THE TERM SHEET CREATES A OPPORTUNITY TO SCOPE AND CONSTRUCT ‘CRIMSON TIDE’ LITHIUM HYDROXIDE PILOT PRODUCTION FACILITY IN ALABAMA Press Release

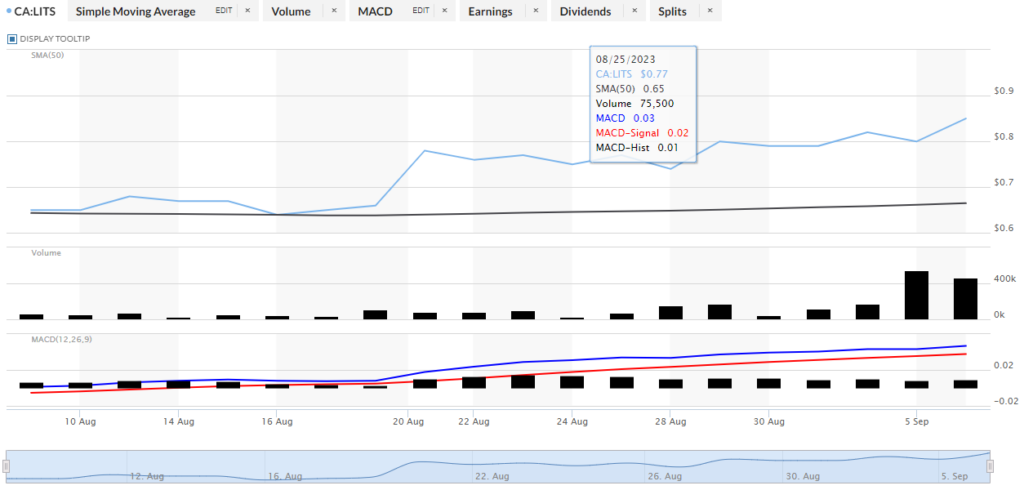

Let us review the chart before we go over this exciting news because the technical on this chart are bullish.

The MACD is strong and continuing to reveal a bullish movement while volume has been increasing.

We are excited for LITS based on this historical trend leading up to this mornings news. At this point, let us review key points found in the press release this morning.

- LiTHOS will own and operate the Crimson Tide production facility.

- The ‘Crimson Tide’ Hydroxide facility will selectively pre-treat raw continental brines, concentrate lithium chloride with DLE, and upgrade the concentrate into a final battery grade product of lithium hydroxide monohydrate.

- Facility is strategically located next to Mercedes-Benz US International, Inc., Honda Manufacturing of Alabama, LLC, Hyundai Motor Manufacturing Alabama, LLC. The Alabama site is Hyundai’s first U.S. manufacturing plant and ranks as the state’s third-largest industrial employer tied with Merceds-Benz.

- In regional proximity to the Smackover brine reservoir and all major U.S automobile Manufacturers including Tesla, G.M, and Ford.

- The complex consists of 3 buildings that are 6,000, 7,000, and 42,000 sq. ft. each and are all located in Bessemer, Alabama.

- This facility seeks to enhance LiTHOS’ capacity to conduct multiple simultaneous customer pre-treatment, and DLE demonstration programs.

VANCOUVER, BC , Sept. 6, 2023 /PRNewswire/ – LiTHOS Energy Ltd. (the “Company“) (CSE: LITS) is pleased to announce that LiTHOS Technology LLC (“LiTHOS“), a wholly-owned subsidiary of the Company, has signed a non-binding indicative term sheet (this “Term Sheet“) with Sand Spirit LLC (“Sand Spirit“) to develop, construct, own and operate a testing and production facility to handle raw brine and upgrade it into a final yield product of lithium hydroxide monohydrate (“LiOH H2O“), inclusive of, but not limited to, the following key operations (collectively, the “System“) and ancillary equipment and services to be located at Sand Spirit’s Buildings 1, 2 and 3 located in Bessemer, Alabama (the “Site“):

(i) Storage of raw, intermediate, and processed brines;

(ii) Pre-treatment processing systems and operations;

(iii) Lithium chloride (“LiCl“) concentration processing systems and operations; and

(iv) Direct lithium extraction (“DLE“) processing systems and operations;

(v) Lithium chloride treatment and refining activities (“Refining“) into LiOH H2O.

