Healthier Choices Management (HCMC) Stock Suddenly Soars 25%: Here is Why

Over the past week or so, the Healthier Choices Management Corp (OTCMKTS:HCMC) has been on the radars of many investors owing to the company’s rights offering. As everyone knows, a rights offering is an important event and can prove to be quite popular among the existing shareholders of a company.

Last week the company announced that the extension of the rights offering to June 10, 2021, since there had been some confusion regarding cut-off dates. The original cut off date for the offering had been set for June 3, 2021. The company claimed that it had got reports in which some custodians and brokers had misled clients by informing them of an earlier cut-off date.

The company further informed that shareholders and some of the international investors of the company had been told by their brokerage firms that the cut off date was May 28, 2021. Hence, the cut off date was extended by Healthier Choices Management Corp so that all investors could participate in the rights offering. The rights offering has been one of the more important events for the company in recent times.

The company announced that the whole thing had commenced on May 19, 2021 and investors were told that subscription rights had been made available through their brokers, dealers and banks among others.

That was however not the only important development in relation to Healthier Choices Management Corp last month. Back on May 10 the company announced its financial results for the first fiscal quarter ended on March 31, 2021. During the period, the company managed to generate net sales of $3.5 million, which reflected a decline of 14% year on year.

That being said, it is also necessary to point out that in the same period last year, the company’s sales had surged owing to the significant rise in sales in the grocery department during the COVID 19 pandemic. On the other hand, total operating expenses declined by 15% year on year to $2 million.

HUMBL (HMBL) Stock Sees Profit Booking: Will The Rally Resume This Week?

Last week the HUMBL Inc (OTCMKTS:HMBL) stock was one of the major gainers and ended up clocking gains of as much as 100%. However, the situation has been markedly different this week and yesterday; the stock actually went down by 7%.

It is now important for investors to figure out if the correction in the HUMBL stock could be a fresh opportunity for investors. Hence, it is necessary to take a closer look at the company. Yesterday, HUMBL announced that it got into collaboration with Athletes First in order to develop new lines of businesses like ticketing, digital marketing and non-fungible tokens (NFTs).

Athlete First is one of the leading lights in the sports agency business and over the past decades it has represented broadcasters, NFL players, coaches and executives. By way of this collaboration, the agency is going to help HUMBL in delivering high quality white glove services to its some of its selected clients in the fields of entertainment and sports.

However, there have been other recent developments as well that investors need to keep in mind when analysing HUMBL. Back on May 25, the company had announced that it closed two new financing that brought in a total of $2500000.

The fresh capital is meant for being a bridge as HUMBL readies for equity financing to the tune of $50000000. The round of investment that had been attracted by the company also included participation from entities based out of Australia and the United States. The company has been busy over the past month or so in making deals and collaborations.

In early May, HUMBL was in focus after it announced that it completed the acquisition of the well-known creative advertising firm named Monster Creative LLC. Monster is going to operate independently but it is going to help HUMBL with the creation of multimedia NFTs. The company has moved into NFTs in a decisive manner in recent times.

Enzolytics (ENZC) Stock Attempts To Recovery: Will The Rally Continue?

In the past two weeks, the Enzolytics Inc (OTCMKTS:ENZC) stock has been on the radars of many investors and that becomes far more apparent from the price action in the stock. The stock has recorded gains of 35% during that period and the rally continued on Tuesday.

Yesterday, it jumped by as much as 15.5% and in this sort of situation; it might be a good idea for investors to take a closer look at the company. One of the more important positive triggers for the stock came about on May 26 when the company announced that it had managed to identify immutable sites on the HTLV-1 virus.

It is a major development since it is going to help Enzolytics in its work to product monoclonal antibodies that are supposed to work against the HTLV-1 virus. In this regard, investors need to keep in mind that at this point there are no effective vaccines in the market that can actually tackle the HTVL-1 virus.

While this discovery was an important factor behind the rally in the Enzolytics stock, it is important to mention that there were some other important developments as well. In the middle of May, it was announced that Enzolytics collaborated with Intel Corporation to publish a white paper.

The white paper, titled “Optimizing Empathetic A.I. to Cure Deadly Diseases”, pointed out that the innovative approach of Enzolytics and the artificial intelligence analytics tools of Intel could be combined to produce effective treatments meant for all types of virus infections. This white argues that in the future the aim of healthcare is going to be more anticipatory than reactionary.

Back in April the company had also made an announcement with regards to the sort of progress it has made on a range of initiatives including the one related to its multiple therapeutics platform. It is now going to be interesting to see if the Enzolytics stock can maintain its momentum in the coming days.

Atossa Therapeutics (ATOS) Stock Is About To Hit New Highs: How to Trade?

Over the course of the past six weeks, the Atossa Therapeutics (NASDAQ:ATOS) stock has been in the middle of a strong rally and during that period, it managed to deliver gains of as much as 160%.

