FNY Buys Open Door Technologies (NASDAQ-OPEN)

FNY Investment Advisors, LLC buys more stock of Open Door Technologies OPEN. Wall street is definitely paying close attention. We know that the street is interested in OPEN but what does our Alexander Goldman think about Open Door Technologies, Inc.

However, before you read this insightful information, sign up below, let’s stay in contact.

[thrive_leads id=’9907′]

Open Door Technologies, Inc. has investment advisors buying more positions of their stock because they are a fundamentally sound company. However, before we get started, let’s review some basic information on this company.

Open Door Technologies OPEN Company Summary

Company Name: Open Door Technologies, Inc.

Ticker: OPEN

Exchange: NASDAQ

Website: https://investor.opendoor.com.

Company Summary

Eric Wu, Co-Founder and CEO of Opendoor in an interview recently stated, “in our view, the end state for the real estate marketplace will inevitably be a simple, certain, and fast transaction powered by technology. It is just a matter of when. So we have been consistently focused on investing in that future experience, piece by piece, with the consumer in mind at every step.

Also, We take great pride in doing the hard work to execute with excellence in our consumer experience, technology, business performance, and company culture. This is what sets us apart,”

OPEN News

Nov. 10, 2021

Reported financial results for its quarter ended September 30, 2021 Opendoor’s third quarter 2021 financial results with commentary below.

“Over the years, I am often asked whether our vision and strategy has changed. The short answer is no – we have always been focused on making it possible to buy, sell, and move at the tap of a button.” Eric Wu, Co-Founder and CEO of Opendoor

Furthermore, he goes onto “Our third quarter results are the byproduct of our focus on the consumer experience and strong, consistent execution. We exceeded our expectations in generating $2.3 billion of revenue, acquiring 15,181 homes, and delivering over $170 million of Contribution Profit and $35 million of Adjusted EBITDA.”

Open Door 5 Day Chart

Open Door Technologies, Inc. Technical Analysis

This is going to be an easy analysis, it’s BULLISH and go NOW to your trading desk and take a look. This is the most clear breakout I’ve seen in a while! Also, the housing market is going bananas and they have incredible revenues. Moreover, they are a fundamentally sound company, with a good balance sheet.

The first reversal from the bearish trend was at $11.50 a few days ago and then I started watching it, like a hawk. Next, today, it leaped past the next resistance point at $12.20 and consolidated above it. Therefore, this is a HUGE (Donald Trump Voice) buy signal. Take head, listen and take a close look at this gem. Open Door Technologies, Inc is BULLISH!

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

[thrive_leads id=’9907′]

Talon Metals TLOFF 50% gains today

Talon Metals TLOFF is up 50% after due to a massive amount of volume being injected into this little well known stock. I have written a full report on TLOFF that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Talon Metals announced today, “Tesla TSLA recently signed its first nickel supply deal in the United States, selecting Talon Metals Corp’s Tamarack mine project in Minnesota in a bid to make the electric vehicle (EV) battery metal in a sustainable way.” However, before we get started, let’s review some basic information on this company.

Talon Metals TLOFF Company Summary

Company Name: Talon Metals, Inc

Ticker: TLOFF

Exchange: OTC

Website: www.talonmetals.com/

Talon Metals, Inc . Company Summary

Talon is a TSX-listed base metals company in a joint venture with Rio Tinto on the high-grade Tamarack Nickel Project located in central Minnesota. Talon currently owns a 51% interest in the Tamarack Project and has the right to increase its interest by 9% to 60%.

Also, The Tamarack Nickel Project comprises a large land position (18km of strike length) with numerous high-grade intercepts outside the current resource area. Talon is focused on expanding its current high-grade nickel mineralization resource prepared in accordance with NI 43-101.

Therefore, identifying additional high-grade nickel mineralization; and developing a responsible processing capability in the United States. In July 2021, Talon entered into an MOU with the United Steelworkers whereby the parties outlined a number of ways that they will work with, and support, one another.

Moreover, Talon has a well-qualified exploration and mine management team with extensive experience in project management.

