ADGI Stock Price has been trying to recover since it’s all-time high of almost $60. Wondering why this stock is having such a hard time and if it can break the overall trend?

If it went back to that PPS then that is 1,000% ++ gains, but can it?

Before we go over my opinion, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks! 👇 It’s free!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! ADGI Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

Now, let’s go over some of the basic information on this stock before we get in the technical analysis

Adagio Therapeutics Company Information

Company Name: Adagio Therapeutics Inc.

Ticker: ADGI

Exchange: NASDAQ

Website: https://adagiotx.com/

Adagio Therapeutics Company Summary:

Adagio Therapeutics, Inc. engages in the discovery, development and commercialization of antibody-based solutions for infectious diseases with pandemic potential.

The firm develops antibodies that can neutralize SARS-CoV-2, SARS-CoV-1, and additional emergent coronaviruses.

It offers, ADG20, a monoclonal antibody targeting the spike protein of SARS-CoV-2 and related coronaviruses.

The company was founded by Tillman U. Gerngross, Ren? Russo and Laura Walker on June 3, 2020 and is headquartered in Waltham, MA.

ADGI stock price is due to News?

March 30, 2022

Reported that the primary endpoints were met with statistical significance for all three indications in the company’s ongoing global Phase 2/3 clinical trials evaluating its investigational drug adintrevimab (ADG20) as a pre-and-post-exposure prophylaxis (EVADE) and treatment (STAMP) for COVID-19.

EVADE and STAMP were primarily conducted during a time when pre-Omicron SARS-CoV-2 variants were dominant.

Following the emergence of the Omicron variant, in a pre-specified exploratory analysis in a subset of the pre-exposure cohort, a clinically meaningful reduction in cases of symptomatic COVID-19 was observed with adintrevimab compared to placebo.

Across both trials, a single intramuscular (IM) administration of adintrevimab at the 300mg dose had a similar safety profile to that of placebo.

Based on these data, Adagio plans to engage with the U.S. Food and Drug Administration (FDA) and to submit an Emergency Use Authorization (EUA) application in the second quarter of 2022 for adintrevimab for both the prevention and treatment of COVID-19.

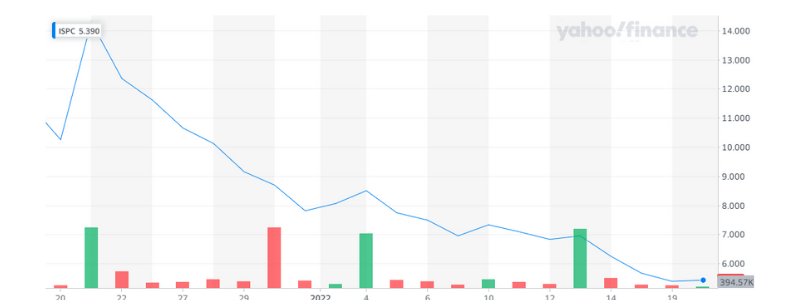

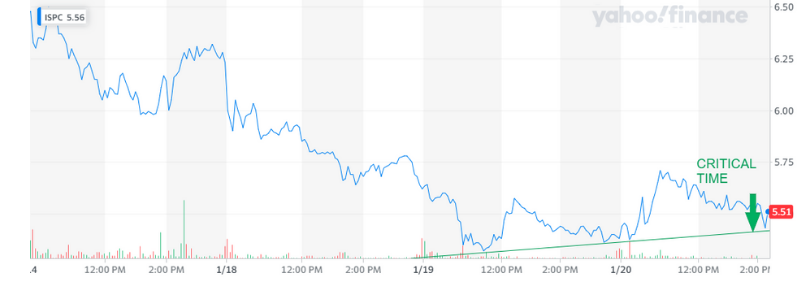

ADGI 5 Day Chart

ADGI Stock Price Technical Analysis:

I absolutely love it! I like it a $5.35 with a stop loss at $5.20. The news is incredible. The chart looks like it has infinite upside potential with the all-time high at $60 providing 1,000% gain potential.

Sign up below, I’m good at what I do and it’s free. 👇💎🚀

[thrive_leads id=’14274′]