Camber Energy, Inc. (NYSE...

Oil and Gas

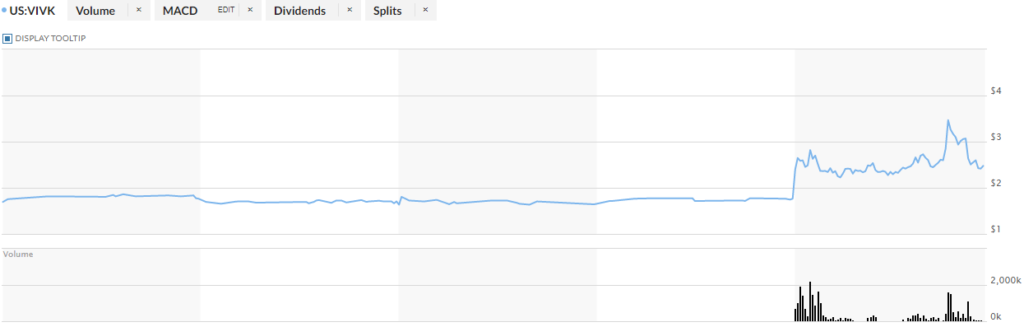

Vivakor VIVK Stock Price is consolidated and ready for a run? UPDATE

VIVK Stock Price has been trying to recover since it’s January’s high of almost $10. Wondering why this stock is having such a hard time and if it can break the overall trend? Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! VIVK Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Vivakor Inc. Company Information

Company Name: Vivakor Inc.

Ticker: VIVK

Exchange: OTC

Website: https://vivakor.com/

Vivakor Inc. Company Summary:

Vivakor, Inc. engages in the operation, acquisition, and development of clean energy technologies and environmental solutions that focus on soil remediation. It specializes in the remediation of soil and the extraction of hydrocarbons, such as oil, from properties contaminated by or laden with heavy crude oil and other hydrocarbon-based substances. The company focuses on the remediation of contaminated soil and water resulting from either man-made spills or naturally occurring deposits of oil. Its primary focus is remediation of oil spills resulting from the Iraqi invasion of Kuwait and naturally occurring oil sands deposits in the Uinta basin located in Eastern Utah. Vivakor was founded on November 1, 2006 and is headquartered in Lehi, UT.

VIVK stock price is due to News?

Jun 16, 2022 (ACCESSWIRE via COMTEX) — IRVINE, CA / ACCESSWIRE / June 16, 2022 / Vivakor, Inc. (NASDAQ:VIVK) (“Vivakor” or the “Company”), a socially responsible operator, acquirer and developer of clean energy technologies and environmental solutions, today announced that it has signed a definitive agreement to acquire Silver Fuels Delhi, LLC (operating in Louisiana) (“SF Delhi”) and White Claw Colorado City, LLC (operating in Texas) (“WCCO”). If consummated, the acquisitions will enable Vivakor to enter a synergistic segment of the energy industry with the combination of a crude oil gathering, storage, and transportation facility, which feature long-term ten year take or pay contracts. In 2021, SF Delhi generated $33 million in revenue and positive operating cash flow.

VIVK 5 Day Chart

VIVK Stock Price Technical Analysis:

What can I say, it is frightening in this market coupled with the obvious pullback from the rush of demand.

If it can consolidate here and stabilize it might be a good scalp.

[thrive_leads id=’14274′]

CA:KEI stock price, is it time to sell or rebuy? URGENT UPDATE!

Kolibri Global Energy Inc. CA:KEI stock price and chart looks great, is it time to sell or rebuy? Famed stock picker, Alexander Goldman has his analysis, take a look below.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! CA:KEI Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

If you want stocks delivered to your inbox, no hassle, no research with this massive community of traders, sign up below. Now, let’s go over some of the basic information on this stock before we get in the technical analysis.

Kolibri Global Energy Inc. Company Information

Company Name: Kolibri Global Energy Inc.

Ticker: CA:KEI

Exchange: Canadian Stock Exchange

Website: https://www.kolibrienergy.com/

Kolibri Global Energy Company Summary:

Kolibri Global Energy, Inc. is an international energy company. It is focused on finding and exploiting energy projects in oil, gas and clean and sustainable energy. The firm operates through the United State, Canada, and Other segments. The company was founded on May 6, 2008 and is headquartered in Newbury Park, CA.

CA:KEI stock price is due to News?

