NLLSF Stock Price has been trying to recover since it’s Nov high of almost $10. Wondering why this stock is having such a hard time and if it can break the overall trend? Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! NLLSF Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Nel ASA Company Information

Company Name: Nel ASA

Ticker: NLLSF

Exchange: OTC

Website: https://nelhydrogen.com/

Nel ASA Company Summary:

NEL ASA operates as a hydrogen company, which provides solutions to produce, store and distribute hydrogen from renewable energy. Its hydrogen solutions cover the value chain from hydrogen production technologies to manufacturing of hydrogen fueling stations. The firm operates through the following segments: Nel Hydrogen Fueling and Nel Hydrogen Electrolyser. The Nel Hydrogen Fueling segment engages in manufacturing of hydrogen fueling stations providing fuel cell electric vehicles with the same fast fueling and long range as conventional fossil fuel vehicles. The Nel Hydrogen Electrolyser segment operates as a global supplier of hydrogen production equipment and plants based on both alkaline and PEM water electrolyser technology. The company was founded by Erik Anders Lönneborg and Praveen Sharma in 1927 and is headquartered in Oslo, Norway.

NLLSF stock price is due to News?

16 February 2022) Nel ASA (Nel) reported all time high revenues of NOK 248.1 million in the fourth quarter of 2021, up from NOK 229.1 million in the same quarter of 2020 and an EBITDA of negative NOK -167.7 million (Q4 2020: -96.2) following the global scale-up strategy to maintain the leadership position in a market set to grow rapidly. The company had an order intake of NOK 418 million in the period ending the quarter with a record order backlog. The addressable project pipeline doubled during the fourth quarter of 2021, providing a strong long-term outlook.

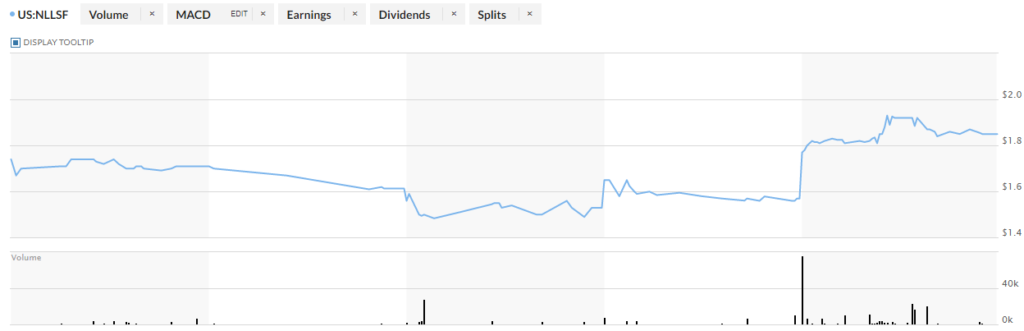

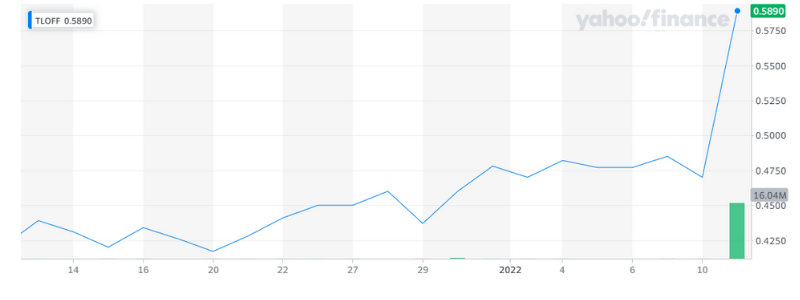

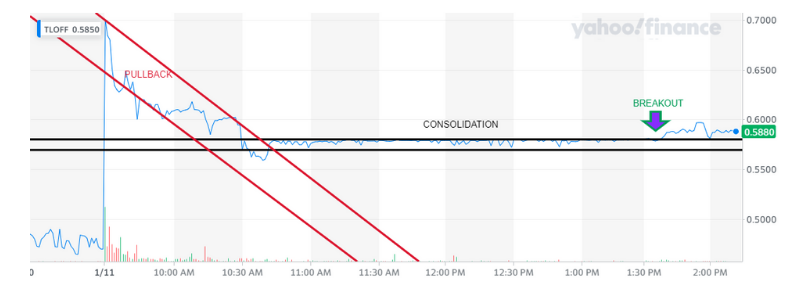

NLLSF 5 Day Chart

NLLSF Stock Price Technical Analysis:

NLLSF is trending stock for good reason, I like it. I would place a stop loss at $1.80.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

Shares of

Shares of