GWPH Long Term Major Player in Medical Cannabis (NASDAQ:GWPH)

Intro & History:

GWPH, GW Pharmaceuticals (NASDAQ: GWPH) is a British biopharmaceutical company known for its multiple sclerosis treatment product Sativex, and Epidiolex (cannabidiol) which is their lead development drug nearing market introduction to treat a rare form of childhood-onset epilepsy which currently has few, if any, real treatment options. Sativex was the first natural cannabis plant derivative to gain market approval in any country. Founded in 1998 and based in Salisbury, UK GWPH is headed by Geoffrey W. Guy and Brian Whittle. GWPH calls themselves the “global leader in developing cannabinoid-based medicines.” We think that the epilepsy market is a sweet spot for cannabinoids because of relaxing medical marijuana regulations and the increasing prevalence of various types of epilepsy, all over the world.

Recent News & Developments:

On May 24th of this year, GWPH through its subsidiary Greenwich Biosciences published a “groundbreaking” study of Epidiolex in the prestigious New England Journal of Medicine. This corresponded with a slight surge in stock price, but came nowhere near historical highs. In any case, the current Phase III study has received ample positive attention not only in the NEJoM but from physicians specializing in conditions it is designed to treat at the American Academy of Neurology annual meeting on April 25 of this year.

This is starting to sound repetitive, but we have to say again that with relaxation of regulations at the state level, the federal government will eventually have to follow suit. So far that has remained elusive, especially with notorious drug warrior Jeff Sessions, the current U.S. Attorney General pressing Congress for the repeal of the Rohrabacher-Farr Amendment which prevents the federal government from prosecuting (or persecuting) marijuana based businesses that are in compliance with their state and local laws.

In some good news to counter the bad, Cory Booker, a liberal Democrat from New Jersey; Kirsten Gillibrand, a more moderate Democrat from New York; and Rand Paul, a libertarian leaning Republican from Kentucky introduced the CARERS Act which directly benefits firms like GW Pharmaceuticals by officially codifying Obama era policies whereby the feds largely ignored medical marijuana based businesses, and expanding opportunities for medical and scientific research into therapeutic uses for cannabinoids through a combination of banking, veterans access, and perhaps most importantly rescheduling marijuana away from the Schedule I designation which it shares with Heroin and LSD, making it very cumbersome to perform research. Finally, this act would completely remove cannabidiol (CBD), GWPH’s bread and butter so to speak, from federal drug schedules.

GWPH’s pipeline includes CBDV (GWP42006) for epilepsy and autism spectrum disorders and a host of other similarly cannabis-derived compounds for conditions including a form of neonatal encephalopathy, glioma, schizophrenia and complications stemming from multiple sclerosis. There are numerous clinical trial actions underway, viewable at the Clinicaltrials.gov website here.

Market Data & Performance:

Currently at $103.49 with a Market Cap of $2.61B. This is down from their all-time high of $132.73 in September of 2016 that coincided with the end of that fiscal quarter, the impending filing for FDA approval of Epidiolex (which still has yet to occur), and a resulting sharp spike of $50 in share price from August 1 to September 1, 2016. Since that time performance has been mostly negative, but could be looking up for Q3 2017.

Various positive indicators came out of the Q2 2017 call in early May. These included improving assets to liabilities and assets to inventory ratios. They’ve budgeted a significant $130M-$150M to spend for the next 12 month period, largely on operations, research and market penetration. They also discussed high profile Phase III research and development news regarding Epidiolex – which may finally be nearing FDA approval, several management changes including the hire of Scott Giacobello as their new CFO and plans to become a U.S. domestic NASDAQ registrant reporting under U.S. GAAP (and in U.S. dollars) in the near future, among other items.

Conclusion & Looking Ahead:

Based on current and historical performance, as well as positioning of current and future drug releases, GWPH is probably a bit undervalued. Sales of legal cannabis and marijuana in both the recreational and medical sectors are expected to rise by ~30% in 2017, ~45% in 2018, and reach $17 billion (or more) in 2021, per the “Marijuana Business Factbook 2017”. Numerous cannabis related stocks have already surpassed 2X or 3X on their value at introduction/IPO and GW is sitting at a pretty low point right now.

