KushCo Holdings (OTC:KSHB) reports Quarterly results: What Next?

One of the cannabis companies which had a remarkably bad time in 2019 was KushCo Holdings (OTC:KSHB), and it seems that the company’s troubles are not over yet. Health-related panic about vaping had hit KushCo pretty hard last year, and this past Wednesday, the company announced its fiscal second-quarter results following the closure of markets.

The company is also facing troubles from the mayhem unleashed by the coronavirus pandemic. Here is a look at some of the highlights from the company’s fiscal second-quarter results for 2020.

Earnings Review

In the second quarter, the company’s net revenues came in at $30.14 million, which reflects a year on year fall of 14%. While that piled on the misery for KushCo, it should be noted that the figure scraped past analysts’ estimates of $30.13 million. The losses widened significantly to $44.4 million for the quarter, which worked out to losses $0.40 a share. In the year-ago period, the company’s net losses stood at $8.9 million, which worked out to losses of $0.10 per share, and that reflects a major rise in the company’s losses. The decline in the vaping business has been cited as one of the key reasons behind the loss.

[thrive_leads id=’8276′]

In November last year, the company had launched its hemp trading business, but until now, it has not been able to boost its earnings. KushCo also has a considerable presence in California, and despite the state declaring cannabis as essential business, its sales took a hit as more people ordered the product. One of the brighter points from the earnings report was that the company managed to boost its sales in some of its markets. Sales rose in Michigan, Massachusetts, Canada, and Illinois. The company’s Chief Executive Officer stated that investors could accept more stable revenues in the coming quarters and went on to say that KushCo could also produce positive EBITDA earnings soon.

Inovio Pharmaceuticals Inc (NASDAQ:INO) More Than Doubled in 2020: What to do Now?

The coronavirus pandemic may have led to a historic collapse in the stock market, but from certain stocks, the situation has been different. Companies involved in developing coronavirus related products have experienced significant bumps in their stock prices, and one such company is Inovio Pharmaceuticals Inc (NASDAQ:INO).

INO Stock is Up 120% This Year

The stock has recorded gains of as much as 120% over the course of the year so far after it emerged that Inovio is working on developing a DNA based coronavirus vaccine. The company has also gone into a partnership with Ology Bioservices to develop the vaccine, and Phase 1 testing for the same is expected to commence later on in April.

[thrive_leads id=’8276′]

However, anyone who is interested in investing in the Inovio stock needs to keep certain things in mind. First and foremost, there are other companies who are also working on developing vaccines for the coronavirus. Hence, it is a race among many companies, and the ones who get there first are going to see significant upside. On the other hand, the rationale behind an investment in Inovio is binary in nature. Either the company will be successful or if it will fail. However, in the second instance, the price of the stock could go to the levels it was trading at prior to the coronavirus crisis.

In its initial rally, the stock had soared from $4 to $20 within a matter of days, but since then, it has grown steadily, and in fact, it has recorded declines of 50% since hitting its highs in March. While it has become abundantly clear that the DNA based coronavirus vaccine could be massive for Inovio, it should be noted that the company has other products in the pipeline as well. One of the more interesting products in its pipeline is the VGX 3100, which is immunotherapy for those suffering from anal dysplasia. Investors could watch the proceedings closely before coming to a decision.

Gold Stocks Soar On Safe-Haven Buying

The coronavirus pandemic has proven to be a hammer blow to the global economy and also for the financial markets. In addition to that, the latest jobs report from the United States has revealed that as many as 6.6 million Americans had applied for unemployment claims last week.

What to Watch

That is an alarming number, and in such a situation, it is bound to force investors to look to invest in safe-haven assets like gold. That has, in turn, helped in the recent surge in gold, silver, and precious metal stocks. Some of the stocks that recorded significant gains last week include Coeur Mining, Hecla Mining, Pan American Silver, and First Majestic Silver.

