MULN Stock Price is up over 50% with a volume increase of 27%. There has been some early signs of a possible retrace so let’s look at it a little closer.

Wondering why this stock is having such a hard time and if it can break the overall trend? Keep reading to find out more!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! MULN Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Mullen Automotive Inc. Company Information

Company Name: Mullen Automotive Inc.

Ticker: MULN

Exchange: NASDAQ

Website: https://www.mullenusa.com/

Netlist Inc. Company Summary:

Mullen Automotive Inc. operates as an electric car company. It develops electric vehicles and energy solutions. The company was founded by David Michery in 2014 and is headquartered in Brea, California.

MULN stock price is due to News?

May 31st

- Mullen Automotive Inc (NASDAQ: MULN) has put forth the results of its solid-state polymer battery testing with the Battery Innovation Center (BIC) in Indiana.

- “The battery has performed exceptionally well, and I’m pleased with the results from BIC in Indiana,” said David Michery, CEO and chairman.

- Testing results from BIC show the solid-state polymer cell, rated at 300 Ah and 3.7 volts, tested at 343.28 Ah at 4.2 volts, exceeding expectation and is in line with test tolerance from previous EV Grid test results.

Feb. 28, 2022 (GLOBE NEWSWIRE) — via InvestorWire — Mullen Automotive, Inc. (NASDAQ: MULN) (“Mullen” or the “Company”), an emerging electric vehicle (“EV”) manufacturer, announces an update on Mullen’s next-generation solid-state polymer battery technology, which is a significant advancement over today’s current lithium-Ion batteries.

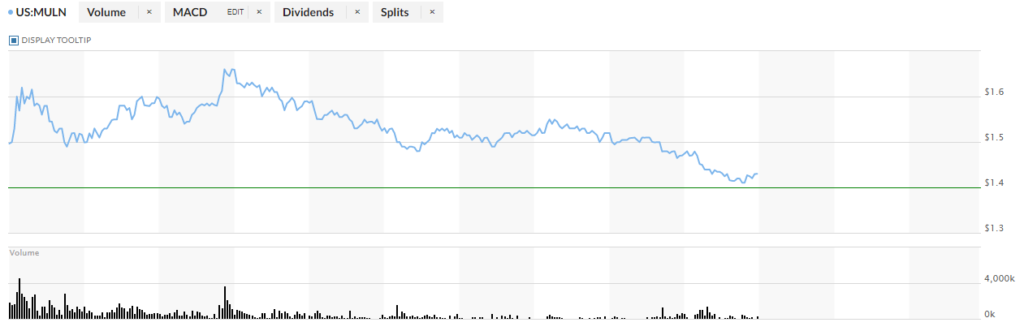

MULN 5 Day Chart

MULN Stock Price Technical Analysis:

I like the stock only if it can beat resistance at $1.55 and if you are truly conservative the $1.66 PPS is important too. The 1 day is showing the bearish move so just be aware of the movement.

This is Alex, reminding all the traders out there to leave your emotions at the door and never, ever, try to catch a falling knife. I strive to find breakout stock alerts and deliver them before the market finds out.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below

[thrive_leads id=’14274′]