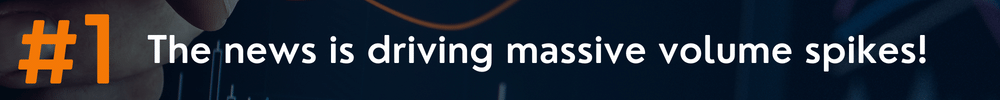

TipRanks Reported $5.25 Target Provides Over 320+% Potential Upside

GLDG is displaying a ton of potential upside to this $5.25 target.

In fact, that’s 320+% potential upside.

Now, I’m not saying this profile is going to surge to $5.25 this week, but the potential upside needs to be noted.

Plus, don’t forget, GLDG has a 52-week high over $2.00 which may also help signal that this NYSE American profile could be undervalued from current levels.

Also, GoldMining (NYSE: GLDG) has yet another strong buy target by these 3 analysts and could it be one of the best stocks of 2023? link

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has been compensated $7,500 from East Coast Media, LLC for profiling GLDG. We own ZERO shares in GLDG.

Best Stocks of 2023 Best NASDAQ Stocks, delivered to YOU

Delivering the best NASDAQ stocks of 2023 yielding on average double digit gains.

We believe in transparency!

We post every pick so you can feel confident in our 💎 featured breakout alerts.

Small Cap Exclusive’s Best NASDAQ Stocks of 2023:

Best Stock of 2023 Avalon GloboCare Corp. (ALBT)

Ticker: ALBT

Corp Name: Avalon GloboCare Corp.

Date Of Alert: March 6th

Alert Price: $2.14

Date Of High: March 6th

High After Alert: $3.87

Gain/Loss: Gain of 81%

Best Stock of 2023 Mainz Biomed (MYNZ

Ticker: MYNZ

Corp Name: Mainz Biomed

Date Of Alert: February 15th

Alert Price: $7.35

Date Of High: February 15th

High After Alert: $7.50

Gain/Loss: Gain of 17%

Best Stock of 2023 FSD Pharma Inc. (HUGE)

Ticker: HUGE

Corp Name: FSD Pharma Inc.

Date Of Alert: February 9th

Alert Price: $1.44

Date Of High: February 11th

High After Alert: $1.68 (52 Week High)

Gain/Loss: Gain of 17%

Best Stock of 2023 MDJM Ltd (MDJH)

Ticker: MDJH

Corp Name: MDJM Ltd

Date Of Alert: February 3rd

Alert Price: $1.80

Date Of High: February 3rd

High After Alert: $2.10

Gain/Loss: Gain of 17%

Best Stock of 2023 Uranium Royalty Corp. (UROY)

Ticker: UROY

Corp Name: Uranium Royalty Corp.

Date Of Alert: February 1

Alert Price: $2.80

Date Of High: February 1st

High After Alert: $2.93

Gain/Loss: Gain of 5%

Best Stock of 2023 Stock GoldMining Inc. (GLDG)

Ticker: GLDG

Corp Name: GoldMining Inc.

Date Of Alert: January 31st

Alert Price: $1.15

Date Of High: February 1st

High After Alert: $1.24

Gain/Loss: Gain of 7%

Best Stock of 2023 Stock Avalon GloboCare Corp. ALBT

Ticker: ALBT

Corp Name: Avalon GloboCare Corp

Date Of Alert: January 8th

Alert Price: $4.01

Date Of High: January 9th

High After Alert: $4.47

Gain/Loss: Gain of 11%

Best Stock of 2023 Stock Clearmind Medicine Inc. CMND

Ticker: CMND

Corp Name: Clearmind Medicine Inc.

Date Of Alert: January 4th

Alert Price: $3.26

Date Of High: January 9th

High After Alert: $5.10

Gain/Loss: Gain of 56%

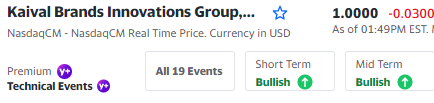

Best NASDAQ Stock Kaival Brands Innovations Group, Inc. (KAVL)

Ticker: KAVL

Corp Name: Kaival Brands Innovations Group, Inc.

Date Of Alert: December 6th

Alert Price: $.98

Date Of High: December 8th

High After Alert: $1.10

Gain/Loss: Gain of 11%

Best NASDAQ Stock LuxUrban Hotels Inc. (LUXH)

Ticker: LUXH

Corp Name: Kaival Brands Innovations Group, Inc.

Date Of Alert: November 30th

Alert Price: $1.40

Date Of High: January 11th

High After Alert: $1.80

Gain/Loss: Gain of 28%

Our commitment to delivering the best stocks of 2023:

Facebook LINK

How do we deliver the best stocks of 2023?

Fast & Actionable Alert Delivery

As soon as a potential trade presents itself, our team works to send out the trade alert quickly, delivering high quality alerts for traders and investors.

Unlock Your Best Trading Potential

The best NASDAQ Stocks are more accessible than ever before. Get started with just a smart phone in your hand, use the tools we provide to enhance your trading level.

Top Picks From Curated Watchlists

We spend our time scanning the market and analyzing our watchlists looking for the best trade ideas to alert our members. Our team does this so you don’t have to!

Partial Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has been compensated $5,000 by Life water Media on Jan 9 for ALBT, $5,000 from Life Water Media for profiling CMND, KAVL on Dec 6 paid $8,000 by Awareness Consulting. LUXH – Nov 30 – not compensated. We own ZERO shares in any above mentioned stock.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign.

Sharps Technology, Inc. (NASDAQ: STSS) Has An Accelerated Near-Term Path Product For The Commercialization & Accelerated Revenue Growth!