We think you are capable of doing the math here. While I cannot make any specific recommendations on this stock, you will be well served to short list a group of marijuana based stocks and follow them closely in the coming months and years. This should be one of them – keep an eye on upcoming clinical trials because the FDA and EMA processes to bring new drugs to market is long and fraught with peril and the floor can drop out at any time as a result. You should also be wary of a “green rush” bubble propping up marijuana based stocks but also understand that the inherent safety of cannabinoid products and derivatives, along with the aforementioned relaxed federal medical cannabis regulatory environment, do provide some insulation from sudden stock crashes resulting from suits or government “imminent public safety” action.

Finally, the status quo in Washington D.C. could be good for firms with existing research capabilities and market penetration like GW. Namely, recreational use is facing a steep climb toward federal legality, but numerous pieces of legislation currently making their way through Congress with the aim of easing restrictions on all aspects of the medical marijuana business.

ABBV AbbVie Inc Continues To Impress (NYSE:ABBV)

Intro & History on ABBV (NYSE:ABBV) :

In the biotech and medical marijuana arena, we think that ABBV AbbVie Inc. (NYSE ABBV) is an interesting and well known stock to keep an eye on. ABBV is a pharmaceutical development, discovery, manufacturing and sales firm based in Illinois near Chicago, and traded on NYSE and they are, according to Wikipedia, the world’s eighth-largest independent biotech company by market cap. AbbVie falls squarely into the “Big Pharma” category. From their own company literature they are:

“…a global, research-driven biopharmaceutical company committed to developing innovative advanced therapies for some of the world’s most complex and critical conditions. The company’s mission is to use its expertise, dedicated people and unique approach to innovation to markedly improve treatments across four primary therapeutic areas: immunology, oncology, virology and neuroscience. In more than 75 countries, AbbVie employees are working every day to advance health solutions for people around the world.”

AbbVie originated in 2013 when Abbott Laboratories decided to separate into two separately traded companies. Abbott is now focused only on medical devices, equipment and nutrition products whereas AbbVie is strictly in the pharmaceutical research and manufacturing business.

They manufacture several products, which in this day and age of ubiquitous pharma adverts, can arguably be called household names. The two most prominent of which – for our purposes anyway – are Humira and Marinol. Humira – This immunosuppressive drug accounts for over 60% of AbbVie’s revenue and is used to treat Crohn’s disease and happens to be the highest grossing drug *in the world*, with over 15% growth in the past year alone. There are so-called “patent cliff” concerns looming, but I’ll address those momentarily. Marinol – This marijuana derivative, also known as Dronabinol, is marketed to chemotherapy, AIDS and other patients dealing with nausea, vomiting and suppressed appetite resulting from a pathology or treatment regimen. It is currently regulated as a Schedule III substance under the Controlled Substance Act, differing markedly from marijuana which sits at Schedule I and carries unreasonably harsh criminal penalties in many places in the United States and abroad. Medicinal cannabis/marijuana is currently approved in over half of the United States.

Recent News & Developments:

ABBV currently has an alphabet soup of promising experimental drugs in the hopper. The one drawing the most publicity is Upadictinib (formerly research chemical ABT-494) which recently significantly outperformed a placebo in clinical trials for rheumatoid arthritis. The FDA recently rejected Baricitinib (developed and submitted by Eli Lilly and Incyte) thereby seriously limiting competition for Upadictinib. Now all AbbVie has got to do is find a catchier name for Ubpadictnib it and send out the sales force. I kid, of course; if history is any indication, it could be named “Thistuffakillyatinib” and it wouldn’t make a bit of difference – so long as it continues to work without any previously unforeseen large scale side effects and the accompanying class actions cropping up.

