Three Reasons Why You Should Be Looking At Global Blockchain Technologies Corp (OTCMKTS:BLKCF) Right Now

Here Are Three Reasons Why You Should Be Looking At Global Blockchain Technologies Corp (OTCMKTS:BLKCF) Right Now

In this article, I’m going to show you exactly why Global Blockchain Technologies Corp (OTCMKTS:BLKCF) is one of the most exciting stocks on the market right now.

Missed out on the Bitcoin bull run? Don’t miss out on this…

During 2017, the price of bitcoin ran from less than $1,000 to nearly $20,000 a piece. That’s an incredible 1,900% return. Against a backdrop of this steep rise, the technology that underpins bitcoin and other cryptocurrencies, blockchain technology, has firmly established itself as certain to be the driver behind the next technological revolution – blockchain is changing (and in many cases, has already changed) the way the world works.

With this technological revolution will come a wave of opportunities for traders and investors but, right now, the landscape is somewhat wild-west. Participation in initial coin offerings (ICOs) is risky at best and buying and holding cryptocurrency can be a complicated and insecure process.

Our team have been on the lookout for an allocation that offers an alternative way to pick up an exposure to the space’s incredible growth. That is, an exposure to bitcoin without having to buy bitcoin and, at the same time, an exposure to the technological shift being spearheaded by some of the younger companies in the sector without having to risk buying tokens as part of an ICO.

And we’ve found exactly what we were looking for.

Put Global Blockchain Technologies Corp (OTCMKTS:BLKCF) on your watchlist right now.

[thrive_leads id=’8129′]

No other company offers what BLKCF offers – a direct exposure to the explosive growth potential of bitcoin and blockchain but, at the same time, a diversified, portfolio-type approach to risk mitigation.

It can only be a matter of time before markets turn on to this unique opportunity and the speculative capital starts to flow towards Global Blockchain Technologies. In fact, the inflow has already started. Back at the start of October, daily volume in BLKCF fluctuated in and around 10K shares. During the week leading up to the Holliday break (12/18-12/22), more than 7.5 million shares changed hands.

Traders still have time to get in…

As you can see from the chart, this one is winding up for what could be an explosive breakout as we head into the start of 2018. It’s not going to take much to get the stock running and, when it does, how high and fast things go is limited only by the growth potential in the underlying space.

Not Convinced

We’ve got three reasons for you why Global Blockchain Technologies looks like one of the top exposures to bitcoin and blockchain right now.

A quick introduction

Before we jump into Reason #1, and for anyone new to this one, let’s kick things off with a quick introduction to the company.

Here’s the blurb:

“Global Blockchain is an investment company providing investors access to a basket of holdings within the blockchain space, managed by a team of industry pioneers and early adopters of all major cryptocurrencies. Global Blockchain is focused on streamlining the current arduous, lengthy and complicated process that interested investors need to undergo in order to gain exposure to the cryptocurrency space with a view to becoming the first vertically integrated originator and manager of top-tier blockchains and digital currencies.”

That’s a bit jargony but here’s what’s important – this company identifies the top opportunities in the blockchain space and picks up a stake in them, with a view to this stake increasing in value as the industry expands and the company (that BLKCF has invested in) grows.

Which brings us to Reason #1.

Reason #1 – BLKCF Does The Hard Work For You

When you take a position in Global Blockchain, you’re picking up a position in all of the companies that the top tier management team at BLKCF has hand-picked as the players in the sector with explosive and huge long-term growth potential.

Right now, the hard part (and, by proxy, the primary risk) of investing in cryptocurrencies and blockchain companies is rooted in separating the wheat from the chaff. Sure, there are a bunch of extremely high growth potential plays out there but, at the same time, there’s an equally large number of scam entities and fraudulent activity.

Take a look at this article from Forbes to get an idea of what we’re talking about.

The team at Global Blockchain have been in this space since the beginning. They know what to look for as potential red flags. They know who to look out for – that is, whose involvement indicates growth potential and whose involvement might be cause for concern. They also know where the real opportunities lie as far as applying blockchain technology to legacy industries.

Acquiring, uncovering and applying all of this information and knowledge, then using it to underpin a solid and rewarding investment strategy, is a full-time job. When you pick up shares of Global Blockchain, the company’s management is doing this job for you and, not only that, but also doing it better than the vast majority of others can.