NEWBURY PARK, Calif., (BUSINESS WIRE) — Kolibri Global Energy Inc. (the “Company” or “KEI”) (TSX: KEI, OTCQB: KGEIF) is providing an update on the Barnes 7-3H well (98.07% working interest), which began flowback production last week in its Tishomingo field in Oklahoma.

The Barnes 7-3H well is currently flowing back stimulation fluid at a rate that has been restricted by the Company’s operations team. Despite the restricted rate, the well is producing approximately 400 barrels of oil a day. It is still early in the cleanup process, with only about 3.5% of the stimulation fluid recovered to date.

CA:KEI 5 Day Chart

CA:KEI Stock Price Technical Analysis:

The chart looks amazing. I like the stock it is bullish and the 5 day chart looks amazing.

Once again my name is Alex and I’m so glad you took the time to read this far. I would love to have you be apart of our growing family of traders.

I always like giving tid bits of knowledge that I have learned from my mentors, so here goes. As a reminder to all of the traders out there to leave your emotions at the door and never, ever, try to catch a falling safe. Simply let it crash to the ground and then, walk over and pick up the money. That is a reference to bounce plays LOL.

I strive to find breakout stock alerts and deliver them before the market finds out. I’m the original OG trend setter of trending stocks! If you want stocks delivered to your inbox, no hassle, no research with this massive community of traders, sign up below.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below 👇

[thrive_leads id=’14274′]

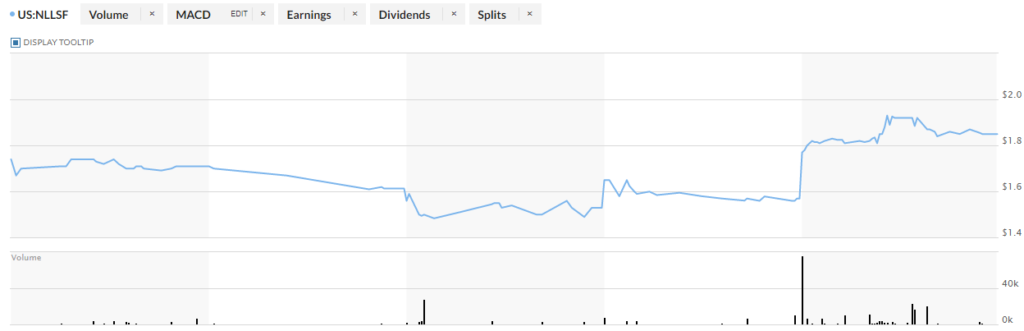

Nel ASA NLLSF Stock Price is ready for another run? Shocking Analysis

NLLSF Stock Price has been trying to recover since it’s Nov high of almost $10. Wondering why this stock is having such a hard time and if it can break the overall trend? Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! NLLSF Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Nel ASA Company Information

Company Name: Nel ASA

Ticker: NLLSF

Exchange: OTC

Website: https://nelhydrogen.com/

Nel ASA Company Summary:

NEL ASA operates as a hydrogen company, which provides solutions to produce, store and distribute hydrogen from renewable energy. Its hydrogen solutions cover the value chain from hydrogen production technologies to manufacturing of hydrogen fueling stations. The firm operates through the following segments: Nel Hydrogen Fueling and Nel Hydrogen Electrolyser. The Nel Hydrogen Fueling segment engages in manufacturing of hydrogen fueling stations providing fuel cell electric vehicles with the same fast fueling and long range as conventional fossil fuel vehicles. The Nel Hydrogen Electrolyser segment operates as a global supplier of hydrogen production equipment and plants based on both alkaline and PEM water electrolyser technology. The company was founded by Erik Anders Lönneborg and Praveen Sharma in 1927 and is headquartered in Oslo, Norway.

NLLSF stock price is due to News?

16 February 2022) Nel ASA (Nel) reported all time high revenues of NOK 248.1 million in the fourth quarter of 2021, up from NOK 229.1 million in the same quarter of 2020 and an EBITDA of negative NOK -167.7 million (Q4 2020: -96.2) following the global scale-up strategy to maintain the leadership position in a market set to grow rapidly. The company had an order intake of NOK 418 million in the period ending the quarter with a record order backlog. The addressable project pipeline doubled during the fourth quarter of 2021, providing a strong long-term outlook.

NLLSF 5 Day Chart

NLLSF Stock Price Technical Analysis:

NLLSF is trending stock for good reason, I like it. I would place a stop loss at $1.80.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]

Imperial Petroleum IMPP Stock Price is consolidated and ready for a run?

IMPP Stock Price has been trying to recover since it’s IPO over $7. Wondering why this stock is having such a hard time and if it can break the overall trend?

