Dates: 2/3/2026 Speculative Momentum...

Lifestyle

Kaival Brands Innovations KAVL Stock Price UPDATE

KAVL Stock Price has been breaking it’s trend with large volume and a 36% change in PPS in 2 days. Wondering why this stock took off and now is retracing, take a look below. Before we do, remember to stop what you are doing and 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! KAVL Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Kaival Brands Innovations Inc. Company Information

Company Name: Kaival Brands Innovations Group Inc.

Ticker: KAVL

Exchange: NASDAQ

Website: https://kaivalbrands.com/

Kaival Company Summary:

Kaival Brands Innovations Group, Inc. engages in the sale of e-cigarettes. It markets its products under the BIDI brand. The company was founded by Paul Moody in 1998 and is headquartered in Grant, FL.

KAVL Stock Price and how News affects it.

Feb. 18, 2022

Announced that it has received a letter dated February 17, 2022 from The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it has regained compliance with the minimum bid price requirement under Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”).

KAVL 5 Day Chart

Kaival KAVL stock price Technical Analysis:

We are not so interested in the spike due to the news, I’m interested in has it consolidated? Is it ready to go up? I like this one, make sure to keep it above $2.50 and it should break $2.80 soon or I would cut my losses and get it out.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out. I sure hope you enjoyed this article, if you would like to receive more exclusive content from me 👇 sign up for our newsletter below. 👇

[thrive_leads id=’14274′]

Wynn Macau WYNMF explode Friday!

Wynn Macau WYNMF is up big after positive news in regard to Covid that has been making the stock crashing for over the last 12 months. I have written a full report on on WYNMF that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Wynn Macau announced as the government of the world’s largest gambling hub retained the limit on casino licences to six. However, before we get started, let’s review some basic information on this company.

Wynn Macau WYNMF Company Summary

Company Name: Wynn Macau

Ticker: WYNMF

Exchange: OTC

WYNMF 1 Month Chart

Wynn Macau Technical Analysis

Wynn Macau announced as the government of the world’s largest gambling hub retained the limit on casino licences to six. Keeping the market competition exactly where it is so they can continue it’s domination. HERE

The stock has hit a 1 month high and has reversed it’s bearish trend, keep an eye on it.

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Sands China SCHYF had a great month, what’s next?

Sands China SCHYF is up 32% over the last month. I have written a full report on SCHYF that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Sands China announced last month, “The Venetian® Macao Thursday, where they built 20,000 hygiene kits for Clean the World” However, before we get started, let’s review some basic information on this company.

Sands SCHYF Company Summary

Company Name: Sands China Ltd.

Ticker: SCHYF

Exchange: OTC

Website: www.sandschina.com.

Sands China Company Summary

Sands China Ltd. (Sands China or the Company) is incorporated in the Cayman Islands with limited liability and is listed on The Stock Exchange of Hong Kong Limited (HKEx: 1928).

Sands China is the largest operator of integrated resorts in Macao. The Company’s integrated resorts on the Cotai Strip comprise The Venetian® Macao, The Plaza® Macao, The Parisian Macao and The Londoner® Macao. The Company also owns and operates Sands® Macao on the Macao peninsula.

The Company’s portfolio features a diversified mix of leisure and business attractions and transportation operations, including large meeting and convention facilities; a wide range of restaurants; shopping malls; world-class entertainment at the Cotai Arena, The Venetian Theatre, The Parisian Theatre, the Londoner Theatre and the Sands Theatre; and a high-speed Cotai Water Jet ferry service between Hong Kong and Macao.

The Company’s Cotai Strip portfolio has the goal of contributing to Macao’s transformation into a world centre of tourism and leisure. Sands China is a subsidiary of global resort developer Las Vegas Sands Corp. (NYSE: LVS).

SCHYF News

Dec. 16, 2021

Got together with volunteers from two local community groups at The Venetian® Macao Thursday, where they built 20,000 hygiene kits for Clean the World, an international social enterprise that provides hygiene supplies essential for good health to populations in need around the globe, helping prevent the spread of disease.

SCHYF 1 Month Chart

Sands China 5 Day Chart

SCHYF Technical Analysis

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Limitless Venture Group LVGI Bullish?

Limitless Venture Group LVGI is up 98% after due to a massive amount of volume being injected into this little well known stock that has been crashing for the last 6 months. I have written a full report on LVGI that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Limitless Venture Group announced today, “the best revenue year in the history of LVGI and update shareholders on what’s ahead for 2022 and beyond.” However, before we get started, let’s review some basic information on this company.