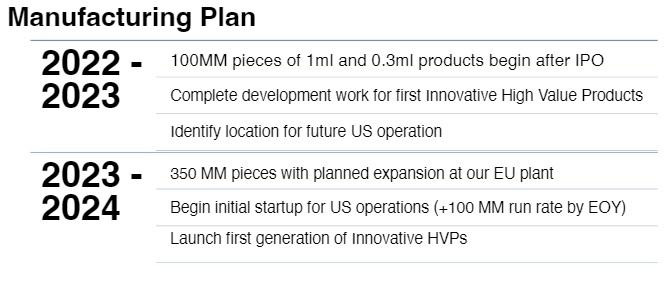

With An Accelerated Near-Term Path For Product Commercialization And Expanded Manufacturing Capacity, Sharps Technology, Inc. (NASDAQ: STSS) Will Have The Ability To Support The Industry With Innovative, Market Leading Injectable Drug Delivery Solutions And Accelerate A Path Towards Revenue Growth.

Newly NASDAQ-traded Sharps Technology, Inc. (NASDAQ: STSS) offers innovative injectable syringe solutions to a global healthcare crisis that is not being talked about nearly enough.

- Most syringes waste a significant amount of injectable medicine which is thrown away with the used needle/syringe.

- This adds cost and reduces the availability of life-saving injectable drugs for us all. Whether we are looking at a pandemic response, hard-to-manufacture drug products, or managing long-term chronic illness, we can’t afford to waste this precious supply.

- The problem is sufficiently worrisome that the Federal Government is passing new legislation (January 1, 2023) requiring pharmaceutical companies to pay financial penalties for injectable drugs which are thrown away with the syringe and not injected into the patient.

Sharps Technology Company Summary

Company Name: Sharps Technology, Inc.

Ticker: STSS

Exchange: NASDAQ

Website: www.sharpstechnology.com

Sharps Technology Company Summary:

Sharps Technology is a medical device and pharmaceutical packaging company specializing in the development and manufacturing of innovative drug delivery systems.

The company’s product lines focus on low waste and ultra-low waste syringe technologies that incorporate both passive and active safety features.

These features protect front line healthcare workers from life-threatening needle stick injuries and protect the public from needle re-use.

Sharps Technology has extensive expertise in specialized prefilled syringe systems and ready to use processing.

The company has a manufacturing facility in Hungary and has partnered with Nephron Pharmaceuticals to expand its manufacturing capacity in the US.

Sharps Technology has agreed to manufactured in collaboration with Nephron Pharmaceuticals at the Inject EZ facility in West Columbia, South Carolina.

Jan. 10, 2023

Announces the advancement of the Company’s specialized prefillable syringe (“PFS”) system product line, which will be manufactured in collaboration with Nephron Pharmaceuticals at the Inject EZ facility in West Columbia, South Carolina.

Braden Miller, Sharps Director of Product Management, commented, “Sharps has developed an alternative high-quality solution to glass syringes through the use of inert polymers such as Cyclic Olefin Polymer (COP) and Cyclic Olefin Copolymer (COC), which offers a high-quality solution compared to traditional glass syringe systems.

These polymer syringes have many of the same characteristics as current pharmaceutical glass designs to support long term drug stability and increase shelf life for customers in the pharmaceutical segment. Polymer syringes can also be made into custom configurations, which can eliminate breakage, minimize dead space, reduce contamination, and support the development of custom devices including autoinjectors.

The ability to produce these innovative products using advanced manufacturing techniques creates additional advantages in the areas of quality, performance and safety when compared to similar glass syringe products. We look forward to introducing this line of next generation products to the market.”

Sharps Technology commenced manufacturing of their much-needed ultra-low waste smart safety syringe products in their European operation in Hungary.

Dec. 20, 2022

Announced they have commenced manufacturing of their much-needed ultra-low waste smart safety syringe products in their European operation in Hungary.

The plant has been producing products and will begin shipments to support the distribution and sales agreement with Nephron Pharmaceuticals by the end of the year, and customer agreements in Europe in early 2023. The production of these specialty syringe products will ramp up over the next several months to increase supply.

Sharps innovative syringe designs provide a beneficial set of features and advantages for the healthcare industry.

These syringe product features include a combination of ultra-low waste, passive and active safety, and reuse prevention.

By combining all these features and building them into a portfolio of syringe offerings, it will create product platforms that can help drive down the cost of healthcare treatments.

Sharps Technology signed of a distribution agreement with partner Nephron Pharmaceuticals

Dec. 13, 2022

Announced the signing of a distribution agreement with partner Nephron Pharmaceuticals. This is a strategic first step in building the larger partnership between the two companies and is in support of their recently announced collaboration.

“This distribution agreement opens so many possibilities for Sharps Technology and Nephron Pharmaceuticals,” commented Robert Hayes, Sharps Technology CEO. “The timing is perfect in that we are expanding our ability to supply innovative drug delivery systems at a point when the market is in demand for them. Through this distribution plan, Sharps Technology will be able to deliver increased capacity, driving growth for one of the high value product segments of our business.”

- Each year almost 20 billion injections are administered, globally and the World Health Organization (WHO) are advocating for the use of low waste syringes, with passive safety devices which engage automatically and have auto disable features.

- STSS anticipates signing its first product orders any moment now this development will represent a huge milestone for this recently debuted NASDAQ company, and should provide them with a solid foundation for growth.

- The company has raised $16M to scale operations in the coming quarters as they begin to meet the strong and growing demand for smart safety syringes

The global vaccines market is projected to grow from $61.04 billion in 2021 to $125.49 billion in 2028 at a CAGR of 10.8% in the forecast period, 2021-2028.