The one big question mark at this point; and one which doesn’t have too many informed investors and biotech experts worried given the timeframe, is the expiration of Humira’s patent in 2022 and the introduction of competing drugs. Since ABBV derives so much of their current income from this product, it is of course incumbent on them to develop replacement revenue drivers between now and then. Again, most analysts with whom I am familiar are bullish on the likelihood that this will indeed happen.

Market Data & Performance:

During the last one-year period this Large Cap stock has fluctuated between $55.06 (low) and $73.67 (high) with an average volume of 5,560,234, a current volume of over 9,000,000 and higher than average yield. The characteristic zigzag graph indicates rallies and reactions over the past five years, but the stock has trended generally upward in every year for which data is available since 2012. To further belabor the point, almost every new peak or trough has been higher than the preceding peak or trough through time, and the line-of-best-fit has a definitively positive slope. ABBV has used about 58% of free cash flow to cover their past four quarterly payments which isn’t ideal, but far from abnormal. Price closed at $73.18 on June 22, 2017 and is currently trending down, but only by about 1% on June 23. Other mostly current stats are as follows:

- Market Cap: 469B

- PE Ratio: 18.97

- EPS: 3.86

- 6% yield

The company released its first quarter 2017 financial results and outlook at the end of April and it contained the following statement:

AbbVie is confirming its GAAP diluted EPS guidance for the full-year 2017 of $4.55 to $4.65. AbbVie expects to deliver adjusted diluted EPS for the full-year 2017 of $5.44 to $5.54, representing growth of 13.9 percent at the mid-point. The company’s 2017 adjusted diluted EPS guidance excludes $0.89 per share of intangible asset amortization expense and other specified items.

Paying down of the relatively high debt load has not, and looks to continue to not be a priority, which could mean that the C-suite is confident in the likelihood of continued future growth.

Looking Ahead:

To those of you with a particular interest in the cannabis market sector, AbbVie has had Marinol since 1985 and has over 30 years of research into cannabinoid compounds. Several experts have speculated that one path away from ABBV disproportionately heavy reliance on Humira and the dangers associated with the impending collapse of its veritable monopoly, would be in medical marijuana derivatives – the market for which is in the process of moving from $5 Billion in 2015, to over $20 Billion by 2020.

Conclusion:

Humira is facing existential competition, but not anytime soon. Toward weaning themselves from Humira, ABBV acquired rights to ½ of sales of Imbruvica, a cancer drug, in 2015 and it is joined in their oncology drug portfolio by Venclexta another novel cancer treatment drug. There are, again, many more products in the research phase.

Even if there is an overall market correction in biotech, it would affect all such stocks equally and probably hit the smaller companies harder – and given the increasingly positive reception to relaxed medical (and recreational) marijuana laws and the tax revenues that decriminalization and legalization would bestow at the state and national levels, it would behoove AbbVie to seriously consider this market vertical for continued research, development, and acquisitions. They have the benefit of their extensive previous research and the notion that the DEA simply has to be trending toward totally re-scheduling marijuana (and its derivatives); and we feel like they can afford to be; actually – they NEED to be very aggressive in pursuing innovations in this market.

Further, given Humira’s continuing status as the #1 revenue grossing drug on the planet, the next 3 or so years look promising as a mid-term investment – depending on how proactive AbbVie can be in staking out aforementioned (or currently unannounced) new market footprint(s). Overall, in our opinion, the lower AbbVie trends toward the $60-65 threshold, the better the mid-to-long term bargain for investors and the more closely it should be followed.

Cara Therapeutics Continues to Climb (NASDAQ:CARA)

We think Cara Therapeutics (NASDAQ: CARA), a boutique “clinical stage” biotech/biopharma firm which develops novel compounds (including cannabis derived chemicals) for neuropathic pain is worthy of a close look. Cannabis regulation has been relaxing both globally and in the United States and this influences our stance on CARA stock. But there has also been positive recent product news. Furthermore, current trend analysis indicates that CARA could be on the cusp of becoming a real steady performer on the market.

