SpotLite360 CA:LITE is looking like it could take off, it’s up 100%!

SpotLite 360 CA:LITE is looking strong as it reverses it’s bearish trend for a bullish one, look out! It is already up over 100% and doesn’t look like there will be a stop anytime soon! Before we get started, sign op for our newsletter below, it’s FREE and we are really good!

Company Snapshot:

Company Name: SpotLite IOT Solutions, Inc.

Ticker: CA.LITE

Exchange: Canadian Securities Exchange

Website: https://www.spotlite360.com/

Company Summary:

SpotLite360 CA:LITE is a logistics technology developer unlocking value, opportunities, and efficiencies for all participants in a supply chain. The company endeavors to set new standards of transparency, integrity, and sustainability in the pharmaceutical, healthcare, and agriculture industries. Its flagship SaaS solution has been engineered to seamlessly track the movement of a product by integrating with systems of all major stakeholders in a supply chain ranging from the raw materials to the hands of the end consumer. Spotlite360 Technologies was founded on September 23, 2014 and is headquartered in Vancouver, Canada.

Latest news for Spotlite360

Feb. 03, 2022

Entered into an agreement with Control Union (“Control Union”) in which the parties will produce, develop, market and deliver an exclusive global hemp supply chain certification. The initial certification will leverage partnerships with seed genetic companies, hemp farmers and hemp extraction/processing companies to develop a seed, to product, to consumer supply chain best practices. Control Union, a Peterson Control Union Company, will help author the standard and will audit companies against this standard to guarantee consistent product quality, chain of custody, proof of origin, environmentally sound practices, sustainable sourcing and prove of ESG (“Environmental, Social, Governance”) initiatives. The standard will leverage SpotLite360 Technologies and its unique supply chain focused tracing and tracking capabilities, leveraging RFID and IoT (“Internet of Things”) technologies to ensure real time data and visibility throughout the entire partner ecosystem.

5 Day Chart

Technical Analysis:

The stock looks insanely good, it is BULLISH and I like it! That was easy and quick

Petros PTPI bounce play alert–

Petros PTPI is possibly about to explode again as the short position increases as PPS is ticking up. Pay attention to PTPI as this stock may skyrocket

Petros Pharma PTPI company summary

Company Name: Petros Pharmaceuticals, Inc.

Ticker: (PTPI)

Exchange: NASDAQ

Website: https://www.petrospharma.com/

Petros PTPI Company Summary:

Petros Pharmaceuticals is committed to the goal of becoming a world-leading specialized men’s health company by identifying, developing, acquiring, and commercializing innovative therapeutics for men’s health issues, including, but not limited to, erectile dysfunction, endothelial dysfunction, psychosexual and psychosocial ailments, Peyronie’s disease, hormone health, and substance use disorders.

Why is it down?

The NEWS:

Petros PTPI released incredible news that is found below late in 2021.

Petros reported positive over-the-counter (OTC) draft label comprehension study results for its erectile dysfunction (ED) Drug STENDRA® (avanafil). This Pivotal Label Comprehension Study was designed to assess comprehension of a draft STENDRA® Drug Facts Label intended for OTC use.

What did the say, “The label comprehension study is a key component of our plans to help expand access for STENDRA beyond the prescription model, and to make

The first “potentially the first prescription-grade ED medication to become available over-the-counter in the United States.” EVER?!?

PTPI 5 Day Chart

PTPI 5 Day Analysis

This stock is fully consolidated so I expect the moment they issue positive news, it will skyrocket.

