As trade tensions rise between what appears to be the only two economies capable of staving off a global recession in the US and China, we’ve been on the lookout for plays that traditionally weather the storm that often comes with a pullback.

One such play that’s flying completely under the radar right now has us very excited and we are happy to bring it to you before anyone else. It’s a North American Gold mining play that has some unique advantages over the other guys that we want to share with you.

After Major Buyout All Eyes on Meguma Gold

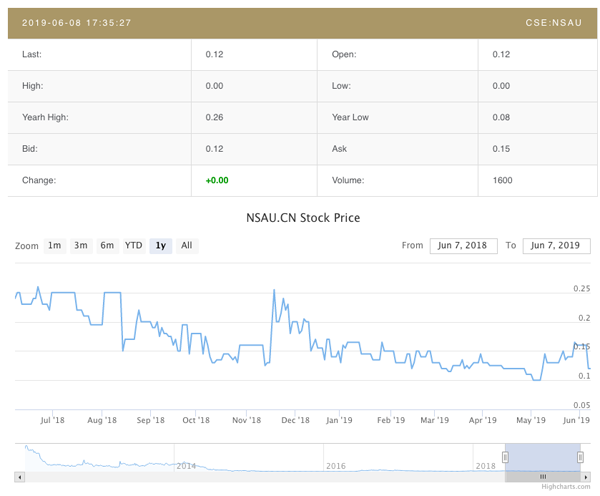

The company’s name is MegumaGold Corp, which traditionally trades in the Canadian markets under the ticker NSAU.CN but can also be found on the American OTC trading under the ticker NSAUF.

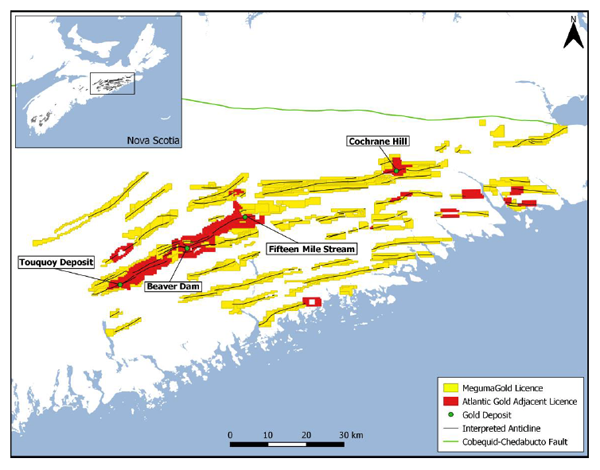

Currently trading at the low price of $0.0892, MegumaGold Corp is a fresh face in the mining exploration industry that began trading around this time last year but don’t let that fool you as the company is one of the single largest mineral claims holders in Nova Scotia and has the potential to constitute a district-scale gold development opportunity across their 179,280 hectare land position and over 11,147 mineral claims.

When it comes to mining companies worth our watch list, it all comes down to location, location, location. There’s simply nothing a mining CEO can do if there’s nothing worth mining on the land. With that being said, we believe that MegumaGold has tapped into something worth your immediate attention.

Why do we believe this? Because they own land bordering one of the biggest success stories in junior gold mining this year.

Atlantic Gold saw its price surge 73% YTD after receiving a buyout offer of $802 Million from Australian gold producer St Barbara for 100% of the gold company.

[thrive_leads id=’8276′]

Because of this buyout offer, and the fact that MegumaGold’s extensive land holdings are directly adjacent to Atlantic Gold’s, many analysts believe that there is significant gold content near the surface of MegumaGold’s projects. This is an excellent sign that MegumaGold is in the right position to capitalize on their potentially perfect location.

Could MegumaGold have the potential to get a buyout opportunity like Atlantic Gold? Only time will tell but if recent news is any indicator, I think they’ve struck gold on this one.

