Wellfield TSXV-WFLD announced massive news after the IPO which made it skyrocket. Famed stock picker, Alexander Goldman’s, much anticipated follow-up technical analysis below.

Company Snapshot

Company Name: Wellfield

Ticker: WFLD.V

Exchange: TSXV

Website: https://wellfield.io/ (Crypto Experts, highly recommend, too granular for a typical investor)

Investor Deck: Here (Crypto Experts, highly recommend, too granular for a typical investor)

Industry: Blockchain – Decentralized Finance

Company Summary: Wellfield Technologies develops hardcore technology that gives blockchain the power to unlock the future of finance. WFLD is unique among public company opportunities because they have built decentralized smart contracts and protocols on the Etherum and Bitcoin blockchainsand also user friendly financial applications that will bring decentralized finance (DeFi) mainstream.

[thrive_leads id=’9849′]

Top FOUR Reasons Why Wellfield TSXV-WFLD could become a Juggernaut with Massive Upside!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION#

#2 IPOs can be massive for tech US IPOS have already totaled $171 billion

#3 Wellfield understands the essence of crypto, deregulation

#4 Wellfield’s management team and R&D talented and impressive.

Before jumping into the main talking points, let’s look at the chart & the exciting news they have been releasing.

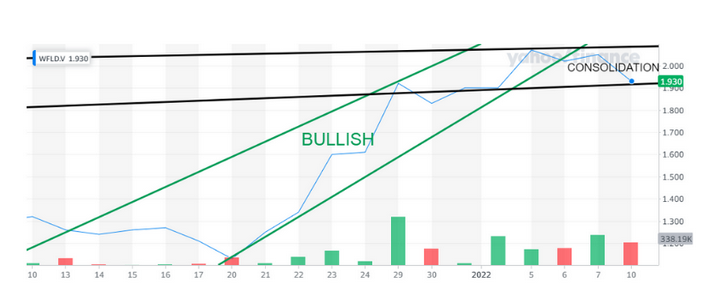

WFLD 1 Month CHART LOOKS FANTASTIC!

WFLD 1 Day CHART, a clear head and shoulders indicating a reversal, Pay Attention!

Technical Summary:

I am so excited for our subscribers, almost 100% gains in 10 trading days! Congratulations on the big win. I originally brought you this stock back on December 17th in this full report HERE. Since then almost 100% GAINS, not too shabby but given this company’s potential and low free trading float I believe WFLD is just getting started.

Take a look at the 1 month chart, clear bullish trend and 4 days of consolidation with a bearish move today and a recovery. Very exciting chart that appears to be ready to explode again. Get ready traders this could be the winner of the year!

Wellfield WFLD ran from December 20th until just yesterday, January 9th 2022. That is an incredible run and we have been all waiting for a slight pull-back then consolidation and I think we got it today. The 1 day reveals a bearish move towards the end of the day but you see a clear head and shoulders reversal indicating the bearish move was completed.

This stock is exciting and I believe could be poised for an incredible run. Don’t hesitate, put it on your watchlist today.

Before jumping into the top 4 reasons, let’s review the amazing news that has been released since the IPO.

Jan. 6, 2022 – Wellfield Outlines 2022 Focus

Wellfield Outlines 2022 and put the foundation in place for rapid expansion during 2022 – a business combination that formed Wellfield was successfully completed, which resulted in the operation of two brands: MoneyClip and Seamless. Together, these brands build bridges from traditional finance to DeFi and set the foundation for DeFi services for all.

- Introducing solutions that address the following: make bitcoin compatible with DeFi; enable decentralized cross-blockchain trading; permit existing DeFi liquidity providers to scale; and empower non-participating institutions to put capital to work within familiar risk frameworks.

- Plans to begin executing its multi-year project to integrate new blockchain infrastructure into the MoneyClip app, as it becomes available, to provide consumers with access to a full range of DeFi and traditional finance services.

Dec. 29, 2021 – Amir Shpilka to the Company’s advisory board

Announced that it has named Amir Shpilka, a globally recognized professor and researcher, as the third member of the Company’s advisory board. This follows the appointments of Global Payments and Fintech Leader William Keliehor and Global Financial Leader, Professor Tamir Agmon.