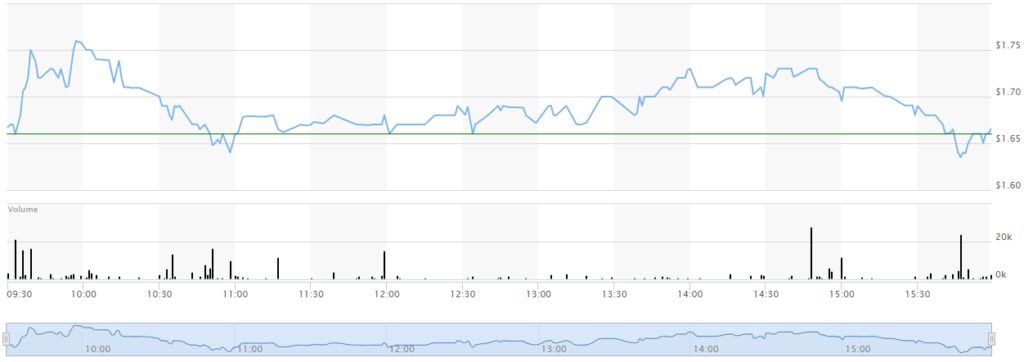

PTPI 1 Day Chart

1 Day Analysis

You can clearly see thin the one day that there is a slight bearish trend. Get ready traders because I’ve been following PTPI for a while and I believe it is getting ready for another move as long as the stock has good news attached to it to get it going.

Kodak NYSE: KODK UPDATE: KODK outlook

Kodak NYSE: KODK is a stallworth in American business but lately they have been struggling mightily. Could this be a reversal?

Company Name: Eastman Kodak Company

Ticker: NYSE: KODK

Exchange: NYSE

Website: https://www.kodak.com/en

Company Summary:

Kodak is a global technology company focused on print and advanced materials & chemicals. We provide industry-leading hardware, software, consumables and services primarily to customers in commercial print, packaging, publishing, manufacturing and entertainment.

We are committed to environmental stewardship and ongoing leadership in developing sustainable solutions. Our broad portfolio of superior products, responsive support and world-class R&D make Kodak solutions a smart investment for customers looking to improve their profitability and drive growth.

Why has it gone down?

Marketwatch recently wrote the following, “Some business executives have profited handsomely from the practice of earning “spring-loaded” stock options that take advantage of information not available to the public, but U.S. regulators on Monday announced plans to put a stop to it.

The Securities and Exchange Commission issued new guidance for companies on how to reflect the potential value of spring-loaded options when they disclose how much top executives actually earn.

Spring-loaded awards are a type of compensation in which a company grants stock options shortly before it announces market-moving information, such as an stronger-than-expected earnings release or disclosure of important transactions. The options have the potential to soar in value once the news is made public.”

