Is Abraxas Petroleum AXAS the best stock to buy? What is a Good Stock to buy?

Is AXAS the best stock to buy because it has been breaking it’s trend with large volume and a 48% change in PPS in 2 days. Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! AXAS Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over if AXAS is the best stock to buy? Below, is some of the basic information on this stock before we get in the technical analysis

Abraxas Petroleum Company Information

Company Name: Abraxas Petroleum Corp.

Ticker: AXAS

Exchange: OTC

Website: http://www.abraxaspetroleum.com/

Abraxas Petroleum Corp. Company Summary:

Abraxas Petroleum Corp. engages in the acquisition, exploration, development, and production of crude oil and natural gas. It focuses primarily on the development of conventional and unconventional resources in its primary operating areas in the Rocky Mountains, South Texas, Powder River Basin, and Permian Basin. The company was founded by Robert L.G. Watson in 1977 and is headquartered in San Antonio, TX.

Is AXAS and if it is the best stock to buy? Let’s look at the News.

Feb 28th

Abraxas Petroleum Corporation (“Abraxas” or the “Company”) (OTCQX:AXAS) today provided the following reserve and operational update. Note that all annual reserve comparisons stated below are for Delaware Basin assets only (all sold Bakken assets were removed from the December 31, 2020 totals). Highlights include:

- Total Proved PV-10 reserves grew 467% to $229 million at December 31, 2021 using SEC pricing

- Reserve Report captures the Company’s Delaware Basin West Texas assets only, post-sale of the Company’s Bakken assets, as previously reported

- Reserve Report doesn’t include additional geologic horizons being pursued by offset operators such as the Woodford/Meramec

- Company has approximately 11k net acres in the heart of the Southern Delaware Basin where it has successfully drilled 23 Wolfcamp/3rd Bone Springs horizontals across 5 distinct geologic benches.

- Company’s leasehold is entirely HBP and includes all depths/rights along with associated water infrastructure

AXAS 5 Day Chart

Abraxas Technical Analysis:

Let’s start off with the obvious, the news was incredible. So what is the answer to the question, is AXAS a good stock to buy? First things first, I’m not a registered broker so I can’t advise someone on whether to buy or not buy a stock. With that being said, I like the stock from a fundamental standpoint. Strong revenues and increases from last quarter.

However, I’m aware that there is more that goes into if a stock goes up than strong fundamentals. For instance, the technical set up at the current moment on the 5 day is looking suspect. I believe the stock will pull back and retrace from here, consolidate and then run again.

I hope I did a good job with my analysis of AXAS and if it is the best stock to buy?

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

ANPC the best stock to buy? Trending stock? Breakout stock?

ANPC the best stock to buy? Trending stock? Breakout stock? Is ANPC the best stock to buy stock because it has been breaking it’s trend with large volume and a 26% change in PPS in 5 days. Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! ANPC Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over if AXAS is the best stock to buy? Below, is some of the basic information on this stock before we get in the technical analysis

Abraxas Petroleum Company Information

Company Name: Abraxas PAnPac Bio-Medical Science Co.

Ticker: ANPC

Exchange: NASDAQ

Website: https://www.anpacbio.com/

AnPac Bio-Medical Science Co. Summary:

Anpac Bio-Medical Science Co. Ltd., is a biotechnology company. It engages in marketing and selling multi-cancer screening and detection test that uses patented cancer differentiation analysis, or CDA, technology and proprietary cancer-detection device or CDA device. The company was founded by Chris Chang Yu and He Yu in 2010 and is headquartered in Lishui, China. ANPC the best stock to buy? Trending stock? Breakout stock?

ANPC the best stock to buy? Let’s look at the News

Feb 03, 2022

Filed for a breakthrough device designation request for its cancer differentiation analysis (“CDA”) technology-based medical device; the company filed the request with the Food and Drug Administration (“FDA”) earlier this week. According to the announcement, the company’s novel CDA technology and medical device detects and analyzes biophysical signals in a blood sample to determine the risk level of more than 20 different types of cancers.AnPac Bio has collected more than 43,000 samples as the company has worked with hospitals and medical institutions in extensive retrospective and prospective clinical trials.

ANPC 5 Day Chart

Abraxas PAnPac Bio-Medical Trending Stock, Technical Analysis:

Great news was delivered with the Patent. The stock is down 88% on the 1 year coupled with the great news, I like it.