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! IMPP Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Imperial Petroleum Inc. Company Information

Company Name: Imperial Petroleum Inc.

Ticker: CA:IMPP

Exchange: NASDAQ

Website: https://www.imperialpetro.com/

Imperial Petroleum Inc. Company Summary:

Imperial Petroleum is an international shipping transportation company specialized in the transportation of various petroleum and petrochemical products in liquefied form.

IMPP stock price is due to News?

February 2, 2022 – Imperial Petroleum Inc. (Nasdaq: IMPP) (the “Company”) announced today the closing of an upsized underwritten public offering of 9,600,000 units at a price of $1.25 per unit. Each unit consisted of one common share (or prefunded warrant in lieu thereof) and one Class A warrant to purchase one common share, and immediately separated upon issuance. In addition, the Company granted the underwriter a 45-day option to purchase up to an additional 1,440,000 common shares and/or prefunded warrants and/or 1,440,000 Class A warrants, at the public offering price less underwriting discounts and commissions, which the underwriter has partially exercised to purchase 1,440,000 additional Class A Warrants.

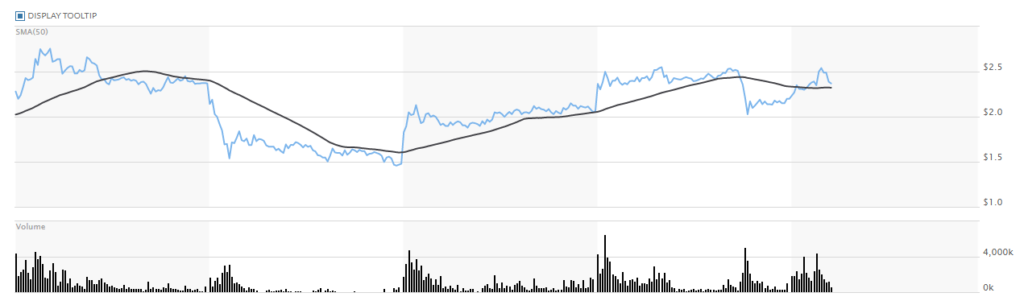

CA:IMPP 5 Day Chart

IMPP Stock Price Technical Analysis:

CA:IMPP needs to beat $2.755 for me before I would purchase it. There is resistance there so I expect it to be difficult but if it does, that is the double confirmation breakout and reversal I’m looking for to enter a stock!

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below👇

[thrive_leads id=’14274′]

Is Petrogress PGAS the best stock to buy right now? Important update!

Is PGAS the best stock to buy because it has been breaking it’s trend with large volume and a 42% change in PPS in 5 days. Wondering why this stock is taking off, take a look below. PGAS is the best stock to buy? Breakout stock maybe? Possibly a trending stock?

Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! PGAS Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over if PGAS is the best stock to buy? Breakout stock maybe? Possibly a trending stock? Below, is some of the basic information on this stock before we get in the technical analysis

Petrogress Inc. Company Information

Company Name: Petrogress Inc.

Ticker: PGAS

Exchange: OTC

Website: https://petrogressinc.com/

Petrogress Inc. Company Summary:

Petrogress, Inc. is an integrated energy company, engaged in the downstream and midstream sectors of the energy industry. It operates through the following segments: Commodities and Other (C&O) and Hires & Freights (H&F). The C&O segment involves in storing, distributing, and marketing crude oil, gas oil, and refined petroleum products, and also includes retailing sales of its gas stations and rest areas, terminals, and refined logistics. The H&F segment relates to marine transportations, transports, and marine service. The company was founded by Barry Michael Friedman on February 10, 2010 and is headquartered in Piraeus, GI.

PGAS News could indicate whether it is the best stock to buy! Trending stock PGAS!

Feb 08, 2022

Announced the Grand Opening of EOS Areopolis Gas Station in Greece. The gas station is located at one of the most touristic areas of Greece and provides fuels supply, convenience store, food, coffee, drinks and rest area. This gas station is an innovate station with unique distinct design which offers high performance fuels and new experience to the customers, with a concept to be established “from a Gas Station to a community Hub“.

PGAS 5 Day Chart, breakout stock?

Trending stock PGAS Technical Analysis:

Is PGAS the best stock to buy? Is it a trending stock? A breakout stock? Let’s answer these questions.

Is it the best stock to buy? NO! There is no recent news to indiccate it.

Is it a trending stock? NO! There is no volume that is significant.