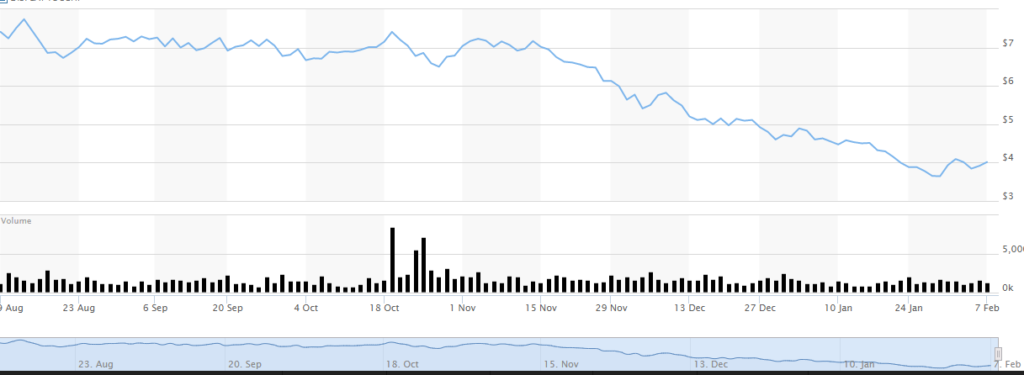

EKodak NYSE: KODK: KODK 6 month Chart

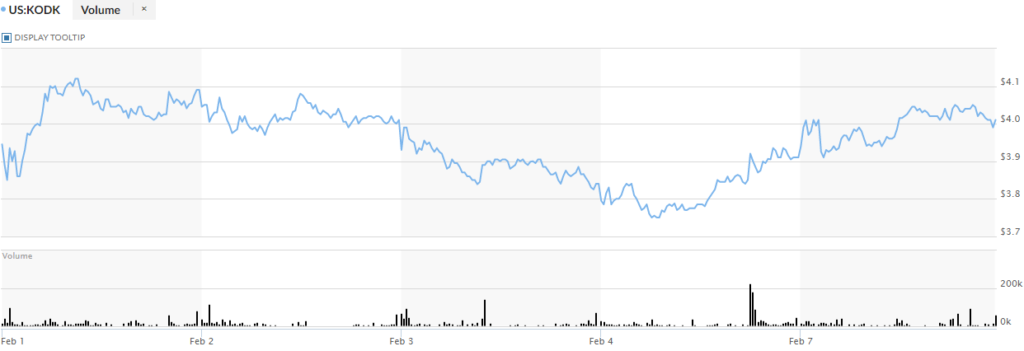

5 Day Chart

Eastman Kodak Company NYSE: KODK Technical Analysis:

Can Kodak NYSE: KODK stay above $4.00, and perhaps consolidate there after it’s little run and reversal? If so, that would be a decent signal. The other option is that it continues the slide it did at the end of today and trades in between $3.70 and $3.85 and consolidates there.

The other two options are: Bullish move or a continued bearish trend. A double confirmation of a reversal would be the stock sliding past $4.15 PPS. That would be a buy signal in my opinion.

Falling below $3.75 is a clear sign that KODK is continuing a bearish trend.

NVDA & U & ADSK all have something in Common, guess what?

Metaverse is big, NFTs are even bigger and Crypto is a mammoth in the market right now. All three have this in common, they are linked to one of the aforementioned tickers. NVDA & U & ADSK all are stocks to keep an eye on.

Just today look at what Morgan Stanley wrote, HERE. The article glows about the Metaverse, “The metaverse has been a hot-button term, with corporations ranging from Meta to Microsoft using it in their business plans. But recently massive investment banks such as Morgan Stanley have added it to their lexicon as well.”

The article goes on to say, “The Wall Street giant said in a note to investors that the nascent virtual space in China alone would become an $8 trillion market in the future — the same valuation fellow investment bank Goldman Sachs recently forecast the metaverse would be worth globally.”

Hence, let’s take a look at NVDA & U & ADSK to see if these could grab a significant amount of that $8 Trillion market share. To give our readers the idea of how big that number is, take a look at the sectors below and their total market valuation.

If that projection comes true, it would be the third largest sector just behind the FINANCIAL sector. WOW! It would also beat out Health Care, are you kidding me? Readers, pay attention this is a historic moment in the financial markets.

Let’s take a look at NVDA, U & ADSK

Company Name: Nvidia

Ticker: NVDA

Exchange: NASDAQ

Company Summary:

Nvidia is already one of the most heralded and recommended stocks there is. Wall Street remains high on Nvidia for multiple reasons. The semiconductor firm touches on gaming, crypto, data center, automobiles and the metaverse among many others.

Company Name: Unity Software

Ticker: U

Exchange: NYSE

Company Summary:

Unity Software might not be a household name like some of the other stocks on this list. But if you or someone you know is a gamer, Unity Software has likely touched your life. That’s because Unity Software is utilized in 71% of the top 1,000 games. More than 50% of mobile, PC, and console games were made with Unity. So, despite its relatively lesser known name, it is ubiquitous.

Company Name: Autodesk

Ticker: ADSK

Exchange: NASDAQ

Company Summary:

Autodesk is changing how the world is designed and made. Our technology spans architecture, engineering, construction, product design, manufacturing, media and entertainment, empowering innovators everywhere to solve challenges big and small. From greener buildings to smarter products to more mesmerizing blockbusters, Autodesk software helps our customers to design and make a better world for all.

New Listing Alert: Looking Glass Labs (NEO:NFTX) Is Going Public In One Of The Hottest Sectors!

Looking Glass Labs (NEO:NFTX) is looking promising!