In the short term it could retrace a little more, so I would set my stop loss at $.75.

I hope I did a good job with my analysis of ANPC and if it is the best stock to buy?

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Flora Growth Corp. (OTC-FLGC) is the Bounce Play of 2022?

With the lowest production cost in the world, and revenues screaming higher Flora Growth Corp. This is exactly what you have been looking for. This burgeoning giant must get on the top of your watchlist right now…

Let’s take a look at 4 reasons why Flora should be on your HOT list today!

#1 Two research analysts have placed the value of Flora at almost 4X return! (here)

#2 Look at these wholesale distribution channels: Walmart, Macy’s, and many more!

#3 The chart is set up to breakout due to a reversal and volume spike, don’t miss out!

#4 NEWS – Acquisitions, Walmart and international distribution!

#1. Two research analysts have placed the value of Flora at almost 4X return!

It is rare to have such a gap between the current PPS and two stock analysts’ estimates, but we have that here with Flora.

As of 2/25/22 the PPS was $1.84 and the Argus report has a price target of $9.00.

We are 389% away from these estimates to be exact.

This industry is growing at an unparalleled pace. Sales for 2021 are estimated to finish at $31 billion, an increase of 41% over 2020. HERE

And yet, despite this positive sales growth, this whole industry slumped in the second half of 2021.

<<Want to find out the industry? CLICK HERE to find out more.>>

What other industries are sales up, revenues up, growth flourishing – stock prices down?

If you like golden opportunities continue to read! And Flora Growth Corp (NASDAQ: FLGC) is a perfect example.

In fact, not one, but two Wall Street analysts believe Flora could be unreasonably undervalued.

The source for the above information is HERE

The second research report by Argus Research has a value estimate of $9 per share.

The current PPS would provide traders a 389% Here

How did Argus research come up with this incredible estimation, take a look below!

- Flora Growth is well capitalized, with $18.8 million in cash on June 30, 2021, which was subsequently bolstered by $31.5 million in net proceeds raised from a secondary offering completed in November 2021. In addition, we expect an additional approximately $40 million from the exercise of warrants to enable Flora to execute on its strategic plan.

- We expect Flora to expand distribution to the U.S. over time and expect Flora to continue signing such supply agreements as its commercial harvest and export infrastructure takes hold. Flora’s commercial growth strategy is underpinned by three key initiatives: first, to develop a global supply chain that will allow it to move cultivated products around the world; second, to further expand its brand portfolio; and third, to attract talented employees that will lead the company through its next stage of growth.

- We believe that Flora is attractively valued relative to peers based on its low-cost structure, strong brand portfolio, and expanding global distribution. Based on our EV/revenue analysis, our fair value estimate for FLGC is $9 per share.

#2 Look at these wholesale distribution channels: Walmart, Macy’s, and many more!

Skincare & Cosmetics: Launched on Walmart.com and Coppel in Mexico, Shipped to Spain, received sustainability award at Cosmoprof.

Food & Beverage: Signed major deal with Tropi (largest F&B distributor in Colombia with 130,000+ points of distribution) + Tonino Lamborghini partnership.

Lifestyle & Apparel: Now selling on Macys.com.

<<Want to find out more, CLICK HERE>>

#3 The 1-year chart looks nuts! Check it out!

Even though Wall Street has overreacted and the PPS is undervalued by two stock analysts projections, the market always takes notice.

It may be a little delayed but it is efficient and takes notice of undervalued stocks.

That could be what just took place as you can see below.

FLGC 1 Year Chart

I love bounce plays! You know what I like more than bounce plays? When the street overreacts.

Opportunities, opportunities and yes, opportunities! We are trading at a 1 year low with potentially clear skies ahead.

Couple the low PPS with the price targets and the incredible news, well, maybe you’ll thank me later.

FLGC 5 Day Chart

Do you see the volume spikes? The market have have understood FLGC’s value at that position.

<<Want to find out more, CLICK HERE>>

#4 NEWS – Acquisitions, Walmart and international distribution!

2/25/22

Flora continues to strengthen its executive bench with the appointment of Jessie Casner as Chief Marketing Officer.