TLOFF News

January 10, 2022

Talon has entered into an agreement with Tesla TSLA for the supply and purchase of nickel concentrate to be produced from the Tamarack Nickel Project in Aitkin County, Minnesota. The execution of the agreement follows an extensive and detailed due diligence period performed by Tesla TSLA and lengthy negotiations between the parties. HERE

December 16, 2021

TLOFF provided an update on the Tamarack Nickel-Copper-Cobalt Project (“Tamarack Nickel Project“), located in central Minnesota. HERE

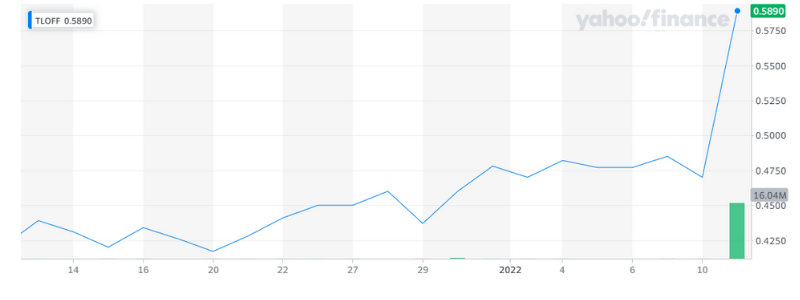

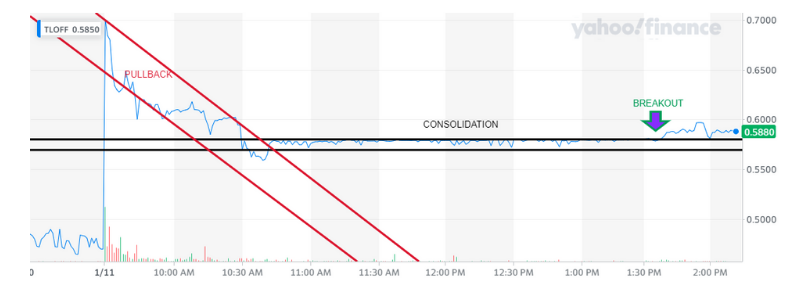

Talon Metals 1 Month Chart

Talon’s 1 Day Chart

TLOFF Technical Analysis

What a day for TLOFF, the news couldn’t have been better. They are working with Wall Street’s darling, Tesla.

Moreover, Talon Metals TLOFF released the announcement that they landed TSLA as a client! Hence, today was huge and the stock responded with a massive amount of volume and a PPS increase of 50%.

I would expect a huge jump, the news was incredible that Talon Metals released today. The interest was huge and the stock responded with a massive amount of volume and a PPS increase of 50%. TLOFF skyrocketed and the run is not over!

Therefore, TLOFF will consolidate and then run again. Put it on your watchlist.

Also, Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Limitless Venture Group LVGI Bullish?

Limitless Venture Group LVGI is up 98% after due to a massive amount of volume being injected into this little well known stock that has been crashing for the last 6 months. I have written a full report on LVGI that you can read below.

However, before you read this insightful information, sign up below, let’s stay in contact.

Limitless Venture Group announced today, “the best revenue year in the history of LVGI and update shareholders on what’s ahead for 2022 and beyond.” However, before we get started, let’s review some basic information on this company.

Limitless Venture Group LVGI Company Summary

Company Name: Limitless Venture Group, Inc

Ticker: LVGI

Exchange: OTC

Website: www.lvginc.com

Limitless Venture Group, Inc. Company Summary

Limitless Venture Group provides its shareholders with access to leading small and medium-sized businesses focused on growth. Leveraging its permanent capital base, disciplined long-term approach, and actionable expertise, LVGI owns controlling interests in its subsidiaries as it partners with management teams to build businesses with the capacity to unlock significant value for its shareholders.

The Company currently has three primary subsidiaries: Rokin, Inc., KetoSports, Inc. and Jasper Benefit Solutions, LLC.

Also, Rokin was founded in 2016 with a mission to provide our customers with the highest quality, technology-driven vaping products available while providing exceptional customer service.

Moreover, KetoSports products flush the body with ketones, raising blood ketone levels within a few minutes.

Also, Jasper Benefit Solutions, LLC (JBS), founded in 2018 with headquarters just outside Nashville, TN, is a Managing General Underwriter (MGU) specializing in risk management services for small to medium self-funded employer “Groups”.

Consequently, Rokin, KetoSports & Jasper Benefit Solutions have benefitted greatly from the management expertise at LVG.

