Imperial Petroleum IMPP Stock Price is consolidated and ready for a run?

IMPP Stock Price has been trying to recover since it’s IPO over $7. Wondering why this stock is having such a hard time and if it can break the overall trend?

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! IMPP Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Imperial Petroleum Inc. Company Information

Company Name: Imperial Petroleum Inc.

Ticker: CA:IMPP

Exchange: NASDAQ

Website: https://www.imperialpetro.com/

Imperial Petroleum Inc. Company Summary:

Imperial Petroleum is an international shipping transportation company specialized in the transportation of various petroleum and petrochemical products in liquefied form.

IMPP stock price is due to News?

February 2, 2022 – Imperial Petroleum Inc. (Nasdaq: IMPP) (the “Company”) announced today the closing of an upsized underwritten public offering of 9,600,000 units at a price of $1.25 per unit. Each unit consisted of one common share (or prefunded warrant in lieu thereof) and one Class A warrant to purchase one common share, and immediately separated upon issuance. In addition, the Company granted the underwriter a 45-day option to purchase up to an additional 1,440,000 common shares and/or prefunded warrants and/or 1,440,000 Class A warrants, at the public offering price less underwriting discounts and commissions, which the underwriter has partially exercised to purchase 1,440,000 additional Class A Warrants.

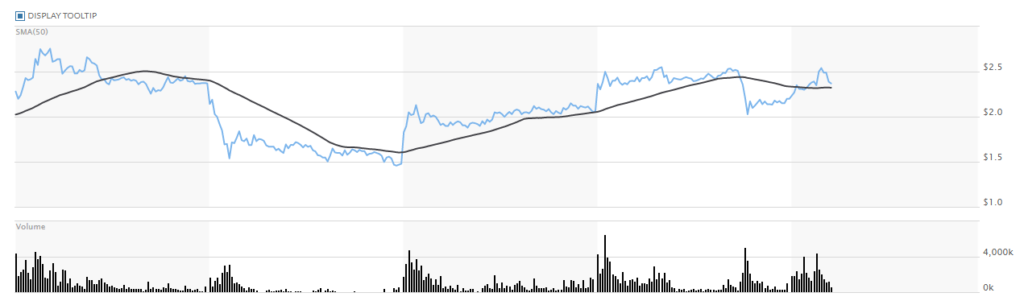

CA:IMPP 5 Day Chart

IMPP Stock Price Technical Analysis:

CA:IMPP needs to beat $2.755 for me before I would purchase it. There is resistance there so I expect it to be difficult but if it does, that is the double confirmation breakout and reversal I’m looking for to enter a stock!

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below👇

[thrive_leads id=’14274′]

Baird Brent D Picked Rand Logistics Inc. (NASDAQ:RLOG) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Rand Logistics Inc. (NASDAQ:RLOG) reported that Baird Brent D has picked up 1,600,000 of common stock as of 2017-05-01.

The acquisition brings the aggregate amount owned by Baird Brent D to a total of 1,600,000 representing less than 8.59% stake in the company.

For those not familiar with the company, Rand Logistics, Inc. is a shipping company that, through its operating subsidiaries, is engaged in the operation of bulk carriers on the Great Lakes. The Company’s shipping business is operated in Canada by Lower Lakes Towing Ltd. (Lower Lakes Towing) and in the United States by Lower Lakes Transportation Company (Lower Lakes Transportation). The Company transports construction aggregates, salt, grain, coal, iron ore, and other dry bulk commodities for customers in the construction, electric utility, food, and integrated steel industries. Lower Lakes’ fleet consists of approximately six self-unloading bulk carriers and over four conventional bulk carriers in Canada and approximately six self-unloading bulk carriers in the United States, including over three articulated tug and barge units. Lower Lakes Towing owns approximately nine Canadian vessels and Lower Lakes Towing (17) Ltd. (Lower Lakes (17)) owns the tenth Canadian vessel.

A glance at Rand Logistics Inc. (NASDAQ:RLOG)’s key stats reveals a current market capitalization of 13.62 Million based on 18.62 Million shares outstanding and a price at last close of $0.720 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-11, Levy picked up 1,500 at a purchase price of $1.04. This brings their total holding to 470,674 as of the date of the filing.

On the sell side, the most recent transaction saw Knott unload 18,013 shares at a sale price of 0.86. This brings their total holding to 260,135.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Rand Logistics Inc. (NASDAQ:RLOG) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Roadrunner Transportation Systems Inc. (NYSE:RRTS) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Roadrunner Transportation Systems Inc. (NYSE:RRTS) reported that Elliott Associates, L.p. has picked up 1,059,356 of common stock as of 2017-04-03.