Why? Because MegumaGold hopped onto our radar back at the end of May after announcing that its initial field work at its Ecum Secum property has returned composite samples grading gold as high as 49.79 g/t from waste rock piles associated with past mining operations. These results, in part, support presence of gold mineralization in geology additional to the main veins targeted in past production.

Ecum Secum is a site of past high-grade gold production for which Nova Scotia government assessment reporting records show an average grade of approximately 12 g/t for total estimated production of 1,275 ounces of gold from 2,984 tons (2707 tonnes) processed.

Further, the company has sufficient capital to continue their drill program and their numerous historical deposits and mineral claims could lead to additional discoveries.

Get The Full Report Here: https://finance.yahoo.com/news/megumagold-fieldwork-returns-49-79-113000604.html

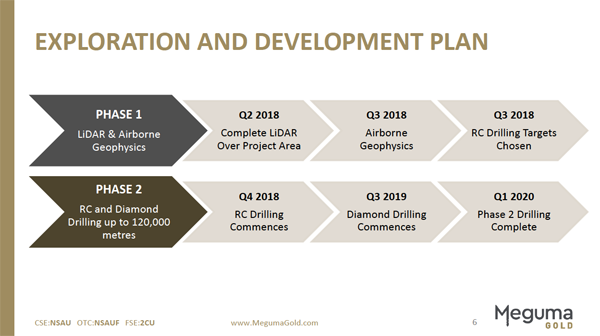

Now while location is a key indicator for success when it comes to gold mining, it means almost nothing if the company that owns the land doesn’t have a plan in place to move forward with exploration and extraction. Again, MegumaGold surprised us with a few key catalysts that have made us very happy as we completed our due diligence on this junior gold mining company play.

MegumaGold Key Catalysts:

- Properties contain large number of gold showings and exploration targets identified by historical work.

- Disseminated gold model and extensive anticlines onstrike have not been fully assessed with advanced exploration.

- MegumaGold portfolio provides an opportunity for immediate discovery by modern low-cost gold exploration methods.

- MegumaGold holds a premier land position for testing disseminated gold deposits – adjacent to Atlantic Gold’s operations.

- MegumaGold is well-funded to support advanced exploration and major drilling campaign.

MegumaGold Project Summary:

- MegumaGold has acquired 11,147 mineral claims totaling 179,280 hectares becoming one of Nova Scotia’s single largest mineral claim holders.

- Claims staked along under-explored trends of known gold occurrences within anticlinal structures Meguma now controls approximately 466 km (total strike length) of gold-prospective anticlines.

- Recently completed a 12,342 kilometre aeromagnetic and radiometric survey and acquired 1,110 square kilometres of LiDAR.

- Planning an aggressive state of the art exploration program to develop a proprietary “fingerprint” model for identifying new deposits and drill targets.

- MegumaGold believes that these land holdings constitute a district-scale gold exploration and development opportunity.

Nova Scotia:

Nova Scotia has a rich gold mining history with in excess of 65 historic gold districts hosting a plethora of past mining operations. Between 1862 and 1927, it was reported that almost 1 Million ounces of gold was mined from over 2 million tons of crushed material.

And, in recent years, after completing extensive geological work, Nova Scotia has seen a resurgence of gold mining as its a safe mining jurisdiction with a strong local mining force that is also being supported by the Nova Scotian Government.

Nova Scotia has experienced a paradigm shift in the understanding of the genesis and economic potential of its gold deposits.

As stated, gold in Nova Scotia has been mined intermittently since the 1860’s from over 350 locations, mainly from high-grade, nugget-style quartz veins. Discovery in the late 1980’s of significant, disseminated gold hosted within argillaceous shales at the Touquoy Deposit in Moose River and the recent opening of Canada’s newest mine by Atlantic Gold has renewed interest in Nova Scotia’s historic gold districts.

