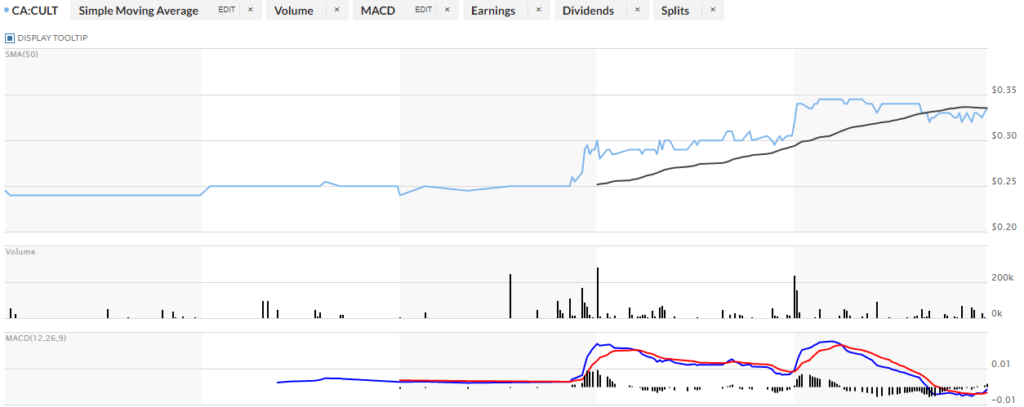

Cult Food CA:CULT is up almost 40%, calm before the storm?

Cult Food CA:CULT is looking strong as it reverses it’s bearish trend for a bullish one, look out! It is already up over 40% and doesn’t look like there will be a stop anytime soon! Before we get started, sign op for our newsletter below, it’s FREE and we are really good!

Company Snapshot:

Company Name: CULT Food Science Corp.

Ticker: CA.CULT

Exchange: Canadian Securities Exchange

Website: https://www.cultfoodscience.com/

Company Summary:

CULT Food Science is an innovative platform advancing the future of food with an exclusive focus on cultivated meat, cultured dairy and cell based foods.

The first-of-its-kind in North America, CULT Food Science provides investors with unprecedented exposure to the most innovative startup, private and early stage cultivated meat, cultured dairy and cell based foods companies around the world.

Latest news for Cult Food

Feb. 7, 2022

Cult Food CA:CULT Announced it has again diversified its cell-based food portfolio via a strategic investment into the leading cultured chocolate manufacturer, California Cultured Inc. (“California Cultured“). Based in Davis, California, California Cultured uses cell culture technology to produce cocoa products like cocoa powder, chocolate, and cocoa butter with the goal of creating sustainable and ethical chocolate for consumption around the world.

5 Day Chart

Technical Analysis:

The stock looks insanely good, it is BULLISH and I like it! It has been very methodical of late, big run, consolidate, big run consolidate. It appears it’s ready for another big RUN.

[thrive_leads id=’13642′]

SpotLite360 CA:LITE is looking like it could take off, it’s up 100%!

SpotLite 360 CA:LITE is looking strong as it reverses it’s bearish trend for a bullish one, look out! It is already up over 100% and doesn’t look like there will be a stop anytime soon! Before we get started, sign op for our newsletter below, it’s FREE and we are really good!

Company Snapshot:

Company Name: SpotLite IOT Solutions, Inc.

Ticker: CA.LITE

Exchange: Canadian Securities Exchange

Website: https://www.spotlite360.com/

Company Summary:

SpotLite360 CA:LITE is a logistics technology developer unlocking value, opportunities, and efficiencies for all participants in a supply chain. The company endeavors to set new standards of transparency, integrity, and sustainability in the pharmaceutical, healthcare, and agriculture industries. Its flagship SaaS solution has been engineered to seamlessly track the movement of a product by integrating with systems of all major stakeholders in a supply chain ranging from the raw materials to the hands of the end consumer. Spotlite360 Technologies was founded on September 23, 2014 and is headquartered in Vancouver, Canada.