Vaccines are the most powerful and cost-effective way to protect billions of people in the world, and according to the WHO, immunization awareness and government initiatives have helped prevent 2-3 million deaths a year.

The Covid-19 outbreak led to a shutdown of syringe manufacturing which in turn led to a supply shortage at a global scale.

Mergers and acquisitions of companies such as STSS are highly attractive and are providing the needed innovation to the vaccine market.

The rise in the need for vaccinations and immunizations, plus a surge in the geriatric population, an increase in the number of surgical procedures, as well as a rise in chronic diseases have contributed to a demand for syringes.

Specialty Syringes – Vial Application

- Global Smart Syringe Market @ $14 billion USD by 2026 w10.0%+ CAGR

- Types: Auto-Disable Syringes and Safety Syringes

- Applications: Vaccination and Drug Delivery

- End Users: Hospitals, HMOs and Clinics

- Target Markets: North America, Europe, and ROW

- Sharps Technology listed as a supplier

The Pre-Filled Syringe (PFS)/Ready- To- Fill (RTF) syringe product segment will be a priority for the company through its collaboration with Nephron, and is expected to be a gamechanger for the company.

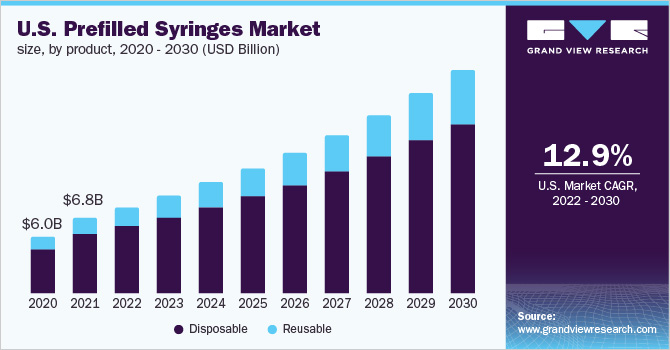

PRE-FILLED SYRINGES MARKET

- Pre-filled syringes have emerged as one of the fastest-growing choices for unit-dose medication as the pharmaceutical industry seeks new and more convenient drug delivery methods.

- With PFS/RTF syringes, pharmaceutical companies are able to minimize drug waste and increase product life span, while patients are able to self-administer injectable drugs at their home instead of the hospital.

Ready-To-Use – Pre-Filled Syringes:

- Types: Plastic and Type I B/S Glass

- Applications: Vaccines, Diabetes, Complex High Value Therapies (Gene-Therapy)

- End Users: Branded Pharma, CMOs, and Biologics

- Target Markets: North America

There is a growing demand for efficient and easy-to-use drug delivery devices and increasing efforts of healthcare professionals to reduce hospital errors are the principal factors driving the market growth.

STSS announced over the summer that it had completed its acquisition of Safegard Medical’s syringe manufacturing facility in Hungary.

The manufacturing facility is located 2 hours from Budapest (160km from Budapest Airport)

- 40,000 sq. ft. factory on 250,000 sq. ft. site

- 20-year history of safety syringe manufacturing

- FDA registered since 1999

- ISO 13485 certified

- CE Mark approved products

- Injection molding and assembly expertise

- ETO on-site sterilization capacity

“The acquisition of our first manufacturing facility is an important milestone in our transformation from an R&D-focused enterprise to revenue-generating commercial operations. With the acquisition now complete, with the addition of further assembly and manufacturing capacity, our team is confident we can deliver world-class products to meet the strong and growing demand for smart safety syringes, a market forecasted to reach $14 billion globally by 2026.”

Robert Hayes, CEO of Sharps Technology

IN SUMMARY

Sharps Technology, Inc. (NASDAQ: STSS) is the newest player in the drug delivery device market to go public and could see tremendous blue-sky growth in its future as it continues to ramp up its commercialization efforts.

- The Company recently announced a significant partnership with Nephron Pharmaceuticals with an anticipated launch into the market in early 2023.

- STSS anticipates shipping first orders of vial draw product by the beginning of 2023 and ready to fill product in mid-2023 to create initial revenue in 2023 and profits in early 2024.

- With the global shortage of syringes that comply with the World Health Organization (WHO) requirements, there is a strategic opportunity for STSS to take market share and support the healthcare industry with a better drug delivery platform.

- The combination of features and benefits for the Sharps products will save lives and eliminate the waste of critically needed medical treatments and therapies for the industry!

- There’s a key opportunity for STSS to grab a big piece of the market with its proprietary smart safety syringe technology designed to eliminate two million potentially infectious accidental needlestick injuries, as well as billions of dollars in medicine wasted with today’s inefficient syringes with their low-dead space feature.

To reiterate, the company anticipates signing its first distributor agreement during the fourth quarter of 2022, which could be at any moment!

Avalon GloboCare’s (Nasdaq: ALBT) Fusion Gene Map Technology Could Be The Greatest Investment?

Literally, this could be the best investment of the year.

Why, think about this!

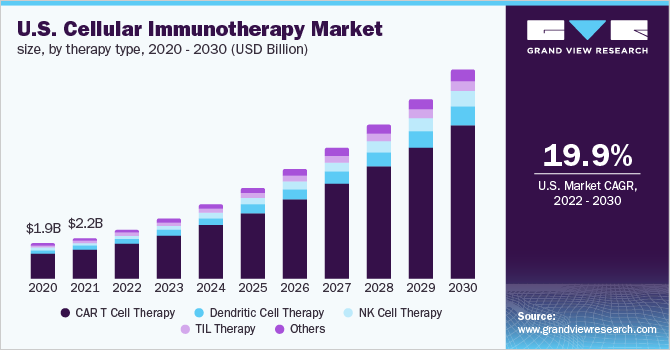

Avalon is establishing a leading role in the fields of cellular immunotherapy, exosome technology (ACTEX™), and regenerative therapeutics.

