Splash Beverage ( SBEV ) Signs Blockbuster Deal With TARGET Nationwide!

UPDATE: 9/20/22 @ 2:30 PM ET

Splash Beverage (NYSE:SBEV) is trending up after building a solid base above $2.05

SBEV is now testing resistance & if she breaks through $2.10 we could see mid $2s by end of week.

REMEMBER, this stock has a 52 week high of $5.60 & Yahoo Finances short term rating to Buy RATING.

That is EF Hutton, Investing.Com & Yahoo Finance issuing a BUY rating!

I repeat, That is EF Hutton, Investing.Com & Yahoo Finance issuing a BUY rating!

Original Post: 9/20/22 @ 9:08 AM ET

I wrote a report a few days ago on the fact that SALT Tequila, the emerging tequila brand owned by Splash Beverages, could be the next Casa Amigos.

Then, this morning, SPLASH the parent company announces a authorization agreement with Target nationwide!

It is becoming very clear to me that Splash Beverage is not trying to be the next Casa Amigos but the next Coca Cola!

Splash Beverage has made two major announcements over the last few weeks:

- Tapout their sports line gets picked up by Targets nationwide!

- Salt Tequila signs a national distribution agreement with the same distributors that represent Coca Cola & Anheuser Busch!

Let’s take a closer look at the THREE reasons why SBEV is poised to be a leader in the beverage industry.

I can’t stress this enough, this is HUGE news!

