Freeline Therapeutics FRLN report

Freeline Therapeutics Holdings plc (FRLN) is going down down down but is the there a reversal coming soon?

Freeline Therapeutics FRLN Company Summary

Company Name: Freeline Therapeutics Holdings plc

Ticker: FRLN

Exchange: NASDAQ

Website: https://www.freeline.life/

Freeline Therapeutics FRLN Company Summary

Freeline is a clinical-stage biotechnology company developing transformative adeno-associated virus (AAV) vector-mediated systemic gene therapies. The Company is dedicated to improving patient lives through innovative, one-time treatments that provide functional cures for inherited systemic debilitating diseases.

Freeline uses its proprietary, rationally designed AAV vector, along with novel promoters and transgenes, to deliver a functional copy of a therapeutic gene into human liver cells, thereby expressing a persistent functional level of the missing or dysfunctional protein into the patient’s bloodstream.

The Company’s integrated gene therapy platform includes in-house capabilities in research, clinical development, manufacturing, and commercialization. The Company has clinical programs in hemophilia B, Fabry disease, and Gaucher disease Type 1. Freeline is headquartered in the UK and has operations in Germany and the US.

Freeline Therapeutics FRLN News

Jan. 06, 2022

Announced that the U.S. Food and Drug Administration (FDA) has cleared its Investigational New Drug (IND) application for FLT201 as an investigational gene therapy for the treatment of Gaucher disease Type 1.

“The FDA clearance of this IND is an important milestone for FLT201, which is the first AAV-mediated gene therapy for patients with Gaucher disease Type 1 in the clinic,” said Michael Parini, Chief Executive Officer of Freeline. “Our FLT201 program harnesses our unique scientific platform capabilities – our highly potent, proprietary AAVS3 capsid, robust CMC and pre-clinical data across all our programs, and our advanced protein engineering capabilities – to develop a potentially transformative treatment for patients suffering from Gaucher disease. The entry of our third program into the clinic is important validation of the advantage of Freeline’s portfolio approach to development.”

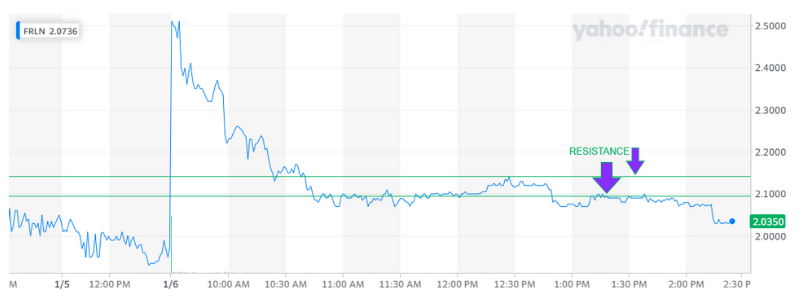

Freeline Therapeutics FRLN Stock Chart

FRLN Analysis

There is resistance at $2.10 and $2.15 and this stock will continue to go down unless it can correct and breakout of the two resistance points. The news is great, so I expect a consolidation soon and a correction. Make sure to keep this on your radar.

China Xiangtai Food PLIN Bottom Play

China Xiangtai Food PLIN is poised for a possible breakout, take a look at the summary below.

China Xiangtai Food Co., Ltd. (PLIN) Summary

Company Name: China Xiangtai Food Co., Ltd

Ticker: PLIN

Exchange: NASDAQ

Website: https://irplin.com.

China Xiangtai Food Co., Ltd. (PLIN) Summary

China Xiangtai Food Co., Ltd., engages in agricultural business. The Company is actively deploying emerging technologies including crypto asset mining and blockchain technologies with diversified expansion strategy. The current operations are in the United States, Canada and China.

China Xiangtai News

Jan. 6, 2022

Entered into a purchase agreement (the “Agreement”) with a global Bitcoin mining hardware company to purchase 686 spot Bitcoin miners that are worth US$6 million. The top-tier newly manufactured miner with a hash rate of 92 TH/s are expected to ramp up the hash rate of the Company’s miner fleet by over 63,000 TH/s.

Dec. 20, 2021

Announced that it has launched its U.S. operation with the establishment of its U.S. headquarter office in the prestigious Seagram Building in New York City. PLIN’s establishment of the New York office marks an important milestone within Company’s global expansion strategy as a U.S. listed company.

The U.S. operation will be led by its senior executive team in the U.S.. This strategic move is to set the foundation for the Company’s diversified growth initiative within the U.S., as well as to demonstrate the management team’s ambition and determination of creating long term value to shareholders and investors.

PLIN 1 Day Chart

PLIN Technical Analysis

$1.35 is the PPS traders should be looking for it to beat. I like the news, crypto is hot and the stock is going to run, it’s just a matter of time. Put it on your watchlist, this is a potential XXX% gainer!

Kaival Brands KAVL ready to breakout?

Kaival Brands KAVL has been in a bearish trend and it is possible that there has been a reversal. Take a look at this chart.

Kaival Brands KAVL Company Summary

Company Name: Kaival Brands Innovations Group, Inc.