- Amir Shpilka is a globally recognized professor and researcher in the field of theoretical computer science. His main research focus is on computational complexity theory, algebraic complexity, and coding theory.

- Currently, Prof. Shpilka is a faculty member at the Blavatnik School of Computer Science, at Tel Aviv University, where he previously served as the head of the Computer Science Department.

- Professor Shpilka has been a significant contributor to Wellfield’s blockchain technology, almost since inception, and he now joins the Advisory Board as the Company begins to commercialize its IP.

Dec. 24, 2021 – Signed retail partners

Announced that its wholly-owned subsidiary, MoneyClip Inc. has launched an intensive engagement program, focused on growing its user base and signing retail partners as it prepares for the introduction of additional functionality through 2022.

- The Company has concluded its initial period of rigorous testing in partnership with early users of the App and will be launching an upgraded user interface and new connectivity features in Q1 2022, to support enhanced usability, brand awareness and scalability as new blockchain infrastructure is integrated over the next 12 months.

- Wellfield’s vision for the MoneyClip app (“MoneyClip” or the “App”), is to build it into the ultimate everyday financial application powered by blockchain, giving consumers easy access to, and greater control over their money by harnessing the full value and flexibility offered by decentralized finance (“DeFi”).

- The Company has also initiated an engagement program that is dually focused on the expansion of the App’s user base and its evolution from a peer-to-peer (P2P) payment app to a broader financial app, powered by blockchain infrastructure.

Dec. 9, 2021- WFLD named Tamir Agmon as the second member of the board

Announced that it has named Tamir Agmon, a renowned professor, researcher and global financial consultant, as the second member of the Company’s advisory board. This follows the appointment of Global Payments and Fintech Leader William Keliehor, as announced on December 3, 2021.

- Professor Agmon is a globally recognized researcher in the field of Decentralized Finance (DeFi) and has authored several research papers on the role of blockchain technology and innovative protocols in the world of finance.

- Currently, Professor Agmon is a Professor of Finance (Emeritus) at the Faculty of Management at Tel Aviv University and Visiting Professor of Finance at the University of Gothenburg (Sweden). He graduated with a Ph.D. in Finance from the University of Chicago and has held visiting appointments at MIT, and the University of Southern California.

- Professor Agmon has served as a director on the Boards of several companies both in the financial and industrial sectors in Israel, including one of the country’s largest insurers and has provided financial consulting services to leading companies in Israel, the U.S. and the EU.

Bird’s Eye View of Wellfield:

Before we take a look at Wellfield, let’s review the backbone, dare I say, the huge bet on a new disruptive global finance mechanism, blockchain. Most people, unless you’ve been living under a rock, have heard of blockchain or cryptocurrency, which trades on the blockchain.

Blockchain has the potential to disrupt global finance and change the way we do banking forever, but just like the internet in its early days, blockchain’s capacity and performance are currently limited and the applications built on it aren’t relevant to most people.

Wellfield has developed critical technology that increases blockchains potential and makes it relevant to our everyday financial lives, let’s take a look!

What the heck do they do?

This is difficult because it is the new frontier. Imagine, it is the 6th of August 1991 and someone is describing the internet, Google and smartphones; you would be lost! We will try to do our best to explain the true MASSIVE value of Wellfield. I’m going to follow the old adage, Keep It SImple Stupid, K.I.S.S.!

Wellfield does 2 things:

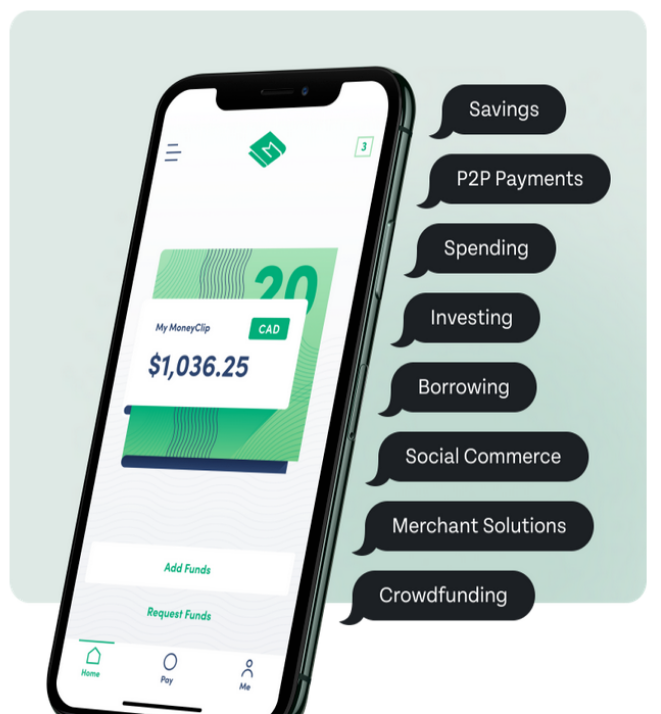

#1 Blockchain Applications (apps) – MoneyClip

#2 Blockchain Protocols – Seamless

#1 Applications (apps) – MoneyClip

MoneyClip is truly the ultimate cryptocurrency and everyday financetrading wallet, it links your bank to blockchain and gives you regulated access to the world’s best DeFi solutions. Above is the Wellfield jargon explanation to the power of their app. Although it is eloquent and chalked full of jargon, the real question is, what does all that mean?

We will do our best to explain their life-changing technology, but it is cutting edge technology that is over our head.

Here goes, nobody likes jumping from app to app, so we’re very excited about the all-in-one solution for savings, borrowing, merchant solutions, investing and so much more. It’s truly innovative even without the whole deregulation of crypto currency. So they go and develop this innovative application to operate on the blockchain so individuals and the government can’t be poking around in your business. It’s truly permissionless.

It’s kind of like, one app to rule them all. Sorry, for the Lord of the Rings reference, we couldn’t resist!

Their website is incredible, check it out here, maybe download it.

Top 3 reasons we love this App!#1 ControlThey promote “No hidden fees” or “recurring payments”, I don’t know about you but we’re big fans of that. #2 SimplicityYou can load digital cash on the go, make payments or send money from your phone, and easily request payments from individuals or groups. Earn high amounts on your balances without locking it into a GIC or buying an investment.#3 Privacy (our favorite)Well it’s not a conspiracy theory anymore, the governments around the world are tracking us. Moneyclip allows you to spend in person and online without leaving trails of personal data.

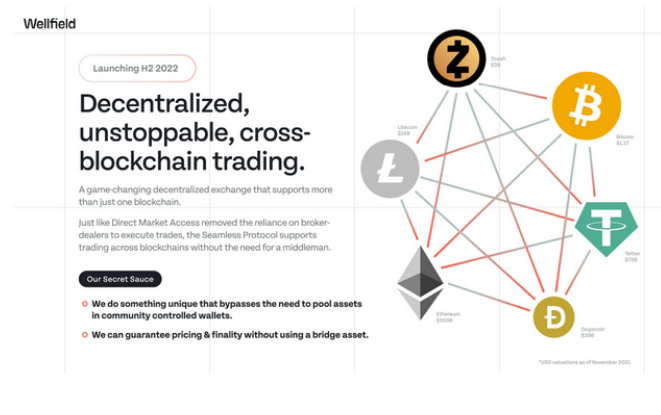

#2 Protocols (smart contracts) – Seamless

Wellfield touts that Seamless is “An ecosystem of protocols that removes the need for intermediaries.”

Well… Again, lots of sophisticated words by undoubtedly someone more intelligent than us, so we’re going to attempt to break down this cutting edge technology.

DeFi (Decentralized Finance) is not yet truly decentralized. Essentially, the whole mantra of crypto is built around decentralization. Meaning, we don’t want governments or five families to run the world banking system. So, crypto was born. Pretty cool in our opinion and many others agree with us, it’s the talk of the town!

Wellfield states, “With Seamless protocols, we accelerate the evolution of the internet”t” of money.

We read this to mean, the internet was built as a decentralizing and empowering technology creating a world where information and power is decentralized and delivered to the common person. That has not been actualized because DeFi is still missing critical infrastructure and this missing infrastructure is exactly why exchanges like Coinbase and Binance exist and are so popular – today users have no other option that to hand over control of their cryptocurrency and rely on these companies to trade and earn interest because blockchain doesn’t have the infrastructure to provide these services without an intermediary yet., but Seamless has literally built this infrastructure and is accelerating the evolution of DeFi where soon trading cryptocurrency and earning yeild without needing an exchange will be aspeed up that reality.