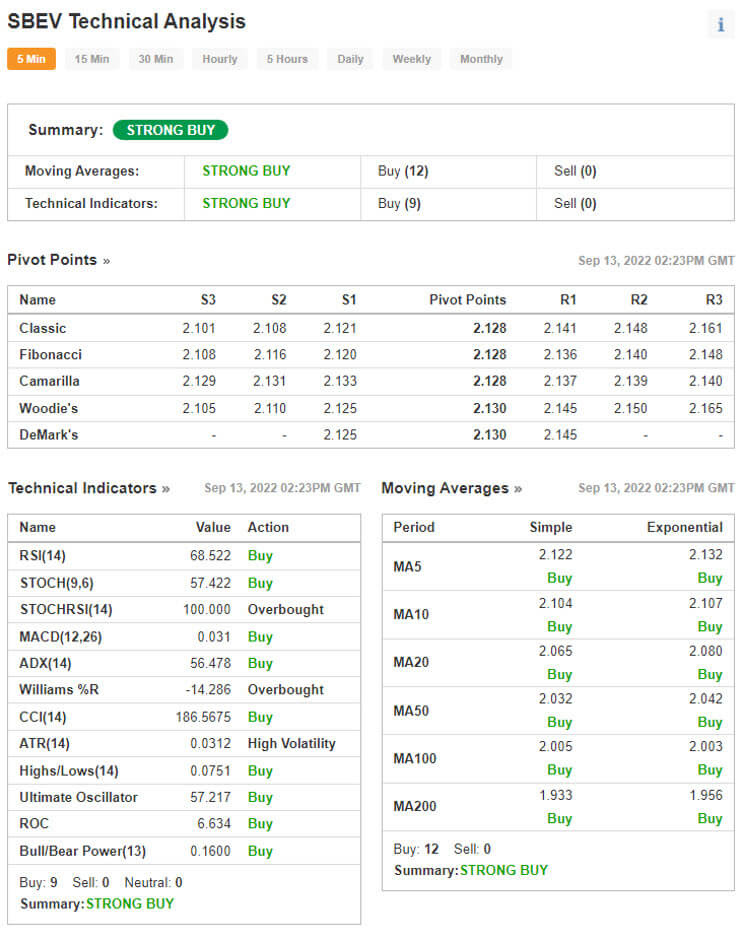

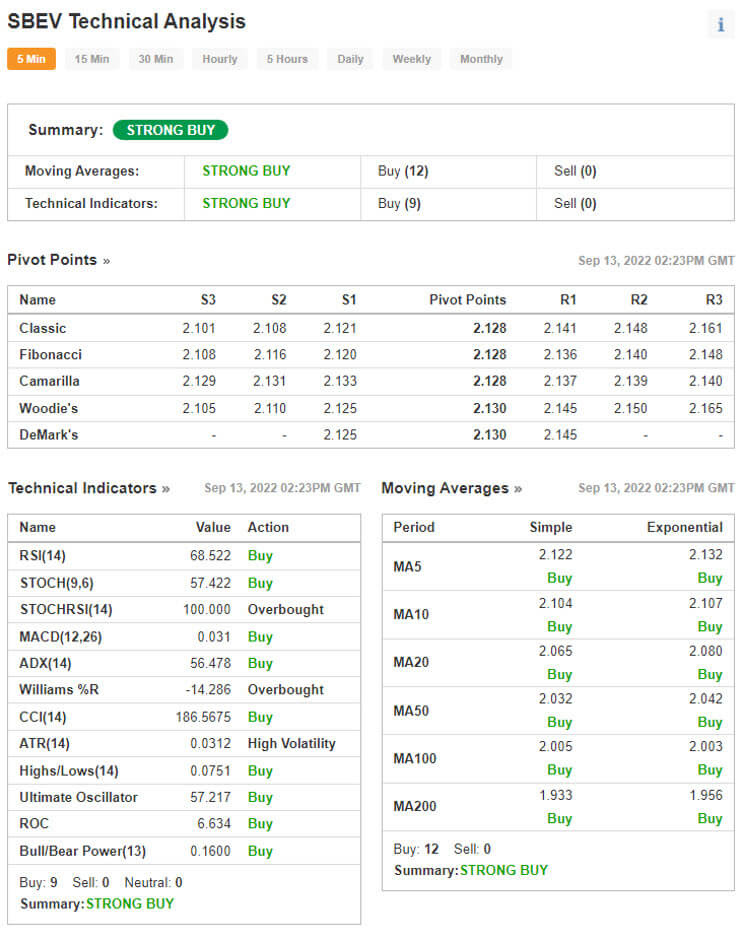

Respected Technical Analysis site Investing.com issued a Bullish Strong BUY Rating, which could be potentially signaling a bigger breakout to the upside is coming. See technicals below.