Why is that a big deal?

The global cellular immunotherapy size is expected to reach USD 37.97 billion by 2030!

It is estimated to register a CAGR of 22.41% during the forecast period.

This amazing growth is driven by the growing government support for innovative therapies research, rising prevalence of cancer & development of advanced cell-based immunotherapies.

Now before we get into the top 4 reasons we like ALBT, let’s do a quick summary on the company.

Avalon GloboCare Company Summary

Company Name: Avalon GloboCare Corp.

Ticker: ALBT

Exchange: NASDAQ

Website: www.avalon-globocare.com

Avalon GloboCare Company Summary:

Avalon GloboCare Corp. (NASDAQ: ALBT) is a clinical-stage biotechnology company dedicated to developing and delivering innovative, transformative cellular therapeutics, precision diagnostics, and clinical laboratory services.

Avalon also provides strategic advisory and outsourcing services to facilitate and enhance its clients’ growth and development, as well as competitiveness in healthcare and CellTech industry markets.

Through its subsidiary structure with unique integration of verticals from innovative R&D to automated bioproduction and accelerated clinical development, Avalon is establishing a leading role in the fields of cellular immunotherapy (including CAR-T/NK), exosome technology (ACTEX™), and regenerative therapeutics.

💥 RECESSION PROOF 💥

Historically, what is a great market segment to invest in during a recession, Medical!

In my opinion, The hottest vertical within The Medical market is biotech stocks.

They are safe and recession-proof.

After all, we can’t stop people from aging or from seeking treatments for a myriad of issues.

Plus, there’s growing demand for innovation in gene therapies, immune-oncology, precision medicine, machine-learning drug discovery, and treatments for unmet medical needs.

According to Grand View Research, the global biotech industry could be worth up to $2.44 trillion by 2028.

The global cellular immunotherapy market size is expected to reach

USD 37.97 billion by 2030!

It is estimated to register a CAGR of 22.41% during the forecast period.

In THREE trading days this stock went up 40%!

Also, it created a base at $4 before it ran 40%!

GUESS WHAT?! It is at $4 again and appears to be ready to run!

Take a look at the buy ratings in #4 Section from Investing.com, Stock.ta and American Bulls!

3 TRUSTED sources saying, “BUY”

Now, let’s look mat what is driving these ratings and explosive gains, the amazing press released by ALBT below.

Jan. 03, 2023

Announced that it has deployed a breakthrough fusion gene map technology to be used for the goal of developing companion diagnostic kits and devices to enhance personalized clinical management of leukemia patients.

In collaboration with the Lu Daopei Institute of Hematology, a fusion gene map database from over 1,000 patients with leukemia was established and the results were previously published in the Blood Cancer Journal. Fusion genes are important genetic abnormalities in leukemia. Using advanced gene sequencing technology, called “Whole Transcriptome Sequencing” (WTS), multiple previously unknown fusion genes were identified which may potentially establish novel diagnostic and therapeutic targets.

Dec. 14, 2022

Announced that the Company completed a private placement of shares of its Series A preferred stock with the Company’s Chairman, Daniel Lu. The gross proceeds of the offering were $4.0 million, which is in addition to the previously announced private placement of $5 million of Series A preferred stock, all of which will be used to pay a portion of the purchase price for the announced acquisition of Laboratory Services MSO, LLC.

As previously announced, the Company’s Series A preferred stock is convertible into shares of the Company’s common stock at price per share equal to the greater of $1.00 or 90% of the closing price of the Company’s common stock on the Nasdaq Stock Market on the day prior to conversion. All holders of the Series A preferred stock will be restricted from selling the shares of common stock issuable upon conversion of the Series A preferred stock for a period of 9 months and will be limited to selling no more than 10% of their shares of common stock in any calendar month.

Sept. 29, 2022

The Company received a Notice of Allowance from the United States Patent and Trademark Office (USPTO) related to its QTY fusion water-soluble receptor protein platform. The patent was jointly filed with Dr. Shuguang Zhang of the Massachusetts Institute of Technology (MIT) and covers seven claims related to the technology.

ALBT has a 52-week high of $9.40, which is MORE THAN DOUBLE compared to current levels. In fact, it would be upside of 126% if the stock climbs back there.

ALBT even has a STRONG BUY Rating From Highly Respected Investing.com!

ALBT also has a BULLISH sentiment from StockTa.com right now which can be seen HERE.

Additionally, the stock has a STAY LONG rating at AmericanBulls.com which can be seen below:

Currently ALBT boasts a relatively small trading float for a NASDAQ stock at a little over $13M.

Wall Street is still uncovering this hidden gem and with a small number of shares available for trading, a sudden demand could create a major sudden upswing in price.

Now let’s review the 4 reasons we encourage you to turn your attention to ALBT.

As a quick reminder of the 4 REASONS why you should pull up ALBT right now:

- BioTech Market Is Recession Proof

- The Chart Looks Like an “Ideal Setup”

- The Press Releases are Simply Incredible

- Buy Rating Issued from Investing.com

Source 1: https://www.grandviewresearch.com/press-release/global-cellular-immunotherapy-market

Source 2: https://www.grandviewresearch.com/industry-analysis/cellular-immunotherapy-market-

Clearmind Medicine Inc. (Nasdaq: CMND) Is Disrupting The Pharmaceutical Industry with a Revolutionary Treatment!

Clearmind Medicine CMND has consolidated from the latest amazing 252% run & indicators appear to reveal more explosive gains in the near future!