The JDA will contemplate the establishment of a governance structure for the Transaction as well as the allocation of the following duties and responsibilities of the parties for the development of each aspect of the Site in the following three phases (collectively, the “Project Phases“):

Phase 1: Site Development Strategy

Phase 2: Site Contracting and Implementation

- Complete front-end loading designs and engineering for the Site upon selection of a target source brine, volume of brine to processed and location for processing plant;

- Negotiate definitive agreements, including a fixed-price and date-certain engineering, procurement and construction contract and a comprehensive lithium marketing and distribution strategy for the Site;

Phase 3: Final Investment Decision

- Mutually agree to a final investment decision (“FID“), provided that all conditions precedent to FID as set forth in the JDA are met to the satisfaction of each of the parties; and

- Complete the construction, commissioning, and placement into service of the Site consistent with the purpose and Project Phases. The pilot production System capacity shall be right-sized for Building 3 or other suitable site as determined by the parties.

ABOUT THE SAND SPIRIT FACILITY

Facilities and Equipment are in downtown Bessemer, Alabama. Bessemer is an adjacent city to Birmingham, Alabama and only 30 miles to the University of Alabama. The complex consists of 3 buildings that are 6,000, 7,000, and 42,000 sq. ft. each. Each building has an office, laboratory, and warehouse space. Two buildings have fume hoods for solvent related work. Fire Extinguishers and eye-wash / safety showers are located throughout the buildings.

Equipment

- ICP-OES Agilent

- LC-MS Sciex Triple Quad 5500 Mass Spec.

- Silverson L4RT High Shear Mixer with 4 different heads.

- Shimadzu TA-60 Differential Scanning Calorimeter (DSC)

- TA Instruments Q2000 Differential Scanning Calorimeter (DSC)

- TA Instruments Q600 Thermogravimetric Analyzer (TGA).

- Three Hewlett Packard 6890 gas chromatograph (GC-MS)-5973 MS detector and autosampler.

- Shimadzu HS-20 gas chromatograph (GC-MS) with head space analyzer

- Hewlett Packard 5890 gas chromatograph (GC-FID) detector and autosampler

- Hewlett Packard 1100 high performance liquid chromatograph (HPLC) including detector analysis by evaporative light scattering and an autosampler.

- Dionex LC-20 with PAD and AS40 Autosampler

- KNAUR Simulated Moving Bed Lab Bench

- Buchi Reveleris X2 Flash chromatography

- Buchi Reveleris PREP flash chromatography

- Calgon ISEP – Simulated Moving Bed Pilot Plant with 30 columns (3 inch by 4 foot) (4 systems)

- Nanalysis NMReady 60 Pro

- 10L photochemical reactor

- 20L photochemical reactor (4 systems)

- Multiple ovens, chillers, balances, and chemical storage cabinets.

- Denver Instruments Karl Fisher Titrator Model 375

- Denver Instruments Model 250 pH/Ion/Conductivity Meter.

- Metrohm 743 Rancimat Analyzer

- Heidolph 4001 Efficient Rotary Evaporator (3 units)

- Pensky Martin Closed Cup Flash Point

- SI Analytics Acid and Base Auto Titrators

- Brookfield DV-E Viscometer

- Wurster Bed Coater

- Spray dryer – 4L/hr pilot

- Multiple Environmental Chambers

- BR Instruments Spinning Band Distillation Column with eight fraction collectors, BR Instruments 36/100 with CPU and vacuum

- BR Instruments Spinning Band Distillation Column with eight fraction collectors, BR Instruments 9600 with CPU and vacuum

- Spinning Disk Molecular Distillation Lab 3 Still from Meyers Vacuum.