LVGI News

January 11 , 2022

Announced the best revenue year in the history of LVGI and update shareholders on what’s ahead for 2022 and beyond. HERE

December 7, 2021

Announced that it has signed an LOI to acquire 100% of an Oklahoma operating grow facility with both Indoor and outdoor operations, exclusive to LVGI for 60 days from the signing of the LOI. HERE

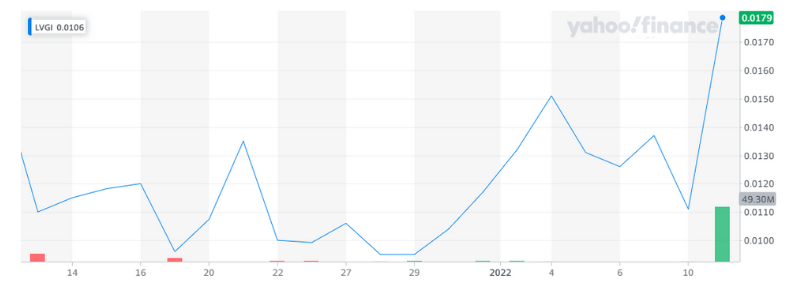

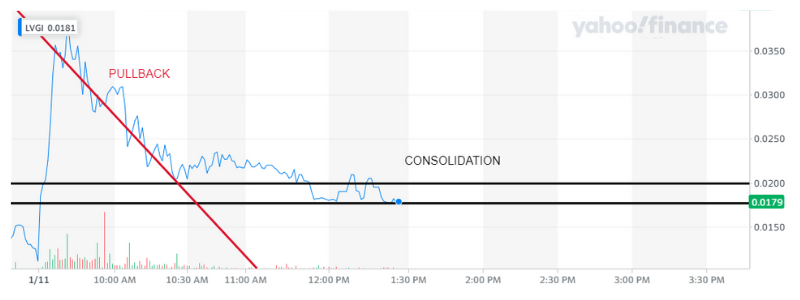

Limitless 1 Month Chart

LVGI 1 Day Chart

Limitless Venture Group Technical Analysis

The news was incredible that Limitless Venture Group LVGI released today was huge and the stock responded with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

The real question is, what is it going to do now? Well, it has pulled back as expected but it will now consolidate. Next, it will make a move up or down depending on the indicators within the consolidation. It is too early to determine which way it will move, but it is showing an early tendency to bearish.

I would expect The news was incredible that Limitless Venture Group LVGI released today was huge. The stock responded with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

I would expect, the news was incredible that Limitless Venture Group LVGI released today was huge and the stock responded. Therefore, LVGI opened with a massive amount of volume and a PPS increase of 251%. LVGI skyrocketed from $.011 to $.0388 with 50 million+ shares traded.

I am thinking Limitless will continue to drop in PPS until it fully consolidates then it will make a run! Stay tuned traders

Remember, to never try and catch a falling safe, or a knife for that matter. Simply let it fall to the ground, walk over, and pick up the money and walk away. If you enjoyed this article, sign up below, I promise I will never spam you and I’m pretty darn good at picking winners. Let’s make some trades together!

Marijuana Company of America MCOA Intro

Marijuana Company of America MCOA is looking very interesting, take a look!

Marijuana Company of America Company Summary

Company Name: Marijuana Company of America

Ticker: MCOA

Exchange: NASDAQ

Website: https://www.marijuanacompanyofamerica.com/

MCOA Company Summary

Marijuana Company of America (MCOA) invests in the cannabis sector directly. The company’s operations include C-Distro, one of the THC, Hemp & CBD cannabis industries fastest growing distribution companies, and hempsmart™, a Premium CBD company. The company’s core mission is to leverage its experience, and access to capital to identify and invest in acquisitions with unique growth potential.

Why did Marijuana Company of America go up?

Dec. 15, 2021

Announced that it has recently completed the acquisition of VBF Brands, Inc. (“VBF”) a marijuana cultivator and distributor based in Salinas, California. VBF was previously a wholly-owned subsidiary of Sunset Island Group, Inc. (OTC: SIGO).