MegumaGold believes this new understanding of the greater deposit model demonstrates how historic vein-focused production extracted but a mere fraction of the total gold potential and that wide zones of non-visible, disseminated gold in Nova Scotia, presents an opportunity to advance Nova Scotia as a world-scale gold mining district.

Positioned for Success Through Anticlinal Control

In Nova Scotia, significant quantities of gold are hosted in regional-scale anticlinal structures. These structures are critical to the concentration of gold in near surface, low-cost economic quantities.

The evolution of the disseminated gold model has also generated new investor and industry awareness of the significant potential of Nova Scotia’s anticlinal structures.

Through Meguma’s 100% owned 11,147 mineral claims totaling 179,280 hectare the company estimates that it now controls approximately 466 km of gold-prospective anticlines.

Killag Project

- Through its maiden drill campaign at Killag the company has established anomalous gold over a strike length of more than a 1km

- The Killag Gold District held by MegumaGold is reported in Nova Scotia Department of Energy and Mines database records as having produced at least 3,500 ounces of gold from underground mining between 1869 and 1946 at an estimated average gold grade of 0.96 oz/ton (32.91 g/t). Historic work in the immediate area of past mining is documented in government records and these clearly show that the property has not been extensively explored to date.

- The 2019 maiden RC drilling program completed by the Company resulted in the discovery of new, high grade gold mineralization intercepts in zones of combined quartz veins and argillite that occur in the vicinity of past workings and also to both east and west of the workings area, which was most directly tested by previous exploration. These new mineralized intercepts remain open in both strike and dip extents within the Axial Zone and are targeted for additional drilling during the 2019 field season.

- Interpreted results of 2018 airborne geophysics, historic work compilation and 3D modelling programs by MegumaGold were used to target 2019 RC drill holes at Killag. In February and early March of 2019. 20 inclined RC drill holes (1622m) were completed to initially test the Axial Zone mineralization concept in the “Killag East” area and to provide stratigraphic assessments in the Killag Central and Killag West areas.

Dufferin Gold Project:

- The Dufferin Gold Project consist of 218 claims covering approximately 3,529 Ha

- Meguma Gold claims are located along strike and adjacent to Resource Capital Gold Corp’s property.

- Discovered in 1868, production on the adjacent property totaled approximately 35,300 ounces of gold mined from 110,566 tons of ore between 1883 and 1925 from 18 vein systems over a strike length of 1.5 km

- East Dufferin was discovered in the early 1980’s, production in 2001 of 55,000 tonnes averaging a recovered grade of 13.4 g/t Au. A total of 35 quartz saddle reef zones have now be discovered over 3 km of strike length

- Adjacent property hosts an Indicated Resource of 115,500 tonnes @ 11.9 g/t gold for 58,000 contained ounces and an Inferred Resource of 703,900 tonnes @ 6.6 g/t gold for 150,000 contained ounces (NI 43-101 Resource Estimate – Resource Capital Gold Corp – April 2017)

- Recent PEA completed on adjacent property indicates 216,050 gold ounces could be recovered over a 10 year mine-life with a post-tax $89.2M NPV (5%) and 121% IRR (NI 43-101 PEA – Resource Capital Gold Corp – Apr 2017)

Goldboro & Isaacs Harbour

- The Goldboro & Isaacs Harbour claim blocks consist of 174 claims covering approximately 2,815 Ha and located along strike and adjacent to Anaconda Mining Inc.’s property

- Mining in the Goldboro area between 1893 and 1912 produced approx. 55,000 ounces of gold mined from approx. 415,000 tons of ore at an average grade of 6.7 g/t

- Mining in the Goldboro area between 1893 and 1912 produced approx. 55,000 ounces of gold mined from approx. 415,000 tons of ore at an average grade of 6.7 g/t

- A total of 65,968 metres of surface and underground diamond drilling was completed between 1984 and 2011 on the adjacent property