Ms.Casner joins the Company from the recently acquired Vessel brand, where she was Vice President of Sales and Marketing. The appointment of this position continues to strengthen Flora’s executive bench and leadership within the organization. Ms.Casner’s experience in brand marketing will support the rapid growth of Flora’s core CPG brands, including Vessel, Tonino Lamborghini, Mind Naturals, Stardog, among others.

“I’m excited to welcome Jessie Casner as our Chief Marketing Officer,” said Luis Merchan, CEO of Flora Growth. “This appointment is another example of our commitment to invest in human capital at all levels of the organization. Jessie’s expertise in go-to-market strategy and consumer marketing make her the right choice to guide our multi-national marketing campaign objectives for both Flora and our growing portfolio of brands.”

1/4/22

Flora has launched sales through Walmart.com and Coppel, a nationwide department store in Mexico. The launch includes 12 products from the Mind Naturals portfolio, initially on e-commerce with subsequent plans to sell in brick and mortar retail locations.

This launch expands upon last month’s initial orders for Mind Naturals to Mexico and Spain. Walmart is one of the leading retail chains in Central America, while Coppel has 1,253 stores in Mexico. It is estimated that the global market for canna-bis and its derivatives will generate sales of 102 billion dollars by 2026, and Mexico is expected to be one of the countries with the highest commercialization of CB-D products.

12/2/21

Flora Beauty division has received initial orders for its Mind Naturals and Awe CB-D skincare brands. These initial orders are for the Spanish and Mexican markets and will be exported in December of 2021. Evergreen CB-D has issued an initial purchase order for select Mind Naturals products for the Mexican market, while Amma Spain has issued an initial purchase order for both Mind Naturals and Awe products for the Spanish market.

11/15/21

Flora announced that it has closed the acquisition of Vessel Brand Inc. (“Vessel”). As set forth below, Flora has acquired Vessel for aggregate consideration of US$30M, consisting of a combination of cash and the issuance of Flora common shares.

- Acquisition provides Flora with an immediate foothold in the North American cannabis market by acquiring a rapidly growing company with trailing 12-months revenue of $6.6M and year-over-year growth of 90%

- Acquisition diversifies Flora’s premium brand portfolio through Vessel’s strong position in Vessel’s vertical

- Key Vessel team members will join the executive bench and guide the growth of Flora’s brand portfolio, with an initial focus on enhancing the U.S. marketing and sales strategies for the Stardog, Mind Naturals, and Ô (Awe) brands

Let’s review the 4 reasons why Flora should be on your HOT list today!

#1 Two research analysts have placed the potential value of Flora at almost 4X higher!

#2 Look at these wholesale distribution channels: Walmart, Macy’s, and many more!

#3 The 1-year chart looks nuts! Check it out!

#4 NEWS – Acquisitions, Walmart and international distribution!<<Want to find out more, CLICK HERE>>

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, FLGC. Small Cap Exclusive has been hired by TD Media for a period beginning on February 19, 2021 to publicly disseminate information about (FLGC) via website and email. We have been compensated $20,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

CULT Stock Price was predicted by Alexander Goldman, he has a new update inside.

CULT Stock Price is up almost 100% this month and famed stock picker Alexander Goldman called it. He has a brand new technical analysis below, take a look, you don’t want to miss it! Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇 Often Alex provides stock picks exceeding 100%, in fact almost monthly he does! Signup and find out just how good he is.

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! CULT Stock Price could? In fact it is almost up 100% this month.

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

CULT Food Science Corp. Company Information

Company Name: CULT Food Science Corp.

Ticker: CULT

Exchange: CSA

Website: https://www.cultfoodscience.com/

CULT Food Science Company Summary:

CULT an innovative investment platform with an exclusive focus on cellular agriculture that is advancing the development of novel technologies to provide a sustainable, environmental, and ethical solution to the global factory farming and aquaculture crises.

The current state of the food industry is a global issue, with ramifications reaching across borders and continents. It is affecting our environments, natural space, and climate on an unprecedented level.

While our core team is based in North America, we are operating on a global scale and supporting innovative companies around the world to help address these issues, blazing a path to a future of food security and climate stability.