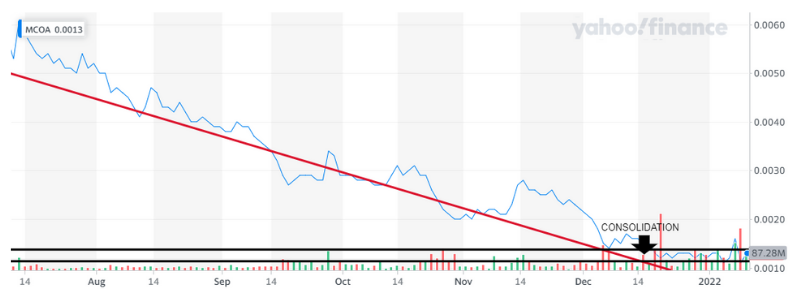

MCOA 1 Day Chart

MCOA Technical Analysis

MCOA has been on a major slide for over a month. It appears that it is consolidating and it may be ready to move once we see a double confirmation. We just got one this week the next confirmation will be $.0017, keep a keen eye on that price target. It could take off once it crosses it.

TDH Holdings PETZ ready to bounce?

TDH Holdings PETZ has been bearish for almost a month and I believe it is almost ready to reverse it’s trend, stay tuned! To review TDH Holdings, keep on reading, there is some good stuff below that you don’t want to miss.

TDH Holdings PETZ Company Summary

Company Name: TDH Holdings, Inc.

Ticker: PETZ

Exchange: NASDAQ

Website: www.tiandihui.com

TDH Holdings Company Summary:

Founded in April 2002, TDH Holdings, Inc. (the “Company”) (NASDAQ: PETZ), is a developer, manufacturer and distributer of a variety of pet food products under multiple brands that are sold in China, Asia and Europe. More information about the Company can be found at

What was the last news for PETZ?

Dec. 10, 2021

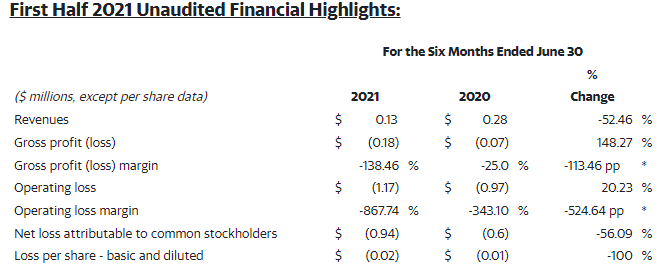

TDH Holdings PETZ announced today its financial results for the six months ended June 30, 2021.

Revenues decreased by 52.46% to $0.13 million for the first half of 2020. Eesh, that is bad news bears! I am confident that is

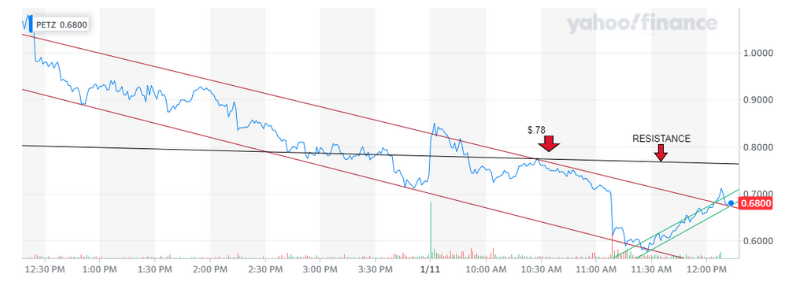

PETZ 1 Month Chart

PETZ 1 Day Chart

PETZ Technical Analysis

TDH Holdings PETZ $4.00 to $.60 is an incredible drop, 80% to be exact. As a trader we should be waiting the bottom because it should be coming here soon.

In fact, it tapped over $.711 which was it’s first resistance point. Currently, it attempting to breakthrough. Stay tuned because I am leery this a head fake unless it can beat $.78. Put it on your watchlist but be careful for that double confirmation.

Reviva Pharma RVPH down big.

Reviva Pharma RVPH down big on massive volume, to find out why take a look at this technical analysis by our Alexander Goldman down below

Reviva Pharmaceuticals RVPH Company Summary

Company Name: Reviva Pharmaceuticals Holdings, Inc.

Ticker: RVPH

Exchange: NASDAQ

Website: https://ir.revivapharma.com/

Reviva Pharmaceutical Company Summary

Reviva Pharma RVPH is a clinical-stage biopharmaceutical company that discovers, develops and seeks to commercialize next-generation therapeutics for diseases representing unmet medical needs and burdens to society, patients, and their families.

