LuxUrban Hotels (NASDAQ:LUXH) could be a little missile and trading under $1.50 and positioned to soar like a eagle with just the slightest volume. We could see $2.00+++ tomorrow with modest volume!

Think about this:

Higher LOWS +

Low Float +

Bouncing Off Incredible Support and Creating A New Higher BASE +

Walking into the vacation season, ONE of the busiest seasons of the YEAR!

= EXPLOSIVE POTENTIAL GAINS COME EARLY FOR CHRISTMAS

Let’s take a close look at the top 3 catalysts that could ignite this missle!

I can’t stress this enough, this is low float is a HUGE cataylst!

TWO points we would like to make!

#1

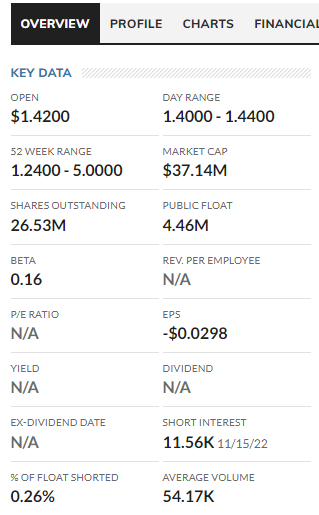

4.4 Million shares in the float is TINY! That is a little over $6M in total volume to trade the whole float in a day! That is not out of the realm of possibility for tomorrow!

#2

LUXH ONLY trades 55,000 shares daily! That is $70,000 +/-!

Are you kidding me? Lux will trade that in the first 30 minutes tomorrow!

What does that mean? Hmmmm… We will SEE!

I do predict, a massive spike in volume and a potential rocket ship in price per share!

Christmas could be tomorrow for our subscribers!

Record Quarterly Net Rental Revenue of $11.6 Million

Significant Increases in Gross Profit, RevPAR, and Occupancy Rates

Adjusted Net Income of $0.6 Million Excludes $4.6 Million of Non-Cash and One-Time Expenses

Adjusted EBITDA Rose to $2.4 Million

Reiterates Annual Guidance for 2022 and 2023

MIAMI, November 14, 2022–(BUSINESS WIRE)–LuxUrban Hotels Inc. (or the “Company”) (Nasdaq: LUXH), which utilizes a long-term lease, asset-light business model to acquire and manage a growing portfolio of short-term rental properties in major metropolitan cities, today announced financial results for the third quarter (“Q3 2022”) and nine months ended September 30, 2022.

2022 Third Quarter Financial Overview Compared to 2021 Third Quarter

- Net rental revenue rose 74.2% to $11.6 million from $6.6 million

- Gross profit improved to $4.9 million, or 42.2% of net rental revenue, from $0.8 million, or 11.9% of net rental revenue

- Net loss of $3.2 million, or $(0.13) per share, was primarily impacted by a one-time, non-cash $2.4 million warrant expense and a one-time cash expense of $1.8 million related to the Company’s planned exit from its legacy apartment rental business as part of its rebranding initiatives; net loss in Q3 2021, which did not include these expenses, was less than $0.1 million

- Adjusted net income (a non-GAAP measure; see reconciliation tables in this press release) improved to $0.6 million, or $0.03 per share, from a net loss of less than $0.1 million

- Adjusted EBITDA (a non-GAAP measure; see reconciliation tables in this press release) increased to $2.4 million from $0.5 million

Operational Highlights

- For the 2022 nine-month period, RevPAR rose 30% to $149 from $115, and occupancy rates improved to 87% from 71%

- Currently operate approximately 1,200 short term hotel rental units, which have been fully funded

- Expect to operate a total of approximately 1,500 short term hotel rental units by or around December 31, 2022, with no outside funding required for the additional 300 units

- Launched corporate rebranding initiative

- Implemented initiatives to expand margins, generate positive cash flows, and drive profitability

“Our performance in Q3 2022 validated the growth, sustainability, and predictability of our operating model,” said Brian Ferdinand, Chairman and Chief Executive Officer. “We recorded the highest quarterly net revenue in our history, expanded our operating portfolio of short-term rental hotel units, and grew RevPAR and occupancy rates across the portfolio. Excluding the one-time, non-cash warrant expense charges and one-time costs associated with our planned exit from our legacy apartment rental business, adjusted net income improved to $0.6 million and adjusted EBITDA rose 348%, respectively, from last year’s third quarter.

“We are confident in the trajectory of our business and excited about our performance through the first nine months of the year, reporting net rental revenue of $30.9 million, adjusted net income of $3.5 million, EBITDA of $4.3 million, and adjusted EBITDA of $6.5 million. As such, we are pleased to reiterate our full year 2022 and 2023 net revenue and EBITDA guidance.”

He concluded, “As a complement to anticipated net revenue growth, we have commenced initiatives designed to expand margins, generate positive cash flows, and drive profitability. This includes our agreement with Rebel Hotel Company, which we estimate will deliver margin enhancements that we would not have been able to realize until at least 2024, and our recently announced agreement with a new credit card processing company that eliminates the need for reserves and reduces associated processing expenses by approximately 400 bps compared to our former processor relationships. As a result of this new relationship, our former credit card processors will release to the Company approximately $5.5 million in reserves over the next 12 months.”

If I had a microphone I would DROP IT!

Stevie Wonder could see the potential!

I’m out of jokes, just go pull up LUXH right NOW because we have enough REGRET, we don’t need anymore!

DISCLAIMER:

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has NOT been compensated for profiling LUXH. We own ZERO shares in LUXH.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).