I Normally Wait To Point Out The Value Propositions Until Later, But I Can’t Help Myself

#1 NFTs, from $100 Million To $40 BILLION, In One Year 1

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE 2

#3 Looking Glass is generating Multiple, Perpetual revenue streams.

#4 People Lie, Numbers Don’t

Looking Glass Labs (NEO:NFTX) has everything I look for in an investment opportunity.

Looking Glass Labs could be your answer, I researched LGL and believe with their excellent executive team and expertise they could be an answer to the noisy market. We are all awaiting the corporate leaders of this vertical to establish themselves and it is possible that LGL is a front runner.

Looking Glass Labs (NEO: NFTX) is a new public company in the red hot sector of NFTs and the metaverse and I couldn’t be more excited! Hi, I’m Alexander Goldman, and for those that know me I have been following the NFT stocks very closely.

The average gains of over my last three picks have been phenomenal, in fact I’ve strung together consecutive winners yielding 186% increases in about one month. I say that because, well, you’re only as good as your last trade.

I’m excited, so let’s go over why I spent the last month researching LGL. Then, we can go over the macros before we get into the specifics.

Company Name: Looking Glass Labs, Inc.

Ticker: NEO:NFTX

Exchange: NEO

Website: https://www.lgl.io/investors

Investor Deck: Here

Company Summary:

Looking Glass Labs a leading Web3 platform specializing in non-fungible token (“NFT”) architecture, immersive metaverse environments, play-to-earn tokenization and virtual asset royalty streams.

The company is a full service digital agency with a wealth of experience in creating and issuing NFTs in exchange for cryptocurrencies on the blockchain. Their team also provides full service support to brands, artists, and communities who require technical, legal, promotional, or creative assistance.

Looking Glass Lab’s Brands

House of Kibaa (HoK) is a digital studio at the forefront of technologies in the blockchain, NFT and metaverse sectors. HoK designs and curates a next-generation metaverse for 3D assets, allowing functional art and collectibles to exist simultaneously across different NFT blockchain environments.

Looking Glass Labs

With a wealth of experience in NFTs and cryptocurrencies, LGL both creates and issues NFT collections as well as provides a full range of support services to third party clients. Additionally, through the Company’s NFT royalty streams LGL earns a share of value each time NFTs change hands within certain ecosystems.

What is a NFT and why should you pay attention?

I’m going to give you two definitions, the first definition is filled with jargon and then I will do my best to explain the second one in lay terms.

Non-fungible tokens or NFTs are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.

Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency.

This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can be used as a medium for commercial transactions.

Let’s try to break that down for us simple folk.

Non-fungible tokens are called NFTs for short and they are unique, like a digital Mona Lisa and completely different from the dollar. There was only one Mona Lisa made and it carries a very real monetary value.

On the contrary, as us Americans are finding out, when you own a fungible currency, like the dollar, you can print, print, print and continue printing which in turn debases the value.

NFTs typically represent real-world objects and collections including artwork, memorabilia, music , virtual/in-game items, videos, etc. Below is an NFT from the Bored Ape Yacht Club collection:

Just like NFTs, and really any product or service, it boils down to supply and demand. The more desirable your NFT is, the more its worth.

The only way to acquire an NFT is with a cryptocurrency via the blockchain. Without boring you, here are the cliff notes on crypto.

There is a large segment of the population that doesn’t trust governments or centralized power. They are not big fans of fiat currency (fungible) otherwise government run banks, like the Fed.

So crypto developed as a necessity to put the power back in the hands of the people.

Cryptocurrency trades on something called the blockchain and there is a large amount of interest to see if it can disrupt the global finance mechanism.

Most people, unless you’ve been living under a rock, have definitely heard of blockchain and it is simply the backbone of where cryptocurrencies trade. We are in the first lap of a marathon, like the advent of the internet. It is truly exciting times for investors, for the people and

So to summarize, in the simplest terms, NFTs transform digital works of art and other collectibles into one-of-a-kind, secure, verifiable assets that are easy to purchase and sell on the blockchain with crypto.