Good news: The U.S. Food and Drug Administration (FDA) just granted “breakthrough therapy status” to Cara’s CR845, a unique therapeutic compound which has provided significant clinical benefits to some patients with chronic kidney disease and osteoarthritis (more on that in a bit) and trading has picked up significantly in recent days likely as a result.

Cara is based in Stamford, CT and was founded by Derek T. Chalmers, Michael E. Lewis, and Frédérique Menzaghi in 2004 (initial IPO on January 30 of that year) with the following mission:

… to fundamentally change the way acute pain, chronic pain and pruritus are managed. We aim to achieve this by developing new products that selectively target the body’s peripheral kappa opioid receptors. Cara is developing a novel and proprietary class of product candidates that target the body’s peripheral nervous system and have demonstrated initial efficacy in patients with moderate-to-severe pain and pruritus (itch) without inducing many of the undesirable side effects typically associated with currently available pain and itch therapeutics.

Recent News & Developments:

The FDA granted breakthrough therapy status for CR845, a drug for treating itching (uremic pruritis), which is an intractable and common (affecting up to 50% of patients) presenting symptom with chronic kidney disease patients undergoing hemodialysis. Currently CR845 is an intravenous drug, but an oral version is in late stage development. This is significant because of the lack of available effective systemic treatments that is compounded by a dearth of new product development by other pharmaceutical companies. Available treatment regimens span the gamut from oral antihistamines to topical creams, standard analgesics (NSAIDs) to risky ultraviolet light treatments which can cause skin cancers in individuals with fair complexions. CR845 showed a 68% reduction in worse itching scores and a 100% improvement to quality of life.

A quick note on the meaning of breakthrough therapy status: According to Wikipedia, breakthrough therapy is a United States Food and Drug Administration designation that expedites drug development that was created by Congress under Section 902 of the July 9, 2012 Food and Drug Administration Safety and Innovation Act. It allows the FDA to grant priority review to drug candidates if preliminary clinical trials indicate that the therapy may offer substantial treatment advantages over existing options for patients with serious or life-threatening diseases. The FDA will work with the sponsor of the drug application to expedite the approval process. This can include rolling reviews, smaller clinical trials, and alternative trial designs. In short, it simply means that 3-9 months are potentially shaved off of the standard review and approval cycle time.

Cara’s pipeline consists of CR845, variants upon CR845 and CR701, a chronic pain treatment which operates on peripheral cannabinoid receptors, particularly in immune cells such as leukocytes and mast cells, which have been shown to be involved in pain and inflammatory responses but do not affect cannabinoid receptors of the Central Nervous System (CNS). CR701 is an advanced compound presently in preclinical development for hyperalgesia (extreme sensitivity to pain) and allodynia (perception of harmless stimuli as pain) where it has been proven significantly effective in laboratory trials involving rodents.

Looking to extend their coverage abroad,Cara has in place licensing agreements with Chong Kun Dang Pharmaceutical Corporation to develop, manufacture, and commercialize products containing CR845 in South Korea; and Maruishi Pharmaceutical Co., Ltd to develop, manufacture, and commercialize drug products containing CR845 in Japan.

Market Data & Performance:

In 2017, Cara shares have risen a phenomenal 134+%, with stocks going for about $4.50 in July of 2016 trending all the way up to where they sat at $22.87 on Friday June 23, 2017. There was a slight dip in afterhours trading ending at $22.59 – but overall performance for CARA definitely defied the general biotech sector’s slide for the past month or so. Market Cap is $736.28M. Financials appear to be up-to-date and are listed at www.sec.gov or at their investor relations webpage. An EPS of $-2.52 might usually raise red flags, but given that we’re talking about a biotech – a sector in which firms lose money for years during the development of patient-ready products – CARA’s negative earnings per share is probably not a big deal.

Conclusion & Looking Ahead:

With the recent good news from the FDA and resulting trading performance, you can probably assume that EPS and share prices will improve in the near- to mid-term, but it will be important to keep an eye on how CARA manages its revenues and expenses moving forward.