And this isn’t technology that anyone can build. Only teams with heavy investment into research and bleeding expertise in cryptography and complexity and other computer science fields could begin to try and build what Seamless has built. Seamless has a strong research team and advisors who are PhDs at world leading universities like Amir Shpilka to assist.

- Top THREE selling points of Seamless are:1. Blockchain-agnostic 2. Open 3. Permissionless

#1 TAKEAWAY Seamless has built the technology blockchain users want and need to trade and invest without relying on a cryptocurrency exchange.

Let us not forget about:

Security will be a cornerstone of Seamless.

The control and performance at scale will be unparalleled.

Seamless will be a truly decentralized protocol designed for DeFi services. Furthermore, it will be deployed across the most popular public blockchains like Bitcoin and Ethereum for the global crypto community, as well as for MoneyClip users.

Now, Let’s Review The Top FOUR Reasons Why WFLD could become a Juggernaut!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION #2 IPOs can be massive for tech US IPOS have already totaled $171 billion #3 Wellfield understands the essence of crypto, deregulation #4 Wellfield’s team is impressive.

#1 Crypto & The Metaverse is the future, valued today at $3 TRILLION

The cryptocurrency market is now worth more than $3 trillion, that is a lot of 00000s.

“The little more than a decade old market for digital assets has already roughly quadrupled from its 2020 year-end value, as investors have gotten more comfortable with established tokens such as Bitcoin and networks like Ethereum and Solana continue to upgrade and attract new functionality. Excitement about the possibilities of decentralized finance and non-fungible tokens is growing, and memecoins like Dogecoin and Shiba Inu continue to attract attention.” Here

In case you have been under a rock, LOOK AT BITCOIN!

Crypto currency is positioning itself as the new currency of the future! Wellfield is building with Seamless the ability to monetize the possible Crypto takeover and be in a position to dominate the market!

#2 IPOs can be massive for tech US IPOS have already totaled $171 billion

Wellfield has a suite of technology and the resources to be a serious player in the blockchain ecosystem. But right now they’re pre-revenue and relatively unknown, trading on the TSX-V. As the market becomes aware of the company, and if they pursue a cross border listing, Wellfield can be a highly unique opportunity for the public markets. When will the us IPO launch?

“With more than six months until the year ends, U.S. initial public offerings have already totaled $171 billion, eclipsing the 2020 record of $168 billion, according to data from Dealogic.” Here

Wellfield just had an IPO on the TSX, the Canadian exchange, and now the question becomes when is the USA next?

#3 Wellfield understands the essence of crypto, DEREGULATION!

“”What Facebook is doing with meta…is a ‘fake metaverse,’ unless they actually have a real description as to how we can truly own it,” said Yat Siu, chairman and co-founder of Animoca Brands, an investor in and builder of metaverse platforms, speaking on a panel at the Reuters Next conference.” Here

The essence of crypto is disintermediation, freedom and taking back control and power from the banks and tech companies, hence the “fake metaverse” that Mr. Siu chastises Facebook for creating a BIG problem. Wellfield is a purist in the realm of the ideology of Defi, they are the opposite of META.

This will bodes well for them as they scale up, simply put, the backbone of crypto is built upon deregulation and they embody it.

#4 Wellfield’s team is impressive

Wellfield’s Team is incredibly impressive with titans of silicon valley and finance.

“None of us is as smart as all of us.”

–Ken Blanchard

With that being said, take a look at the “us” in none of us is as smart as all of us!

Now, Let’s Review The Top FOUR Reasons Why WFLD could become a Juggernaut!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION

#2 IPOs can be massive for tech US IPOS have already totaled $171 billion

#3 Wellfield understands the essence of crypto, deregulation

#4 Wellfield’s team is impressive

[thrive_leads id=’9849′]

Disclaimer :This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on WFLD (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS. By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com/ and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, WFLD. Small Cap Exclusive has been hired by Civit Digital for a period beginning on December 17, 2021 to publicly disseminate information about (WFLD) via website and email. We have been compensated $37,870. We will update any changes to our compensation.Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. WFLD is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.