And that’s not all.

If you want to take part in an ICO, you’ve got to buy and store Ethereum or bitcoin before exchanging it for ICO tokens of whatever company you’re looking to back. You’ve then got to store your tokens (generally on a pricey hardware wallet). IN order to realize any gains, you’ve then got to open an account with an exchange, wait for your tokens to list and then – if they do list – exchange them for bitcoin and, eventually, fiat currency.

Every step of this process is tricky for even the most technologically savvy and, for someone new to the space, can be incredibly risky – one wrong step and you could lose your entire investment to hackers. When you take a position in BLCKF as opposed to a direct position in an ICO, you’re still getting an exposure to the high growth ICO companies but you are getting it simply by placing an order through your standard trading platform. Hassle free and secure.

Reason #2 – Institutional Interest

Analysts suggesting a company has high growth potential is one thing but when a big name institution puts its money where its mouth is and takes a stake in a company, it’s a real sign of fundamental strength.

So when this hit press, on November 7, it flagged up the company as one to watch in this space right now:

“GLOBAL BLOCKCHAIN TECHNOLOGIES CORP. (“Global Blockchain” or the “Company”) (TSX V: BLOC | Frankfurt: BWSP | OTC: BLKCF) is pleased to announce that it has entered into an agreement with Canaccord Genuity Corp., acting as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (the “Underwriters”), pursuant to which the Underwriters have agreed to purchase 11,800,000 units of the Company (the “Units”), on a “bought deal” private placement basis, at a price per Unit of $2.55 (the “Offering Price”), for total gross proceeds of $30,090,000 (the “Offering”).”

And then a couple of days later, November 9, our thesis strengthened:

“(BLKCF) is pleased to announce today that it has entered into an amended agreement with Canaccord Genuity Corp., acting as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (the “Underwriters”), to increase the size of the offering by an additional 3,900,000 units and increase the Underwriters’ Option (as defined below).”

Canaccord is a wealth management and investment behemoth with circa $30 billion assets under management. That the firm is acting as lead underwriter for a bought deal that will see BLCKF pick up more than $40 million (gross) in operational and expansion capital is a very big deal and one that really serves to underline the growth potential that exists at BLKCF right now.

Reason #3 – Fast-Paced Operational Expansion

Blockchain and bitcoin is a buzzword right now. Change the name of a company to Blockchain Inc. and you can see a triple-digit revaluation overnight. The problem is, however, that many of the companies doing exactly that are doing very little outside of the name change to establish themselves as a player in this space.

This is not true of Global Blockchain Technologies.

In the final few months of this year alone, BLKCF has taken a number of key steps towards positioning itself to take advantage of the explosive growth potential that exists in the bitcoin and blockchain spaces and, with each new announcement, is strengthening this positioning.

On November 7, the company announced one of its first interest acquisitions in line with the model outlined above.

As per the announcement, and through its wholly owned subsidiary Global Blockchain Mining Corp., BLKCF has entered into an agreement to acquire a 49.9% interest in an entity called Coinstream Mining Corp., (“Coinstream”). Coinstream is the world’s first cryptocurrency mining company to employ the streaming model, providing strategic upfront capital and an additional payment upon delivery of the cryptocurrency, to select, proven, best-in-class operators and operations, in exchange for a stream of future cryptocurrency production, at a fixed price.

Coinstream provides capital to bitcoin and other cryptocurrency miners in return for a fixed stream of bitcoins going forward. Under the terms of streaming deals that are already in place, and over the life of the contracts, the company would receive 12,500 bitcoins, which represents a current undiscounted value of approximately CAD$112,500,000.

Then, on November 16, BLKCF announced that it has entered into an agreement with Distributed Mining Inc. (“DMI” or Distributed Mining) for an investment of common shares. The agreement will see Coinstream purchase 1,000,000 common shares, for $1,500,000, representing a post-money interest of 25% of DMI.

DMI is building software that will allow anyone with an internet connected device (so, a cell phone, a tablet, etc.) mine cryptocurrency – something that (as things stand) requires powerful, specialized and expensive computing equipment.