[thrive_leads id=’8276′]

Gold has enjoyed a remarkable rally in recent weeks, and as of Thursday last week, it was trading at $1,680 an ounce. That is close to the record highs it had hit back in 2013. Silver, on the other hand, climbed more steadily and was trading at $15 an ounce, up from $12 an ounce in March. While it is true that the higher price of gold is expected to be a major boost for gold producers, it should also be noted that the coronavirus pandemic has forced many companies to suspend operations temporarily.

Hence, it might not be right to assume that higher gold prices are going to lead to higher gains for gold mining companies. While the shutdowns at many mines are a factor, it should also be kept in mind that the current crisis has affected economies all over the world. It is still unknown whether the lockdowns are going to be extended in many countries.

Hence, it could lead to an indefinite period of disruption to the gold mining process. In this sort of situation, investors need to analyze the different gold producing companies on merit and weight those companies against the existing situation in the global economy, before making a decision.

3 Healthcare Stocks Working Aggressively on Coronavirus Vaccine

The coronavirus pandemic has been not only resulted in an economic crisis on a global level, but it has also sent the markets into a tailspin. Almost all stocks across the board have seen deep declines in recent days; however, there are some stocks in the healthcare sector that have shown promise. There are some healthcare stocks that are involved in developing products meant for tackling the coronavirus, and it could be worthwhile for investors to keep an eye on these stocks. Here is a closer look at three healthcare stocks fighting the coronavirus that could be tracked at this point.

Kiniksa Pharmaceuticals Ltd. (KNSA)

One of the healthcare stocks that could be tracked at this point is that of Kiniksa Pharmaceuticals Ltd. (KNSA). Recently, it emerged that the company’s anti-GM-CSFRα antibody product named mavrilimumab was used to treat six patients suffering from coronavirus as part of a study. The study in question was conducted at the San Raffaele University in Italy.

[thrive_leads id=’8276′]

David Nierengartne, who is an analyst at Wedbush that the symptoms tackled by the product, is similar to the ones that are consistent with coronavirus, and the firm also gave the stock an outperform rating. Wedbush set the target price for the Kiniksa stock at $30 in 12 months and represents an upside of as much as 68%. In addition to that, it should be noted that there is a total of 3 buy recommendations for the stock, and that is a 100% strike rate for Kiniska.

CytoDyn, Inc. (CYDY)

The other healthcare stock that could be worth adding to the watch list at this point in time is that of CytoDyn, Inc. (CYDY). The company is involved in developing a product named Leronlimab, which can be used to treat a wide range of ailments like metastatic cancer, multiple sclerosis, and Parkinson’s disease, among others. However, there is the possibility of the product being used to treat coronavirus as well, and hence, the CytoDyn stock has jumped by as much as 179% this year so far.

Yi Chen, who is an analyst at Wainwright, stated that due to the rising number of cases in New York and elsewhere in the United States, there is a possibility of Leronlimab getting fast track approval for the FDA to treat coronavirus. The probability of getting approval has been set at 35%. Chen gave a buy rating and also upped the target price to $3 from $1.5.

BioNTech SE (BNTX)

Last but not least, investors could also consider having a look at the BioNTech SE (BNTX) stock. The company, which is involved in creating customized cancer treatments, recently launched a program to create a coronavirus vaccine. That has resulted in a rally of 56% in the BioNTech stock in 2020 so far.

Analyst Arlinda Lee of Canaccord stated that the company’s tie-up with China’s Fosun and Pfizer to develop the vaccine is a significant development. Analysts seem to be divided regarding their position on the stock. Three analysts have given a hold rating, while three others have placed a buy rating on the BioNTech stock. The target price average of $38.40 actually represents a decline of 27%.

Amazon.com Inc. (NASDAQ:AMZN) Demonstrating Its Strength During Coronavirus Crisis

During this coronavirus pandemic, Amazon.com Inc. (NASDAQ:AMZN) has done well as the number of home deliveries grew with the stay at home to combat the spread of the virus. Although the company has experienced challenges like running out of hand sanitizer, toilet paper, and other products it has nevertheless proved its strength during this crisis. Amazon making the best out of the COVID-19 crisis.