- Glass Wiped Film Evaporator with continuous feed pump and two stage condenser, InCon ICL-04WR WFE

- Two inch glass distillation column

- Oldershaw Glass distillation Column

- Parr series 4550 high pressure reactor (2,500psi) (4 units)

- Parr series 4540 high pressure reactor (3,500psi) (2 units)

- 200 gallon glass lined pressure reactor with agitator

- 150 gallon Inconel pressure reactor (600psi) with agitator

- 5L, 20L and 50L rotary evaporators

- 10L, 20L, 50L and 100L jacketed stirring glass reactors

- Falling film evaporators

- Thin film evaporator

- Wiped film evaporators

- Multiple heating and cooling utilities (Mokon, Julabo, Chromalox, PCS)

- Multiple batch pressure vessel reactors

- Three 10 gallon, and one 20-gallon pilot scale reactor for use up to 2100 kPa,

- 75, 150 and 200 gallon market-development reactor,

- typical glassware reactor configurations,

- 4 liter Zipperclave by Autoclave Engineers with pneumatic drive rated at 2000psi

- 50 ml, 600 ml and three 2000 ml PARR reactor with PID control, programmable temperature control

- 100 L jacketed Glass Reactor

- three packed-bed reactor systems capable of programmed and remote operation through the CAMILE control system with NT software.

- 200 ml Autoclave Engineer Model 401A-9723 reactor capable of 5500psi at 650°F

- Continuous 200 ft long reactor 1.0 inch diameter Plugged Flow Reactor, with dual agitated piston pumps

- CIX/CIC system

- Computer/Software

- Aspen for chemical engineering modeling

- Solid Works for CAD drawings

- Scifinder for Chemical Research

- Access to the University of Alabama Electronic Library

To see last week’s in-depth analysis on LiTHOS click here

The lithium market is projected to grow from USD 21 billion in 2021 to USD 83 billion in 2035, according to Benchmark Mineral Intelligence. 1

Check out this interview with CEO Scott Taylor from LiTHOS explaining this amazing technology!

Scott mentions in his interview that Albemarle is the ONLY US-based brine Lithium producer and they are only meeting 1% of worldwide demand. Let us echo Scott’s sentiment, could you imagine if 99% of oil and gas supply was outside the control of the US?? The company that can deliver sustainable domestic lithium production may be positioned for massive growth that is reminiscent of Tesla or Google!

Albemarle is trading at US$191 per share. 2

Now let’s look at the supply and demand shortfall in the world -wide market. After 2025, we believe there could potentially be a supply imbalance which exacerbates over the next decade. Someone needs to deliver a new technology to unlock trapped resources in the ground to meet demand.

As you may imagine, not all mines have the same production potential. This is why Benchmark Mineral Intelligence (“BMI”) made its calculations based on annual production averages for each of the necessary mines lithium-ion cell manufacturing requires.

According to BMI, a lithium mine delivers an average of 45,000 metric tons LCE per year. 3 At that production level, the world would demand 74 new mines by 2035, for a total requirement for NEW production of 3.3 million metric tons per year. 4

That will complement the world’s current annual production capacity for the 4 million metric tons of lithium per year EVs will need by 2035. 5

As you will see in the technology section of BMI’s report, we believe LiTHOS may have the right technology to help capture a significant market share by 2035. 5

If you think that isn’t enough to get excited, look at what the Biden administration announced last year.

June 2022

WASHINGTON, D.C.— President Biden today issued presidential determinations providing the U.S. Department of Energy (“DOE”) with the authority to utilize the Defense Production Act (“DPA”) to accelerate domestic production of five key energy technologies:

Critical Materials Defined by the Energy Act of 2020 The Presidential Determination references five minerals associated with large capacity, rechargeable batteries (lithium, nickel, cobalt, graphite, and manganese); these minerals, among others, have been designated “critical minerals” by the U.S. Geological Survey (USGS).

DOE’s Continued Commitment to Bolstering a Domestic Clean Energy Supply Chain

In February, the DOE launched the new Office of Manufacturing and Energy Supply Chains to secure energy supply chains needed to modernize America’s energy infrastructure and support the full transition to clean energy Defense Production Act HERE

Here is a great article on the amazing market advantages to North American energy corporations when the government enacts such legislation.