The Atossa stock kicked off the month of June on a strong note as well and clocked gains of as much as 20% yesterday. There was no announcement from the company yesterday but an analyst actually raised his price target for the Atossa stock and that seems to have come as a major trigger for the rally in the stock. Hence, it might be a good idea now for investors to take a closer look at the stock.

In a new development, analyst Edward Woo raised the target price for the Atossa stock from $7.75 a share to $8 a share. However, it should be noted that the new target price is just more than double the previous closing price of the stock. On the other hand, Woo maintained the buy rating on the stock.

One of the biggest reasons behind the bullish sentiments about the Atossa stocks is its oral breast cancer product named Endoxifen. Breast cancer is a widespread disease and it is believed that Endoxifen could eventually add substantially to the company’s revenues.

Back in February, Atossa also conducted a phase 2 clinical study of the product in Australia and announced that the results were ‘overwhelmingly positive’. The comment was in relation to the effectiveness of the product in reducing the activity of tumour cells.

In addition to that, the company has also managed to come up with two medications that are meant to treat patients suffering from COVID 19. In this regard it is also important to note that Woo has been bullish about the stock for quite some time and had given a buy rating to Atossa in September last year.

Green Organic Dutchman (TGODF) (TGOD) Stock Makes Sudden Move: Time To Buy?

The cannabis sector had gone through considerably tough times for months before it made a recovery of sorts earlier on this year and many stocks have managed to come into prominence in a big way in recent weeks.

One of the cannabis stocks that could be worth looking into at this point is that of The Green Organic Dutchman Holdings Ltd (OTCMKTS:TGODF) (TSE:TGOD). The Green Organic Dutchman stock has performed strongly over the past two weeks and managed to deliver gains of as much as 60%. The rally was triggered by the company’s performance in the fiscal first quarter.

In the first quarter that ended on March 31, 2021, The Green Organic Dutchman managed to generate revenues of $8.98 million and that reflected a year on year rise of as much as 194% from the prior year period. On the other hand, the company also managed to churn out a gross profit of $3.13 million in the first quarter.

The gross profit figure was 83% higher than what the company generated in the prior year period. The revenues generated by The Green Organic Dutchman were made out of $6.67 million in sales of cannabis product in the Canadian market and $2.31 worth of sales of hemp based products in Europe.

While the revenues soared on a year on year basis, it was actually lower than the revenues in the previous quarter. However, it should be noted that the revenues were on expected lines. The lower revenues was primarily a by product of the restrictions at stores and stay at home rules because of the coronavirus pandemic.

On the other hand, The Green Organic Dutchman continued to reap the benefits of controlling its expenses. The company’s G&A expenses for the quarter went down by as much as 53% year on year and this is a metric that is expected to be watched closely by investors going forward. At this point, it might be a good move to add The Green Organic Dutchman stock to the watch lists.

Relief Therapeutics (RLFTF) Stock Tries To Move Back to 30 cents: What Next?

In recent months, Relief Therapeutics Holdings AG (OTCMKTS:RLFTF) has been in considerable focus among investors due to its work in relation to RLF 100. The product, which is meant for treating patients suffering from severe symptoms of COVID 19 infection, is currently in advanced clinical development.

On Friday, the stock was on the move after the company announced that its Annual General Meeting is going to be hosted on June 18, 2021. The announcement was made on Thursday and on Friday, the Relief stock clocked gains of as much as 15% as investors piled on to it in a big way.

The company also pointed out that due to the circumstances owing to the coronavirus pandemic, shareholders would not need to be present in person at the meeting. Relief also pointed out that it sent out the instructions with regards to voting procedures to the shareholders as well.

In addition to that, the company also announced that set of agendas which are going to be deliberated at the meeting. However, there was another development on Friday that investors ought to keep in mind. The company announced on Friday that it appointed Taneli Jouhikainen as its new Chief Operating Officer.

The position was recently created by the company and Jouhikainen is going to take charge from June 1, 2021. The company had decided to create this position in order oversee the transition of Relief Therapeutics to a diversified product focussed company from a clinical stage firm.

Jouhikainen will be charged with overseeing all the product development initiatives and will also manage the intellectual property portfolio that is owned by Relief Therapeutics at this point. It is a significant appointment and one that could have a long term effect on the fortunes of Relief Therapeutics as a company. In light of these developments and the rally in the stock, it might be a good idea for investors to keep an eye on the Relief stock.

Can High Tide (HITID) stock Move Back To New Highs In June?

When a company gets the opportunity to list its shares in a large exchange then it is regarded as a major boost for the stock and that is what has happened with the High Tide Inc (OTCMKTS:HITID) stock on Friday. This past Friday the company announced that it got approval for listing its shares on the NASDAQ Capital Market.