- Adjacent Goldboro property hosts a Measured & Indicated Resource of 3,645,000 tonnes @ 4.48 g/t gold for 525,400 contained ounces and Inferred Resource of 2,542,000 tonnes @ 4.25 g/t gold for 347,300 contained ounces – combined open-pit & underground mining scenario (NI 43-101 PEA – Anaconda Mining Inc. – Mar 2018)

- Recent PEA completed on adjacent Goldboro property indicates 375,900 gold ounces could be recovered over an 8.8 year mine-life with a post-tax $61M NPV (7%) and 26% IRR (NI 43-101 PEA – Anaconda Mining Inc. – Mar 2018)

Mooseland Area Project

- The Mooseland Area Project consist of 243 claims covering approximately 3,934 Ha

- Meguma Gold claims are located along strike and adjacent to NS Gold Corporation’s property

- Discovered in 1858, production in the area totalled approximately 3,865 ounces of gold mined from 9,058 tons of ore between 1863 and 1934

- Historically mined from stratabound, quartz vein-hosted gold mineralization

- Between 1986 and 2011, 3 companies completed 183 diamond drill holes totalling 44,385 metres in the area

- An adjacent property hosts an Inferred Resource of 2,520,000 tonnes @ 5.6 g/t gold for 454,000 contained ounces (NI 43-101 Resource Estimate, July 2012 – NSGold Corporation)

Greater Goldenville Area

- The Greater Goldenville Area Project consist of 233 claims covering approximately 3,772 Ha

- Meguma Gold claims are located along strike and adjacent to Osprey Gold’s property

- Approximately 212,300 ounces of gold mined in the area from 551,797 tonnes of ore between 1862 and 1942

- Historically mined from stratabound, quartz vein-hosted gold mineralization

- 150 drill holes totalling 30,159 metres have been completed in the area since 1985

- The adjacent Osprey Gold property hosts an Inferred Resource of 2,800,000 tonnes @ 3.20 g/t gold for 288,000 contained ounces – combined open-pit and underground scenario (NI 43-101 Resource Estimate Osprey Gold–Mar 2017)

Greater Beaverdam Project

- The Beaver Dam claim group consists of 114 claims covering roughly 1,824 Ha on strike of Atlantic Gold’s property which contains a 43-101 resource cut-off grade of 0.5 g/t Au, the optimized pit shell contains Measured and Indicated Resources of 9.27 Mt at an average grade of 1.43 g/t Au and 1.84 Mt of material at 1.37 g/t Au in the Inferred category (Atlantic Gold website).

- Gold was first discovered in the Beaver Dam area in 1889 and by 1941 a total of 967 oz were mined.

- From 1986 to 1989 Seabright mined approximately 41,119 tonnes at a grade of 1.85, almost exclusively quartz material.

Fifteen Mile Stream Regional Project

- The Fifteen Mile Stream claim block consists of 177 mineral claims covering 2,865 Ha. Gold was first discovered in the Fifteen Mile area in 1867 with about 19,400oz mined between 1883 and 1911.

- The Fifteen Mile Stream claim block encompasses the northeast extension of the anticlinal structure which hosts Atlantic Gold’s 43-101 compliant resource described as; a selected cut-off grade of 0.35 g/t Au the optimized pit shell for Fifteen Mile Stream contains Measured and Indicated Resources of 10.58 Mt at an average grade of 1.33 g/t Au and 6.64 Mt of material at 1.12 g/t Au in the Inferred category.

Cochrane Hill Regional Project

- The Cochrane hill block consists of 556 mineral claims covering 9’001 Ha

- The Cochrane hill claim block is located along strike of Atlantic Gold’s Cochrane Hill property which had a 43-101 resource estimate completed in 2017. At a selected cut-off grade of 0.35 g/t Au the optimized pit shell for Atlantic Gold’s Cochrane Hill contains Measured and Indicated Resources of 10.66 Mt at an average grade of 1.16 g/t Au and 1.63 Mt of Inferred material at 1.32 g/t Au.

