Robinhood Markets HOOD is up almost 30% after great 4th QTR earning news and due to a massive amount of volume being injected into this trading platform that has been crashing since August. I have written a full report on HOOD that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Robinhood announced today, “Total net revenues for the quarter increased 14% to $363 million, compared with $318 million in the fourth quarter of 2020, and for the year increased 89% to $1.82 billion, compared with $959 million for the year ended December 31, 2020.” However, before we get started, let’s review some basic information on this company.

Robinhood Markets HOOD Company Summary

Company Name: Robinhood Markets, Inc

Ticker: HOOD

Exchange: NASDAQ

Website: https://robinhood.com/

Robinhood Markets, Inc Company Summary

Robinhood Markets is on a mission to democratize finance for all. With Robinhood, people can invest with no account minimums through Robinhood Financial, LLC, buy and sell crypto through Robinhood Crypto, LLC, and learn about investing through easy-to-understand educational content.

Robinhood intends to use its blog, Under the Hood, as a means of disclosing material information to the public in a broad, non-exclusionary manner for purposes of the SEC’s Regulation Fair Disclosure (Reg. FD). Under the Hood can be accessed at blog.robinhood.com and investors should routinely monitor that website, in addition to Robinhood’s press releases, SEC filings, and public conference calls and webcasts, as information posted on Robinhood’s blog could be deemed to be material information.

“Robinhood” and the Robinhood feather logo are registered trademarks of Robinhood Markets, Inc. All other names are trademarks and/or registered trademarks of their respective owners.

HOOD News

Jan 27th, 2022

Total net revenues for the quarter increased 14% to $363 million, compared with $318 million in the fourth quarter of 2020, and for the year increased 89% to $1.82 billion, compared with $959 million for the year ended December 31, 2020.

Dec. 31, 2021

Wolf Haldenstein Adler Freeman & Herz LLP announces that a federal securities class action lawsuit has been filed in the United States District Court for the Northern District of California on behalf of investors who purchased or otherwise acquired Robinhood Markets, Inc. (“Robinhood” or the “Company”) (NASDAQ: HOOD) common stock pursuant and/or traceable to the Registration Statement issued in connection with the Company’s July 2021 initial public offering (the “IPO” or “Offering”).

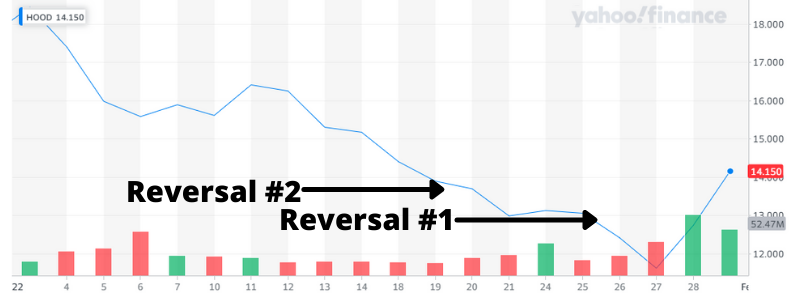

HOOD 3 Month Chart

HOOD Technical Analysis

The news of the class action lawsuit has sent HOOD tumbling. Could the financials reverse it’s trend?

The answer is yes, it has from a technical analysis. HOOD has broken through resistance #1 and resistance #2. WOW, this could take off. Remember it was trading at $70 not too long ago.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!