Is it a breakout stock? Yes, it broke out of it’s trend and is stabilized in a consolidation pattern but still appears to be trending bearish! I give this a class 3 ranking at best!

I hope I did a good job with my analysis of AXAS and if it is the best stock to buy?

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Is Abraxas Petroleum AXAS the best stock to buy? What is a Good Stock to buy?

Is AXAS the best stock to buy because it has been breaking it’s trend with large volume and a 48% change in PPS in 2 days. Wondering why this stock is taking off, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! AXAS Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over if AXAS is the best stock to buy? Below, is some of the basic information on this stock before we get in the technical analysis

Abraxas Petroleum Company Information

Company Name: Abraxas Petroleum Corp.

Ticker: AXAS

Exchange: OTC

Website: http://www.abraxaspetroleum.com/

Abraxas Petroleum Corp. Company Summary:

Abraxas Petroleum Corp. engages in the acquisition, exploration, development, and production of crude oil and natural gas. It focuses primarily on the development of conventional and unconventional resources in its primary operating areas in the Rocky Mountains, South Texas, Powder River Basin, and Permian Basin. The company was founded by Robert L.G. Watson in 1977 and is headquartered in San Antonio, TX.

Is AXAS and if it is the best stock to buy? Let’s look at the News.

Feb 28th

Abraxas Petroleum Corporation (“Abraxas” or the “Company”) (OTCQX:AXAS) today provided the following reserve and operational update. Note that all annual reserve comparisons stated below are for Delaware Basin assets only (all sold Bakken assets were removed from the December 31, 2020 totals). Highlights include:

- Total Proved PV-10 reserves grew 467% to $229 million at December 31, 2021 using SEC pricing

- Reserve Report captures the Company’s Delaware Basin West Texas assets only, post-sale of the Company’s Bakken assets, as previously reported

- Reserve Report doesn’t include additional geologic horizons being pursued by offset operators such as the Woodford/Meramec

- Company has approximately 11k net acres in the heart of the Southern Delaware Basin where it has successfully drilled 23 Wolfcamp/3rd Bone Springs horizontals across 5 distinct geologic benches.

- Company’s leasehold is entirely HBP and includes all depths/rights along with associated water infrastructure

AXAS 5 Day Chart

Abraxas Technical Analysis:

Let’s start off with the obvious, the news was incredible. So what is the answer to the question, is AXAS a good stock to buy? First things first, I’m not a registered broker so I can’t advise someone on whether to buy or not buy a stock. With that being said, I like the stock from a fundamental standpoint. Strong revenues and increases from last quarter.

However, I’m aware that there is more that goes into if a stock goes up than strong fundamentals. For instance, the technical set up at the current moment on the 5 day is looking suspect. I believe the stock will pull back and retrace from here, consolidate and then run again.

I hope I did a good job with my analysis of AXAS and if it is the best stock to buy?

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

TechCom (OTC:TCRI) has a big day for a non operating shell, buyer beware

Company Name: TechCom, Inc.

Ticker: (TCRI)

Exchange: OTC

Website: https://www.techcominc.com/

Company Summary:

The Company is a non-operating holding company. Historically, the Company has been involved and invested in gaming and vending businesses, the focus of which was on the entertainment, travel and leisure industries. Current management is in the process of identifying operating businesses that are potential candidates for acquisition.

5 Day Chart

1 Day Chart

Technical Analysis:

Non Operating shell, I have very little faith and it would be a true gamble to play this. With that being said, it is slightly bullish and finished the day strong.

88 Energy (EEENF) Stock Soars 35% in a Month: More to Come?

After having gone through a fair degree of volatility, the oil and gas company 88 Energy (OTCMKTS:EEENF) saw its stock make a strong move over the course of the past month.

The stock has come into the radars of many traders in a big way and over the course of the past month, it managed to clock gains of as much as 35%. The fresh momentum in the stock is something that investors need to look into closely before they make any decision one way or another. There are two main factors that drove the rally in the stock. Last month 88 Energy had announced that it had sold off its oil and gas credits from its Alaskan interests for a total of $18.7.

While that was a nice chunk of change for 88 Energy, the company decided to pay off the entirety of its debts amounting to $16.1 million. The company added at the time that the rest of the money from the sale was going to be used for working capital needs and also for strengthening its balance sheet.

The company’s operations are very small when compared to some of the other oil and gas companies, which is why it was such a major development and led to such excitement among investors. The other important development was 88 Energy’s decision to issue as many as 204 million fully paid-up shares in the company at $0.026 a share. The proceeds for the same was used to pick up a 50% stake in Project Peregrine.