Blox Inc. BLXX (OTCMKTS:BLXX) makes easy gains off Lows

Blox Inc (OTCMKTS:BLXX) has made nice gains today on record volume. Today BLXX traded from $0.04 to highs of $0.09 and is currently sitting around $0.08 pos.

Todays total $ volume is just under $40,000.00 but even that is more than its traded in a single day for more than a year. With little selling pressure todays gains of 70% could just be the beginning of a nice move back to prices around $0.35 and needless to say its not going to take much volume to really move BLXX.

If less than $40,000 in trade value can move BLXX 70%

BLXX could really have some potential over the near future and we will continue to be watching and updating our subscribers.

Business Description

Blox Inc. (“Blox”), is a publicly traded Resource Exploration and Development Company.

Blox Inc. is focused on West Africa and at present has three Gold concessions in Ghana and one Gold concession in Guinea.

Blox Energy aims to green the mining process by implementing renewable energy into its own production processes and ultimately into those of other bulk power consumers in West Africa.

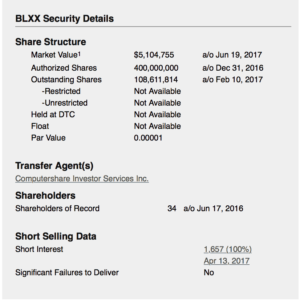

Blox’s shares trade on the OTCQB under the symbol BLXX.

Blox Inc. is based out of Vancouver B.C. Canada

http://www.otcmarkets.com/stock/BLXX/quote

Guess Who Picked Up Dgse Companies Inc. (NYSEMKT:DGSE) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Dgse Companies Inc. (NYSEMKT:DGSE) reported that Ntr Metals, Llc. has picked up 6,365,460 of common stock as of 2017-02-16.

The acquisition brings the aggregate amount owned by Ntr Metals, Llc. to a total of 6,365,460 representing a 23.7% stake in the company.

For those not familiar with the company, DGSE Companies, Inc. buys and sells jewelry, diamonds, fine watches, rare coins and currency, precious metal bullion products, scrap gold, silver, platinum and palladium, as well as collectibles and other valuables. The Company’s operations are organized into approximately two primary types of customers, retail customers and wholesale customers. Its products and services are marketed through approximately eight retail locations. Its retail locations operate under a range of banners, including Charleston Gold & Diamond Exchange, Chicago Gold & Diamond Exchange and Dallas Gold & Silver Exchange, and are supported by Websites at www.CGDEinc.com and www.DGSE.com. Its Fairchild International (Fairchild) division is a dealer of pre-owned fine watches. Fairchild supplies over 1,100 regional jewelry stores across the country, with pre-owned Rolexes and aftermarket Rolex accessories, such as bands, bezels and dials. Its customers include individual consumers, dealers and institutions.

A glance at Dgse Companies Inc. (NYSEMKT:DGSE)’s key stats reveals a current market capitalization of 32.52 million based on 26.87 million shares outstanding and a price at last close of $1.21 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-12-09, Elemetal picked up 8,536,585 at a purchase price of $0.41. This brings their total holding to 12,814,727 as of the date of the filing.

On the sell side, the most recent transaction saw Smith unload 55,000 shares at a sale price of $1.06. This brings their total holding to 1,211,797.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Dgse Companies Inc. (NYSEMKT:DGSE) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.