Mawson Infrastructure Group Inc. MIGI Stock Price is up 20% in the last 5 days. The stock is still exhibiting a bullish trend and is looking solid! My exclusive updated report on Mawson Infrastructure Group Inc. is below, with a time sensitive analysis. The original where I called it is right HERE

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expertise I have accumulated over the last two decades at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month is always my goal, not a guarantee, but always my aspiration! Mawson Infrastructure Group Inc. MIGI might have what it takes to be my latest winner!

Not to be egocentric, but I’m very good at uncovering winners! Take a look at this article I wrote, where I made 5 BOLD predictions on 5 stocks. I identified 3 losers and 2 winners and every one of my predictions came true, 100%! That is not a once in a while happening either, time and time again I have been correct.

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on MIGI before we get in the technical analysis and MIGI Stock Price

Mawson Infrastructure Group Inc. Company Information

Company Name: Mawson Infrastructure Group Inc.

Ticker: MIGI

Exchange: NASDAQ

Website: https://mawsoninc.com/

Mawson Infrastructure Group Inc. Company Summary:

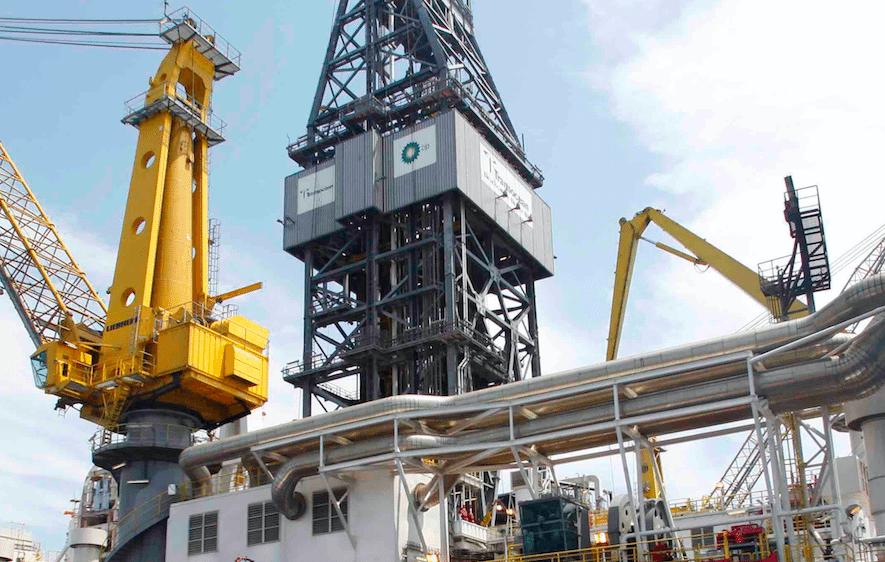

Mawson is a global leading-edge digital asset infrastructure company. The world is rapidly changing, and with it are processing requirements. From social media, artificial intelligence to blockchain developments the underlying requirement is for the infrastructure to operate all the end applications. Mawson solves this through a combination of energy generation and mobile data centre solutions to reduce the overall cost to own and operate efficient processing technology.

What has Mawson Infrastructure Group {NASDAQ:MIGI} done since my alert.

The chart is still bullish & MIGI has issued news!

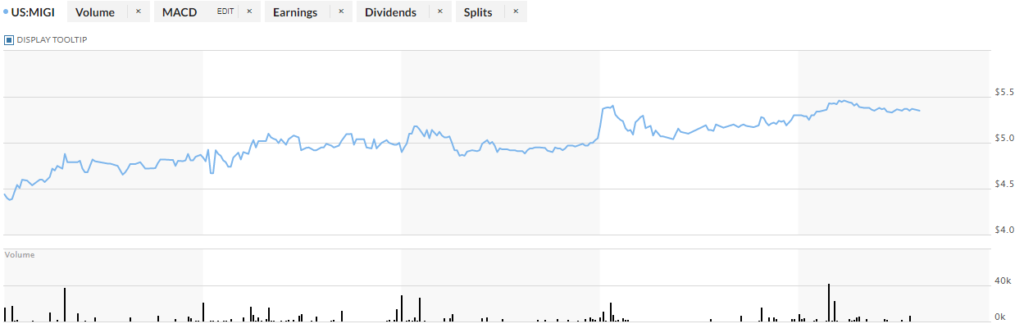

#1 MIGI 5 Day Chart

Mawson Infrastructure Group Stock Price Technical Analysis:

MIGI Stock Price is greatly impacted by this trend line is a classic bullish trend. I called it over a week ago and our subscribers should be very happy! Check out the original report. HERE

I really like how controlled the volume and trend line is. No massive spikes but just a steady uptick on KPIs.

I am a technical trader, I analyze charts and make my trades based on the evidence from past trading activity. Hence, just like MIGI’s chart, I am still bullish on Mawson!

MIGI stock price almost 25% increase is due to exciting News?

March 22, 2022

Mawson Infrastructure Group Inc. (NASDAQ:MIGI) (“Mawson”), a digital infrastructure provider, is pleased to announce financial highlights and financial results, for the fourth quarter and full year ended December 31, 2021.

- Revenue of $19.6 million compared to $10.9 million in Q3 2021, up 79%

- Gross profit of $16.0 million, compared to $8.4 million in Q3 2021, up 89%

- Non-GAAP EBITDA of $10.0 million, compared to $3.3 million in Q3 2021, up 203%

This is Alex signing off, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife.

I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up to our FREE newsletter below 👇

[thrive_leads id=’14274′]

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and PPS of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they invest in the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, MIGI. Small Cap Exclusive has been hired by Awareness Consulting for a period beginning on March 18th, 2022 to publicly disseminate information about (MIGI) via website and email. We have been compensated $4,450 USD. We will update any changes to our compensation. Read FULL DISCLAIMER