Now that it has created a base it appears ready for it’s next HUGE run, could it be 600%, 700%, 1,000%?!?!

Let’s take a quick look at the basics before digging into why CMND could be ready for it’s next big move!

Clearmind Medicine Company Summary

Company Name: Clearmind Medicine, Inc.

Ticker: CMND

Exchange: NASDAQ

Website: https://www.clearmindmedicine.com/

Clearmind Medicine Company Summary:

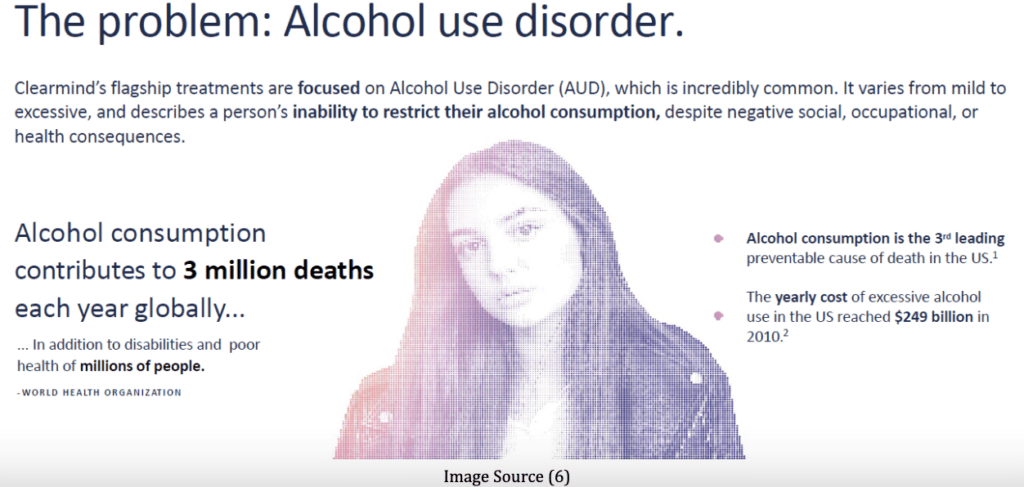

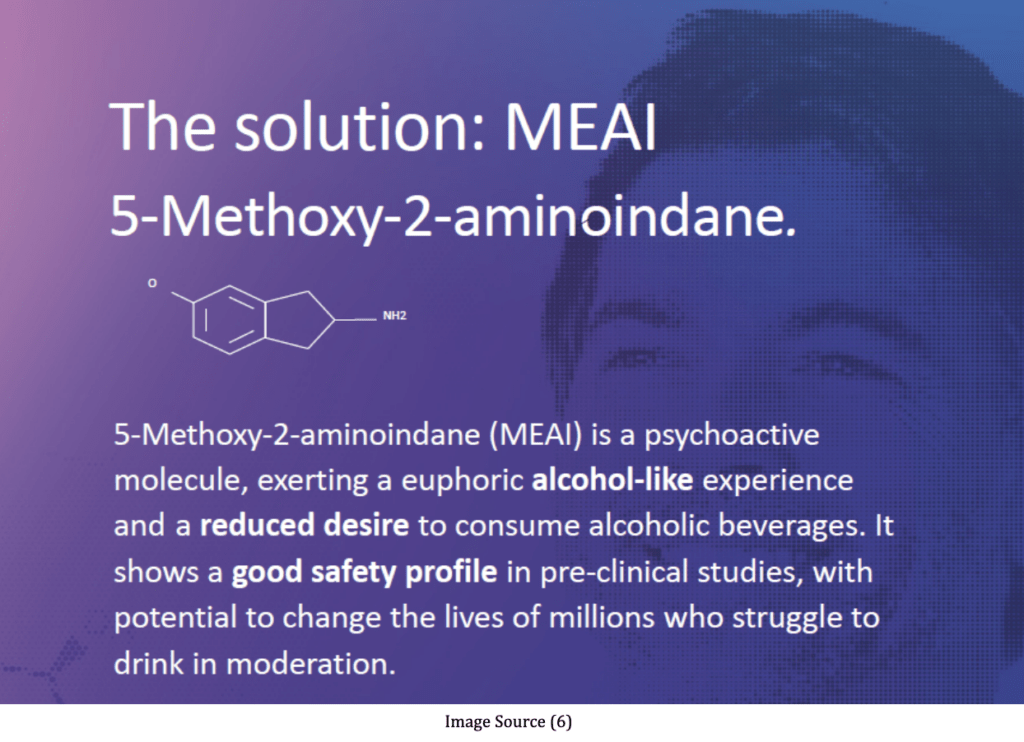

Clearmind Medicine Inc. (Nasdaq: CMND) is a psych-e-delic pharmaceutical biotech company focused on the discovery and development of novel psych-e-delic-derived therapeutics to solve widespread and underserved health problems, including alcohol use disorder.

Its primary objective is to research and develop psych-e-delic-based compounds and attempt to commercialize them as regulated medicines, foods or supplements.

The Company’s intellectual portfolio currently consists of seven patent families.

Clearmind Medicine Inc. (Nasdaq: CMND) intends to seek additional patents for its compounds whenever warranted and will remain opportunistic regarding the acquisition of additional intellectual property to build its portfolio.

Clearmind’s flagship treatments are focused on Alcohol Use Disorder(AUD), which is incredibly common. It varies from mild to excessive, and describes a person’s inability to restrict their alcohol consumption, despite negative social, occupational, or health consequences.