ANOTHER BUY RECOMMENDATION

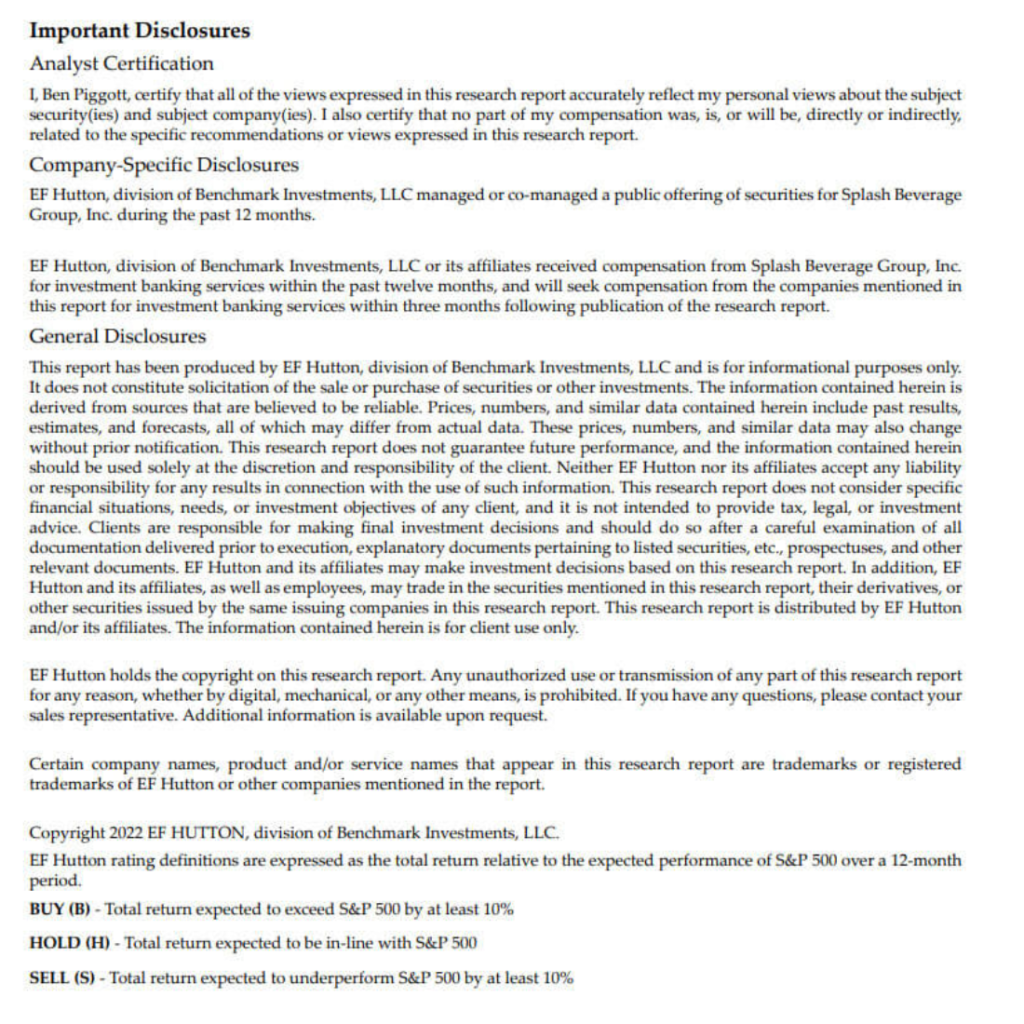

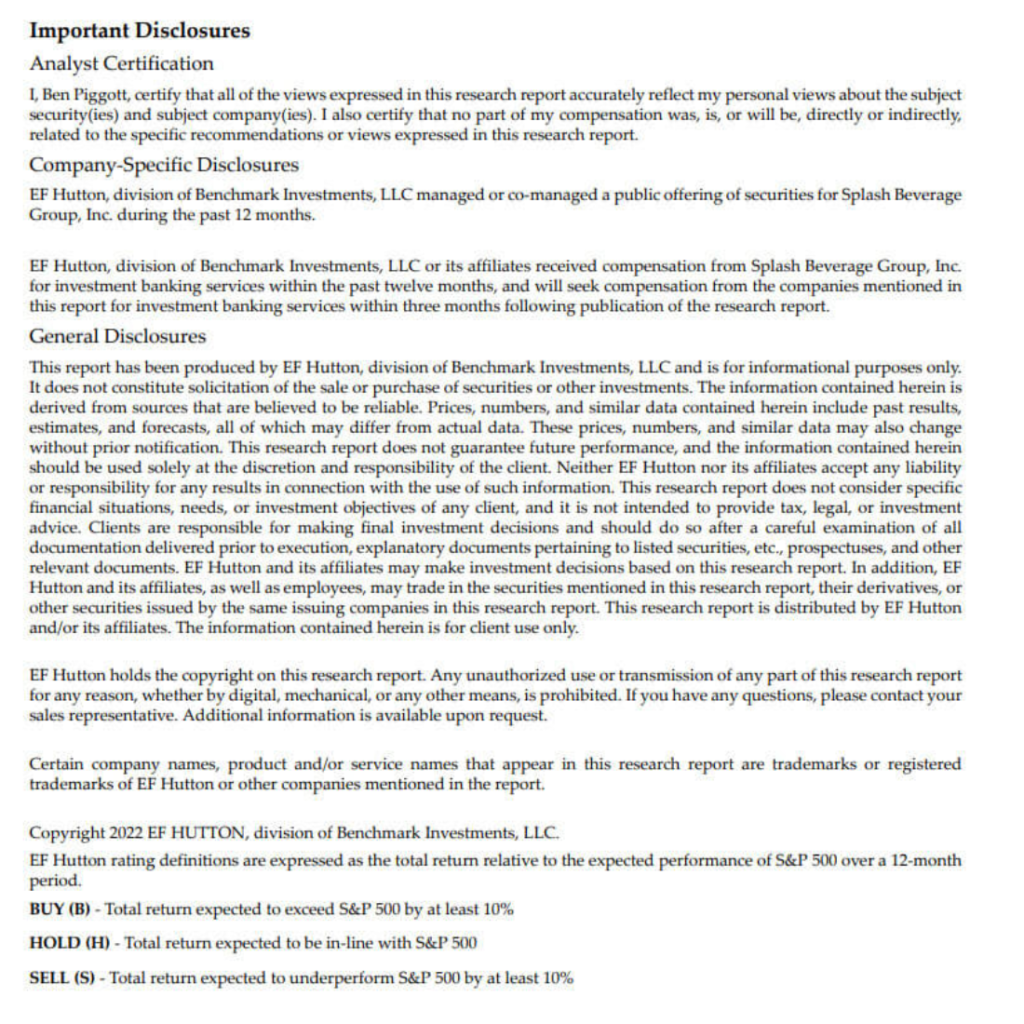

Equity Analyst EF Hutton Initiated a “BUY” Recommendation and Staggering $5.00/Share Price Target!

Additionally, Global Investment Bank Equity Analyst EF Hutton initiated coverage on Splash Beverage Group (NYSE: SBEV) issuing a “BUY” Recommendation and a staggering $5.00/share price target!

*Representing an approx. 133%+ in upside potential from current price

Splash announced a Blockbuster Distribution announcement Last Week that SALT Tequila continues its Aggressive National Expansion with full distribution agreements throughout the states of Nevada and Maryland.

Splash Beverage Group’s SALT Tequila Continues Expansion with Full Coverage in Nevada and Maryland

Fort Lauderdale, Florida, Sept. 13, 2022 (GLOBE NEWSWIRE) — Splash Beverage Group, Inc. (NYSE American: SBEV) (“Splash” or the “Company”), a portfolio company of leading beverage brands, announced that SALT Tequila continues its national expansion with full distribution agreements throughout the states of Nevada and Maryland.

Splash announced that Central Distributors of Las Vegas will now distribute SALT Tequila across Nevada. At the same time, the Company announced agreements with Maryland-based Carey Distributors and Wantz Distributors to round out statewide distribution with along with Buck Distributing (previously announced) to distribute SALT throughout Maryland.

