Why was (LITS:CNSX)(LITSF:OTC US) Up 32% in August? You won’t believe the reason!

We did it again, we have uncovered a stock that is up almost 60% even in a bearish market!

(CSE:AMS) Alchemist Mining is the parent company to Lithos Technology, building a sustainable solution for lithium production.

The lithium market is projected to grow from USD 21 billion in 2021 to USD 83BN billion in 2035, according to Benchmark Mineral Intelligence.

As you may imagine, not all mines have the same production potential. This is why Benchmark Mineral Intelligence (BMI) made its calculations based on annual production averages for each of the necessary mines lithium-ion cell manufacturing requires.

According to the company, a lithium mine delivers an average of 45,000 metric tons per year. At that production level, the world would demand 74 new mines by 2035, for a total production of 3,3 million metric tons.

That will complement our current production capacity for the 4 million metric tons of lithium EVs will need by 2035.

As you will see in the technology section of this report, Lithos may have the right technology to capture 20% of market share by 2035.

If they did, they would have $16 Billion in revenue with a current float of $33,360,000 would place the price per share at $479.

That is a rough estimate but you get the idea, tons of upside.

If you think that is enough to get excited, look at what the Biden administration announced last year.

June 2022

WASHINGTON, D.C.— President Biden today issued presidential determinations providing the U.S. Department of Energy (DOE) with the authority to utilize the Defense Production Act (DPA) to accelerate domestic production of five key energy technologies:

Critical Materials Defined by the Energy Act of 2020

The Presidential Determination references five minerals associated with large capacity, rechargeable batteries

(lithium, nickel, cobalt, graphite, and manganese); these minerals, among others, have been designated “critical

minerals” by the U.S. Geological Survey (USGS).40

DOE’s Continued Commitment to Bolstering a Domestic Clean Energy Supply Chain

In February, DOE launched the new Office of Manufacturing and Energy Supply Chains to secure energy supply chains needed to modernize America’s energy infrastructure and support the full transition to clean energy Defense Production Act HERE

Here is a great article on the amazing market advantages to North American energy corporations when the government enacts such legislation.

It is a big deal, let’s recap the “perfect storm” that is brewing for (CSE:AMS):

#1 The lithium market is expected to grow by almost $80BN in the next decade!

#2 Rough calculations would place (CSE:AMS) at $400 PPS+/-?

#3 Defense Production Act (DPA) to accelerate domestic production of lithium

So, why is AMS up almost 60%? I think it is pretty obvious.

Let’s cover the mundane first, then get to the information that every trader needs to see.

Company Name: Alchemist Mining Inc.

Ticker: AMS

Exchange: CSE Canadian Stock Exchange

Website: https://www.lithostechnology.com/

Alchemist Mining Company Summary

Alchemist’s subsidiary LiTHOS is developing the trusted standard for environmentally efficient and economically sustainable brine-lithium resource development.

Now that we got the particulars out of the way, let’s go over something very exciting for investors.

We have uncovered 3 catalysts that could send AMS on the Bullish run of the year.

More importantly, we will then unveil the long awaited “reason” why AMS is getting major attention lately.

Without further ado,

The Top 3 Catalysts that Could Send AMS on the Bullish Run of 2023:

#1. The Chart Is Perfect, Literally Perfect!

#2. IPOs Offer A Significant Upside Potential

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

#1. The Chart Is Perfect, Literally Perfect!

Our research team at Small Cap Exclusive is good, really good! They have uncovered some of the most explosive trades in the last ten years.

Take a look at what we have done lately HERE.

Tens of Thousands of traders trust SCE, the reason why, we uncover the best investment opportunities before the general population are aware.

Creating a unique situation of positioning before the volume spikes.

(CSE:AMS) is yet another diamond in the rough with incredible upside potential, take a look at the chart below!

Keep in mind, the market has been a blood bath lately, why is this stock up so much?

Wait until the conclusion, it’s important to have a foundational research established to understand the significance.