Limitless Venture Group LVGI Company Summary

Company Name: Limitless Venture Group, Inc

Ticker: LVGI

Exchange: OTC

Website: www.lvginc.com

Limitless Venture Group, Inc. Company Summary

Limitless Venture Group provides its shareholders with access to leading small and medium-sized businesses focused on growth. Leveraging its permanent capital base, disciplined long-term approach, and actionable expertise, LVGI owns controlling interests in its subsidiaries as it partners with management teams to build businesses with the capacity to unlock significant value for its shareholders.

The Company currently has three primary subsidiaries: Rokin, Inc., KetoSports, Inc. and Jasper Benefit Solutions, LLC.

Also, Rokin was founded in 2016 with a mission to provide our customers with the highest quality, technology-driven vaping products available while providing exceptional customer service.

Moreover, KetoSports products flush the body with ketones, raising blood ketone levels within a few minutes.

Also, Jasper Benefit Solutions, LLC (JBS), founded in 2018 with headquarters just outside Nashville, TN, is a Managing General Underwriter (MGU) specializing in risk management services for small to medium self-funded employer “Groups”.

Consequently, Rokin, KetoSports & Jasper Benefit Solutions have benefitted greatly from the management expertise at LVG.

LVGI News

January 11 , 2022

Announced the best revenue year in the history of LVGI and update shareholders on what’s ahead for 2022 and beyond. HERE

December 7, 2021

Announced that it has signed an LOI to acquire 100% of an Oklahoma operating grow facility with both Indoor and outdoor operations, exclusive to LVGI for 60 days from the signing of the LOI. HERE

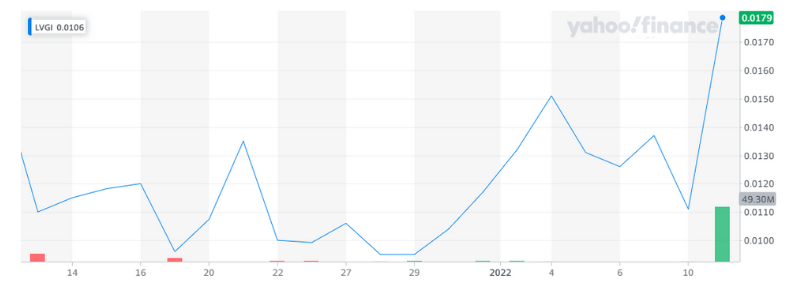

Limitless 1 Month Chart

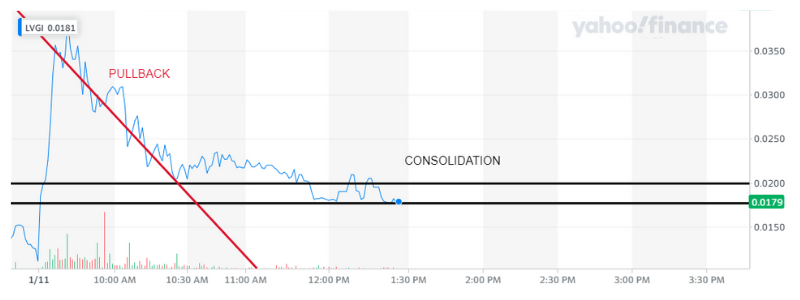

LVGI 1 Day Chart

Limitless Venture Group Technical Analysis

The news was incredible that Limitless Venture Group LVGI released today was huge and the stock responded with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

The real question is, what is it going to do now? Well, it has pulled back as expected but it will now consolidate. Next, it will make a move up or down depending on the indicators within the consolidation. It is too early to determine which way it will move, but it is showing an early tendency to bearish.

I would expect The news was incredible that Limitless Venture Group LVGI released today was huge. The stock responded with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

I would expect, the news was incredible that Limitless Venture Group LVGI released today was huge and the stock responded. Therefore, LVGI opened with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

I am thinking Limitless will continue to drop in PPS until it fully consolidates then it will make a run! Stay tuned traders

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Zynga ZNGA purchased for $12B

Zynga ZNGA purchased for $12B by Take-Two Interactive. ZNGA gaps up 46% with heavy trading volume this morning. Let’s take a closer look at Zynga.

Zynga Inc. ZNGA Company Summary

Company Name: Zynga Inc.

Ticker: ZNGA

Exchange: NASDAQ

Website: www.zynga.com

[thrive_leads id=’9825′]

Zynga Inc. ZNGA Company Summary

Zynga ZNGA is a global leader in interactive entertainment with a mission to connect the world through games.

Therefore with it’s massive global reach in more than 175 countries and regions, Zynga has a diverse portfolio of popular game franchises that have been downloaded more than four billion times. Just on mobile including CSR Racing™, Empires & Puzzles™, FarmVille™, Golf Rival, Hair Challenge™, Harry Potter: Puzzles & Spells™, High Heels!, Dragons!™, Merge Magic!™, Toon Blast™, Toy Blast™, Words With Friends™ and Zynga Poker™.