Latest news for Spotlite360

Feb. 03, 2022

Entered into an agreement with Control Union (“Control Union”) in which the parties will produce, develop, market and deliver an exclusive global hemp supply chain certification. The initial certification will leverage partnerships with seed genetic companies, hemp farmers and hemp extraction/processing companies to develop a seed, to product, to consumer supply chain best practices. Control Union, a Peterson Control Union Company, will help author the standard and will audit companies against this standard to guarantee consistent product quality, chain of custody, proof of origin, environmentally sound practices, sustainable sourcing and prove of ESG (“Environmental, Social, Governance”) initiatives. The standard will leverage SpotLite360 Technologies and its unique supply chain focused tracing and tracking capabilities, leveraging RFID and IoT (“Internet of Things”) technologies to ensure real time data and visibility throughout the entire partner ecosystem.

5 Day Chart

Technical Analysis:

The stock looks insanely good, it is BULLISH and I like it! That was easy and quick

Petros PTPI bounce play alert–

Petros PTPI is possibly about to explode again as the short position increases as PPS is ticking up. Pay attention to PTPI as this stock may skyrocket

Petros Pharma PTPI company summary

Company Name: Petros Pharmaceuticals, Inc.

Ticker: (PTPI)

Exchange: NASDAQ

Website: https://www.petrospharma.com/

Petros PTPI Company Summary:

Petros Pharmaceuticals is committed to the goal of becoming a world-leading specialized men’s health company by identifying, developing, acquiring, and commercializing innovative therapeutics for men’s health issues, including, but not limited to, erectile dysfunction, endothelial dysfunction, psychosexual and psychosocial ailments, Peyronie’s disease, hormone health, and substance use disorders.

Why is it down?

The NEWS:

Petros PTPI released incredible news that is found below late in 2021.

Petros reported positive over-the-counter (OTC) draft label comprehension study results for its erectile dysfunction (ED) Drug STENDRA® (avanafil). This Pivotal Label Comprehension Study was designed to assess comprehension of a draft STENDRA® Drug Facts Label intended for OTC use.

What did the say, “The label comprehension study is a key component of our plans to help expand access for STENDRA beyond the prescription model, and to make

The first “potentially the first prescription-grade ED medication to become available over-the-counter in the United States.” EVER?!?

PTPI 5 Day Chart

PTPI 5 Day Analysis

This stock is fully consolidated so I expect the moment they issue positive news, it will skyrocket.

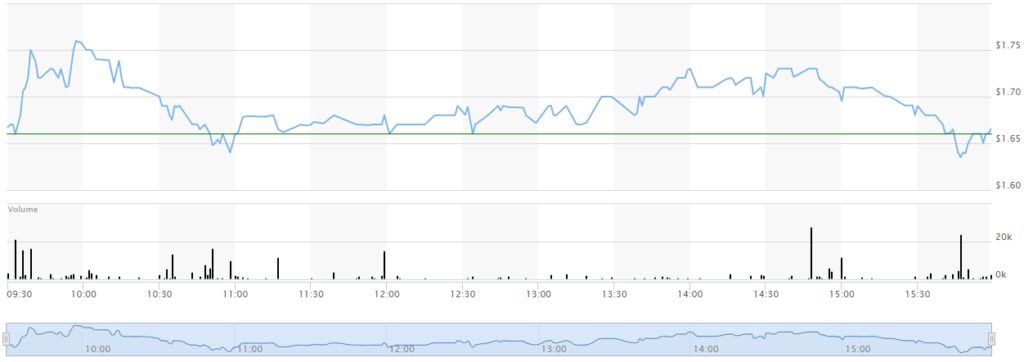

PTPI 1 Day Chart

1 Day Analysis

You can clearly see thin the one day that there is a slight bearish trend. Get ready traders because I’ve been following PTPI for a while and I believe it is getting ready for another move as long as the stock has good news attached to it to get it going.

Kodak NYSE: KODK UPDATE: KODK outlook

Kodak NYSE: KODK is a stallworth in American business but lately they have been struggling mightily. Could this be a reversal?

Company Name: Eastman Kodak Company

Ticker: NYSE: KODK

Exchange: NYSE

Website: https://www.kodak.com/en

Company Summary:

Kodak is a global technology company focused on print and advanced materials & chemicals. We provide industry-leading hardware, software, consumables and services primarily to customers in commercial print, packaging, publishing, manufacturing and entertainment.