So let’s bring all this together…

The opportunity here is clear. This is a company that allows traders and investors to gain an exposure to what is already proving to be the most revolutionary wave of technological change since the internet and – more importantly – allows them to do so without having to take on the risk of choosing, acquiring and storing cryptocurrencies or ICO tokens themselves. The bitcoin space is exploding (but this really could just be the start) and investors are looking for allocation options.

The company is well financed subsequent to the above-discussed bough deal placement and, as such, is primed to expand its portfolio.

In ten years, people who missed out on BLKCF could be looking back at this stock and saying that the company was just in the right place at the right time. The thing is, however, you can only be in the right place if you put yourself there and BLKCF is rapidly taking steps to do just that.

The bottom line:

Make a list of the top allocations in this space and you’ll see two things – that it’s very short and that Global Blockchain Technologies is at the top.

And right now, it’s available at a 30% discount to its November highs.

What are you waiting for? Put BLKCF at the top of your watchlist and get started with your research here:

https://www.otcmarkets.com/stock/BLKCF/quote

https://finance.yahoo.com/quote/BLKCF?p=BLKCF

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on BLKCF (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety. Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations. Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers. Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur. THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK. TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES. CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable. The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster. You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification. Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (the “Information”) about publicly traded companies (the “Profiled Issuers”). We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, BLKCF Global Blockchain Technologies Corp. Small Cap Exclusive has been hired by a third party, Sunrise Media LLC., for a period beginning on November 19th 2017 and is scheduled to end on January 19th 2018 to publicly disseminate information about (BLKCF) via website and email. We have been compensated $336,000. We will update any changes to our compensation. We own zero shares of (BLKCF). During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment. The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities. All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources. We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision. The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities. We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation. We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase. There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer. We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses. Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses. We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information. We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources. We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns. Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below. We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate. If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment. The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities. The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance. You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor. When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses. The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers. We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you. If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions. If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies. The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and or remove all or part of this Disclaimer and or Terms of Use at any time.

All Eye’s on BLKCF Global BlockChain Technologies Corp. Are You Watching?

All Eyes on BLKCF Global Blockchain Technologies Corp (OTCMKTS:BLKCF)

Put BLKCF on Your Watchlist

Bitcoin Hit’s $8,200.00 Today, BLKCF Shares Trading at $2

(OTCMKTS:BLKCF)

(OTCMKTS:BLKCF)

As the price of Bitcoin continues to increase, investors are looking to put their money behind companies that are staking a claim in the blockchain technology. The general public is also accepting the fact that Bitcoin, Blockchain and Crytocurrencies are becoming a force they can no longer ignore.

Put BLKCF on Your Radar Now

(OTCMKTS:BLKCF) (TSXV:BLOC) Global Blockchain Technologies Corp is one of those trending companies investors are buying up quick. Today the company is trading just under $2 with a 30 day average of 504,000 shares. Just 3 months ago shares of BLKCF were trading under $0.40 with no volume and since then its hit highs of $2.55

“Investing in blockchain is Investing in the future whether you like it or not”

GLOBAL BLOCKCHAIN (OTCMKTS:BLKCF)(TSXV:BLOC) is an investment company whose business model is to build a listed company that invests in a basket of holdings within the blockchain markets and giving investors an opportunity to claim a portion of this growing market before it explodes.

Put BLKCF on Your Watchlist Now

Managment of Canadian-based GLOBAL BLOCKCHAIN (OTCMKTS:BLKCF) possess impressive resumes in regard to innovative technology plays. Chairman of the Board Steve Nerayoff is an early pioneer and leader in the Blockchain industry and a senior advisor to Ethereum and Lisk. CEO Rik Willard founded America’s first digital out of home company in early the 90s and one of Silicon Alley’s first digital boutiques in 1994.

[thrive_leads id=’8129′]

Managment :

CEO : Rik is a pioneer in branded digital engagement concepts, including DOOH and large-public screen projects, branded content, CMS, mobile and social media with clients and productions, including MGM Resorts, Calvin Klein Cosmetics, Lucent Technologies, Dictaphone, The World-Famous Apollo Theater, Couture designers (including Chado Ralph Rucci, Oscar de LaRenta and Kevan Hall), The French Ready-to-Wear Association (Pret-a-Porter) and others.

He founded America’s first digital out of home company in early the 90s and one of Silicon Alley’s first digital boutiques in 1994. Rik consulted with Winston & Co to design many of the LED screens in Times Square then with MGM Resorts in Las Vegas for DOOH, mobile and social media convergence platforms.

