Warpspeed Taxi Inc. WRPT stock price is still bearish. WRPT is down -5% in the last 5 days and I will be evaluating many factors to determine just how hot the stock is.

The official heat level for WRPT is, a

2 out of 5.

2 out of 5.

Continue reading to see why I think it is just a 2 out of 5. There is some shocking takeaways from this article that you must read if you are interested in WRPT.

If you are interested in finding out more about me, famed stock picker, Alexander Goldman or if you’re interested in my HOT grading system, sign up today, it’s FREE!

[thrive_leads id=’28419′]

Before I go over this exciting trending stock, I wanted to introduce myself. Hello

I found my home at Small Cap exclusive 4 years ago. Now, I’m helping traders find breakout stocks. Not to sound egotistical but I’m very good at finding small cap stocks that are winners.

What do I mean by big winners?

Stocks that move more than 100% in a month! WRPT Stock Price could?

Does that always happen, NO! But, I’m very consistent! Take a look at this article I wrote below, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE and I shine a spotlight on these breakout stocks and also those losers!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis and how I came up with HOT grade.

Warpspeed Taxi Inc. Company Information

Company Name: Warpspeed Taxi Inc.

Ticker: WRPT

Exchange: OTC

Website: https://warpspeedtaxi.com/

Breakout Stock Warpspeed Taxi Inc. Company Summary:

WarpSpeed Taxi, Inc. engages in the development of ride-hailing and food delivery computer and mobile device application. The company was founded on November 18, 2020 and is headquartered in Las Vegas, NV.

WRPT stock price is due to News?

The Company announced it had signed an Agreement with a U.S.-based joint venture partner (the “US Partner”) to launch ride-hailing and delivery operations in the United States using the Company’s feature-rich, white-label software platform.

The US Partner has agreed to contribute $1 million in stages by December 31, 2022 in order to drive the launch of operations in return for access to the WarpSpeed Taxi platform and 50% ownership of the venture.

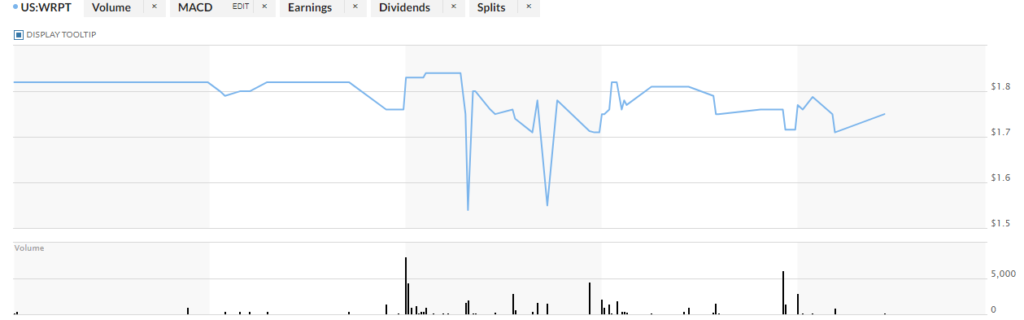

Trending Stock WRPT 5 Day Chart

WRPT Stock Price HOT Stock Grade:

The official heat level for SMCE is, a

The volume, which is basically demand of a stock is sporadic and has a downward pressure on it.

The news, there is no significant news cycle circulating around SMCE stock price.

The chart, it is bearish and has been that way for a while.

The fundamentals, there is no exciting financial filings associated with this stock.

Marketing efforts, I have found marketing efforts around the investor awareness of this company which saved it from a 1 out of 5 rating.

To receive my

[thrive_leads id=’14274′]