It is a big deal, let’s recap for (CSE: LITS)(LITSF:OTC US):

#1 The lithium market is expected to grow by almost $80BN in the next decade! 6

#2 We believe the DPA intends to accelerate domestic production of lithium

So, why is LITS up almost 32%?

Let’s cover the mundane first, then get to the information that every trader needs to see.

Company Name: LiTHOS Energy Ltd.

Ticker: LITS (LITSF:OTC US)

Exchange: Canadian Stock Exchange (“CSE”)

Website: https://www.lithostechnology.com/

LiTHOS Energy Ltd. Summary

LiTHOS is delivering the standard for environmentally efficient and economically sustainable brine resource development. LiTHOS’ mission is to eliminate the use of evaporation ponds and enable the lithium industry a step-change in sustainable extraction processes.

The unique brine pre-treatment solution was originally engineered in 2016-18 as a modular oil and gas waste water treatment and recycling solution to turn contaminated water produced, flowback water into purified, particle-free and sanitized frac water for beneficial reuse. The robust system is mobile, highly automated and built for continuous operations under harsh conditions in remote locations.

After more than 6 years and $10 million invested, these systems are fully commercialized and operate in the field at scale. Each modular system can process a throughput feed of 10,000 barrels/day or 1,600 m³/day. AcQUA™, is a patent-pending electro-pressure membrane process which optimizes the pre-treatment of raw brines and then rapidly concentrates a lithium chloride with the use of multiple Direct Lithium Extraction, or ‘DLE’, techniques. Further, Aqueous Resources LLC, a wholly-owned subsidiary of LiTHOS, was recently awarded a $1.3 million grant from the DOE and a $250,000 grant from the state of Colorado to accelerate pilot demonstration testing. LiTHOS operates a fully commissioned lab facility and are working with multiple strategic mineral resource owners in Chile, Argentina, and the United States.

AcQUA™ technology avoids the typical challenges faced by chemically-intensive DLE technologies currently in development phase. AcQUA™ enables lithium brine resource operators to deploy economically viable and sustainable field-ready extraction solutions that seek to substantially reduce water consumption by recycling more than 98% of the input brine water, and substantially eliminate the use of evaporation ponds in the pre-treatment and concentration phases of production. AcQUA™ hopes to enable mining operators to implement economically viable and sustainable water reuse plants.

Without further ado,

The Top 3 reasons we think LITS is keenly positioned for 2023:

#1. The Chart!

#2. The Technology Is A Game Changer

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

#1. The Chart!

Our research team at Small Cap Exclusive (“SCE”) is good, really good! Their prospecting has helped lead to some very significant discoveries in the last ten years.

Tens of Thousands of traders trust SCE, the reason why, we help uncover potentially significant investment opportunities before the general population is aware.

We believe LiTHOS (CSE: LITS) is yet another diamond in the rough with potential upside. Accordingly, take a look at the chart below!

Keep in mind, the market has been a blood bath lately, why is this stock up so much?

We believe the chart above is an example of a bullish chart with technicals indicating bullish patterns both in the short term and long term and our analysists believe the next bullish pattern has just started to begin.

However, wait until the conclusion, as it’s important to have a foundational research established to understand the significance.

#2. We think the AcQUA™ Technology Is a Game Changer –Lithium Production Without Evaporation Ponds

AcQUA™ is a patent pending technology for an electro-pressure membrane process and method for recovery and concentration of lithium chloride from aqueous sources.

- Unique modular technology is capable of pre-treatment, selective purification, and concentration of lithium-enriched brines prior to extracting lithium chloride.

- Avoids the typical challenges faced by chemically intensive DLE technologies currently in development phase.

- Enables lithium brine resource operators to deploy economically viable and sustainable field-ready extraction solutions that will substantially reduce water consumption by recycling >98% of the input brine water and eliminate the use of evaporation ponds in the pre-treatment and concentration phases of production.