FOUR REASONS Looking Glass Labs Could Be Worth Putting On Your Watchlist

#1 NFTs, from $100 Million To $40 BILLION, In One Year 1

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE 2

#3 Looking Glass is generating Multiple, Perpetual revenue streams.

#4 People Lie, Numbers Don’t

Before we go over the top 4 reasons I love Looking Glass Labs, let’s look at one of their latest press releases.

Jan 25 2022 – Looking Glass Labs’ GenX NFT Collection by House of Kibaa “Verified” on the LooksRare NFT Marketplace Click Here

LGL announced that the GenX NFT collection issued by the Company’s flagship studio, House of Kibaa, has been authenticated by the LooksRare NFT marketplace, thereby making it one of the first NFT collections to receive “Verified” status.

Jan 18 2022 – Looking Glass Labs’ Live-Action NFT Series “GenZeroes” Featured in Deadline Hollywood

As NFT Trading Volumes Clear $23 Billion in 20211, the Use Cases for NFTs in Areas such as Entertainment are Beginning to Attract Mainstream Industry Attention such as Deadline Hollywood’s Coverage of GenZeroes

December 21 – Looking Glass Labs’ GenX NFT Collection by House of Kibaa “Verified” on the LooksRare NFT Marketplace

During LookRare’s First Week Post-Launch, the New NFT Marketplace Facilitated over USD 3.2 Billion of Trading Volume, More Than Double the Trading Volume of OpenSea During the Same Period

Dec 2021-Looking Glass Labs Announces Strong Financial Results for the First Fiscal Quarter of 2022.

$5.7 Million of Total Comprehensive Income was Generated by the Company on Revenues of $6.5 Million for the Period Ended October 31, 2021

December 2021 – Looking Glass Labs is ready to monetize the Metaverse with 3D ready assets

Now, 3D Asset NFTs may not look like a thing yet but they are steadily gaining ground as Metaverse ecosystems continue to emerge and Web3 technologies are the basis for interactions within such ecosystems. LGL, the Canadian NFT architecture agency, has created new 3D assets for the popular NFT collections Gutter Cat Gang and Bored Ape Yacht Club. HERE

Tons More Press HERE

Most new listings, in fact, not many companies are ready to go to market in early stage development, while LGL is poised to possibly be an early industry leader.

Without further ado, I present my FOUR REASONS Looking Glass Labs (NEO:NFTX) Could Be Worth Putting On Your Watchlist

#1 NFT Industry went from $100 Million To $40 BILLION, In One Year

This Is Just The Beginning for NFTs & Looking Glass Labs, take a look at the growth projections below.

“Brooklyn, New York, Dec. 17, 2021 (GLOBE NEWSWIRE) — According to a new market research report published by Global Market Estimates, the Global Non-Fungible Tokens Market is projected to grow at a CAGR value of 185.0% from 2021 to 2026.” The full article is here.

Remember back in the day, when you received your Netflix videos in the mail? Look at where we are now! Just like Netflix had a booming start, so are the NFTs, but literally it is just the beginning.

Just back in 2020, the NFT market was $100 million, last year, 2021, $40 Billion! There are huge profit margins in the NFT space and incredible back end royalties in perpetuity. Take a look below at what the major outlets are saying. All Images found on their website, here

A non-fungible token by the artist Beeple sold at Christie’s for over $60 million, making it the most expensive NFT ever sold at auction. Click Here

A set of 101 non-fungible tokens, or NFTs, from the “Bored Ape Yacht Club” collection, which features images of various cartoon apes, sold for $24.4 million in an online sale at Sotheby’s auction house on Thursday, wildly surpassing estimates and offering further proof that the market for NFTs is surging once again. Click Here

William Quigley, a co-founder of stablecoin Tether and a pioneer in the cryptocurrency space, sees the metaverse as a huge economic force that’s going to change people’s lives significantly in coming years. Click Here

The biggest news media outlet is out there drumming up DEMAND, everyone on social media is drumming up demand, all of that equals, you guessed it, DEMAND!

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE

The cryptocurrency market is now worth more than $3 trillion, that is a lot of 00000s.

