DocuSign DOCU was trading at almost $400 a year ago, now it’s at $56. This is an incredible value and we love it!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

DocuSign Inc. Company Information

Company Name: DocuSign

Ticker: DOCU

Exchange: NASDAQ

Website: www.docusign.com

DOCUSIGN Company Summary:

DocuSign helps organizations connect and automate how they prepare, sign, act on, and manage agreements. As part of the DocuSign Agreement Cloud, DocuSign offers eSignature, the world’s #1 way to sign electronically on practically any device, from almost anywhere, at any time. Today, over 1.2 million customers and more than a billion users in over 180 countries use the DocuSign Agreement Cloud to accelerate the process of doing business and simplify people’s lives.

DocuSign stock price is due to News?

Sept. 8, 2022 /PRNewswire/ — DocuSign, Inc. (NASDAQ: DOCU), which offers the world’s #1 e-signature solution as part of the DocuSign agreement platform, today announced results for its fiscal quarter ended July 31, 2022.

“We delivered solid Q2 results, with a strong finish to the first half of the year. These results reflect the focus and dedication of our team on execution during this transition period, with a stronger foundation in place to deliver in the second half of the year. We enter this next phase with a clear set of vital few deliverables for our people initiatives and product roadmap, while driving sustainable and profitable growth at scale,” said Maggie Wilderotter, DocuSign’s Interim CEO and Board Chair. “We have a $50 billion market opportunity, an industry leading digital agreement platform, strong market position, and an experienced leadership team. I have total confidence our team will successfully deliver for all stakeholders.”

Second Quarter Financial Highlights

- Total revenue was $622.2 million, an increase of 22% year-over-year. Subscription revenue was $605.2 million, an increase of 23% year-over-year. Professional services and other revenue was $17.0 million, a decrease of 11% year-over-year.

- Billings were $647.7 million, an increase of 9% year-over-year.

- GAAP gross margin was 78% for both periods. Non-GAAP gross margin was 82% for both periods.

- GAAP net loss per basic and diluted share was $0.22 on 201 million shares outstanding compared to $0.13 on 196 million shares outstanding in the same period last year.

- Non-GAAP net income per diluted share was $0.44 on 206 million shares outstanding compared to $0.47 on 208 million shares outstanding in the same period last year.

- Net cash provided by operating activities was $120.9 million compared to $177.7 million in the same period last year.

- Free cash flow was $105.5 million compared to $161.7 million in the same period last year.

- Cash, cash equivalents, restricted cash and investments were $1,129.6 million at the end of the quarter.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures and Other Key Metrics.”

Operational and Other Financial Highlights

DocuSign Agreement Cloud 2022 Product Release 2. DocuSign announced new product capabilities, including:

- DocuSign eSignature. Introduced Shared Access, which allows a user to be granted permission to send or manage envelopes on another user’s behalf, and announced enhancements to Bulk Send and Agreement Actions.

- DocuSign eSignature App for Stripe. A new integration that allows account, finance and support teams to view eSignature agreements and Stripe payments side-by-side and launch new agreements right from their Stripe dashboards. Stripe users no longer need to go between the two platforms to complete transactions, support customers, or review transactions.

- DocuSign CLM. Introduced a new CLM Integration within Slack that enables customers to collaborate and move their agreements forward in a more streamlined way. CLM for Slack allows users to navigate the full agreement processes from redlining, to reviews and approvals, using our leading CLM solution without ever leaving the Slack platform. Other CLM enhancements include CLM AI-assisted data capture and a new integration with DocuSign CLM Connector for Coupa.

- DocuSign Notary. Introduced support for notaries seated in two additional U.S. states, New Jersey and Oregon, bringing the total number of states supported by DocuSign Notary to 25.

Outlook

The company currently expects the following guidance:

| • Quarter ending October 31, 2022 (in millions, except percentages): | |||

| Total revenue | $624 | to | $628 |

| Subscription revenue | $609 | to | $613 |

| Billings | $584 | to | $594 |

| Non-GAAP gross margin | 79 % | to | 81 % |

| Non-GAAP operating margin | 16 % | to | 18 % |

| Non-GAAP diluted weighted-average shares outstanding | 205 | to | 210 |

| • Year ending January 31, 2023 (in millions, except percentages): | |||

| Total revenue | $2,470 | to | $2,482 |

| Subscription revenue | $2,405 | to | $2,417 |

| Billings | $2,550 | to | $2,570 |

| Non-GAAP gross margin | 79 % | to | 81 % |

| Non-GAAP operating margin | 16 % | to | 18 % |

| Non-GAAP diluted weighted-average shares outstanding | 205 | to | 210 |

The company has not reconciled its guidance of non-GAAP financial measures to the corresponding GAAP measures because stock-based compensation expense cannot be reasonably calculated or predicted at this time. Accordingly, a reconciliation has not been provided.