Robert Nistico, Splash Beverage Group’s Chairman and CEO, commented, “We’re honored to partner with these top tier distribution companies as consumer demand for SALT Tequila continues to grow along with the entire tequila segment nationally. We believe SALT is positioned very well to capitalize on this demand; flavored spirits, 100% agave tequilas and the overall tequila segment are key drivers in the spirits segment in the U.S. The agreement with Central Distributors of Las Vegas provides us with terrific opportunity in the Las Vegas and Reno markets. ‘Vegas-born’ Central Distributors is a family-owned wholesaler distributing a diverse portfolio of premium beverages and we’re proud to have SALT added to their stable. Similarly, our agreements with Carey Distributors, Wantz Distributors, along with Buck Distributing gives us coverage in the entire state of Maryland with distributors carrying top-tier brands, including Anheuser-Busch and Miller Coors.”

By The Way, SALT has a 5/5 Tasting REVIEW, look out Casa Amigos

Fort Lauderdale, Florida, Sept. 20, 2022 (GLOBE NEWSWIRE) — Splash Beverage Group, Inc. (NYSE American: SBEV) (“Splash” or the “Company”), a portfolio company of leading beverage brands, today announced it has received authorization to sell its TapouT performance drink in select Target stores across the nation.

Robert Nistico, Splash Beverage Group’s Chairman and CEO commented, “Target is an iconic premium retailer and one of the most visible retail brands in the nation with stores in all 50 states and the District of Columbia. 75% of the population in the U.S. lives within 10 miles of Target stores and we will now have an opportunity to offer TapouT to these customers. This is a very exciting new relationship and we’re grateful and proud to have earned this authorization from such important retailer.”