The acquisition brings the aggregate amount owned by Elliott Associates, L.p. to a total of 1,059,356 representing a 2.8% stake in the company.

For those not familiar with the company, Roadrunner Transportation Systems, Inc. (RRTS) is an asset-light transportation and logistics service provider. The Company offers a suite of global supply chain solutions, including truckload logistics (TL), customized and expedited less-than-truckload (LTL), intermodal solutions (transporting a shipment by over one mode, primarily through rail and truck), freight consolidation, inventory management, expedited services, air freight, international freight forwarding, customs brokerage and transportation management solutions. The Company operates through three segments: Truckload Logistics, Less-than-Truckload and Global Solutions. The Company utilizes a third-party network of transportation providers, consisting of independent contractors (ICs) and purchased power providers, to serve a diverse customer base. It primarily focuses on small to mid-size shippers.

A glance at Roadrunner Transportation Systems Inc. (NYSE:RRTS)’s key stats reveals a current market capitalization of 281.30 Million based on 38.34 Million shares outstanding and a price at last close of $7.05 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-05-12, Stoelting picked up 14,100 at a purchase price of $7.93. This brings their total holding to 49,700 as of the date of the filing.

On the sell side, the most recent transaction saw Thayer unload 2,000,000 shares at a sale price of $24.34. This brings their total holding to 7,801,625.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Roadrunner Transportation Systems Inc. (NYSE:RRTS) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Baird Brent D is Buying Rand Logistics Inc. (NASDAQ:RLOG) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Rand Logistics Inc. (NASDAQ:RLOG) reported that Baird Brent D has picked up 1,000,000 of common stock as of 2017-04-03.

The acquisition brings the aggregate amount owned by Baird Brent D to a total of 1,000,000 representing less than 5.37% stake in the company.

For those not familiar with the company, Rand Logistics, Inc. is a shipping company that, through its operating subsidiaries, is engaged in the operation of bulk carriers on the Great Lakes. The Company’s shipping business is operated in Canada by Lower Lakes Towing Ltd. (Lower Lakes Towing) and in the United States by Lower Lakes Transportation Company (Lower Lakes Transportation). The Company transports construction aggregates, salt, grain, coal, iron ore, and other dry bulk commodities for customers in the construction, electric utility, food, and integrated steel industries. Lower Lakes’ fleet consists of approximately six self-unloading bulk carriers and over four conventional bulk carriers in Canada and approximately six self-unloading bulk carriers in the United States, including over three articulated tug and barge units. Lower Lakes Towing owns approximately nine Canadian vessels and Lower Lakes Towing (17) Ltd. (Lower Lakes (17)) owns the tenth Canadian vessel.

A glance at Rand Logistics Inc. (NASDAQ:RLOG)’s key stats reveals a current market capitalization of 10.95 Million based on 18.62 Million shares outstanding and a price at last close of $0.630 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-11, Levy picked up 1,500 at a purchase price of $1.04. This brings their total holding to 470,674 as of the date of the filing.

On the sell side, the most recent transaction saw Knott unload 18,013 shares at a sale price of $0.86. This brings their total holding to 260,135.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Rand Logistics Inc. (NASDAQ:RLOG) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Roadrunner Transportation Systems Inc. (NYSE:RRTS) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Roadrunner Transportation Systems Inc. (NYSE:RRTS) reported that Elliott Associates, L.p. has picked up 915,084 of common stock as of 2017-03-03.

The acquisition brings the aggregate amount owned by Elliott Associates, L.p. to a total of 915,084 representing a 2.4% stake in the company.

For those not familiar with the company, Roadrunner Transportation Systems, Inc. (RRTS) is an asset-light transportation and logistics service provider. The Company offers a suite of global supply chain solutions, including truckload logistics (TL), customized and expedited less-than-truckload (LTL), intermodal solutions (transporting a shipment by over one mode, primarily through rail and truck), freight consolidation, inventory management, expedited services, air freight, international freight forwarding, customs brokerage and transportation management solutions. The Company operates through three segments: Truckload Logistics, Less-than-Truckload and Global Solutions. The Company utilizes a third-party network of transportation providers, consisting of independent contractors (ICs) and purchased power providers, to serve a diverse customer base. It primarily focuses on small to mid-size shippers.

A glance at Roadrunner Transportation Systems Inc. (NYSE:RRTS)’s key stats reveals a current market capitalization of 293.30 million based on 38.34 Million shares outstanding and a price at last close of $7.70 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-12-05, Stoelting picked up 14,100 at a purchase price of $7.93. This brings their total holding to 49,700 as of the date of the filing.