Moose River Area Project

- The Moose River block consist of 282 mineral claims covering 4,565 Ha and contains the extension of the anticline structure which hosts Atlantic Gold’s Touquoy deposit which contains a resource of 10.1 Mt at an average grade of 1.5 g/t Au and 1.6 Mt of inferred material at 1.5 g/t Au (Atlantic Gold Website)

- Gold production in the Moose River area dates back to 1877 and approximately 21,500 oz were produced in the area prior to Atlantic Gold becoming active.

The Team:

Theo van der Linde, CA President and Director: Mr. van der Linde is Chartered Accountant with 17 years of extensive finance, administration and public accounting experience in mining, oil & gas, financial services, manufacturing and retail industries. He has extensive experience with Junior Exploration (Mining and Oil & Gas) and producing mining companies at various stages of growth. He has in the past, and is currently working on projects in South Africa, West-Africa, East-Africa, Peru, United Kingdom, Sri-Lanka and the United States.

Regan Isenor CEO: Mr. Isenor obtained a B.A. from Acadia University and Masters in Project Management from Saint Mary’s University and has 14 years’ experience in exploration projects around the world with publicly traded companies. Mr. Isenor has worked on various international projects in Turkey (Menderes), West Africa (Burkina Faso, Bissa Hill deposit, Mali Siribaya Gold project), Ireland (Zinc), Northern Ontario and at home in Nova Scotia. Mr. Isenor served on the executive and was a past president of the Mining Society of Nova Scotia.

Fred Tejada, P.Geo. Independent Director: Mr. Tejada is a professional geologist registered in British Columbia. He has over 30 years of international mineral industry experience and has a proven track record, working with both major and junior mining and exploration focused organizations. He is currently CEO and director of European Electric Metals Inc, a company focused on electrification metals. Mr. Tejada was Country Manager for Phelps Dodge Exploration Corporation in the Philippines and previously Vice President for Exploration of Panoro Minerals Ltd. where he directed the resource definition drilling of its two major copper projects in Peru. He had also been previously involved in the exploration of the Trend and the Belcourt Saxon coal projects in Northeast British Columbia. Mr. Tejada is also a director of several junior mining companies based in Vancouver, BC.

Stephen Stine, PE Independent Director: Mr. Stine is a mining executive with 39 years’ experience in public/private company formation, acquisitions, turnarounds, debt and equity financings and mine operations around the world. Mr. Stine is a co-founder and former director of Alamos Gold where he served as COO in charge of exploration and production. Mr. Stine previously worked for Southern Peru Copper in Peru and speaks Spanish. Most recently, Mr. Stine acted as Director and COO of Etruscan Resources where he was responsible for turning around the Youga Gold Mine in Burkina Faso, West Africa. During that time, the mine doubled production and the cost of production was reduced by 50%.

The bottom line for MegumaGold is that they are continuing to execute on a sound business plan to establish the premier gold exploration opportunity base within Nova Scotia’s developing Meguma gold belt.

The pending acquisition of Atlantic Gold is a Gold Star indicator that they have positioned themselves in a new and untapped gold vein worth immediate attention as the province has now received international recognition as an emerging gold district that validates the bulk tonnage model Atlantic Gold first recognized and then perfected with the industry’s lowest cost per ounce.

All in all, Atlantic Gold was the trailblazer and MegumaGold is acting with sound mining strategy, taking advantage of a new golden era in Nova Scotia. Make sure to continue to follow MegumaGold as this one continues to develop.

Disclaimer :

This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on NSAU.CN (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Stock Talk Today endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, stocktalktoday.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, MegumaGold. Small Cap Exclusive has been hired by MegumaGold, for a period beginning on June 10, 2019 to publicly disseminate information about (NSAU.CN) via website and email. We have been compensated $10,000. We will update any changes to our compensation. We own zero shares of (NSAU.CN).

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. MegumaGold is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.