The High Tide share is going to start trading on NASDAQ from June 2, 2021 under the ticker sign ‘HITI’. Considering the fact that NASDAQ is one of the biggest stock market exchanges in the world, the stock is going to get exposed to a much larger pool of capital and investors.

Hence, it goes without saying that it is a major development for High Tide and resulted in a considerable optimism among market participants. In this regard, it is also necessary to note that High Tide has been one of the better performers in the cannabis sector this year so far and has clocked gains of 190% in the period. While the stock is all set to be listed on NASDAQ, it is also important to note that the High Tide stock is going to continue to trade on the TSX Venture Exchange concurrently.

The Chief Executive Officer and President of the company Raj Grover spoke about the listing as well. He said that it is a major success for High Tide that it managed to be listed on NASDAQ in less than three years since its establishment as a company.

In addition to that, he went on to state that High Tide is also going to become the first major publicly trade cannabis retail company to trade NASDAQ. In addition to the exposure to a vast pool if investors, the listing is also going to make it easier for institutional investors to get involved with High Tide and that is another reason why it is a major development.

Asensus Surgical (ASXC) stock Makes A Stunning Comeback: What Now?

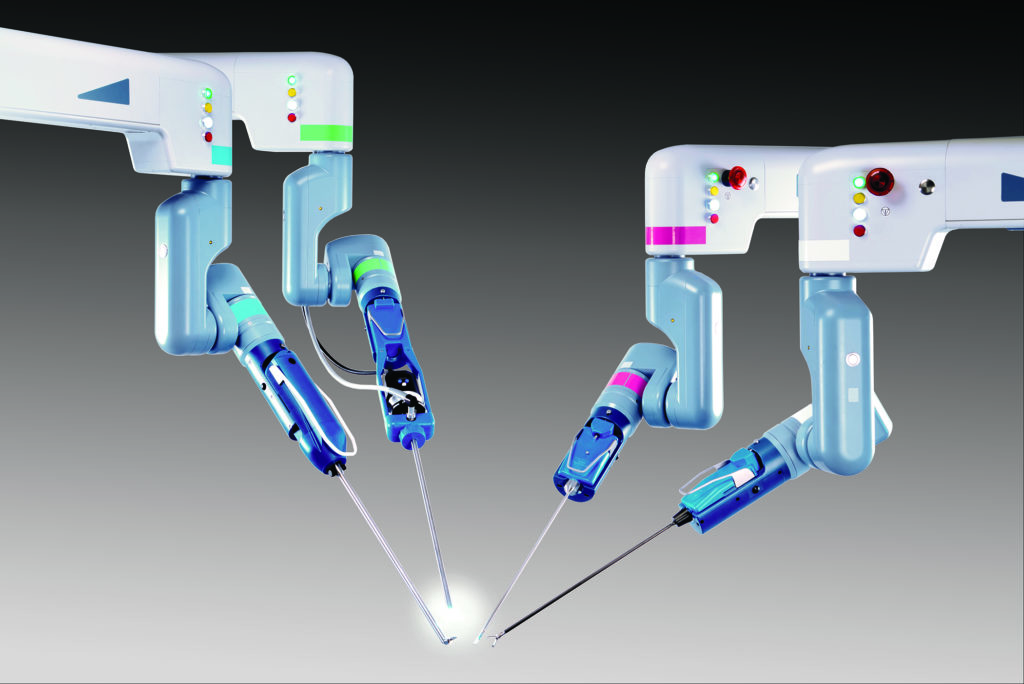

When a stock gets a favourable rating from analysts then it almost always leads to gains in the stock and that is what seemed to have happened with the Asensus Surgical (NYSEAMERICAN:ASXC) stock on Wednesday.

The stock is back in favour among many penny stocks investors and yesterday it clocked gains of as much as 23%. The firm H.C. Wainwright started covering the stock and gave the stock a buy rating. In this regard, it should be noted that the latest rating was done not even two weeks after the company announced its financial results for the first quarter.

In the three month period ended on March 31, 2021, Asensus managed to generate revenues of as much as $2.1 million, which was a considerable jump from the $600000 it generated in revenues in the prior year period.

It should also be noted that as much as $1.3 million out of the total revenue was generated through the sales of Asensus Surgical’s Senhance Surgical System. Hence, the latest bullish sentiment from the analysts at H.C. Wainwright has not come as a complete surprise. It is now going to be interesting to see if the Asensus stock can continue to hold on to the momentum that it has managed to gain this week.

The company has become an important player in surgical instruments space and has developed devices that provide greater control as well as minimum variability. Asensus aims to combine the powers of machine learning and automated intelligence in order to improve the outcomes from surgeries.

Moreover, it is also necessary to point out that for more than a year, the stock has had a remarkable run. After hovering around the 33 cents market around a year ago, the stock soared to 63 cents by the end of 2020. At the beginning of 2021, the Asensus stock had another remarkable rally and touched $6.95 in February. It corrected after that but now the stock seems to be readying for another run.