DirecAST SpaceMobile ASTS stock price is half of it’s all-time high, has it officially reversed trend? Famed stock picker, Alexander Goldman has his analysis, take a look below.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Before we get started, I wanted to introduce myself to you. Hi 🙋♂️ I’m Alexander Goldman and I have been successfully trading breakout stocks and trending stocks for two decades now.

I’m now helping traders find breakout stocks. My claim to fame is the expert at finding trending stocks.

What do I mean by big winners?

Stocks that move more than 100% in a month! ASTS Stock Price could?

Does that always happen, NO! But, I’m very good! Take a look at this article I wrote, where I called 5 stocks, 3 losers and 2 winners and they all did what I thought!

The article is HERE where I shine a spotlight on trending stocks and breakout stocks!

If you want stocks delivered to your inbox, no hassle, no research with this massive community of traders, sign up below. Now, let’s go over some of the basic information on this stock before we get in the technical analysis.

Trending Stock AST SpaceMobile Inc. Company Information

Company Name: AST SpaceMobile Inc.

Ticker: ASTS

Exchange: NASDAQ

Website: https://ast-science.com/

Breakout Stock AST SpaceMobile Inc. Company Summary:

AST Spacemobile, Inc. engages in the building global broadband cellular network in space to operate directly with standard, unmodified mobile devices based on extensive IP and patent portfolio. The company’s team of engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. The company was founded on May 31, 2017 and is headquartered in Midland, TX.

ASTS stock price is due to News?

March 9th 2022

Announced it has signed a multi-launch agreement with Space Exploration Technologies Corp. (“SpaceX”). In addition to the planned summer launch of the BlueWalker 3 test satellite (BW3), the agreement covers the launch of the first BlueBird satellite and provides a framework for future launches.

This is huge news, SPaceX is a globally recognized space exploration company!

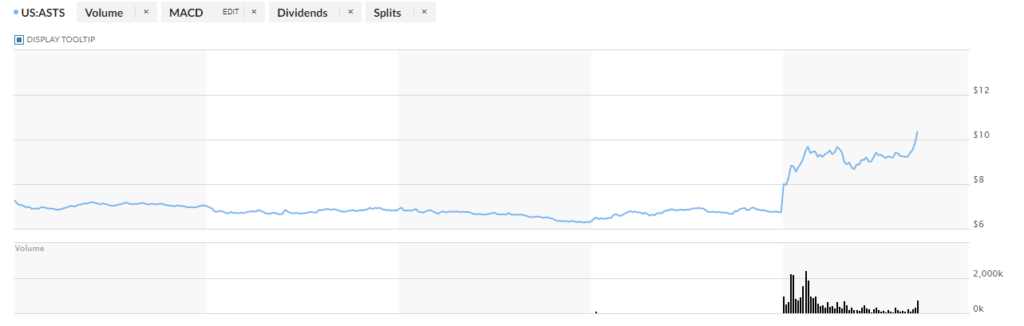

ASTS 5 Day Chart

Trending Stock ASTS Stock Price Technical Analysis:

An a agreement with SpaceX, say what! This is big news and I like the stock! It is a trending stock!

Caveat, I feel like it is over bought today so I would wait for a pull back and consolidation before I would purchase!

Once again my name is Alex and I’m so glad you took the time to read this far. I would love to have you be apart of our growing family of traders.

I always like giving tid bits of knowledge that I have learned from my mentors, so here goes. As a reminder to all of the traders out there to leave your emotions at the door and never, ever, try to catch a falling safe. Simply let it crash to the ground and then, walk over and pick up the money. That is a reference to bounce plays LOL.

For instance, trending stock ASTS should pullback very soon, don’t try to catch it at the “perfect” moment and get caught in the fall. Simply wait until it “crashes” to the ground, meaning, a confirmed bottom and reversal. Then you buy it, if you want.

I strive to find breakout stock alerts and deliver them before the market finds out. I’m the original OG trend setter of trending stocks! If you want stocks delivered to your inbox, no hassle, no research with this massive community of traders, sign up below.

I sure hope you enjoyed this article, if you would like to receive more exclusive content from me sign up for our newsletter below 👇

[thrive_leads id=’14274′]