“The little more than a decade old market for digital assets has already roughly quadrupled from its 2020 year-end value, as investors have gotten more comfortable with established tokens such as Bitcoin and networks like Ethereum and Solana continue to upgrade and attract new functionality. Excitement about the possibilities of decentralized finance and non-fungible tokens is growing, and memecoins like Dogecoin and Shiba Inu continue to attract attention.” Here

In case you have been under a rock, LOOK AT BITCOIN!

Crypto currency is positioning itself as the new currency of the future! Looking Glass Labs is creating the ability to monetize the possible NFT boom via HOK.

#3 Looking Glass (NEO:NFTX) is generating Multiple, Perpetual revenue streams.

Lay Term translation for NFT/Crypto Jargon Below

Asset Design – House of Kibaa (HoK) if you remember is their digital agency, which is essentially a team of digital artists creating non-stop for the metaverse & NFT to be used as currency.

Exclusive Drops – Pretty self explanatory, but it is an attractive aspect of HOK.

Minting as a Service – There are several impressive market forecasts for just this revenue stream,

Royalties – If you have been following me there is only one thing I love more than a short squeeze for massive opportunities, continuity! That is revenue streams that run in perpetuity. Subscription-based models and royalty-based models producing recurring revenue in perpetuity, growth and more importantly VALUATIONS!

Merchandise Sales –

It is a revenue stream but not very exciting to me. Not that apparel is not exciting, they could make a significant amount of revenue per year with their incredible artists producing clothing that represents the youngsters. I guess what I’m trying to say is this, the first 4 revenue streams, individually, are enough to get me excited. They have all 4 under one corporation that I have the opportunity to be a part of via the stock exchange.

What do these 5 revenue streams look like over time?

Remember, when they add their revenue from this year, next year and so on and so forth, they are positioned to significantly increase their strong numbers above.

#4 People Lie, Numbers Don’t

If those numbers didn’t make you get excited, Looking Glass Labs numbers are equally as impressive. Take a look below.

First Drop Revenue – I write for tech all the time and I remember so many publicly traded companies with no revenue or foreseeable revenue trading massive volume. LGL doesn’t need a “what if” idea, they are already proving their worth.

Secondary Revenue monthly Growth – Moreover, they are producing multiple revenue streams which are also positive in financial terms.

Memberships Sold – This is no surprise, I love memberships, ie continuity, for profitability and valuations.

Membership Floor – Continuing the dialogue of continuity, monthly, semi-guaranteed revenue is the golden grail.

After a month of research in regards to Looking Glass Labs, I’m beyond excited and you should be too. Put it on your watchlist!

Let’s Recap The FOUR REASONS Looking Glass Labs Could Be The Most Explosive New Listing of 2022!

#1 NFTs, from $100 Million To $40 BILLION, In One Year 1

#2 Metaverse & Crypto is forecasted to exceed $2 TRILLION HERE 2

3 Looking Glass is generating Multiple, Perpetual revenue streams.

#4 People Lie, Numbers Don’t

Those were my FOUR REASONS Looking Glass Labs (NEO:NFTX) Could Be Worth Putting On Your Watchlist, I hope you enjoyed the research. Happy Trading and Remember, never try to catch a falling knife! This has been Alex and I bid you a good day.

- https://www.ft.com/content/e95f5ac2-0476-41f4-abd4-8a99faa7737d

- https://www.coindesk.com/business/2021/11/25/grayscale-says-metaverse-is-a-trillion-dollar-market-opportunity/

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, NFTX. Small Cap Exclusive has been hired by Looking Glass Labs for a period beginning on February 2, 2021 to publicly disseminate information about (NFTX) via website and email. We have been compensated $100,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

Exicure XCUR has been on fire lately, up almost 50% in 5 days.

Exicure XCUR has been on fire lately, up almost 50% in 5 days after a massive amount of volume being injected into this little well known stock. The stock has been crashing for the last 6 months. I have written a full report on XCUR that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Exicure XCUR has some very bad press, check it out “UPCOMING DEADLINE ALERT: The Schall Law Firm Encourages Investors in Exicure, Inc. with Losses of $100,000 to Contact the Firm” Before we get started, let’s review some basic information on this company.