Clearmind Medicine Inc. Scores Milestone Patent

Dec 27, 2022

Clearmind Medicine Inc. (NASDAQ: CMND) (CSE: CMND) has taken a giant step forward in its mission to deliver a first-to-market psychedelic-based treatment targeting Alcohol Use Disorder (AUD). Last Wednesday, CMND announced being granted a patent from the United States Patent and Trademark Office (USPTO) to use its proprietary MEAI as an alcoholic beverage substitute. This allowance strengthens an already robust IP portfolio by adding to similar patents earned for its MEAI-based alcohol substitute in Europe and India.

The full article can be found HERE

Clearmind Medicine Inc.’s Psychedelic-Based Therapeutics Are Revolutionary To The Pharmaceutical Sector; Treating AUD In The Crosshairs ($CMND)

January 3rd, 2023

Driving that proposition is Clearmind Medicine nearing its goal of delivering a first-to-market psychedelic-based treatment to market, with its lead candidate, MEAI, targeting a $395BN alcohol-substitute product market.

“In pre-clinical trials, showed an ability to mitigate AUD Alcohol Use Disorder: a condition that encourages a vicious cycle of binge drinking by circumventing specific neural pathways that lead to sensible behavioral decisions. “

The full article can be found HERE

Clearmind Medicine Inc. Positions To Deliver A First-To-Market Psychedelic-Based Treatment For Alcohol Use Disorder

Dec 29, 2022

Thanks to a series of milestones reached, patents earned, and valuable partnerships, the company’s lead candidate, MEAI, may soon become the first-to-market psychedelic-based treatment targeting Alcohol Use Disorder (AUD). As an alcohol-substitute product, MEAI positions Clearmind to target a more than $395 million alcohol-substitute market opportunity and, more importantly, provide a product that could save millions of lives each year.

The full article can be found HERE

There is a massive market potential for Clearmind Medicine Inc. (Nasdaq: CMND). The company focuses on a huge untapped market with yearly economic impact costing the U.S. over $249 billion.(1)

Clearmind Medicine Inc. (Nasdaq: CMND) currently has 8 patents granted with 15 patent applications pending.(1) A patent can be an economic catalyst to pharmaceutical companies who push to research new and beneficial drugs on the premise that they will be able to reap rewards by way of profits.(2)

According to a national survey, 14.1 million adults ages 18 and older (5.6 percent of this age group) had AUD in 2019. (3)

Among youth, an estimated 414,000 adolescents ages 12–17 (1.7 percent of this age group) had AUD during this timeframe.(3)

What Increases the Risk for AUD? A person’s risk for developing AUD depends, in part, on how much, how often, and how quickly they consume alcohol. (3)

Alcohol misuse, which includes binge drinking and heavy alcohol use, over time increases the risk of AUD.(3)

Other factors also increase the risk of AUD, such as:

- Drinking at an early age. A recent national survey found that among people ages 26 and older, those who began drinking before age 15 were more than 5 times as likely to report having AUD in the past year as those who waited until age 21 or later to begin drinking. The risk for females in this group is higher than that of males. (3)

- Genetics and family history of alcohol problems. Genetics play a role, with heritability approximately 60 percent; however, like other chronic health conditions, AUD risk is influenced by the interplay between a person’s genes and their environment. Parents’ drinking patterns may also influence the likelihood that a child will one day develop AUD.(3)

- Mental health conditions and a history of trauma. A wide range of psychiatric conditions—including depression, post-traumatic stress disorder, and attention deficit hyperactivity disorder—are comorbid with AUD and are associated with an increased risk of AUD. People with a history of childhood trauma are also vulnerable to AUD.(3)

Breaking the Cycle

Clearmind Medicine Inc. (Nasdaq: CMND) believes that MEAI breaks the vicious binge-drinking cycle at the decision point to drink more alcohol,by potentially innervating neural pathways such as 5-HT1A that lead to “sensible behavior.”(6)

Non-Addictive

Anecdotal reports and pre-clinical in-vivo results indicate on the self-limiting property of MEAI—unlike traditional treatments.(6)

Expansive Potential

The literature shows that 5-HT1A receptors are associated with controlling craving behavior across the board. This indicates that MEAI may have a wide range of applications beyond binge drinking.(6)

Successful preclinical results in MEAI treatment for alcohol consumption.(6)

Clearmind Medical is advancing its proprietary CMND-100, 5-methoxy-2-aminoindane-based treatment (MEAI), intending to provide relief to millions worldwide by using psychedelics to treat Alcohol Use Disorder (AUD).

The market potential from an approved CMND therapeutic can be enormous, replacing drugs and treatments that are sometimes more debilitating than the condition itself.

More importantly, CMND’s approach could mitigate patient resistance to treatment, opening the door to potentially billions in long-term revenues and saving thousands of lives per year.

Biotech and Pharmaceutical stocks can offer tremendous upside potential when positive news is announced from Phase 1, Phase 2, and Phase 3 trials. Clearmind Medicine Inc. (Nasdaq: CMND) recently announced the initiation of a program to address its upcoming clinical trial.(4)

Clearmind Medicine Inc. recently announced the initiation of clinical batches of production of its novel psychedelic-derived drug candidate, the MEAI- based molecule- CMND-100.(4)

The produced batches will be used in the Company’s upcoming first in human (FIH) clinical trial evaluating the proprietary drug candidate compound CMND-100 for the treatment of Alcohol Use Disorder (AUD).

Following MEAI’s synthesis development process, the compound is being produced under GMP (Good Manufacturing Process) conditions to comply with FDA requirements.

The clinical batches production is made possible due to prior successful production of MEAI drug substance that was used in the Company’s pre- clinical studies designed to evaluate the safety of its innovative compound.

