Kodak NYSE: KODK is a stallworth in American business but lately they have been struggling mightily. Could this be a reversal?

Company Name: Eastman Kodak Company

Ticker: NYSE: KODK

Exchange: NYSE

Website: https://www.kodak.com/en

Company Summary:

Kodak is a global technology company focused on print and advanced materials & chemicals. We provide industry-leading hardware, software, consumables and services primarily to customers in commercial print, packaging, publishing, manufacturing and entertainment.

We are committed to environmental stewardship and ongoing leadership in developing sustainable solutions. Our broad portfolio of superior products, responsive support and world-class R&D make Kodak solutions a smart investment for customers looking to improve their profitability and drive growth.

Why has it gone down?

Marketwatch recently wrote the following, “Some business executives have profited handsomely from the practice of earning “spring-loaded” stock options that take advantage of information not available to the public, but U.S. regulators on Monday announced plans to put a stop to it.

The Securities and Exchange Commission issued new guidance for companies on how to reflect the potential value of spring-loaded options when they disclose how much top executives actually earn.

Spring-loaded awards are a type of compensation in which a company grants stock options shortly before it announces market-moving information, such as an stronger-than-expected earnings release or disclosure of important transactions. The options have the potential to soar in value once the news is made public.”

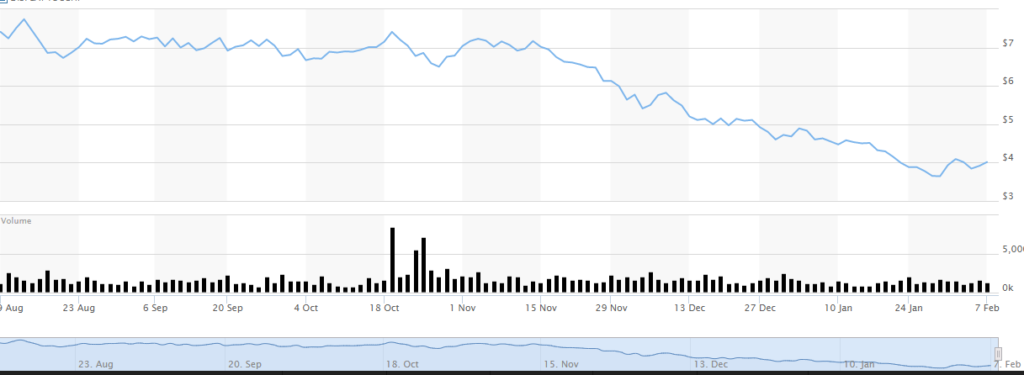

EKodak NYSE: KODK: KODK 6 month Chart

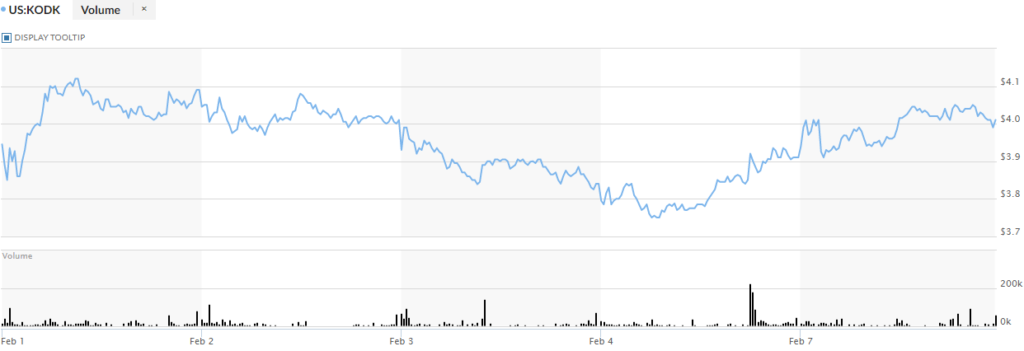

5 Day Chart

Eastman Kodak Company NYSE: KODK Technical Analysis:

Can Kodak NYSE: KODK stay above $4.00, and perhaps consolidate there after it’s little run and reversal? If so, that would be a decent signal. The other option is that it continues the slide it did at the end of today and trades in between $3.70 and $3.85 and consolidates there.

The other two options are: Bullish move or a continued bearish trend. A double confirmation of a reversal would be the stock sliding past $4.15 PPS. That would be a buy signal in my opinion.

Falling below $3.75 is a clear sign that KODK is continuing a bearish trend.