With Chartboost, a leading mobile advertising and monetization platform, Zynga is an industry-leading next-generation platform with the ability to optimize programmatic advertising and yields at scale.

Founded in 2007, Zynga is headquartered in California with locations in North America, Europe and Asia.

Why did ZNGA go up over 40% overnight?

Jan. 10th 2021

Take-Two to acquire all the outstanding shares of Zynga for a total value of $9.861 per share – $3.50 in cash and $6.361 in shares of Take-Two common stock, implying an enterprise value of $12.7 billion.

Transaction represents a 64% premium to Zynga’s closing share price on January 7, 2022.

Establishes Take-Two as one of the largest publishers of mobile games, the fastest-growing segment of the interactive entertainment industry.

Unifies highly complementary businesses, including Take-Two’s best-in-class portfolio of console and PC games and Zynga’s industry-leading mobile franchises.

Creates one of the largest publicly traded interactive entertainment companies in the world, with $6.1 billion in trailing twelve-month pro-forma Net Bookings for the period ended September 30, 2021.

Consequently, Transaction expected to deliver approximately $100 million of annual cost synergies within the first two years after closing, and more than $500 million of annual Net Bookings opportunities over time.

Take-Two TTWO Company Summary

Company Name: Take-Two Interactive Software, Inc.

Ticker: TTWO

Exchange: NASDAQ

Website: https://www.take2games.com/

Zynga Inc. ZNGA Company Summary

Headquartered in New York City, Take-Two Interactive Software, Inc. is a leading developer, publisher, and marketer of interactive entertainment for consumers around the globe.

We develop and publish products principally through Rockstar Games, 2K, Private Division, and T2 Mobile Games.

Take-Two TTWO products are designed for console systems, personal computers, and mobile, including smartphones and tablets.

Also, they deliver through physical retail, digital download, online platforms, and cloud streaming services. Take-Two TTWO common stock trades on NASDAQ under the symbol TTWO.

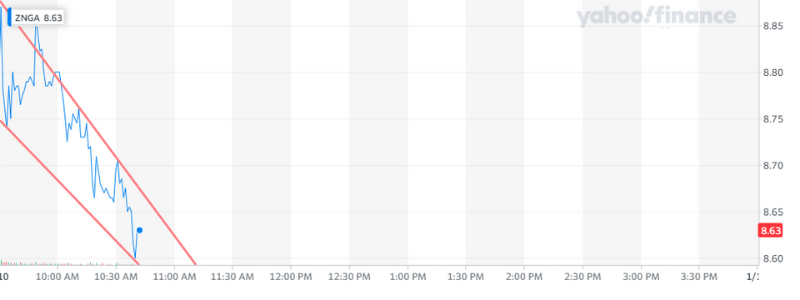

ZNGA 3 Month Chart

Zynga ZNGA 1 Day Chart

ZNGA Technical Analysis

After the announcement that Take-Two TTWO was acquiring Zynga Inc. ZNGA the stock gapped up with heavy trading volume by over 40%! Meanwhile TTWO suffers in PPS with a massive sell off.

ZNGA is shockingly consolidating after the massive run with a slight pullback. This is a good sign. Therefore, I would like to see it break $8.70 then $8.76 before I would take a position because normally there will be a massive sell off after a huge gap up like this.

[thrive_leads id=’9825′]

Kaival Brands KAVL ready to breakout?

Kaival Brands KAVL has been in a bearish trend and it is possible that there has been a reversal. Take a look at this chart.

Kaival Brands KAVL Company Summary

Company Name: Kaival Brands Innovations Group, Inc.

Ticker: KAVL

Exchange: NASDAQ

Website: www.ir.kaivalbrands.com.

Kaival Brands Company Summary:

Based in Grant, Florida, Kaival Brands is a company focused on growing and incubating innovative and profitable products into mature and dominant brands in their respective markets.

Our vision is to develop internally, acquire, own, or exclusively distribute these innovative products and grow each into dominant market-share brands with superior quality and recognizable innovation. Kaival Brands is the exclusive global distributor of all products manufactured by Bidi Vapor.

KAVL News

Dec. 14, 2021

Announced today that 80% of adult participants in a recent survey of e-cigarette users and cigarette smokers in the United Kingdom (“U.K.”) preferred the BIDI® Stick over their current options.