The chart above is a clear example of a bullish chart with technicals indicating bullish patterns both in the short term and long term.

There are two bullish moves, one in early February and one in the beginning of March.

Moreover, there are two consolidation patterns from Feb 8th till March 2nd.

The next consolidation has just started to begin.

Once a double confirmed breakout takes place, we will see another move upwards.

Traditionally, this is when savvy investors execute a position during the consolidation before the next move.

So start your research now.

#2. IPOs Offer A Significant Upside Potential

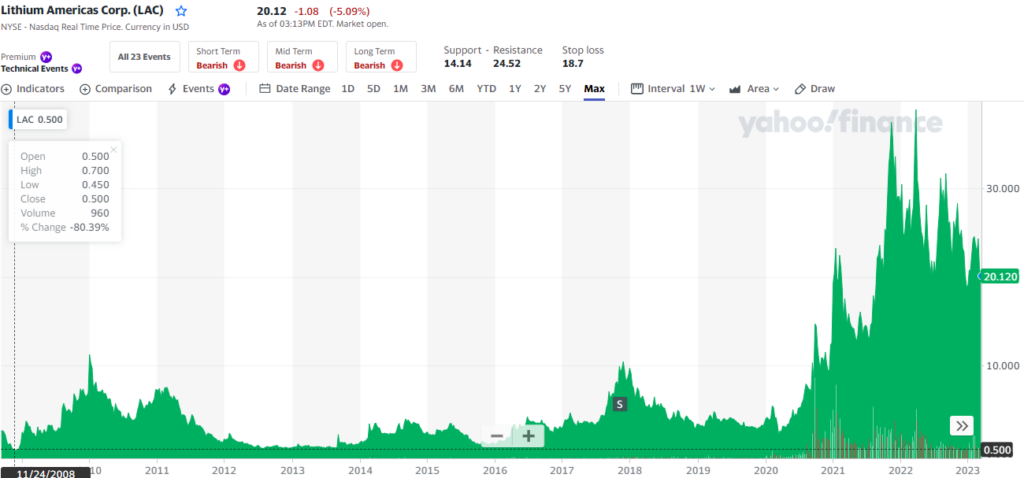

Lithium Americas Corp. (LAC)

In the lithium sector and has

On the IPO, on 11/24/2008 if you invested in LAC with $12,500 at $.50 on 3/28/2022 your 25,000 shares would be worth $1,000,000!

Lithium is the new oil and Alchemist is revolutionizing the lithium vertical.

In 2022 it was maxing out at $340, and in 2013 average investors had many opportunities to average out at $20, 1,600% growth!

The point of showing this example is that savvy investors have known for a while that energy is the new tech!

Lithium, which runs most battery operated items including vehicles is the investments making normal traders into millionaires with IPOs!

Why IPOs, you are getting in early before the parabolic growth.

Look at the chart above, the early investors are the winners!

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

Let’s get nerdy for a minute and go over the VERY important process of lithium extract.

Currently, most of the world’s lithium reserves are found in continental brines – natural salt water deposits.

Currently 2/3 of the world production of lithium is extracted from brines, a practice that evaporates on average half a million litres of brine per ton of lithium carbonate. For an average mine that’s 40 billion litres of water per year. This is hardly sustainable.

Furthermore, the extraction is chemical intensive, extremely slow, and wastes up to 60% of the lithium resources in place while destroying the land.

However, efforts to increase production from brines have mostly stalled due to environmental and technical problems.

That is a big problem, Lithium brine resource owners need new technology to deliver new production quickly, efficiently, and sustainably.

In a free market economy, the bigger the problem, the bigger the revenue.

AMS is positioning itself as an industry leader with cutting edge technology that could be disruptive!

What is the technology?