Regarding the negative EPS, in Q1 2017 CARA managed to expend $22M, but the prospect of having its first product reach the market many months ahead of schedule means they have a good shot of reversing cashflow into the black sooner rather than later – and making a serious run at $30/share in the next six months. Of course there are well documented risks for retail investors in small cap biotech so it’s not wise to make such a stock the centerpiece of your portfolio or go in too heavy before the medical sector starts buying CARA’s products in quantity. We think this is a cannabis related stock to watch closely through the end of Q2 and into Q3, 2017.

(OTCMKTS:ADRNY) ADRNY Ahold NV Goes Green

(OTCMKTS:ADRNY) Ahold NV Goes Green on Massive Volume

Shares of (OTCMKTS:ADRNY) Ahold NV traded green with massive volume brought on by possible Kroger speculation ( Amazon just purchased Whole Foods). ADRNY shares have been on a downward ride for almost a month but today that changed. With over 7,000,000 shares trading, and a close of $18.37

As traders talk of possible take over by Kroger (NYSE:KR) things look promising considering the Amazon purchase of Whole Foods. A large acquisition from Kroger could make stealthy traders very happy. Of course this is all speculation, but speculation may not be the only driving force. With share price at a one year low the bottom of ADRNY was bound to be found, Is this it?

Could this be the bottom of ADRNY? Could we see a share price of $22 or $23 again?

Company Profile

Ahold Delhaize is one of the world’s largest food retail groups, a leader in supermarkets and e-commerce, and a company at the forefront of sustainable retailing. Our family of 21 great local brands serves more than 50 million shoppers each week in 11 countries. Each brand shares a passion for delivering great food, value and innovations, and for creating inclusive workplaces that provide rewarding professional opportunities. Our brands have also established meaningful, lasting commitments to strengthen local communities, source responsibly and help customers make healthier choices. Ahold Delhaize was formed in July 2016 from the merger of Ahold and Delhaize Group, retail innovators for almost 150 years. Our local brands employ more than 375,000 associates in 6,500 local grocery, small format and specialty stores.

Ahold owns US brands such as Food Lion, Stop & Shop New York, Hannaford, and Martin’s Food Markets among other large retail stores.

https://www.aholddelhaize.com/en/home/

Todays volume was nothing short of crazy for ADRNY with a few trades exceding 1.9million shares. Another day like today could be what ADRNY needs to change from red to green. I will be watching this one close over the next few weeks.

We will continue to follow (OTCMKTS:ADRNY) Ahold NV with any updates.

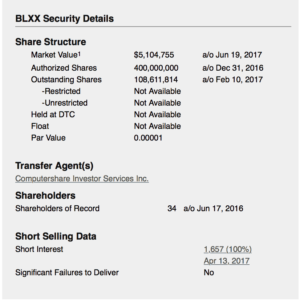

Blox Inc. BLXX (OTCMKTS:BLXX) makes easy gains off Lows

Blox Inc (OTCMKTS:BLXX) has made nice gains today on record volume. Today BLXX traded from $0.04 to highs of $0.09 and is currently sitting around $0.08 pos.

Todays total $ volume is just under $40,000.00 but even that is more than its traded in a single day for more than a year. With little selling pressure todays gains of 70% could just be the beginning of a nice move back to prices around $0.35 and needless to say its not going to take much volume to really move BLXX.

If less than $40,000 in trade value can move BLXX 70%

BLXX could really have some potential over the near future and we will continue to be watching and updating our subscribers.

Business Description

Blox Inc. (“Blox”), is a publicly traded Resource Exploration and Development Company.

Blox Inc. is focused on West Africa and at present has three Gold concessions in Ghana and one Gold concession in Guinea.

Blox Energy aims to green the mining process by implementing renewable energy into its own production processes and ultimately into those of other bulk power consumers in West Africa.

Blox’s shares trade on the OTCQB under the symbol BLXX.