Dec. 6, 2021

Announced that it has partnered with Koupon to create an electronic engagement program involving Koupon’s digital promotion platform. The partnership will offer customers who purchase the BIDI® Stick—a premium electronic cigarette—digital opportunities based on their purchases.

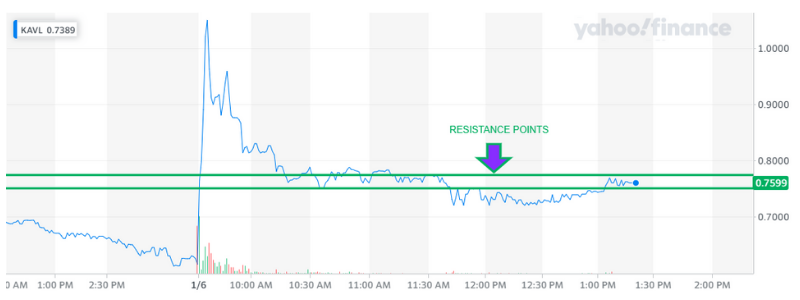

KAVL 1 Day Chart

Kaival Brands Innovations Group, Inc. (KAVL) analysis

This stock is trying it’s best to break the second level of resistance and it should move once it does. Keep an eye on the $.78 PPS, it is a resistance point that is important!

MGM Reversal? MGM Growth Properties announces dividends!

Company Name: MGM Growth Properties LLC

Ticker: (MGP)

Exchange: NYSE

Website: http://www.mgmgrowthproperties.com

Company Summary:

MGM Growth Properties LLC (NYSE:MGP) is one of the leading publicly traded real estate investment trusts engaged in the acquisition, ownership and leasing of large-scale destination entertainment and leisure resorts, whose diverse amenities include casino gaming, hotel, convention, dining, entertainment and retail offerings. MGP, together with its joint venture, currently owns a portfolio of properties, consisting of 12 premier destination resorts in Las Vegas and elsewhere across the United States, MGM Northfield Park in Northfield, OH, Empire Resort Casino in Yonkers, NY, as well as a retail and entertainment district, The Park in Las Vegas.

Why did it go up over 100%?

MGM announced that its board of directors declared a quarterly cash dividend of $0.525 per Class A common share for the fourth quarter. On an annualized basis, the dividend of $2.10 represents an increase of $0.02 per share. This is the 15th dividend increase since MGP’s initial public offering in April 2016. The dividend will be payable on January 14, 2022 to shareholders of record as of the close of business on December 31, 2021.

5 Day Chart

Technical Analysis:

A head and shoulders pattern has been detected and a reversal might be under way. Be careful with the resistance at $38.11 but with the news of the dividend and the reversal yesterday this could be a good play!

Biofrontera Inc. (Nasdaq: BFRI Patent allowed!

Company Name: Biofrontera Inc.

Ticker: (BFRI)

Exchange: NASDAQ

Website: www.biofrontera-us.com

Company Summary:

Biofrontera Inc. is a U.S.-based biopharmaceutical company commercializing a portfolio of pharmaceutical products for the treatment of dermatological conditions with a focus on photodynamic therapy (PDT) and topical antibiotics. The Company’s licensed products are used for the treatment of actinic keratoses, which are pre-cancerous skin lesions, as well as impetigo, a bacterial skin infection.

Why did it go up over 100%?

WOBURN, Mass., Dec. 08, 2021 (GLOBE NEWSWIRE) — Biofrontera Inc. (Nasdaq: BFRI), a biopharmaceutical company specializing in the commercialization of dermatological products, announced today that the United States Patent and Trademark Office (USPTO) has issued a Notice of Allowance for Biofrontera Pharma GmbH’s U.S. patent number 17/215,785 (‘785 patent), titled “Illumination device for photodynamic therapy, method for treating a skin disease and method for operating an illumination device,” which protects a number of innovations relating to the RhodoLED XL lamp.

WOBURN, Mass., Dec. 13, 2021 (GLOBE NEWSWIRE) — Biofrontera Inc. (Nasdaq: BFRI), a biopharmaceutical company specializing in the commercialization of dermatological products, announced today that the first subject has been enrolled in the Phase 2b study performed by Biofrontera Bioscience GmbH to evaluate the safety and efficacy of Ameluz® in combination with the red-light lamp BF-RhodoLED® for the treatment of moderate-to-severe acne with photodynamic therapy (Ameluz®-PDT).

5 Day Chart Technical Analysis

I like the stock! Great news and the 5 day is bullish and has solid news with a patent being accepted and a phase 2b clinical trial being announced.

1 Day Chart Technical Analysis

Technical Analysis:

I like the stock only IF the bearish trend continues in the morning, stay AWAY until there is consolidation and a double confirmation of a bullish move.