“Clearmind continues its progress toward FIH clinical trials,” said Dr. Adi Zuloff-Shani, Clearmind’s Chief Executive Officer.

“This milestone joins other achievements we’ve made in a relatively short period. Non-clinical data generated to date, demonstrate that our MEAI- based treatment has the potential to treat broad range of addictions and binge behaviors such as AUD.”(4)

“Like other addictions, AUD is a chronic relapsing brain disorder characterized by an impaired ability to stop or control alcohol use,” she added. (4)

“Alcohol abuse is the third most-common preventable cause of death in the United States, where almost 6% struggle with this condition.”(4)

The Company previously announced that it completed a highly constructive Pre-Investigational New Drug Application (“pre-IND”) meeting with the U.S. Food and Drug Administration (“FDA”) to discuss the development of CMND-100.

Clearmind Medicine Inc. (Nasdaq: CMND) has less than 1.2M shares available in its public float according to Finviz.(5) Low float stocks have the potential to present significant price swings if active market participants take notice.

Short squeeze?

If you mix in a short squeeze, the potential short-term gains in a low float stock can be extreme. Low float stocks can be some of the most volatile stocks in the market.

Clearmind Medicine CMND has consolidated from the latest amazing 252% run & indicators appear to reveal more explosive gains in the near future! Let’s review the 4 reasons you should put it on you watchlist NOW.

As a quick reminder of the 4 REASONS why you should pull up KAVL right now:

- Incredible Press Releases announcing their US Patent!

- Untapped Market Worth $249BN

- Clinical Trials on the horizon that could be worth Bill-ions

- Extremely Low Float – 1.2M shares is stupid LOW!

Source 1: https://www.clearmindmedicine.com/investors

Source 2: https://www.mckendree.edu/academics/scholars/issue11/bodem.htm

Source 3: https://www.niaaa.nih.gov/publications/brochures-and-fact-sheets/understanding-alcohol-use-disorder

Source 4: https://finance.yahoo.com/news/clearmind-announces-initiation-cmnd-100-134500937.html

Source 5: https://finviz.com/quote.ashx?t=CMND&p=d

Source 6: https://www.clearmindmedicine.com/investors

CMND Disclaimer

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has been compensated $5,000 from Life Water Media for profiling CMND. We own ZERO shares in CMND.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign.

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Kaival Brands Innovations (NASDAQ:KAVL) Has 200% upside, buy rating, killer news & is trading at $1.00!

Kaival Brands KAVL has been reversing from the latest amazing 482% RUN!

Now, it has created a base and appears to be ready for it’s next HUGE run, could it be 600%, 700%, 1,000%?!?!

Let’s take a quick look at the basics before digging into why KAVL could be ready for it’s next big move!

Kaival Brands KAVL Company Summary

Company Name: Kaival Brands Innovations Group, Inc.

Ticker: KAVL

Exchange: NASDAQ

Website: www.ir.kaivalbrands.com.

Kaival Brands Company Summary:

Based in Grant, Florida, Kaival Brands is a company focused on growing and incubating innovative and profitable products into mature and dominant brands in their respective markets.

Our vision is to develop internally, acquire, own, or exclusively distribute these innovative products and grow each into dominant market-share brands with superior quality and recognizable innovation. Kaival Brands is the exclusive global distributor of all products manufactured by Bidi Vapor.

Yahoo Finance and MarketWatch have issued BUY Ratings.

Yahoo Finance Short Term Indicators are:

Short Term KST Indicator: Short-term KST. Short-term KST. Implication. A bullish signal is generated when the KST, “Know Sure Thing“, rises above its moving average. When the KST falls below its moving average, the Technical Event® is a bearish signal.

“This is closest to a guarantee in the trading indicator category, so you can have a little peace of mind.” Alexander Goldman

RSI: The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30.

Moving average convergence divergence (MACD): Moving average convergence/divergence (MACD, or MAC-D) is a trend-following momentum indicator that shows the relationship between two exponential moving

MarketWatch Rating

Buy: A classic BUY signal on Market Watch

You will be able to see why Yahoo and Marketwatch has issued Buy Ratings, take a look below and it is clear as day!

But before, Take a minute and think about this, KAVL is up 32% in 2022!

WOWZERS

Take a look at the 1 year chart below, almost up 100% from January 27th.

As you can see the support has been amazing for the last 5 months around the $1 PPS. I am very confident that there is very little downside and TONS of upside with KAVL based on this chart.

Also, you can see an event looming in the technicals pushing this higher coming very soon.

The squeezing affect of higher bottoms and lower highs until BOOM it breaks out and runs!

I believe the chart is revealing a big move coming!

Also YAHOOFINANCE and MARKETWATCH agrees! BUY RATINGS

I have reviewed countless research reports and press releases and the one below really sums up the true potential in KAVL the best!

“Kaival Brands Innovations Group, Inc. (NASDAQ: KAVL) stock may be trading over 41% higher since the start of the year, but considering its position to capitalize upon and maximize a billion-dollar opportunity within the electronic nicotine delivery system market, that impressive gain is likely the precursor of an even more significant move to come.

That bullish presumption isn’t made on blind faith; it’s a result of a vastly changed competitive landscape in the ENDS market that has left KAVL as one of the few companies left standing able to sell ENDS products into a massive U.S. market.”

As a quick reminder of the 3 REASONS why you should pull up KAVL right now:

- Analyst & Indicators have issued a buyers rating – MarketWatch and Yahoo Finance love KAVL and you should too!

- Up 32% YTD and the chart looks like it is about to explode again! The base is so obvious and it has absolute monster runs and we believe they are about to go on another one again!

- A joint venture with KAVL and Philip Morris, absolutely transformative NEWS!