Nistico added, “We continue to execute and put product on retail shelves … and of course product on shelves equals more revenue as we continue to build all our brands coast to coast.”

In closing, SBEV has several potential bullish catalysts in play right now that could catapult them to a household name like Coca Cola.

Splash Beverage is possibly on the verge of Disrupting the $1.86 Trillion Beverage Market.

Just The Tequila Market is a MULTI-BILLION a year industry!

The global tequila market is expected to grow from $10.43 billion in 2022 to $15.57 billion by 2029, at a CAGR of 5.89% in forecast period, 2022-2029

Read More at:-https://www.fortunebusinessinsights.com/tequila-market-104172

Splash Beverage ( SBEV ) Signs a GROUNDBREAKING DISTRIBUTION AGREEMENT

I mention the fact that SALT Tequila, the emerging tequila brand owned by Splash Beverages, could be the next Casa Amigos because of the THREE reasons mentioned above.

Why is Casa Amigos important? Well, it was founded in 2013 and sold for a cool BILLION DOLLARS 4 short years later, in 2017! Read Article HERE

Imagine what would happen to the parent company if this $2 stock had a subsidiary sell for $1 Billion?!?!

Below you will find these 3 reasons that establish, arguably, a better start to this emerging tequila brand than Casa Amigos!

I can’t stress this enough, this is HUGE news!

Respected Technical Analysis site Investing.com issued a Bullish Strong BUY Rating, which could be potentially signaling a bigger breakout to the upside is coming. See technicals below.

ANOTHER BUY RECOMMENDATION

Equity Analyst EF Hutton Initiated a “BUY” Recommendation and Staggering $5.00/Share Price Target!

Additionally, Global Investment Bank Equity Analyst EF Hutton initiated coverage on Splash Beverage Group (NYSE: SBEV) issuing a “BUY” Recommendation and a staggering $5.00/share price target!

*Representing an approx. 133%+ in upside potential from current price

Splash announced a Blockbuster Distribution announcement Last Week that SALT Tequila continues its Aggressive National Expansion with full distribution agreements throughout the states of Nevada and Maryland.

Splash Beverage Group’s SALT Tequila Continues Expansion with Full Coverage in Nevada and Maryland

Fort Lauderdale, Florida, Sept. 13, 2022 (GLOBE NEWSWIRE) — Splash Beverage Group, Inc. (NYSE American: SBEV) (“Splash” or the “Company”), a portfolio company of leading beverage brands, announced that SALT Tequila continues its national expansion with full distribution agreements throughout the states of Nevada and Maryland.

Splash announced that Central Distributors of Las Vegas will now distribute SALT Tequila across Nevada. At the same time, the Company announced agreements with Maryland-based Carey Distributors and Wantz Distributors to round out statewide distribution with along with Buck Distributing (previously announced) to distribute SALT throughout Maryland.

Robert Nistico, Splash Beverage Group’s Chairman and CEO, commented, “We’re honored to partner with these top tier distribution companies as consumer demand for SALT Tequila continues to grow along with the entire tequila segment nationally. We believe SALT is positioned very well to capitalize on this demand; flavored spirits, 100% agave tequilas and the overall tequila segment are key drivers in the spirits segment in the U.S. The agreement with Central Distributors of Las Vegas provides us with terrific opportunity in the Las Vegas and Reno markets. ‘Vegas-born’ Central Distributors is a family-owned wholesaler distributing a diverse portfolio of premium beverages and we’re proud to have SALT added to their stable. Similarly, our agreements with Carey Distributors, Wantz Distributors, along with Buck Distributing gives us coverage in the entire state of Maryland with distributors carrying top-tier brands, including Anheuser-Busch and Miller Coors.”

By The Way, SALT has a 5/5 Tasting REVIEW, look out Casa Amigos

In closing, SBEV has several potential bullish catalysts in play right now that could catapult them to a household name like Casa Amigos.

Splash Beverage is possibly on the verge of Disrupting the $1.86 Trillion Beverage Market.

Just The Tequila Market is a MULTI-BILLION a year industry!

