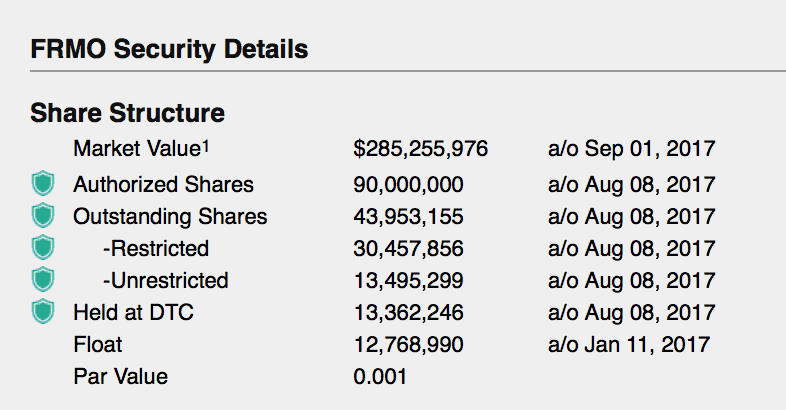

FRMO (OTCMKTS:FRMO) FRMO Corp has solid gains on massive Volume in just 3 days, but why?

We are going to attempt to explain why share prices have gone from $4.30 on 8/30/17 to over $6.49 on Friday 9/1/17

Recent History

FRMO has traded between $ and $4.50 for the last few months with moderate volume and no spikes or drops. On August 28 volume hit a 3 month high but FRMO closed red. On the 29th of August FRMO Corp released its Fiscal Results for 2017

FRMO’s 2017 book value as of May 31, 2017 was $114.2 million ($2.60 per share on a fully diluted basis), including $10.9 million of non-controlling interests. The figure from the prior fiscal year-end as of May 31, 2016 was $102.0 million ($2.33 per share) including $3.7 million of non-controlling interests. Current assets, comprised primarily of cash and equivalents and investments available for sale, amounted to $71.3 million as of May 31, 2017, and $62.8 million as of May 31, 2016. Total liabilities were $13.1 million as of May 31, 2017, compared to $12.9 million as of May 31, 2016, the majority of each being deferred taxes.

FRMO’s 2017 net income (loss) for the fiscal year ended May 31, 2017 was $3,493,948 ($0.08 per share basic and diluted), compared to a loss of $(780,011) ($(0.02) per share basic and diluted) for the 2016 fiscal year. Income from operations for the 2017 fiscal year ended May 31, 2017 was $6,915,986, compared to $993,913 for the prior year. Comprehensive income (loss) attributable to the Company for the same periods was $4,335,956 up from a loss of $(7,020,898). The latter figure included unrealized investment losses.

Business Description

Unable to find much in for a business description:

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

The corporation is an intellectual capital firm identifying and managing investment strategies and business opportunities.

Company website Again not much to it….

My Opinion

There is just not much to talk about with this company but the chart looks amazing. I will continue to watch but would be very cautious about purchasing.