From 2010 through 2013, he assisted tech startups in raising tens of millions of dollars. In 2013, he founded MintCombine to support and develop the branded coin ecosystem.

President & COO : Shidan Gouran is a serial entrepreneur who founded Nuovotel, one of the first and largest wholesale VoIP service providers of its time, Jazinga, developers of an award winning unified communications system and Home Jinni, developers of the first Android based Smart TV platform. Shidan is an investor in and advisor to a number of financial technology and blockchain startups. He mined his first Bitcoin in early 2010 and has been involved with Cryptocurrencies ever since.

Shidan studied Pure Mathematics and Theoretical Physics at the University of Western Ontario.

CFO :Theo van der Linde is Chartered Accountant with 20 years’ extensive experience in finance, reporting, regulatory requirements, public company administration, equity markets and financing of publicly traded companies. He has served as a CFO & Director for a number of TSX Venture Exchange and Canadian Securities Exchange (CSE) listed companies over the past several years. Industry experience include financial services, manufacturing, Oil & gas, mining and retail industries. More recently, Mr. van der Linde has been involved with future use trends of natural resources as well as other disruptive technologies. He has worked and is currently working on projects in South Africa, West-Africa, East-Africa, Peru, United Kingdom, Sri-Lanka, the United States and Norway.

Global Blockchain Business Model

Global Blockchain is an investment company that provides investors access to a mixture of assets in the blockchain space, strategically chosen to balance stability and growth. Blue chip holdings such as Ethereum and Bitcoin are complemented by best-of-breed “smaller cap” crypto holdings, many of which are not yet available to other investors.

Global Blockchain is an investment company that provides investors access to a mixture of assets in the blockchain space, strategically chosen to balance stability and growth. Blue chip holdings such as Ethereum and Bitcoin are complemented by best-of-breed “smaller cap” crypto holdings, many of which are not yet available to other investors.

Simply speaking BLKCF is investing in a network of Companies that are at the forefront of the blockchain technology industry including mega mining companies. Investing in BLKCF is essentially investing in Blockchain at the highest level.

Recently BLKCF announced moves that prove their commitment to invest and build a solid portfolio of Blockchain companies and technologies as well as funding these operations

- November 7, 2017) – GLOBAL BLOCKCHAIN TECHNOLOGIES CORP. (TSXV: BLOC) (FSE: BWSP) (OTC Pink: BLKCF) (“G lobal Blockchain ” or the “Company”) is extremely pleased to announce that its wholly owned subsidiary Global Blockchain Mining Corp. has entered into an agreement to acquire a 49.9% interest in Coinstream Mining Corp., ( “Coinst r eam”) the world’s first cryptocurrency mining company to employ the streaming model, providing strategic upfront capital and an additional payment upon delivery of the cryptocurrency, to select, proven, best-in-class operators and operations, in exchange for a stream of future cryptocurrency production, at a fixed price.

- Nov. 7, 2017 /CNW/ – GLOBAL BLOCKCHAIN TECHNOLOGIES CORP. (“Global Blockchain” or the “Company”) (TSX V: BLOC | Frankfurt: BWSP | OTC: BLKCF) is pleased to announce that it has entered into an agreement with Canaccord Genuity Corp., acting as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (the “Underwriters”), pursuant to which the Underwriters have agreed to purchase 11,800,000 units of the Company (the “Units”), on a “bought deal” private placement basis, at a price per Unit of $2.55 (the “Offering Price”), for total gross proceeds of $30,090,000 (the “Offering”).

- Nov. 9, 2017 /CNW/ – GLOBAL BLOCKCHAIN TECHNOLOGIES CORP. (“Global Blockchain” or the “Company”) (TSX V: BLOC | Frankfurt: BWSP | OTC: BLKCF) is pleased to announce today that it has entered into an amended agreement with Canaccord Genuity Corp., acting as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (the “Underwriters”), to increase the size of the offering by an additional 3,900,000 units and increase the Underwriters’ Option (as defined below). Under the amended terms of the offering, the Underwriters have agreed to purchase 15,700,000 units of the Company (the “Units”), on a “bought deal” private placement basis, at a price per Unit of $2.55 (the “Offering Price”), for total gross proceeds of $40,035,000 (the “Offering”).