The global tequila market is expected to grow from $10.43 billion in 2022 to $15.57 billion by 2029, at a CAGR of 5.89% in forecast period, 2022-2029

Read More at:-https://www.fortunebusinessinsights.com/tequila-market-104172

DOCU DocuSign, Inc Stock Price Is Undervalued!

DocuSign DOCU was trading at almost $400 a year ago, now it’s at $56. This is an incredible value and we love it!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

DocuSign Inc. Company Information

Company Name: DocuSign

Ticker: DOCU

Exchange: NASDAQ

Website: www.docusign.com

DOCUSIGN Company Summary:

DocuSign helps organizations connect and automate how they prepare, sign, act on, and manage agreements. As part of the DocuSign Agreement Cloud, DocuSign offers eSignature, the world’s #1 way to sign electronically on practically any device, from almost anywhere, at any time. Today, over 1.2 million customers and more than a billion users in over 180 countries use the DocuSign Agreement Cloud to accelerate the process of doing business and simplify people’s lives.

DocuSign stock price is due to News?

Sept. 8, 2022 /PRNewswire/ — DocuSign, Inc. (NASDAQ: DOCU), which offers the world’s #1 e-signature solution as part of the DocuSign agreement platform, today announced results for its fiscal quarter ended July 31, 2022.

“We delivered solid Q2 results, with a strong finish to the first half of the year. These results reflect the focus and dedication of our team on execution during this transition period, with a stronger foundation in place to deliver in the second half of the year. We enter this next phase with a clear set of vital few deliverables for our people initiatives and product roadmap, while driving sustainable and profitable growth at scale,” said Maggie Wilderotter, DocuSign’s Interim CEO and Board Chair. “We have a $50 billion market opportunity, an industry leading digital agreement platform, strong market position, and an experienced leadership team. I have total confidence our team will successfully deliver for all stakeholders.”

Second Quarter Financial Highlights

- Total revenue was $622.2 million, an increase of 22% year-over-year. Subscription revenue was $605.2 million, an increase of 23% year-over-year. Professional services and other revenue was $17.0 million, a decrease of 11% year-over-year.

- Billings were $647.7 million, an increase of 9% year-over-year.

- GAAP gross margin was 78% for both periods. Non-GAAP gross margin was 82% for both periods.

- GAAP net loss per basic and diluted share was $0.22 on 201 million shares outstanding compared to $0.13 on 196 million shares outstanding in the same period last year.

- Non-GAAP net income per diluted share was $0.44 on 206 million shares outstanding compared to $0.47 on 208 million shares outstanding in the same period last year.

- Net cash provided by operating activities was $120.9 million compared to $177.7 million in the same period last year.

- Free cash flow was $105.5 million compared to $161.7 million in the same period last year.

- Cash, cash equivalents, restricted cash and investments were $1,129.6 million at the end of the quarter.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures and Other Key Metrics.”

Operational and Other Financial Highlights

DocuSign Agreement Cloud 2022 Product Release 2. DocuSign announced new product capabilities, including:

- DocuSign eSignature. Introduced Shared Access, which allows a user to be granted permission to send or manage envelopes on another user’s behalf, and announced enhancements to Bulk Send and Agreement Actions.

- DocuSign eSignature App for Stripe. A new integration that allows account, finance and support teams to view eSignature agreements and Stripe payments side-by-side and launch new agreements right from their Stripe dashboards. Stripe users no longer need to go between the two platforms to complete transactions, support customers, or review transactions.

- DocuSign CLM. Introduced a new CLM Integration within Slack that enables customers to collaborate and move their agreements forward in a more streamlined way. CLM for Slack allows users to navigate the full agreement processes from redlining, to reviews and approvals, using our leading CLM solution without ever leaving the Slack platform. Other CLM enhancements include CLM AI-assisted data capture and a new integration with DocuSign CLM Connector for Coupa.

- DocuSign Notary. Introduced support for notaries seated in two additional U.S. states, New Jersey and Oregon, bringing the total number of states supported by DocuSign Notary to 25.