LOW Float LuxUrban Hotels (NASDAQ:LUXH) Has 124% upside & is trading under $2, NOT FOR LONG!

LuxUrban Hotels (NASDAQ:LUXH) could be a little missile and trading under $1.50 and positioned to soar like a eagle with just the slightest volume. We could see $2.00+++ tomorrow with modest volume!

Think about this:

Higher LOWS +

Low Float +

Bouncing Off Incredible Support and Creating A New Higher BASE +

Walking into the vacation season, ONE of the busiest seasons of the YEAR!

= EXPLOSIVE POTENTIAL GAINS COME EARLY FOR CHRISTMAS

Let’s take a close look at the top 3 catalysts that could ignite this missle!

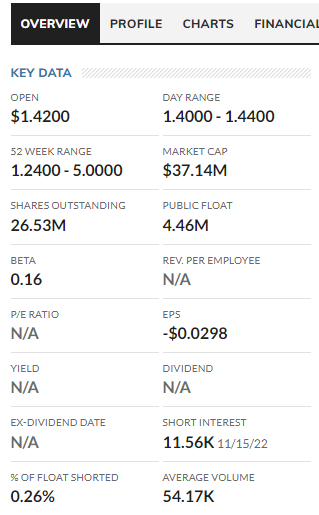

I can’t stress this enough, this is low float is a HUGE cataylst!

TWO points we would like to make!

#1

4.4 Million shares in the float is TINY! That is a little over $6M in total volume to trade the whole float in a day! That is not out of the realm of possibility for tomorrow!

#2

LUXH ONLY trades 55,000 shares daily! That is $70,000 +/-!

Are you kidding me? Lux will trade that in the first 30 minutes tomorrow!

What does that mean? Hmmmm… We will SEE!

I do predict, a massive spike in volume and a potential rocket ship in price per share!

Christmas could be tomorrow for our subscribers!

Record Quarterly Net Rental Revenue of $11.6 Million

Significant Increases in Gross Profit, RevPAR, and Occupancy Rates

Adjusted Net Income of $0.6 Million Excludes $4.6 Million of Non-Cash and One-Time Expenses

Adjusted EBITDA Rose to $2.4 Million

Reiterates Annual Guidance for 2022 and 2023

MIAMI, November 14, 2022–(BUSINESS WIRE)–LuxUrban Hotels Inc. (or the “Company”) (Nasdaq: LUXH), which utilizes a long-term lease, asset-light business model to acquire and manage a growing portfolio of short-term rental properties in major metropolitan cities, today announced financial results for the third quarter (“Q3 2022”) and nine months ended September 30, 2022.

2022 Third Quarter Financial Overview Compared to 2021 Third Quarter

- Net rental revenue rose 74.2% to $11.6 million from $6.6 million

- Gross profit improved to $4.9 million, or 42.2% of net rental revenue, from $0.8 million, or 11.9% of net rental revenue

- Net loss of $3.2 million, or $(0.13) per share, was primarily impacted by a one-time, non-cash $2.4 million warrant expense and a one-time cash expense of $1.8 million related to the Company’s planned exit from its legacy apartment rental business as part of its rebranding initiatives; net loss in Q3 2021, which did not include these expenses, was less than $0.1 million

- Adjusted net income (a non-GAAP measure; see reconciliation tables in this press release) improved to $0.6 million, or $0.03 per share, from a net loss of less than $0.1 million

- Adjusted EBITDA (a non-GAAP measure; see reconciliation tables in this press release) increased to $2.4 million from $0.5 million

Operational Highlights

- For the 2022 nine-month period, RevPAR rose 30% to $149 from $115, and occupancy rates improved to 87% from 71%

- Currently operate approximately 1,200 short term hotel rental units, which have been fully funded

- Expect to operate a total of approximately 1,500 short term hotel rental units by or around December 31, 2022, with no outside funding required for the additional 300 units

- Launched corporate rebranding initiative

- Implemented initiatives to expand margins, generate positive cash flows, and drive profitability

“Our performance in Q3 2022 validated the growth, sustainability, and predictability of our operating model,” said Brian Ferdinand, Chairman and Chief Executive Officer. “We recorded the highest quarterly net revenue in our history, expanded our operating portfolio of short-term rental hotel units, and grew RevPAR and occupancy rates across the portfolio. Excluding the one-time, non-cash warrant expense charges and one-time costs associated with our planned exit from our legacy apartment rental business, adjusted net income improved to $0.6 million and adjusted EBITDA rose 348%, respectively, from last year’s third quarter.

“We are confident in the trajectory of our business and excited about our performance through the first nine months of the year, reporting net rental revenue of $30.9 million, adjusted net income of $3.5 million, EBITDA of $4.3 million, and adjusted EBITDA of $6.5 million. As such, we are pleased to reiterate our full year 2022 and 2023 net revenue and EBITDA guidance.”

He concluded, “As a complement to anticipated net revenue growth, we have commenced initiatives designed to expand margins, generate positive cash flows, and drive profitability. This includes our agreement with Rebel Hotel Company, which we estimate will deliver margin enhancements that we would not have been able to realize until at least 2024, and our recently announced agreement with a new credit card processing company that eliminates the need for reserves and reduces associated processing expenses by approximately 400 bps compared to our former processor relationships. As a result of this new relationship, our former credit card processors will release to the Company approximately $5.5 million in reserves over the next 12 months.”

If I had a microphone I would DROP IT!

Stevie Wonder could see the potential!

I’m out of jokes, just go pull up LUXH right NOW because we have enough REGRET, we don’t need anymore!

DISCLAIMER:

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has NOT been compensated for profiling LUXH. We own ZERO shares in LUXH.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).