The performance is welcome for its shareholders in the long run and it is due to the strengths the company has created over the years. For instance, faster or two-day delivery is the expectation of most people and thus the struggle experienced by the company for some orders is understandable.

[thrive_leads id=’8276′]

During this crisis, nobody foresaw a scenario where cleaning suppliers, food items and toilet paper could run out. But still, the e-commerce retailer did fairly well. Despite listing long delivery times for some orders most were delivered ahead of time. This has been a learning moment for the company which will help it improve operations.

Amazon attracting more online shoppersThe coronavirus situation has also helped the company acquire more customers with most people obeying the shelter-in-place order turning to it for deliveries. These customers gave the company their cards with many buying the Amazon Prime subscription. Even after the pandemic, it is likely that these people will remain and although they won’t be ordering often they might as well do sometimes.

More people are ordering from Amazon because they have realized how effortless it can be to get your stuff shipped to your place. For instance, things like toilet paper will take most of your space when shopping so they should be delivered at your doorstep. Similarly, people may be learning that Amazon stocks some products that they didn’t expect it to. The coronavirus pandemic will help Amazon emerge as a better e-commerce leader than before. Its infrastructure gives it an advantage over competitors in the market. Even when normalcy resumes most people will definitely prefer online shopping to save them the hassle of going to pick grocery and other stuff.

TrovaGene Inc (NASDAQ:TROV) Soars 85% On Solid Data

Avinger Inc (NASDAQ:AVGR) Is Up 60% in 2 Weeks: What’s Next?

Hawkeye Systems, Inc. (OTC-HWKE) An AI Tech Play That’s Flying Under The Radar

Hawkeye Systems, Inc. (OTC-HWKE) has everything we look for in a long term trade and could be a solid winner for savvy traders.

Occasionally, a play with massive potential manages to fly under the radar for weeks before a chance inquiry gives it the coverage that it deserves.

I believe that we’ve found one such play, which is great because now we get to talk about it before anyone else…

While it’s not particularly surprising that investors have missed out on this play since the company has only been publicly trading for about a month, but this company isn’t messing around and what it’s done in those thirty days has been nothing short of impressive.

First they announced the acquisition of an award-winning tech provider, then they announced that they had entered into a Cooperative Research and Development Agreement (CRADA) with the Department of Defense (DOD), and if that wasn’t enough, the company that they acquired announced that it had installed it’s award-winning tech for Sony Innovation Studios, Inc., a division of Sony Pictures Entertainment (SPE). More on all of this in a bit.

First they announced the acquisition of an award-winning tech provider, then they announced that they had entered into a Cooperative Research and Development Agreement (CRADA) with the Department of Defense (DOD), and if that wasn’t enough, the company that they acquired announced that it had installed it’s award-winning tech for Sony Innovation Studios, Inc., a division of Sony Pictures Entertainment (SPE). More on all of this in a bit.

We believe that early investors are really missing out on getting in at the ground floor level of this potential major opportunity as the company is a patent play that’s positioned itself on the cutting edge of artificial intelligence and 4D video / holographic imaging systems offering them near first mover status in what’s being called the fourth industrial revolution of embedded technology, the Internet of Things, autonomous vehicles, and artificial intelligence (AI).

The company’s name is Hawkeye Systems, Inc. and it’s trading under the ticker HWKE.

Trading at $2.81, Hawkeye Systems, Inc. is an American next generation imaging technology company. It was founded by former members of the US Military who joined forces with Hollywood film production veterans to develop professional and military grade imaging products and services to assist with intelligence, surveillance and reconnaissance.