- November 16, 2017) – GLOBAL BLOCKCHAIN TECHNOLOGIES CORP. (TSXV: BLOC) (FSE: BWSP) (OTC Pink: BLKCF) (“GBT” or the “Company”) is pleased to announce that cryptocurrency miner Coinstream Mining Corp. (“Coinstream”) has entered into an agreement with Distributed Mining Inc. ( “DMI” or Distributed Mining) for an investment of common shares. The agreement will see Coinstream purchase 1,000,000 common shares, for $1,500,000, representing a post-money interest of 25% of DMI. Subject to closing of the transaction press released on November 11, 2017, GBT will acquire 49.9 per-cent interest in Coinstream.

For all news click here

Benefits of investing in BLKCF vs Bitcoin

- Bitcoin is extremely volatile as the chart below indicates. The price of bitcoin has dropped as much as 20% in a number of days and then shown gains of equal or greater in the same amount of time.

- Although the price of Bitcoin has continued to hit new highs consistently over the last 12 months the price of just one coin is now above $8000. Investing that same $8000 into a company like BLKCF at its current price of $1.96 would give you over 4000 shares. The Margins here are obvious

- BLKCF shares can be purchased through all common trading platforms including Etrade, TD Ameritrade, etc. No need for coin wallets and the other issues associated with trading and storing cryptocurrencies.

BLKCF Recent Trading History :

Over the last few months Share price of BLKCF has increased from $0.40 and hit highs of $2.55. Share price as of today are just under $2 and appear to building a solid base around $2. Volume has steadily increased with consistent buying pressure as investors are flooding the blockchain market. Resistance looks to be around the $2.50 range and has been tested 3 times in last 2 months. With the growing interest in Bitcoin and Blockchain one can only assume we will see test that resistance again in the very short term. BLKCF could easily be trading above $3 in the near term IMO.

Resources of info for this article come from the following :

https://www.otcmarkets.com/stock/BLKCF/quote

[thrive_leads id=’8129′]

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on BLKCF (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (the “Information”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, BLKCF Global Blockchain Technologies Corp. Small Cap Exclusive has been hired by a third party, Sunrise Media LLC., for a period beginning on November 19th 2017 and is scheduled to end on January 19th 2018 to publicly disseminate information about (BLKCF) via website and email. We have been compensated $60,000 and expect to be compensated another one hundred and twenty five thousand dollars via a series of bank wire transfers over this period. We will update any changes to our compensation. We own zero shares of (BLKCF).

During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

FRMO Corp has OVER 40% Gains in Just 3 Days, BUT WHY?

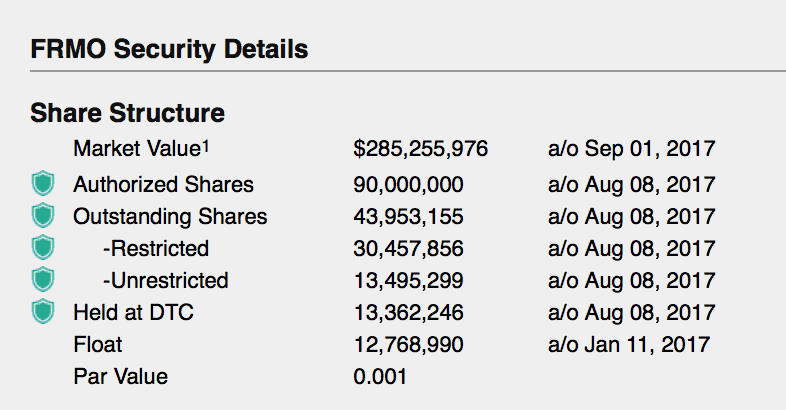

FRMO (OTCMKTS:FRMO) FRMO Corp has solid gains on massive Volume in just 3 days, but why?