Ticker: KAVL

Exchange: NASDAQ

Website: www.ir.kaivalbrands.com.

Kaival Brands Company Summary:

Based in Grant, Florida, Kaival Brands is a company focused on growing and incubating innovative and profitable products into mature and dominant brands in their respective markets.

Our vision is to develop internally, acquire, own, or exclusively distribute these innovative products and grow each into dominant market-share brands with superior quality and recognizable innovation. Kaival Brands is the exclusive global distributor of all products manufactured by Bidi Vapor.

KAVL News

Dec. 14, 2021

Announced today that 80% of adult participants in a recent survey of e-cigarette users and cigarette smokers in the United Kingdom (“U.K.”) preferred the BIDI® Stick over their current options.

Dec. 6, 2021

Announced that it has partnered with Koupon to create an electronic engagement program involving Koupon’s digital promotion platform. The partnership will offer customers who purchase the BIDI® Stick—a premium electronic cigarette—digital opportunities based on their purchases.

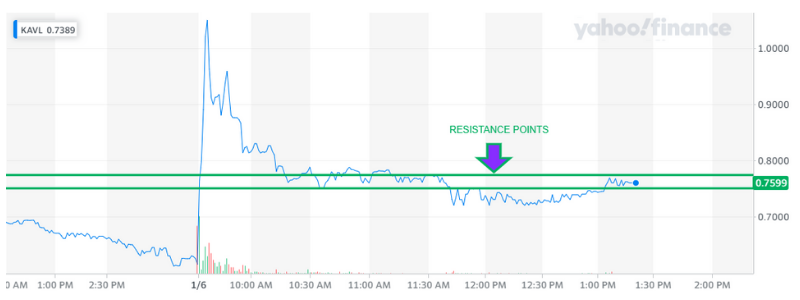

KAVL 1 Day Chart

Kaival Brands Innovations Group, Inc. (KAVL) analysis

This stock is trying it’s best to break the second level of resistance and it should move once it does. Keep an eye on the $.78 PPS, it is a resistance point that is important!

LM Funding America LMFA ready?

LM Funding America LMFA has been bearish for almost a month and I believe it is almost ready to reverse it’s trend, stay tuned! To review the bird’s eye view, keep on reading.

LM Funding America LMFA Company Summary

Company Name: LM Funding America, Inc.

Ticker: LMFA

Exchange: NASDAQ

Website: https://lmfunding.com/

LM Company Summary:

LM Funding America LMFA, together with its subsidiaries, is a technology-based specialty finance company that provides funding to nonprofit community associations (Associations) primarily located in the state of Florida, as well as in the states of Washington, Colorado and Illinois, by funding a certain portion of the associations’ rights to delinquent accounts that are selected by the Associations arising from unpaid Association assessments.

The Company has also announced that it is entering the cryptocurrency mining business through a new subsidiary, US Digital Mining and Hosting Co., LLC.

What was the last news for LMFA?

Oct. 19, 2021

Announced the closing of its previously announced underwritten public offering of 6,315,780 shares of its common stock and warrants to purchase up to 6,315,780 shares of the Company’s common stock. Each share of common stock was sold in a unit together with one common warrant at a public offering price of $4.75 per unit, for gross proceeds of approximately $30 million, before deducting underwriting discounts and offering expenses.

The common warrants have an exercise price of $5.00 per share of common stock, are immediately exercisable and will expire five years from the date of issuance. In addition, LM Funding has granted the underwriters a 45-day option to purchase up to an additional 947,367 shares of common stock and/or common warrants to purchase up to 947,367 shares of common stock, at the public offering price less discounts and commissions, of which Maxim Group LLC has exercised its option to purchase an additional 947,367 warrants.

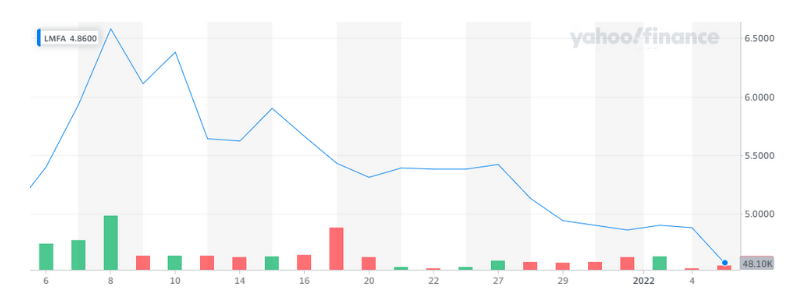

LMFA 1 Month Chart

LMFA 1 Day Chart

LM Funding Technical Analysis

This stock has been falling like a tree in British Columbia Canada, for a long time, almost a month. What comes up must comes down and this has come down, so I’m looking for a bounce soon.

It reversed it’s bearish trend yesterday but it may be a head fake. Make sure you always wait for a double confirmation before considering investing. The second reversal point is $4.60. As a reminder, a second reversal is not a guarantee of a bullish move, it is a signal. Trade carefully always and with stop losses.