[thrive_leads id=’8774′]

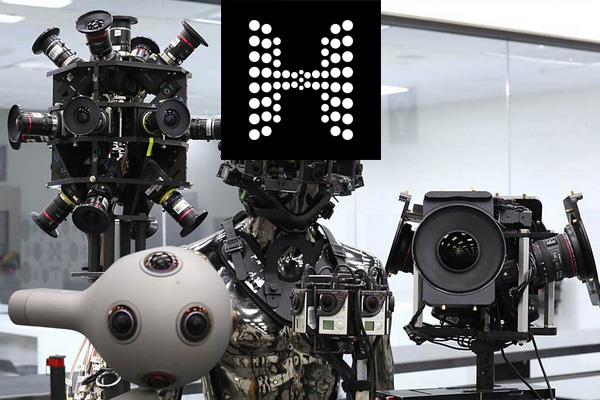

But we can’t talk about Hawkeye without bringing up Radiant Images, a soon to be a division of Hawkeye Systems, which is a multi award winning technology provider to customers worldwide specializing in cinema, immersive, volumetric and light field image capture. ICG Magazine recently named Radiant Images “Light Years Ahead” for their advances in holographic video technology with light field and volumetric image capture.

Investment Highlight: In less than a year, Hawkeye Systems has experienced exponential growth within the imaging technology space.

Their patent pending technologies takes traditional media beyond conventional video or computer screens, as a new communication and interaction medium that can be used across industries such as Military/Law Enforcement, Entertainment, Education, Inspection/Authentication, and Artificial Intelligence.

Products:

Hawkeye Systems’ imaging technology serves as the backbone and infrastructure for some of the largest movie studios and multinational technology companies.

Their patent pending camera systems use RGB, Volumetric and Light Field camera technologies to capture, store, process and output images and depth data in 180 and 360 degrees in real time. These systems provide live streaming and real time image analysis of immersive, 360-degree video which can be applied to a variety of industries and use cases, from the battlefield to the factory floor.

Clients:

But before we go any further, I want to spend some time going over the news that I alluded to earlier.

Recent News:

October 2, 2019: Hawkeye Systems Signs Agreement to Acquire Radiant Images, Deepening its Investment in Providing A.I. and Video Solutions and Expanding Into New Company Verticals

Today, Hawkeye Systems, Inc. (OTCQB: HWKE), announced the execution of a proposed agreement to acquire Radiant Images, an award-winning technology provider to customers world-wide, specializing in cinema, immersive, volumetric and light field.

Hawkeye System’s proposed acquisition of Radiant Images, and its award-winning camera technology, will further enable Hawkeye Systems’ client’s access to combined A.I. and video technology across a variety of industries, as well as granting access to greater capital markets.

The proposed acquisition will now allow the business to create predictive A.I. image analysis solutions. The acquisition is expected to close by the end of December 2019.

Get the full report here: https://finance.yahoo.com/news/hawkeye-systems-signs-agreement-acquire-130000612.html

October 8, 2019: Hawkeye Systems Inc. Announces Department of Defense Agreement and Addition of Former U.S. Naval Aviator

Today, Hawkeye Systems, Inc. (OTCQB: HWKE) is pleased to announce that it has entered into a Cooperative Research and Development Agreement (CRADA) with the Department of Defense (DOD).

The CRADA agreement marks a pivotal milestone for Hawkeye to work collaboratively with the DOD within their various departments to streamline process and further build upon their technology capabilities. Hawkeye will work exclusively to provide technologies and systems that meet DOD capability gaps.

Hawkeye Systems is tasked with developing innovative technologies, materials, components, material combinations, software, modeling, simulations and systems for various DOD applications. The goal is to provide an enhanced operational capability to DOD assets through the development of novel solutions and technologies. Through the interaction and cooperation authorized by this CRADA, the DOD and Hawkeye Systems will develop technologies tailored for Department of Defense needs.

Hawkeye Systems is tasked with developing innovative technologies, materials, components, material combinations, software, modeling, simulations and systems for various DOD applications. The goal is to provide an enhanced operational capability to DOD assets through the development of novel solutions and technologies. Through the interaction and cooperation authorized by this CRADA, the DOD and Hawkeye Systems will develop technologies tailored for Department of Defense needs.