Exicure XCUR Company Summary

Company Name: LimitExicure

Ticker: XCUR

Exchange: NASDAQ

Exicure, Inc. Company Summary

Exicure, Inc. is a development-stage biotechnology company developing therapeutics for neurology and rare genetic disorders based on its proprietary spherical nucleic acid (SNA™) technology. Exicure’s proprietary SNA architecture is designed to unlock the potential of therapeutic oligonucleotides in a wide range of cells and tissues. Exicure’s lead programs address neuroscience diseases and genetic disorders. Exicure is based in Chicago, IL.

SNA constructs overcome one of the most difficult obstacles to nucleic acid therapeutics: safe and effective delivery into cells and tissues. SNA constructs exhibit unparalleled transfection efficiency into numerous cell and tissue types, including the skin, without carriers or transfection agents.

SNA™ technology originated in the lab of Professor Chad A. Mirkin at the Northwestern University International Institute for Nanotechnology.

XCUR News

NEW YORK, NY / ACCESSWIRE / December 16, 2021 / Bronstein, Gewirtz & Grossman, LLC notifies investors that a class action lawsuit has been filed against Exicure, Inc. (“Exicure” or the “Company”) (NASDAQ:XCUR) and certain of its officers, on behalf of shareholders who purchased or otherwise acquired Exicure securities between March 11, 2021 and November 15, 2021, inclusive (the “Class Period”).

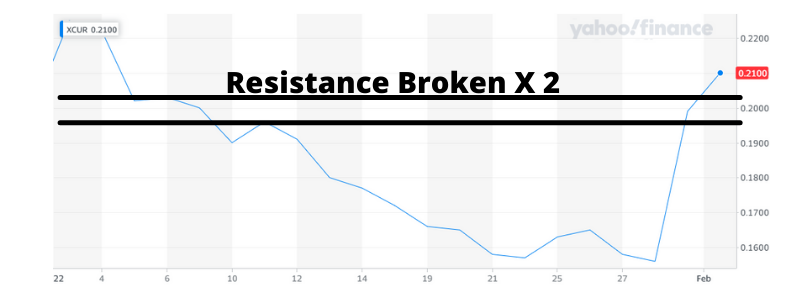

XCUR 1 Month Chart

XCUR Technical Analysis

Why stocks go up baffles me, but this one has broken two resistance points and looks strong and BULLISH. I think its worth putting on your watchlist.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

ProQR Therapeutics PRQR looking to bounce, like a basketball?

ProQR Therapeutics PRQR is up over 15% after due to a massive amount of volume being injected into this stock that has been crashing for the last few months. I have written a full report on PRQR that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

ProQR Therapeutics PRQR Company Summary

Company Name: ProQR Therapeutics N.V.

Ticker: PRQR

Exchange: NASDAQ

Website: www.proqr.com.

ProQR Therapeutics N.V. Company Summary

ProQR Therapeutics is dedicated to changing lives through the creation of transformative RNA therapies for the treatment of severe genetic rare diseases such as Leber congenital amaurosis 10, Usher syndrome and retinitis pigmentosa. Based on our unique proprietary RNA repair platform technologies we are growing our pipeline with patients and loved ones in mind.

LVGI News

Jan. 04, 2022

Announced that the last patient completed their last visit (Month 12) in the Phase 2/3 Illuminate trial of sepofarsen for CEP290-mediated Leber Congenital Amaurosis 10 (LCA10) due to the p.Cys998X mutation, also known as c.2991+1655A>G.