Outlook

The company currently expects the following guidance:

| • Quarter ending October 31, 2022 (in millions, except percentages): | |||

| Total revenue | $624 | to | $628 |

| Subscription revenue | $609 | to | $613 |

| Billings | $584 | to | $594 |

| Non-GAAP gross margin | 79 % | to | 81 % |

| Non-GAAP operating margin | 16 % | to | 18 % |

| Non-GAAP diluted weighted-average shares outstanding | 205 | to | 210 |

| • Year ending January 31, 2023 (in millions, except percentages): | |||

| Total revenue | $2,470 | to | $2,482 |

| Subscription revenue | $2,405 | to | $2,417 |

| Billings | $2,550 | to | $2,570 |

| Non-GAAP gross margin | 79 % | to | 81 % |

| Non-GAAP operating margin | 16 % | to | 18 % |

| Non-GAAP diluted weighted-average shares outstanding | 205 | to | 210 |

The company has not reconciled its guidance of non-GAAP financial measures to the corresponding GAAP measures because stock-based compensation expense cannot be reasonably calculated or predicted at this time. Accordingly, a reconciliation has not been provided.

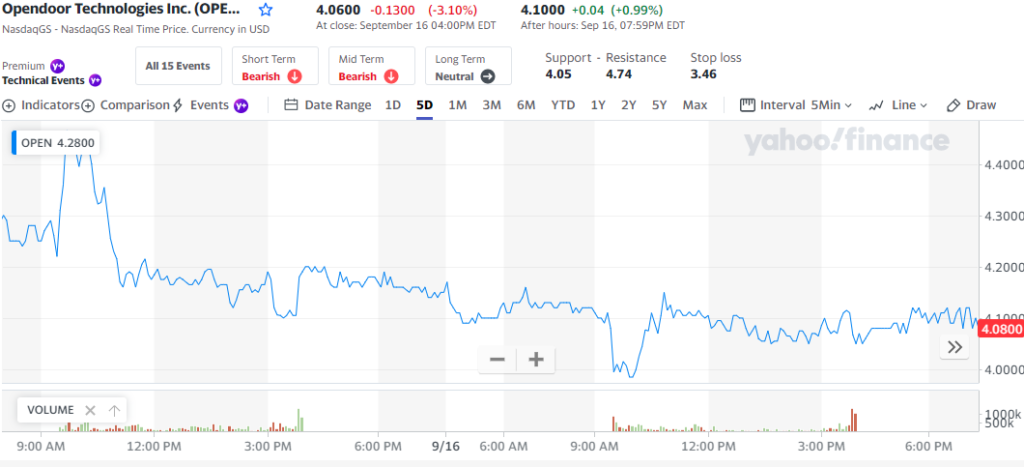

DOCU 5 Day Chart

Breakout Alert!

Docusign is the 500LB gorilla in the electronic document signing vertical and that is not changing anytime soon. The stock is undervalued and took a beating with all other stocks in the massive sell off of 2022. Look for a massive bounce!

[thrive_leads id=’14274′]

(NASDAQ-SNDL) A Cannabis Stock Announces Intl Export!

On Wednesday September 14th SNDL Inc. (SNDL) a Cannabis Stock went Up due to the announcement of an in international export deal with Israel. However, it quickly fell through support. Was it a head fake? Is it the bottom and it’s ready to bounce? Keep reading to find out.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

SNDL Inc. Company Information

Company Name: SNDL Inc.

Ticker: SNDL

Exchange: NASDAQ

Website: https://www.sndl.com/

Sundial Company Summary:

SNDL is the largest private sector liquor and cannabis retailer in Canada with retail banners that include Ace Liquor, Wine and Beyond, Liquor Depot, Value Buds, and Spiritleaf. SNDL is a licensed cannabis producer that uses state-of-the-art indoor facilities to supply wholesale and retail customers under a cannabis brand portfolio that includes Top Leaf, Sundial Cannabis, Palmetto, Spiritleaf Selects, and Grasslands. SNDL’s investment portfolio seeks to deploy strategic capital through direct and indirect investments and partnerships throughout the global cannabis industry.

Sundial stock price is due to News?