Blox Inc. is based out of Vancouver B.C. Canada

http://www.otcmarkets.com/stock/BLXX/quote

Almost Bitcoin, Bitcoin Investment Trust (OTCMKTS:GBTC)

Bitcoin without Owning Bitcoin, Bitcoin Investment Trust (OTCMKTS:GBTC)

Bitcoin Investment Trust (OTCMKTS:GBTC) is a private, open-ended trust that is invested exclusively in bitcoin and derives its value solely from the price of bitcoin. It enables investors to gain exposure to the price movement of bitcoin without the challenge of buying, storing, and safekeeping bitcoins. The BIT’s sponsor is Grayscale Investments, a wholly-owned subsidiary of Digital Currency Group.

So for those of us that would like to invest/trade bitcoins but don’t want to have to deal with bitcoin wallets or transferring funds around you can easily use your current trading platform to purchase GBTC and trade just like any other stock.

https://www.otcmarkets.com/stock/GBTC/quote

Bitcoins Massive Run

Bitcoin has been on a massive run as of late with a value of more than $2,715 today per bitcoin and its not just the regular investors who are taking advantage of the opportunities presented with cryptocurrencies. Unless you have been hiding under a rock for the last few months you’ve heard someone or read something about Bitcoin and thats because its made a run from under $500 in 2015 to a current price of $2,715 6/20/17.

Im not going to try to explain what a bitcoin actually is because it seems that no longer matters, its the fact that the public, businesses, and even governments are beginning to recognize bitcoin is not going away.

What is a Bitcoin :

Bitcoin is a new currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. Transactions are made with no middle men – meaning, no banks! There are no transaction fees and no need to give your real name. More merchants are beginning to accept them: You can buy webhosting services, pizza or even manicures.

No one knows what will become of bitcoin. It is mostly unregulated, but that could change. Governments are concerned about taxation and their lack of control over the currency.

Blue Apron APRN vs Amazon (NASDAQ:AMZN)

Blue Apron (NYSE:APRN) offers customers a simple cook at home meal delivery service in a growing market where consumers demand home delivery options.

Founded in 2012, the New York based company has shown impressive growth through aggressive marketing and strategic partnerships with its vendors and consumers. Recently the company has show interest in the public markets and is currently poised to sell 30,000,000 shares around $15 – $17 per share.

Investors are having mixed emotions after Amazon (NASDAQ:AMZN) announced a bid to purchase Whole Foods (NASDAQ:WFM) Friday. Investors are worried that Amazons take over of Whole Foods could send he majority of food delivery service market share into the hands of the retail giant. With Amazons growing delivery service and delivery speeds along with the the brick and mortar Whole Foods locations a simpler & faster service is the obvious goal. Having a wide and cost-efficient distribution network for fresh food.

Blue Apron’s market is also faced with strong competition from HelloFresh, Purple Carrot, Sun Basket, and Green Chef to name a few.

As Blue Apron argues that its business model is different than Amazon’s service “Prime Fresh”, investors may be hard to convince , we will see…

DELIVERED DAILY, COOK AT HOME MEALS, FROM AMAZON, Prime Fresh by Amazon

Blue Apron’s offering is being led by Goldman Sachs, Morgan Stanley, Citigroup and Barclays. The company plans to list on the New York Stock Exchange under the ticker symbol APRN.

As of 6/20/17 Blue Apron plans to sell 30,000,000 shares around $15-$17 each

Blue Apron, which was founded five years ago by Matt Salzberg, Ilia Papas and Matt Wadiak, believes its rapid growth will be sufficient to entice investors, despite having never turned a profit. Blue Apron has fulfillment centers in Richmond, California, Jersey City, New Jersey, and Arlington, Texas and has also worked to increased its automation.

EYE’S ON TEMPUS APPLIED SOLUTION HOLDINGS (OTCMKTS:TMPS) TMPS

The share price of TEMPUS APPLIED SOLUTION HOLDINGS (OTCMKTS:TMPS) has soared over the last 5 days from a low of under $0.05 to a high of $0.50 on 6/19/17. Investors interest in TMPS is due to the recent purchase of the controlling portion by billionaire Johan Eliasch.

a little info on Johan Eliasch below :

Johan Eliasch (born February 1962), is a Swedish billionaire businessman, and the chairman and chief executive officer (CEO) of Head N.V.,[2] the global sporting goods group, and the former Special Representative of the Prime Minister of the United Kingdom.