Also, Reviva’s current pipeline focuses on the central nervous system, respiratory and metabolic diseases. Reviva’s pipeline currently includes two drug candidates, RP5063 (brilaroxazine) and RP1208.

Therefore, Both are new chemical entities discovered in-house. Reviva has been granted composition of matter patents for both RP5063 and RP1208 in the United States (U.S.), Europe, and several other countries.

Why did RVPH go down?

Jan. 10th 2021

Reviva Pharma RVPH announced today the U.S. Food and Drug Administration (FDA) has notified the Company that it may proceed with Phase 3 clinical investigation of its lead candidate, brilaroxazine, a novel serotonin and dopamine receptor modulator for the treatment of schizophrenia.

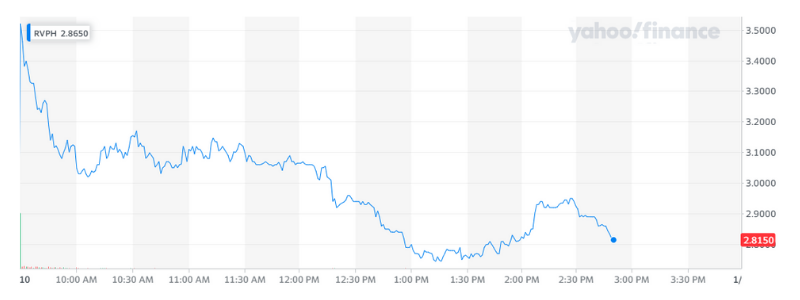

RVPH 3 Month Chart

RVPH 1 Day Chart

RVPH Technical Analysis

Reviva Pharmaceutical is looking bad, real bad. Don’t put it on your watchlist. It’s bearish all the way around.

Pluristem Therapeutics PSTI Collaboration

Pluristem Therapeutics PSTI signs a massive collaboration deal. Also, the stock looks great. Take a look below.

Pluristem Therapeutics PSTI Company Summary

Company Name: Pluristem Therapeutics Inc.

Ticker: PSTI

Exchange: NASDAQ

Website: https://www.pluristem.com/

Pluristem Therapeutics Company Summary

Pluristem is pushing the boundaries of science and engineering to create cell-based products for commercial use. The Company’s cell therapies advance the field of regenerative medicine, with potentially groundbreaking applications for treating ischemia, damaged muscle, hematology deficiencies, and inflammation.

Moreover, pluristem Therapeutics’ sources its therapeutic cells from the placenta, an ethically accepted and potent source.

The Company’s manufacturing platform is a patented and validated state-of-the-art 3D cell expansion system. Pluristem’s method is uniquely accurate, cost-effective, and consistent from batch to batch.

Why did PSTI go up?

Jan. 10th 2021

Announced the launch of an innovative collaboration to develop, manufacture and commercialize cultured cell-based products for the food industry.

Therefore, the collaboration started with the incorporation of a new company (“NewCo”), that will receive exclusive, global, royalty bearing licensing rights to use Pluristem’s proprietary technology, intellectual property and knowhow, to be used in the field of cultured meat.

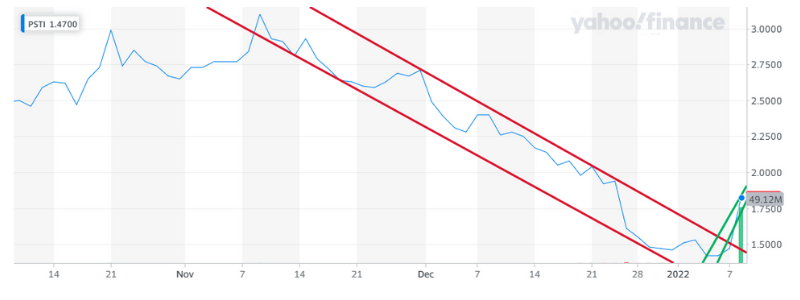

PSTI 3 Month Chart

PSTI 1 Day Chart

PSTI Technical Analysis

The $1.87 PPS for Pluristem Therapeutics PSTI is important before I would consider the trade. However, this stock is looking great! It gapped up big and pulled back for a minute and consolidated all day with a bullish lean.

Pluristem Therapeutics PSTI is possibly a winner, but I wouldn’t expect big things, probably sub 50% gains in the next few weeks.