We are going to attempt to explain why share prices have gone from $4.30 on 8/30/17 to over $6.49 on Friday 9/1/17

Recent History

FRMO has traded between $ and $4.50 for the last few months with moderate volume and no spikes or drops. On August 28 volume hit a 3 month high but FRMO closed red. On the 29th of August FRMO Corp released its Fiscal Results for 2017

FRMO’s 2017 book value as of May 31, 2017 was $114.2 million ($2.60 per share on a fully diluted basis), including $10.9 million of non-controlling interests. The figure from the prior fiscal year-end as of May 31, 2016 was $102.0 million ($2.33 per share) including $3.7 million of non-controlling interests. Current assets, comprised primarily of cash and equivalents and investments available for sale, amounted to $71.3 million as of May 31, 2017, and $62.8 million as of May 31, 2016. Total liabilities were $13.1 million as of May 31, 2017, compared to $12.9 million as of May 31, 2016, the majority of each being deferred taxes.

FRMO’s 2017 net income (loss) for the fiscal year ended May 31, 2017 was $3,493,948 ($0.08 per share basic and diluted), compared to a loss of $(780,011) ($(0.02) per share basic and diluted) for the 2016 fiscal year. Income from operations for the 2017 fiscal year ended May 31, 2017 was $6,915,986, compared to $993,913 for the prior year. Comprehensive income (loss) attributable to the Company for the same periods was $4,335,956 up from a loss of $(7,020,898). The latter figure included unrealized investment losses.

Business Description

Unable to find much in for a business description:

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

Company website Again not much to it….

My Opinion

There is just not much to talk about with this company but the chart looks amazing. I will continue to watch but would be very cautious about purchasing.

ESPR Esperion Therapeutics, Inc. Consolidation (NASDAQ:ESPR)

(NASDAQ:ESPR) Esperion Therapeutics Inc

(NASDAQ:ESPR) Esperion Therapeutics, Inc. peaked out and closed at $48.90, way up from about $10 where it sat last August, but way below its all-time high of $107.51 in spring 2015. Still, ESPR has been on a good run since about January, but especially since June, probably based on positive news coming out on various stages of ongoing clinical trials. ESPR is a pharmaceutical company based in Ann Arbor, MI and dedicated pretty much exclusively to developing non-statin LDL cholesterol drugs with safer profiles and fewer side effects than the statins currently on the market.

THE COMPANY

ESPR Esperion Therapeutics Inc. has an interesting history, having been acquired by Phizer in 2004 for $1.3Bn in order to get sole possession of an experimental statin called ETC-216 and prevent their competitors from obtaining it. Esperion was founded by Dr. Roger Newton, the man responsible for co-discovering the Lipitor molecule, a statin drug and the most prescribed medication in the history of pharmaceuticals. Phizer eventually killed off the research and ESPR was re-acquired by Dr. Newton after he raised the capital to buy the rights to the name and to their other experimental compound, ETC-1002, which is also a novel cholesterol treatment based on the biological properties of bempedoic acid, which is converted to ETC-1002-CoA in the human liver and, through a sequence of reactions, results in the liver’s removal of LDL-C from the blood.

ESPR has pushed bempedoic acid in 18 completed Phase 1 and Phase 2 clinical studies and it is currently being evaluated in four other Phase 3 LDL efficacy and safety studies, along with one cardiovascular outcomes trial. Their pipeline consists solely of Bempedoic Acid (once daily pill) and a combination of Bempedoic Acid and Ezetimibe (once daily pill) which itself just began Phase 3 trials.

ESPR stock price has fluctuated greatly in the past 52-week period with a range of $9.40 to $57.38 and earlier in August they announced an underwritten offering of 3,100,000 shares to the public at $49.00 per with the goal of continuing to finance the previously mentioned clinical trials for the two drugs in their pipeline. There’s lots of detailed technical information out there on these trials, but suffice it to say that if any one or a combination of them are unqualified successes, they could be looking at blockbuster status on par with or even bigger than Lipitor and of course a huge uptick in value. Results are somewhat far off, however, with expected announcements after the completion of the studies in Q2 and Q3 2018 and various bridging studies yet to begin. Of note, ESPR’s R&D budget for the first six months of 2017 was $74.1M compared to $19.5M for the same period in 2016.

We think this makes ESPR an intriguing investment. With the FDA having approved an abbreviated regulatory pathway to the bempedoic acid/ezetimibe combination, and a looming New Drug Application anticipated after the studies are concluded in 2018, this stock may take a slight dive in the next few weeks, but rally significantly toward its $107.51 all-time high by the end of 2018.