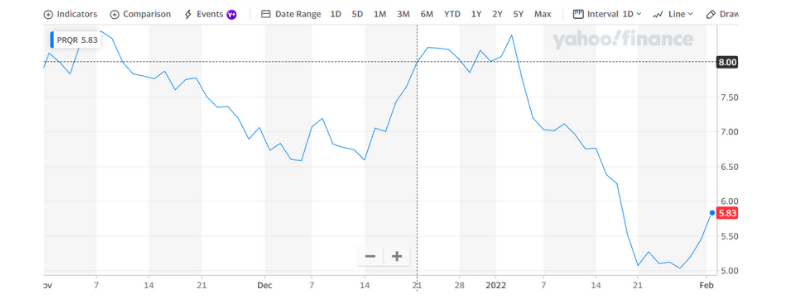

LVGI 1 Month Chart

PRQR Technical Analysis

The stock is looking solid on the 5 day and has broke through resistance. It has officially reversed it’s trend, I like it!

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Robinhood Markets HOOD official trend reversal, take a look!

Robinhood Markets HOOD is up almost 30% after great 4th QTR earning news and due to a massive amount of volume being injected into this trading platform that has been crashing since August. I have written a full report on HOOD that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Robinhood announced today, “Total net revenues for the quarter increased 14% to $363 million, compared with $318 million in the fourth quarter of 2020, and for the year increased 89% to $1.82 billion, compared with $959 million for the year ended December 31, 2020.” However, before we get started, let’s review some basic information on this company.

Robinhood Markets HOOD Company Summary

Company Name: Robinhood Markets, Inc

Ticker: HOOD

Exchange: NASDAQ

Website: https://robinhood.com/

Robinhood Markets, Inc Company Summary

Robinhood Markets is on a mission to democratize finance for all. With Robinhood, people can invest with no account minimums through Robinhood Financial, LLC, buy and sell crypto through Robinhood Crypto, LLC, and learn about investing through easy-to-understand educational content.

Robinhood intends to use its blog, Under the Hood, as a means of disclosing material information to the public in a broad, non-exclusionary manner for purposes of the SEC’s Regulation Fair Disclosure (Reg. FD). Under the Hood can be accessed at blog.robinhood.com and investors should routinely monitor that website, in addition to Robinhood’s press releases, SEC filings, and public conference calls and webcasts, as information posted on Robinhood’s blog could be deemed to be material information.

“Robinhood” and the Robinhood feather logo are registered trademarks of Robinhood Markets, Inc. All other names are trademarks and/or registered trademarks of their respective owners.

HOOD News

Jan 27th, 2022

Total net revenues for the quarter increased 14% to $363 million, compared with $318 million in the fourth quarter of 2020, and for the year increased 89% to $1.82 billion, compared with $959 million for the year ended December 31, 2020.

Dec. 31, 2021

Wolf Haldenstein Adler Freeman & Herz LLP announces that a federal securities class action lawsuit has been filed in the United States District Court for the Northern District of California on behalf of investors who purchased or otherwise acquired Robinhood Markets, Inc. (“Robinhood” or the “Company”) (NASDAQ: HOOD) common stock pursuant and/or traceable to the Registration Statement issued in connection with the Company’s July 2021 initial public offering (the “IPO” or “Offering”).

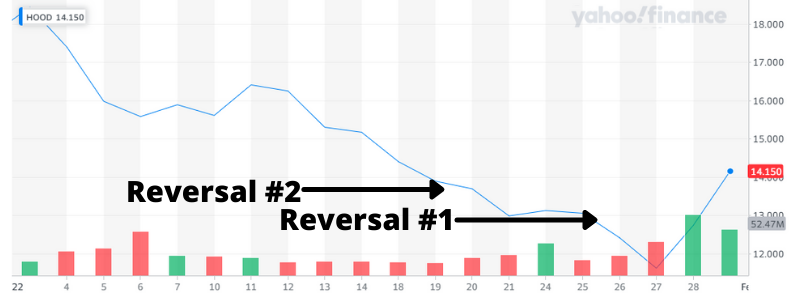

HOOD 3 Month Chart

HOOD Technical Analysis

The news of the class action lawsuit has sent HOOD tumbling. Could the financials reverse it’s trend?

The answer is yes, it has from a technical analysis. HOOD has broken through resistance #1 and resistance #2. WOW, this could take off. Remember it was trading at $70 not too long ago.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!