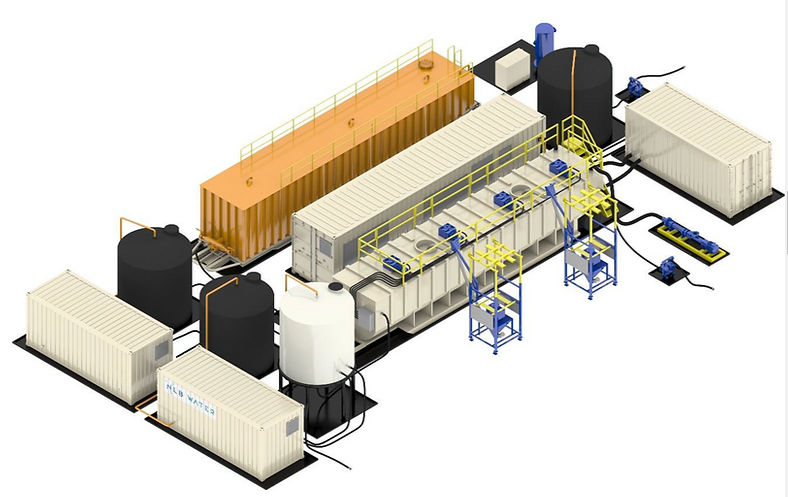

Based on a proven water treatment technology presently used to recycle produced fluids from oil & gas wells:

• Over 6 years of engineering and several million in hard investment

• To deliver a commercial, production robust field-proven modular brine processing unit.

• Current design capacity will convert 24,000 barrels of raw lithium enriched brine fluid per day into 2,512 mt of Lithium Hydroxide Monohydrate.

• Process has a US published patent. Company has an innovation pathway to deliver more patented intellectual property for shareholders.

The company has a pipeline of $5.5 million USD in pre-qualified State (Colorado Advanced Industries) and Federal (US Department of Energy) grant funding which will be awarded in late May

Company has an operational lithium processing facility commissioned in Denver, Colorado and is actively working with multiple major clients to benchmark its technology and deliver comparative results vs. other DLE technologies.

This technology has a potential to clean brines to purified irrigation water, while extracting lithium and other metals.

Above is the revolutionary technology that could transform the extraction of lithium.

The BIG problem: 500% MORE LITHIUM REQUIRED

Requirement by 2035, the western world needs 75 new mines each 45,000 ton mine requires:

- 2500 acres of land

- 10 billion gallons of water Per Year

- Produced 250,000 tons of CO2 Per Year

- up to 2 years to evaporate and deliver production.

Let’s recap the 3 Catalysts that Could Send AMS on the Bullish Run of 2023:

#1. The Chart Is Perfect, Literally Perfect!

#2. IPOs Offer A Significant Upside Potential

#3. Leveraging Massive Efficiencies to Capitalize in a Billion Dollar Market

We have arrived at the much anticipated “reason” why AMS is getting major attention lately.

Research is indicating that the lithium sector could experience a historic boom due to five factors:

- Lithium has proven to be recession proof.

- Renewable energy thrives during a recession

- The lithium market is expected to grow by almost $80BN in the next decade!

- Rough calculations would place (CSE:AMS) at $400 PPS+/-?

- Defense Production Act (DPA) to accelerate domestic production of lithium

Lithium has proven to be recession proof.

Alex Gluyas of AFR states, “Lithium is proving to be largely immune from the volatility that has rocked commodity markets as prices soar in the face of a looming global recession, prompting Macquarie to deliver another round of upgrades for producers and developers of the battery metal.

Lithium prices have continued to hit record levels this year with spodumene, carbonate and hydroxide surging 243 per cent, 124 per cent and 152 per cent respectively.”