He is on the board of directors of Equity Partners,[3] Aman Resorts,[4] London Films,[5] the Foundation for Renewable Energy and Environment,[6] Longleat and Acasta Enterprises. He is an advisory board member of Brasilinvest,[7] Societe du Louvre, Stockholm Resilience Centre, Capstar[specify], Centre for Social Justice and the British Olympic Association. He is a member of the Mayors of Jerusalem and Rome’s International Business Advisory Councils. He is the first president of the Global Strategy Forum,[8] a trustee of Cool Earth and a patron of Stockholm University.

He has also served on the boards of IMG (2006-13) and the British Paralympics Association, the sports advisory board of Shimon Peres Peace Centre, the advisory board of the World Peace Foundation. He was non-executive chairman and a non-executive director of Starr Managing Agents 2008-2015. He was non-executive chairman of Investcorp Europe 2010-2014. He was a trustee of the Kew Foundation 2010-2016. He chaired the Food, Energy and Water security program at RUSI 2010-2016. He was a member of the Mayor of London’s (Boris Johnson) International Business Advisory Council 2008-2016.

https://en.wikipedia.org/wiki/Johan_Eliasch

This sudden spike in TMPS comes just a month after Johan Eliasch made 2 purchases of almost 80,000,000 common shares with a current ownership of almost 90% of Tempus Applied Solutions Holdings. both purchases where made through his holding company Santiago Business Co. International Ltd.

TMPS has had little attention from investors for quite some time, slowly falling from $10.00PPS in 2015 to under $0.03 just a week ago. In the last few days TMPS daily volume has tripled day after day and become one of the top trading stocks on the OTC. Yesterday 6/19/17 had a increase of over 170% with almost 2,000,000 shares trading throughout the day giving early traders a great day.

https://www.otcmarkets.com/stock/TMPS/quote

TEMPUS APPLIED (OTCMKTS:TMPS) is headquartered in Williamsburg, Virginia, Tempus provides turnkey and customized design, engineering, modification and integration services, and operations solutions that support aircraft critical mission requirements for various international customers including the United States Department of Defense, other U.S. government agencies, foreign governments, and heads of state. Tempus designs and implements special-mission aircraft modifications related to intelligence; surveillance and reconnaissance systems; new generation command, control and communications systems; and VIP interior components. Tempus also provides ongoing operational support, including flight crews, maintenance, and other services to its customers.

Since taking over the majority interest in TEMPUS APPLIED SOLUTIONS HOLDINGS (OTCMKTS:TMPS) Johan Eliasch has broght in a new CFO Johan Aksel, a close business partner of Mr Eliasch.

Currently trading at a $35 + million market valuation TMPS has minimal cash and $12 million in current payables. The Company did $4,386,839 in revenues in the first q 2017 and has 10s of million in contracts on the books. TMPS is one exciting story, they are an established small to midsize DOD company in a very lucrative but difficult sector to get into. In this sector once a company like TMPS is established they often acquire other smaller companies to expand their footprint or the get bought out by one of the big 3 which are Boeing, Lockheed Martin, and Northrop Grumman who often pay anywhere from $300 million to $1 billion for companies of this size. We will be updating on TMPS when more details emerge so make sure you are subscribed to Microcapdaily so you know what’s going on with TMPS.

Under the sub-contract, Tempus will utilize highly modified turbo prop aircraft and will provide all flight crew, maintenance services, logistics support and secure facilities. Tempus expects to conduct more than 1,500 mission hours annually in support of the NORTHCOM CN> mission. “Supporting NORTHCOM and Patriot Group with our unique aviation assets and dedicated professional aviators and technicians is a mission that we are proud and honored to be a part of” stated Tempus Chief Executive Officer, Scott Terry.