KAYS Marijuana Company Kaya Holdings (OTCMKTS:KAYS) Announces Property Purchase Agreement

(OTCMKTS:KAYS) Marijuana Company Kaya Holdings 10-Q Details Increase in Institutional Financing Agreement to $6.3M, Targets Property Purchase for Cannabis Production Facility

Aug 22, 2017

OTC Disclosure & News Service

–

FORT LAUDERDALE, Fla., Aug. 22, 2017 (GLOBE NEWSWIRE) — Kaya Holdings, Inc. (OTCQB:KAYS), filed its Quarterly Report on Form 10-Q for the quarter ended June 30, 2017 yesterday afternoon. This confirmed KAYS’ continued growth and detailed an agreement for an increase in funding with the Cayman Venture Capital Fund. This will be used for KAY’s purchase of property to build a Cannabis Production Facility in central Oregon.

“KAYS is pleased to confirm the filing of our 10Q for the period ending June 30, 2017. We are very excited by the growth components that we have developed over the quarter. As we look forward to completing a targeted property purchase, on which we plan to relocate our grow and establish a state-of-the-art medical and recreational cannabis manufacturing facility,” stated Kaya Holdings CEO Craig Frank. “Additionally, we secured additional financing to support the launch of Kaya Shack™ delivery services.”

“Difficulty in transitioning our Portland store from an OHA to an OLCC license resulted in a decline in sales for Q2, year over year, of approximately $50,000. However our cash and other assets have increased by nearly $1mm for the same period. As of June our monthly numbers are on pace to exceed last year’s average monthly revenues by 20%, on an annualized basis. We now have 3 OLCC Licensed Kaya Shack™ marijuana retail outlets, with the 4th location expected to open in Q-3”, continued Frank. “With our growth plan in place, including introducing home delivery service and relocating and expanding our grow and production facility, the Company is taking steps to broaden its market and increase revenues, while lowering costs through more in-house production.”

The Company expects to release full details of the property purchase within the next 2 weeks.

About Kaya Holdings, Inc. (OTCMKTS:KAYS)

Kaya Holdings, Inc. (OTCQB:KAYS) owns and operates Kaya Shack™ legal marijuana dispensaries in Oregon as well as grow and manufacturing operations, which produce, distribute and/or sell premium legal cannabis products under the Company’s own brands, including flower, concentrates, and cannabis-infused baked goods and candies. KAYS is the first publicly-traded U.S. company to own and operate legal marijuana dispensaries and a vertically integrated legal cannabis grow and manufacturing operation.

Important Disclosure

KAYS is planning execution of its stated business objectives in accordance with current understanding of State and Local Laws and Federal Enforcement Policies and Priorities as it relates to Marijuana (as outlined in the Justice Department’s Cole Memo dated August 29, 2013). Also a plan to proceed cautiously with respect to legal and compliance issues. Potential investors and shareholders are cautioned that the Company will obtain advice of counsel prior to actualizing any portion of its business plan. This (including but not limited to license applications for the cultivation, distribution or sale of marijuana products, engaging in said activities or acquiring existing cannabis production/sales operations). Advice of counsel with regard to specific activities of KAYS, Federal, State or Local legal action or changes in Federal Government Policy and/or State and Local Laws may adversely affect business operations and shareholder value.

Forward-Looking Statements

This press release includes statements that may constitute “forward-looking” statements, usually containing the words “believe,” “estimate,” “project,” “expect” or similar expressions. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, acceptance of KAYS’ current and future products and services in the marketplace.

For more information please review our periodic and current filings available at www.sec.gov, call 561-210-5784 or visit www.kayaholdings.com or sign up to receive updates.

GWPH Long Term Major Player in Medical Cannabis (NASDAQ:GWPH)

Intro & History:

GWPH, GW Pharmaceuticals (NASDAQ: GWPH) is a British biopharmaceutical company known for its multiple sclerosis treatment product Sativex, and Epidiolex (cannabidiol) which is their lead development drug nearing market introduction to treat a rare form of childhood-onset epilepsy which currently has few, if any, real treatment options. Sativex was the first natural cannabis plant derivative to gain market approval in any country. Founded in 1998 and based in Salisbury, UK GWPH is headed by Geoffrey W. Guy and Brian Whittle. GWPH calls themselves the “global leader in developing cannabinoid-based medicines.” We think that the epilepsy market is a sweet spot for cannabinoids because of relaxing medical marijuana regulations and the increasing prevalence of various types of epilepsy, all over the world.