The fundamental DLE technology is a mature, field proven, operational system augmented from produced water management and recycling in the oil & gas sector. A fully operational DLE processing facility has been commissioned in Denver, Colorado, USA.

LiTHOS is currently focused on processing continental brines from several strategic resource owners located in the United States, Argentina, and Chile.

Their ADVANTAGE

1. INDUSTRIAL SCALE PRE-TREATMENT CONTROLS PRODUCTION

- LiTHOS is the only company able to take raw brine out of the ground, whereas other companies require evaporation ponds for pre-treatment. Accordingly, we believe it highly unlikely that the US will ever permit a new lithium mine that is reliant on evaporation ponds.

- By leveraging our established systems, LiTHOS hopes to achieve industrial-scale operations while ensuring seamless performance in field conditions.

2. ELIMINATES EVAPORATION PONDS:

Economics: The primary step which can substantially improve both CAPEX and OPEX.

Volume: How much brine fluid can be extracted and run through the production facility.

Efficiency: Pre-treatment is where 60% of the resource is lost & where massive water consumption occurs.

Simplicity: The ‘cleaner’ the input brine, the simpler the DLE solution: less chemicals – better recovery.

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

Let’s get nerdy for a minute and go over the important processes of lithium extraction.

Currently, most of the world’s lithium reserves are found in continental brines – natural salt water deposits.

Accordingly, two-thirds of the world production of lithium is extracted from these brines; a practice that evaporates on average half a million litres of brine per ton of lithium carbonate. For an average mine, that’s 40 billion litres of water per year.7 We believe this as being hardly sustainable.

Furthermore, the extraction is chemical intensive, extremely slow, and wastes up to 60% of the lithium resources in place while destroying the land.

However, efforts to increase production from brines have mostly stalled due to environmental and technical problems.

That is a big problem, Lithium brine resource owners need new technology to deliver new production quickly, efficiently, and sustainably.

Traditionally, in a free market economy, the bigger the problem, the bigger the revenue.

Because of these factors, we believe LiTHOS (CSE: LITS) is positioning itself as an industry leader with cutting edge technology!

What is the AcQUA™ Technology?

Based on a proven water treatment technology presently used to recycle produced fluids from oil & gas wells:

• Over 6 years of engineering and $10 million in hard investment.

• Commercial, production robust field-proven modular brine processing unit.

• Current design capacity will convert a 300ppm brine with a throughput capacity of 24,000 barrels of raw lithium enriched brine fluid per day into 2,512 mt of Lithium Hydroxide Monohydrate.

• Process has a US published patent. Company has an innovation pathway to deliver more patented intellectual property for shareholders.

The company has a pipeline of $1.55 million USD in awarded State (Colorado Advanced Industries) and Federal (US Department of Energy) grant funding contracted.

LiTHOS has an operational lithium processing facility commissioned in Denver, Colorado and is actively working with multiple major clients to benchmark its technology and deliver comparative results vs. other DLE technologies.

This technology has a potential to clean brines to purified irrigation water, while extracting lithium and other metals.

Above is the revolutionary technology that could transform the extraction of lithium.

The BIG problem: 10X MORE LITHIUM REQUIRED

In order for the western world to deliver the projected production of 3.3 million metric tons of lithium necessary by 2035, each of the 74 new producing mines producing 45,000 metric tons per year, requires approximately:

- 2,500 acres of land

- 10 billion gallons of water Per Year

- produces 250,000 tons of CO2 Per Year

- up to 2 years to evaporate and deliver production.

Let’s recap the 3 Catalysts that Could Send LITS on the Bullish Run of 2023:

#1. The Chart!

#2. The Technology Is A Game Changer

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

We have arrived at the much anticipated “reason” why LITS is getting heightened attention lately.

Top four reasons we believe research is indicating that the lithium sector may potentially experience a boom:

- Lithium has proven to be recession proof.

- Renewable energy thrives during a recession

- The lithium market is expected to grow by almost $80BN in the next decade!