CULT News

Feb. 23, 2022

Announced that it has completed an early-stage investment in De Novo Dairy (“De Novo“). The Company continues to broaden its exposure to a diversified and cell-based product and intellectual property (“IP“) pipeline through this net-new exposure to cell-based dairy. CULT joins other notable cellular agriculture (“CellAg“) capital allocators like Sustainable Food Ventures in helping accelerate De Novo’s commercialization and IP pursuits.

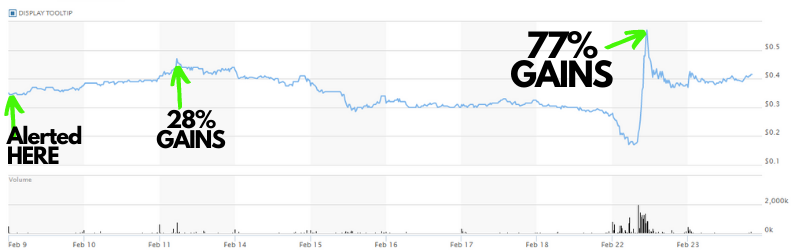

CULT 1 Month Chart

CULT Stock Price over the last month

On February 8th 2022 I stated, “The stock looks insanely good, it is BULLISH and I like it! It has been very methodical of late, big run, consolidate, big run consolidate. It appears it’s ready for another big RUN.” HERE is the article, check for yourself!

In three trading days my breakout stock alert CULT provided 28% gains to our subscribers! However, if our traders were patient there was tons of opportunities for double dips and swing trades.

Even if our traders set it and forgot about it, which I don’t recommend, they would be up 77%. In just 9 trading days, they could have turned $10k into $17,700!

So what’s next for CULT?

CULT 5 Day Chart

CULT Food Science Technical Analysis:

You can see from the 1 month and overall bullish trend. The 5 day also shows a bullish trend. Hence, I like the stock here! It is consolidating with a bullish lean and looks like it wants to test it’s high. $.30 is the support level, I would put a stop loss in at $.38 and sell above $.50-$.55 if it has trouble beating resistance. If it can glide by resistance this could provide 50% gains!

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

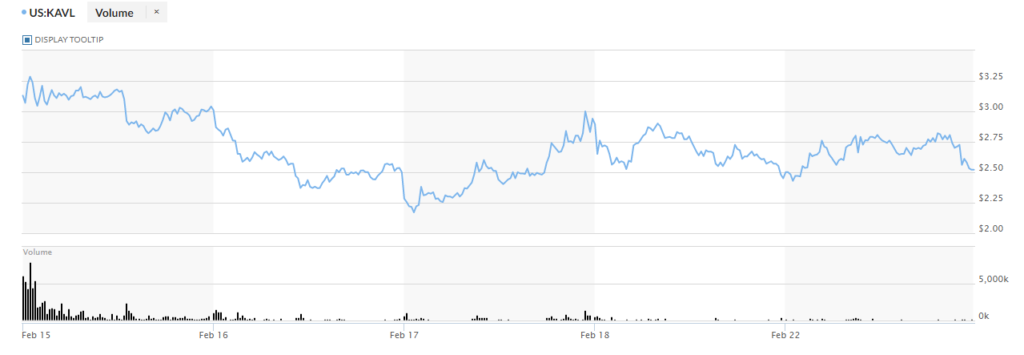

Kaival Brands Innovations KAVL Stock Price UPDATE

KAVL Stock Price has been breaking it’s trend with large volume and a 36% change in PPS in 2 days. Wondering why this stock took off and now is retracing, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! KAVL Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Kaival Brands Innovations Inc. Company Information

Company Name: Kaival Brands Innovations Group Inc.

Ticker: KAVL

Exchange: NASDAQ

Website: https://kaivalbrands.com/

Kaival Company Summary:

Kaival Brands Innovations Group, Inc. engages in the sale of e-cigarettes. It markets its products under the BIDI brand. The company was founded by Paul Moody in 1998 and is headquartered in Grant, FL.

KAVL Stock Price and how News affects it.

Feb. 18, 2022

Announced that it has received a letter dated February 17, 2022 from The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it has regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”).

KAVL 5 Day Chart

Kaival KAVL stock price Technical Analysis:

We are not so interested in the spike due to the news, I’m interested in has it consolidated? Is it ready to go up? I like this one, make sure to keep it above $2.50 and it should break $2.80 soon or I would cut my losses and get it out.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Netlist NLST Stock Price is consolidated and ready for a run?