On the sell side, the most recent transaction saw Thayer unload 2,000,000 shares at a sale price of $24.34. This brings their total holding to 7,801,625.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Roadrunner Transportation Systems Inc. (NYSE:RRTS) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Elliott Associates, L.p. Picked Up Arconic Inc. (NYSE:ARNC) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Arconic Inc. (NYSE:ARNC) reported that Elliott Associates, L.p. has picked up 16,352,683 of common stock as of 2017-02-28.

The acquisition brings the aggregate amount owned by Elliott Associates, L.p. to a total of 16,352,683 representing a 3.7% stake in the company.

For those not familiar with the company, Arconic Inc., formerly Alcoa Inc., is engaged in providing materials and engineered products. The Company operates through segments, including Global Rolled Products, Engineered Products and Solutions, and Transportation and Construction Solutions. The Company offers engineered products and solutions, including fastening systems and rings, titanium and engineered products, power and propulsion, and forgings and extrusions. Its transportation and construction solutions include wheel and transportation products; building and construction systems, and extrusions. Its global rolled products include aerospace and automotive products; Micromill products and services, and brazing, commercial transportation and industrial solutions. It offers a range of aluminum sheet and plate products for the aerospace, automotive, commercial transportation, brazing and industrial markets. The Company’s product portfolio is focused on Arconic Micromill technology.

A glance at Arconic Inc. (NYSE:ARNC)’s key stats reveals a current market capitalization of 12.54 billion based on 438.52 Million shares outstanding and a price at last close of $28.79 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-02-24, Elliott picked up 306,000 at a purchase price of $29.27. This brings their total holding to 34,749,450 as of the date of the filing.

On the sell side, the most recent transaction saw Myers unload 4,337 shares at a sale price of $25.34. This brings their total holding to 25,688.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Arconic Inc. (NYSE:ARNC) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Guess Who Just Picked Up Brinks Co (NYSE:BCO) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Brinks Co (NYSE:BCO) reported that Starboard Value LP has picked up 3,928,930 of common stock as of 2017-02-24.

The acquisition brings the aggregate amount owned by Starboard Value LP to a total of 3,928,930 representing a 7.9% stake in the company.

For those not familiar with the company, The Brink’s Company (Brink’s) is a provider of logistics and security solutions. The Company’s solutions include cash-in-transit, automated teller machine (ATM) replenishment and maintenance, international transportation of valuables, cash management and payment services, to financial institutions, retailers, government agencies (including central banks), mints, jewelers and other commercial operations around the world. The Company operates through nine segments: U.S., France, Mexico, Brazil, Canada, Latin America, Europe, Middle East and Africa (EMEA), Asia and Payment Services. Its cash-in-transit services include the transportation of cash between businesses and financial institutions, such as banks and credit unions; cash, securities and other valuables between commercial banks and central banks. The Company’s global network serves customers in over 100 countries and includes ownership interest in over 40 countries and agency relationships with companies in additional countries.

A glance at Brinks Co (NYSE:BCO)’s key stats reveals a current market capitalization of 2.59 billion based on 49.89 million shares outstanding and a price at last close of $52.00 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-07-14, Domanico picked up 16,744 at a purchase price of $29.86. This brings their total holding to 16,744 as of the date of the filing.

On the sell side, the most recent transaction saw Feld unload 11,105 shares at a sale price of $51.45. This brings their total holding to 660,970.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Brinks Co (NYSE:BCO) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Here’s Who Just Picked Up Blue Bird Corp. (NASDAQ:BLBD) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Blue Bird Corp. (NASDAQ:BLBD) reported that Coliseum Capital has picked up 4,438,712 of common stock as of 2017-02-18.

The acquisition brings the aggregate amount owned by Coliseum Capital to a total of 4,438,712 representing a 14.8% stake in the company.

For those not familiar with the company, Blue Bird offers a complete line of Type A, C and D school buses in a variety of options and configurations. Since 1927, Blue Bird Corporation has continued to set industry standards with its innovative design and manufacturing capabilities. Additionally, Blue Bird provides comprehensive financial solutions through Blue Bird Capital Services. Today, Blue Bird has more than 1,500 employees, Georgia-based manufacturing facilities and an extensive network of Dealers and Parts & Service facilities throughout North America. Its global presence can be seen in more than 60 countries through sales into Africa, Asia, the Caribbean, Latin America, Europe and the Middle East.

A glance at Blue Bird Corp. (NASDAQ:BLBD)’s key stats reveals a current market capitalization of 388.06 million based on 23.03 million shares outstanding and a price at last close of $16.80 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-06-08, Asp picked up 5,000,000 at a purchase price of $11.00. This brings their total holding to 12,000,000 as of the date of the filing.

On the sell side, the most recent transaction saw Coliseum unload 3,000 shares at a sale price of $17.00. This brings their total holding to 2,373,195.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Blue Bird Corp. (NASDAQ:BLBD) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.