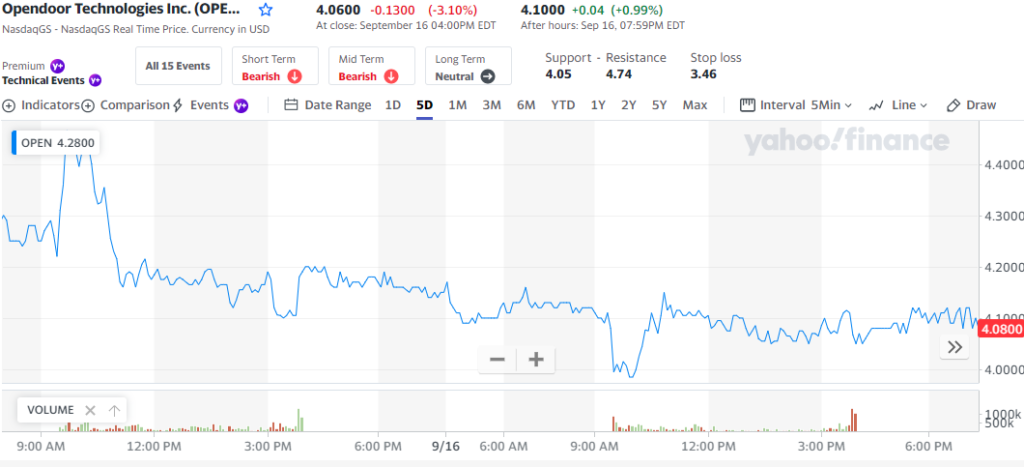

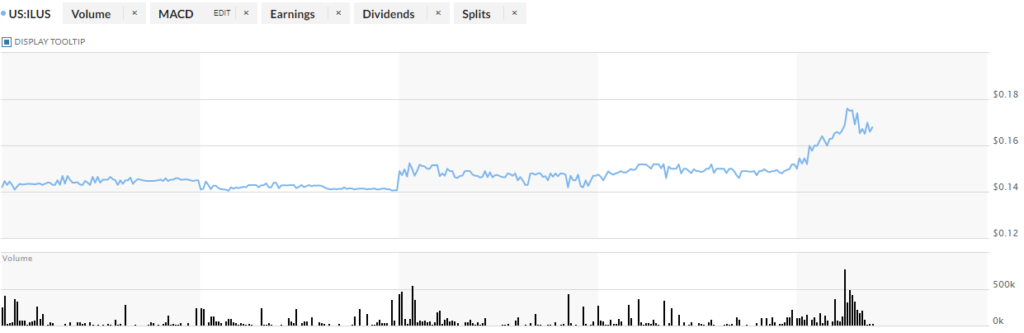

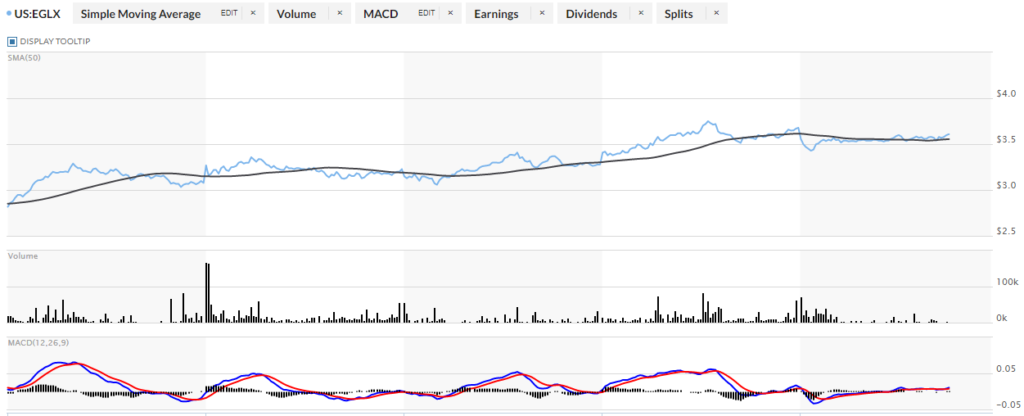

DOCU 5 Day Chart

Breakout Alert!

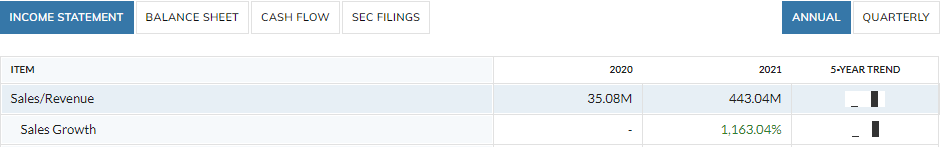

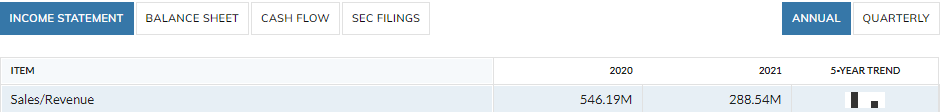

Docusign is the 500LB gorilla in the electronic document signing vertical and that is not changing anytime soon. The stock is undervalued and took a beating with all other stocks in the massive sell off of 2022. Look for a massive bounce!

[thrive_leads id=’14274′]