Zynga ZNGA purchased for $12B

Zynga ZNGA purchased for $12B by Take-Two Interactive. ZNGA gaps up 46% with heavy trading volume this morning. Let’s take a closer look at Zynga.

Zynga Inc. ZNGA Company Summary

Company Name: Zynga Inc.

Ticker: ZNGA

Exchange: NASDAQ

Website: www.zynga.com

[thrive_leads id=’9825′]

Zynga Inc. ZNGA Company Summary

Zynga ZNGA is a global leader in interactive entertainment with a mission to connect the world through games.

Therefore with it’s massive global reach in more than 175 countries and regions, Zynga has a diverse portfolio of popular game franchises that have been downloaded more than four billion times. Just on mobile including CSR Racing™, Empires & Puzzles™, FarmVille™, Golf Rival, Hair Challenge™, Harry Potter: Puzzles & Spells™, High Heels!, Dragons!™, Merge Magic!™, Toon Blast™, Toy Blast™, Words With Friends™ and Zynga Poker™.

With Chartboost, a leading mobile advertising and monetization platform, Zynga is an industry-leading next-generation platform with the ability to optimize programmatic advertising and yields at scale.

Founded in 2007, Zynga is headquartered in California with locations in North America, Europe and Asia.

Why did ZNGA go up over 40% overnight?

Jan. 10th 2021

Take-Two to acquire all the outstanding shares of Zynga for a total value of $9.861 per share – $3.50 in cash and $6.361 in shares of Take-Two common stock, implying an enterprise value of $12.7 billion.

Transaction represents a 64% premium to Zynga’s closing share price on January 7, 2022.

Establishes Take-Two as one of the largest publishers of mobile games, the fastest-growing segment of the interactive entertainment industry.

Unifies highly complementary businesses, including Take-Two’s best-in-class portfolio of console and PC games and Zynga’s industry-leading mobile franchises.

Creates one of the largest publicly traded interactive entertainment companies in the world, with $6.1 billion in trailing twelve-month pro-forma Net Bookings for the period ended September 30, 2021.

Consequently, Transaction expected to deliver approximately $100 million of annual cost synergies within the first two years after closing, and more than $500 million of annual Net Bookings opportunities over time.

Take-Two TTWO Company Summary

Company Name: Take-Two Interactive Software, Inc.

Ticker: TTWO

Exchange: NASDAQ

Website: https://www.take2games.com/

Zynga Inc. ZNGA Company Summary

Headquartered in New York City, Take-Two Interactive Software, Inc. is a leading developer, publisher, and marketer of interactive entertainment for consumers around the globe.

We develop and publish products principally through Rockstar Games, 2K, Private Division, and T2 Mobile Games.

Take-Two TTWO products are designed for console systems, personal computers, and mobile, including smartphones and tablets.

Also, they deliver through physical retail, digital download, online platforms, and cloud streaming services. Take-Two TTWO common stock trades on NASDAQ under the symbol TTWO.

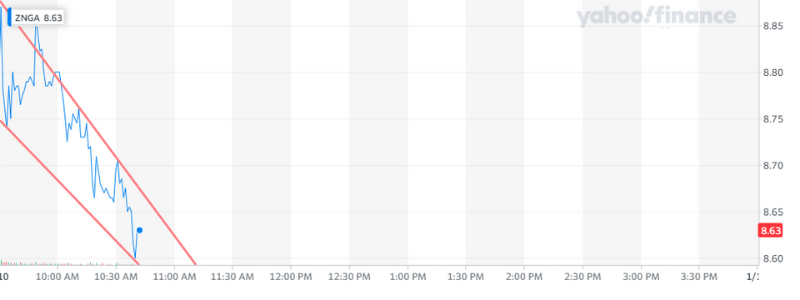

ZNGA 3 Month Chart

Zynga ZNGA 1 Day Chart

ZNGA Technical Analysis

After the announcement that Take-Two TTWO was acquiring Zynga Inc. ZNGA the stock gapped up with heavy trading volume by over 40%! Meanwhile TTWO suffers in PPS with a massive sell off.

ZNGA is shockingly consolidating after the massive run with a slight pullback. This is a good sign. Therefore, I would like to see it break $8.70 then $8.76 before I would take a position because normally there will be a massive sell off after a huge gap up like this.

[thrive_leads id=’9825′]