Quadlogic Controls QDLC Stock Price has been trying to recover since it’s July high of almost $2. Wondering why this stock is having such a hard time and if it can break the overall trend?

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! QDLC Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Quadlogic Controls Inc. Company Information

Company Name: Quadlogic Controls Inc.

Ticker: QDLC

Exchange: OTC

Website: https://www.quadlogic.com/

Quadlogic Controls Inc. Company Summary:

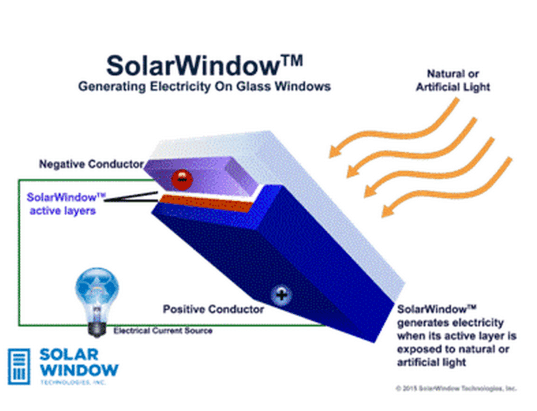

Quadlogic Controls Corp. engages in the business of electricity metering, monitoring, and control. Its products include multi-tenant, in-unit residential, socket, demand, and commercial meter. Its activities include the design, manufacture, and sale of the smart metering systems; technical services including meter reading, customer billing, and system repair and maintenance; concentrated metering, which refers to the Energy Guard system; and royalties from licensees producing and selling the firm’s Energy Guard systems under licensing agreements. The company was founded by Marc Segan, Doron Shafrir, and Sayre Swarztrauber in 1982 and is headquartered in Long Island City, NY.

QDLC stock price is due to News?

NO NEWS, warning!

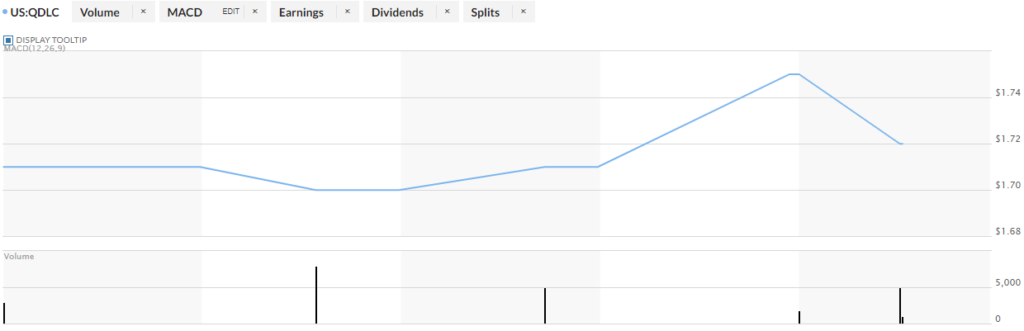

QDLC 5 Day Chart

QDLC Stock Price Technical Analysis: QDLC Stock Price

The PPS is up over 1% over the last month. The volume is also up, to be exact it is up 40%!

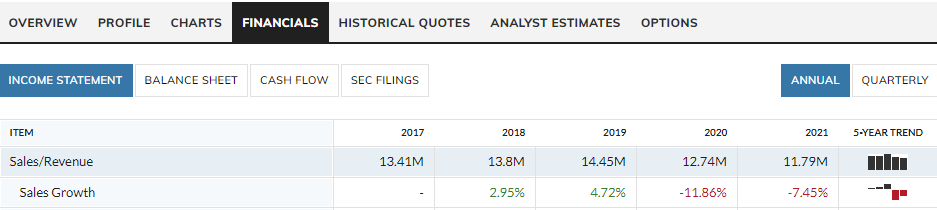

Look at the revenue decreases. That is not good from a fundamental position!

[thrive_leads id=’14274′]