We are committed to environmental stewardship and ongoing leadership in developing sustainable solutions. Our broad portfolio of superior products, responsive support and world-class R&D make Kodak solutions a smart investment for customers looking to improve their profitability and drive growth.

Why has it gone down?

Marketwatch recently wrote the following, “Some business executives have profited handsomely from the practice of earning “spring-loaded” stock options that take advantage of information not available to the public, but U.S. regulators on Monday announced plans to put a stop to it.

The Securities and Exchange Commission issued new guidance for companies on how to reflect the potential value of spring-loaded options when they disclose how much top executives actually earn.

Spring-loaded awards are a type of compensation in which a company grants stock options shortly before it announces market-moving information, such as an stronger-than-expected earnings release or disclosure of important transactions. The options have the potential to soar in value once the news is made public.”

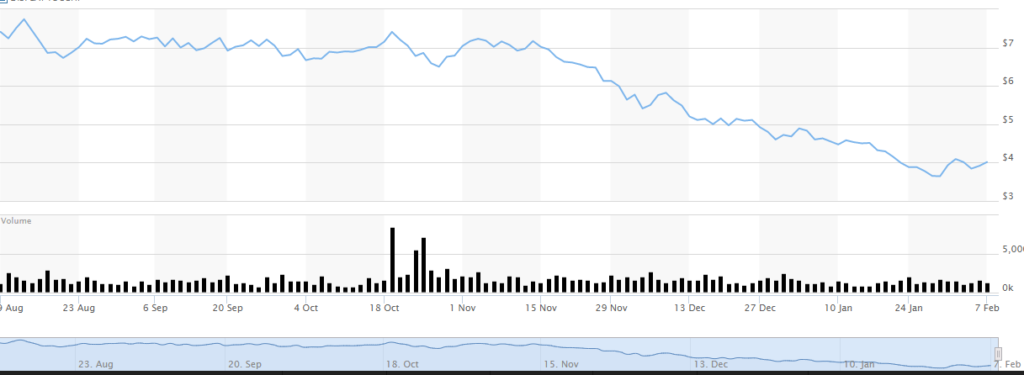

EKodak NYSE: KODK: KODK 6 month Chart

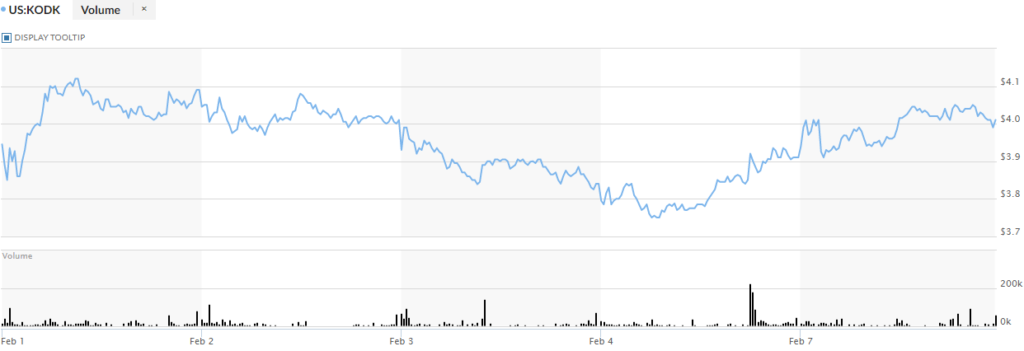

5 Day Chart

Eastman Kodak Company NYSE: KODK Technical Analysis:

Can Kodak NYSE: KODK stay above $4.00, and perhaps consolidate there after it’s little run and reversal? If so, that would be a decent signal. The other option is that it continues the slide it did at the end of today and trades in between $3.70 and $3.85 and consolidates there.

The other two options are: Bullish move or a continued bearish trend. A double confirmation of a reversal would be the stock sliding past $4.15 PPS. That would be a buy signal in my opinion.

Falling below $3.75 is a clear sign that KODK is continuing a bearish trend.