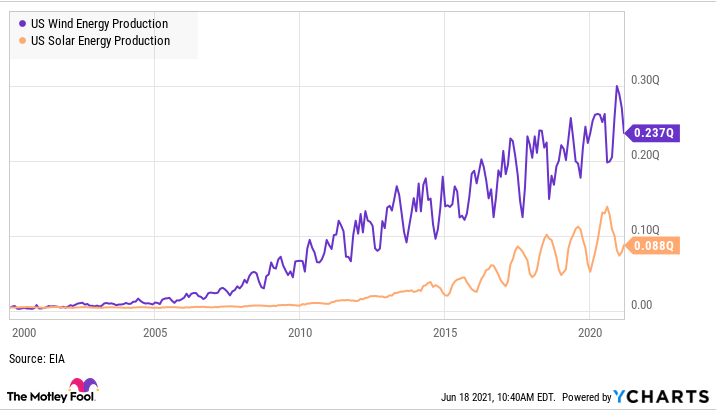

Renewable energy thrives during a recession

Motley Fool has an amazing report on the renewable energy sector thriving during recessions.

Recessions can be scary for investors because the market can crash and, for some businesses, demand can drop like a rock. But not all businesses are affected the same way during a recession.

In renewable energy, there are major tailwinds driving growth even through recessions. The cost of renewable energy is coming down, fossil fuel costs are rising long term, and there’s a political desire to increase renewable energy production. You can see below that recessions haven’t stopped the growth of wind and solar energy projection, two of the main sources of renewable energy over the last two decades — despite three recessions in that time. For investors renewable energy stocks have a lot going for them, even in a recession.

Small Cap Exclusive is preparing for significant press releases that could come very soon from Alchemist Mining (CSE:AMS).

If you want receive breaking news directly to your inbox we recommend signing up for updates on AMS below:

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $160,000 from Alchemist Mining Inc. for profiling (CSE:AMS). We own ZERO shares in AMS.

Full Disclaimer PTN

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal […]

Palatin Technologies (NYSE:PTN) Is Unlocking the Future of Biopharmaceutical Innovation

We are finished with our research report on possibly one of the most undervalued and exciting biopharmaceutical company on the big board. Take a moment and pull up Palatin Technologies (NYSE:PTN) and start your research. In the meantime, continue reading the 5 reasons we believe that PTN could be ready for a major move. Palatin […]

Full Disclaimer CEI

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal […]

Camber Energy (CEI) Announces A Massive Acquisition!

Camber Energy, Inc. (NYSE American:CEI) is a diversified energy company that operates in the oil and gas sector, as well as the power solutions market. Today, they announced the acquisition of Viking Energy Group, Inc. August 1, 2023 Announced today the completion of its previously announced acquisition of Viking Energy Group, Inc. (“Viking”), pursuant to […]

STOCK PRICE OF ALCHEMIST MINING SURGE : REMARKABLE PROGRESS CONTINUES

Stock Price of Alchemist Mining Surge : Remarkable Progress Introduction : Alchemist Mining Company has been making impressive strides in the mining industry over the past three months. This has ultimately contributed to a significant increase in its stock price today. By leveraging innovative technologies, strategic acquisitions, and sustainable mining practices, Alchemist Mining has positioned […]

Coeptis Therapeutics Could Go To The Moon This Week!

WEXFORD, Pa., May 10, 2023 /PRNewswire/ — Coeptis Therapeutics Holdings, Inc. (NASDAQ: COEP) (“Coeptis” or “the Company”), a biopharmaceutical company developing innovative cell therapy platforms for cancer, announced that research involving its SNAP-CAR technology was detailed in a peer-reviewed article published in the peer-reviewed journal, Nature Communications. SNAP-CAR is a multi-antigen chimeric antigen receptor T cell (CAR T) technology that can be adapted to different cancer indications, including hematologic and solid tumors

Full Disclaimer COEP

Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.

Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.

Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.

THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.

TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS.

By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.

The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.

You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated $120,000 from Coeptis Therapeutics for profiling COEP. We own ZERO shares in COEP.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign.

Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign.

The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.

All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.

We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.

The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.

We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.

We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.

There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.

We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.

We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.

We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.

We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.

Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.

We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.

If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.

The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.

The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.

You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.

When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.

The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.

We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.

If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.

If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.

The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.

Small Cap Exclusive , reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.