Recent News & Developments:

On May 24th of this year, GWPH through its subsidiary Greenwich Biosciences published a “groundbreaking” study of Epidiolex in the prestigious New England Journal of Medicine. This corresponded with a slight surge in stock price, but came nowhere near historical highs. In any case, the current Phase III study has received ample positive attention not only in the NEJoM but from physicians specializing in conditions it is designed to treat at the American Academy of Neurology annual meeting on April 25 of this year.

This is starting to sound repetitive, but we have to say again that with relaxation of regulations at the state level, the federal government will eventually have to follow suit. So far that has remained elusive, especially with notorious drug warrior Jeff Sessions, the current U.S. Attorney General pressing Congress for the repeal of the Rohrabacher-Farr Amendment which prevents the federal government from prosecuting (or persecuting) marijuana based businesses that are in compliance with their state and local laws.

In some good news to counter the bad, Cory Booker, a liberal Democrat from New Jersey; Kirsten Gillibrand, a more moderate Democrat from New York; and Rand Paul, a libertarian leaning Republican from Kentucky introduced the CARERS Act which directly benefits firms like GW Pharmaceuticals by officially codifying Obama era policies whereby the feds largely ignored medical marijuana based businesses, and expanding opportunities for medical and scientific research into therapeutic uses for cannabinoids through a combination of banking, veterans access, and perhaps most importantly rescheduling marijuana away from the Schedule I designation which it shares with Heroin and LSD, making it very cumbersome to perform research. Finally, this act would completely remove cannabidiol (CBD), GWPH’s bread and butter so to speak, from federal drug schedules.

GWPH’s pipeline includes CBDV (GWP42006) for epilepsy and autism spectrum disorders and a host of other similarly cannabis-derived compounds for conditions including a form of neonatal encephalopathy, glioma, schizophrenia and complications stemming from multiple sclerosis. There are numerous clinical trial actions underway, viewable at the Clinicaltrials.gov website here.

Market Data & Performance:

Currently at $103.49 with a Market Cap of $2.61B. This is down from their all-time high of $132.73 in September of 2016 that coincided with the end of that fiscal quarter, the impending filing for FDA approval of Epidiolex (which still has yet to occur), and a resulting sharp spike of $50 in share price from August 1 to September 1, 2016. Since that time performance has been mostly negative, but could be looking up for Q3 2017.

Various positive indicators came out of the Q2 2017 call in early May. These included improving assets to liabilities and assets to inventory ratios. They’ve budgeted a significant $130M-$150M to spend for the next 12 month period, largely on operations, research and market penetration. They also discussed high profile Phase III research and development news regarding Epidiolex – which may finally be nearing FDA approval, several management changes including the hire of Scott Giacobello as their new CFO and plans to become a U.S. domestic NASDAQ registrant reporting under U.S. GAAP (and in U.S. dollars) in the near future, among other items.

Conclusion & Looking Ahead:

Based on current and historical performance, as well as positioning of current and future drug releases, GWPH is probably a bit undervalued. Sales of legal cannabis and marijuana in both the recreational and medical sectors are expected to rise by ~30% in 2017, ~45% in 2018, and reach $17 billion (or more) in 2021, per the “Marijuana Business Factbook 2017”. Numerous cannabis related stocks have already surpassed 2X or 3X on their value at introduction/IPO and GW is sitting at a pretty low point right now.

We think you are capable of doing the math here. While I cannot make any specific recommendations on this stock, you will be well served to short list a group of marijuana based stocks and follow them closely in the coming months and years. This should be one of them – keep an eye on upcoming clinical trials because the FDA and EMA processes to bring new drugs to market is long and fraught with peril and the floor can drop out at any time as a result. You should also be wary of a “green rush” bubble propping up marijuana based stocks but also understand that the inherent safety of cannabinoid products and derivatives, along with the aforementioned relaxed federal medical cannabis regulatory environment, do provide some insulation from sudden stock crashes resulting from suits or government “imminent public safety” action.

Finally, the status quo in Washington D.C. could be good for firms with existing research capabilities and market penetration like GW. Namely, recreational use is facing a steep climb toward federal legality, but numerous pieces of legislation currently making their way through Congress with the aim of easing restrictions on all aspects of the medical marijuana business.