- DPA to accelerate domestic production of lithium

Lithium has proven to be recession proof.

Alex Gluyas of Austrailian Financial Review states, “Lithium is proving to be largely immune from the volatility that has rocked commodity markets as prices soar in the face of a looming global recession, prompting Macquarie to deliver another round of upgrades for producers and developers of the battery metal. Lithium prices have continued to hit record levels this year with spodumene, carbonate and hydroxide surging 243 per cent, 124 per cent and 152 per cent respectively.” 8

Renewable energy thrives during a recession

The Motley Fool has a report on the renewable energy sector thriving during recessions.

Recessions can be scary for investors because the market can crash and, for some businesses, demand can drop like a rock. But not all businesses are affected the same way during a recession. 9

In renewable energy, there are major tailwinds driving growth even through recessions. The cost of renewable energy is coming down, fossil fuel costs are rising long term, and there’s a political desire to increase renewable energy production. You can see below that recessions haven’t stopped the growth of wind and solar energy projection, two of the main sources of renewable energy over the last two decades — despite three recessions in that time. For investors renewable energy stocks have a lot going for them, even in a recession. 10

- “,” ( , 2023).

- Albermale Corporation common stock price as of , 2023

- “,” ( , 2023).

- “,” ( , 2023).

- “,” ( , 2023).

- “,” ( , 2023).

- “,” ( , 2023).

- “,” ( , 2023).

- “,” ( , 2023).

- Ibid,.

Small Cap Exclusive is preparing for significant press releases that could come very soon from LiTHOS (CSE: LITS)(LITSF:OTC US).

If you want receive breaking news directly to your inbox we recommend signing up for updates on LITS below:

Forward-Looking Statements and Legal Disclaimers – Please Read Carefully.

This newsletter contains certain forward-looking statements within the meaning of applicable securities laws. All statements that are not historical facts, including without limitation, statements regarding future estimates, plans, programs, forecasts, projections, objectives, assumptions, expectations or beliefs of future performance, are forward-looking statements. Forward-looking statements in this material include, but are not limited to statements concerning: the potential growth, increase in share value and other like statements related to possible increases in the business or operations of LiTHOS; the projected growth of the lithium market in the United States and abroad; any similarities between the share prices of Albermale; bullish sentiments towards LiTHOS, its business operations and share price; any advantages LiTHOS may have over its competitors and, in connection therewith, the widespread acceptance and employment of the AcQUA™ technology; that the lithium boom is just getting started and that demand for lithium will continue to increase globally; that supplies of lithium will not be able to meet the growing global demand for lithium; that lithium is immune from market volatility and the effects of an economic recession; and that LiTHOS can obtain sufficient financing or cash flows to continue its explorations, technology development and current operations. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include: that LiTHOS may be unable to successfully implement and rollout the AcQUA™ technology for large scale commercial use; that LiTHOS may be unable to receive patent AcQUA™ technology; that LiTHOS may be unable to commercially extract lithium and/or enter into any deal for the supply of lithium; that the lithium boom may be ending and that demand for lithium may decline due to other alternative energy sources and/or technologies that replace technologies using lithium; that supplies of lithium will exceed growing global demand; that supply will fail to achieve exploration and development success similar to other companies within the lithium extraction sector; that LiTHOS may fail to obtain sufficient financing or cash flows to continue its explorations and operations; that LiTHOS may ultimately fail to successfully implement its business plans, raise capital or generate any significant revenues.

The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

LEGAL DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Small Cap Exclusive is owned and operated by King Tide Media, LLC and its owners, managers, employees, and assigns (collectively, “King Tide”) has been paid $100,000 dollars by LiTHOS Engery Ltd. (the “Company”) for an ongoing marketing campaign including this article, among other things. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of King Tide may be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. This relationship and the compensation to be received by us is a major conflict with our ability to be unbiased. As of the date of this letter, neither King Tide Media, LLC nor Small Cap Exclusive own any securities in LiTHOS.

NOT AN INVESTMENT ADVISOR. King Tide and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation.

ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.