NLST Stock Price has been trying to recover since it’s July high of almost $10. Wondering why this stock is having such a hard time and if it can break the overall trend? Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! NLST Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Netlist Inc. Company Information

Company Name: Netlist Inc.

Ticker: NLST

Exchange: OTC

Website: https://netlist.com/

Netlist Inc. Company Summary:

Netlist, Inc. engages in the design, manufacture and sale of memory subsystems for the computing and communications markets. Its products include storage class memory, non volatile memory, embedded flash, specialty dimms and NVME SSD. The company was founded by Jayesh Bhakta, Chun Ki Hong and Christopher Lopes in June 2000 and is headquartered in Irvine, CA.

NLST stock price is due to News?

Samsung lost its patent lawsuit against memory module firm Netlist in the US.

Netlist said on Thursday that the United States District Court for the Central District of California entered a judgment in favor of the firm against Samsung for material breaches of obligations under their joint development and license agreement.

NLST 5 Day Chart

NLST Stock Price Technical Analysis:

After looking at the one year chart it is very feasible that this news and chart could reverse the overall trend. The pps of $4.50 and $4.75 is important, if it can stay above those support levels, we are looking at a reversal with a 100% possible gains back to the 52 week high.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Tokens.com SMURF stock price is on the rise, has it reversed it’s bearish trend?

SMURF stock price has been breaking it’s trend, or did it, with large volume and a 16% change in PPS in one trading day. It has produced a double reversal with two clear breakouts but does that always mean it is a safe trade? Before we go over that question, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! SMURF Stock Price could? Has it truly reversed it’s trend?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Tokens.com Corp. Company Information

Company Name: Tokens.com Corp.

Ticker: SMURF

Exchange: OTC

Website: https://www.tokens.com/

Tokens Company Summary:

Tokens.com Corp. is a blockchain technology company that provides transaction processing and validation services for various digital assets using proof-of-stake or staking technology. It develops Decentralized Finance (DeFi) applications that provide automated and transparent financial services, such as borrowing and lending; and Non-Fungible Token (NFT) platforms that redefine how art, gaming, music, and collectibles are created, valued, and traded. The company was founded on April 17, 1998 and is headquartered in Toronto, Canada.

SMURF stock price, is it affected by the News

Feb. 22nd, 2022

Announced that its subsidiary, Metaverse Group, has signed a letter of intent to acquire 20% ownership interest in Metaverse Architects. In addition, Metaverse Group will appoint a representative to the board of directors of Metaverse Architects. The transaction is expected to close in March.

SMURF 5 Day Chart

Tokens SMURF stock price Technical Analysis:

The technicals look neutral to me, maybe a tinge of bullish. The news is, well, news. Nothing to jump up and down about but good enough to prop it up today and reverse the bearish trend. I don’t the stock. It will go down.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Envirotech Vehicles EVTV Stock Price | 100% gains lately, is this it?

EVTV Stock Price has been breaking it’s trend with large volume and a 97% change in PPS in 4 days. Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! EVTV Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Envirotech Vehicles Inc. Company Information

Company Name: Envirotech Vehicles Inc.

Ticker: EVTV

Exchange: OTC

Website: https://evtvusa.com/

Envirotech Inc. Company Summary:

Envirotech Vehicles, Inc. engages in the design, manufacture, and installation of zero-emission electric drivetrain systems for fleet vehicles. Its products and services include zero-emission vehicles and chassis; e-trikes; and Neighborhood Electric Vehicles that are enclosed vehicles with seatbelts, climate control, and fold-down rear seats. The company was founded by Edward Riggs Monfort on August 12, 2012 and is headquartered in Corona, CA.

EVTV stock price, did the News affect it?

Feb 22, 2022

Announced Osceola, Arkansas as the site of its previously announced state-of-the-art manufacturing facility. The Company has purchased an approximately 580,000 square foot facility, located at 1425 Ohlendorf Road, and hiring for the facility will commence immediately. The manufacturing facility is expected to create more than 800 jobs as well as additional indirect jobs in Mississippi County.

EVTV 5 Day Chart

Envirotech Technical Analysis:

Just like Covid-19, we were all waiting for a very long time to “flatten” the curve, it has happened here. Be aware, this stock will either consolidate or go bearish next, wait for confirmation.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]