Hawkeye Systems will also add U.S. Navy Consultant, Shawn Petre, as a principal consultant focusing on all issues related to the Department of Defense. Mr. Petre has served in the U.S. Navy and will bring over 22 years of experience as a Naval Aviator.

Get the full report here: https://finance.yahoo.com/news/hawkeye-systems-inc-announces-department-123000989.html

October 10, 2019: Hawkeye Systems’ Radiant Images Installs Volumetric Light Field Capture System – AXA Stage for Sony Innovation Studios

LOS ANGELES, Oct. 10, 2019 /PRNewswire/ — Hawkeye Systems, Inc. (OTCQB: HWKE) announced today that Radiant Images, installed its volumetric (a.k.a. holographic / 4D video) capture system for Sony Innovation Studios Inc., a division of Sony Pictures Entertainment (SPE). As previously reported, the Company has agreed to acquire Radiant Images.

Get the full report here: https://finance.yahoo.com/news/hawkeye-systems-radiant-images-installs-123000729.html

Hawkeye Systems Tech

AXA Camera System:

The patent pending AXA Camera Platform is a system for capturing 360° images and video with 3D depth. Inspired by nature and the laws which govern physics and geometry, the design provides near-perfect spherical 360° capture beyond any system presently available. The precise spacing and positioning of cameras within the AXA:

- Minimizes occlusions and geometry errors

- Allows computational stitching of 360° images and video

- Allows real time streaming and analysis of 360° images and video

- Allows automation and the application of algorithms in real time to 3D depth mapping Volumetric image capture

The AXA is intended to provide a 360-degree, user-defined and customized, field of view in real-time that is exportable to multiple users or group outputs through various platforms simultaneously. The AXA will also provide geo-location and range data to assist/confirm the objective imagery continuously. In a military setting this would allow for:

- Multiplying your force presence

- Tracking people / subjects

- Real-time coordination of activities

- Complete history / reanalysis

- Fusion across many sensor types

- Intelligent processing (user select perspectives)

- Depth mapping

3D Depth, Volumetric, & Light Field Imaging

Hawkeye Systems is a driving force in 3D depth, Volumetric and Light Field imaging. These imaging technologies are core to Holographic, Free viewpoint video and also serves as an essential element for the next generation of operating systems.

Radiant Images AXA Volumetric & Light Field stages from Radiant Images on Vimeo.

Any industry that can use real time image analysis will see value in Hawkeye’s camera systems. They are currently working to expand their technology into a variety of other verticals including

- Education/Training Simulations

- Manufacturing Quality Control

- Inspection/Authentication of Physcial Goods

Smart AI Enabled Camera Systems

The Hawkeye Smart AI Enabled Camera Systems in Body Worn Configuration gives military and law enforcement personnel essential tools to be safer and more effective, whether collecting intelligence, evidence or assessing threats in the field.

Key features include:

- Multiply camera sensors and optics which provide both the 200° & 110° field of view.

- High resolution at 4K streaming and low-light IR cameras

- AI enabled real-time data processing and notification.

- Tier-1 Federal RLS & ARNS security

- LIVE simulcast and push to video and talk via 5G network, Private LTE and backwards compatible to 4G

- Push notification and LIVE view via Geolocation Framework to nearby patrol view.

We are going to continue to follow Hawkeye as it continues to develop, so, as always, stay tuned for more news and updates and start your own due diligence on Hawkeye Systems today.

Disclaimer :This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on PUDO (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS. By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, www.smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Hawkeye Systems, Inc. Small Cap Exclusive has been hired by Hawkeye Systems, Inc. for a period beginning on October 1, 2019 to publicly disseminate information about (HWKE) via website and email. We have been compensated $20,000. We will update any changes to our compensation.Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. Hawkeye Systems, Inc. is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.