Sept. 15, 2022

Today announced that SNDL has completed its initial international export of approximately 167 kilograms of premium dried flower from Canada to Israel as part of its total commitment with IMC. SNDL and IMC have agreed to the aggregate export of 1,000 kilograms of high-quality dried flower products for processing and distribution in the Israeli medical cannabis market.

The expansion marks a significant milestone for SNDL as it enters the global market. “We are pleased with our partnership with IMC, one of Europe’s most established and trusted medical cannabis companies,” said Andrew Stordeur, President and Chief Operating Officer of SNDL. “SNDL plans to opportunistically expand the Company’s premium inhalables footprint to international cannabis markets, and this initial endeavour strengthens our pursuits in both established medical markets and emerging global recreational markets.”

For IMC, the completed export marks another major step forward in streamlining its expansive global operations that include Israel, Canada, and Germany. “The medical cannabis market in Israel has shifted towards premium and ultra-premium cannabis products. By forming an international partnership with SNDL, we are improving our global supply chain and enhancing our ability to provide the Israeli market with the high-quality products it has come to expect,” said Oren Shuster, Chief Executive Officer of IM Cannabis.

SNDL views the international market as an emerging opportunity to increase revenue from its cannabis operations. The Company is optimistic that an increasing number of global markets will refine regulations, allowing for lower-barrier access to high-quality cannabis products produced by trusted suppliers from Canada.

SNDL 5 Day Chart

#1 Cannabis PLAY!

The announcement Todaythat SNDL has completed its initial international export of approximately 167 kilograms of premium dried flower from Canada to Israel as part of its total commitment with IMC is a groundbreaking deal for the cannabis industry and for SNDL.

[thrive_leads id=’14274′]

(NASDAQ-OPEN) Stock Price Is Ready To Bounce?

On Monday September 12th Ilustrato Open Door Technologies (NASDAQ-OPEN) Stock Price went Up BIG and broke through a serious resistance point. However, it quickly fell through support. Was it a head fake? Is it the bottom and it’s ready to bounce? Keep reading to find out.

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Open Door Technologies Company Information

Company Name: Open Door Technologies

Ticker: OPEN

Exchange: NASDAQ

Website: https://investor.opendoor.com.

Ilustrato Pictures Company Summary:

Selling a home can be full of uncertainty for many consumers who would rather focus on their next chapter than on the stresses of moving. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor and easily compare it to an open-market sale using a real estate agent.

OPEN stock price is due to News?

Aug. 4, 2022

Zillow, Inc. (Nasdaq: Z and ZG) and Opendoor Technologies Inc. (Nasdaq: OPEN) have announced a multi-year partnership that combines two category leaders to transform how people start their move. The partnership will allow home sellers on the Zillow platform to seamlessly request an Opendoor offer to sell their home.

Selling a home can be full of uncertainty for many consumers who would rather focus on their next chapter than on the stresses of moving. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor and easily compare it to an open-market sale using a real estate agent. Opendoor offers will be available on Zillow, and customers will be able to use the service as a standalone offering or package it with other Zillow home shopping services such as financing, closing and agent selection. Additionally, Zillow customers will be able to work with a licensed Zillow advisor who will serve as a helpful guide in understanding these options.

“Zillow is the most visited brand in online real estate. As we bring the housing super app to life, we’re empowering our millions of visitors to understand all their options and transact in the way that best meets their housing needs,” said Zillow Chief Operating Officer, Jeremy Wacksman. “We know choice is important for customers and they can make the best decision when they see all of their selling options up front — including selling on the open market with a Zillow Premier Agent partner and getting a cash offer from Opendoor. This exclusive partnership will pair Zillow’s audience and brand power with Opendoor’s selling solution in one easy place, so customers can evaluate their selling options and easily package it with other Zillow services to buy and finance their next home.”

OPEN 5 Day Chart

Bounce Play, I think so, here is why!

OPEN is the amazon for real estate tech companies and it has been oversold and is greatly undervalued! I am excited for the future of this real estate darling and you should be too!

[thrive_leads id=’14274′]

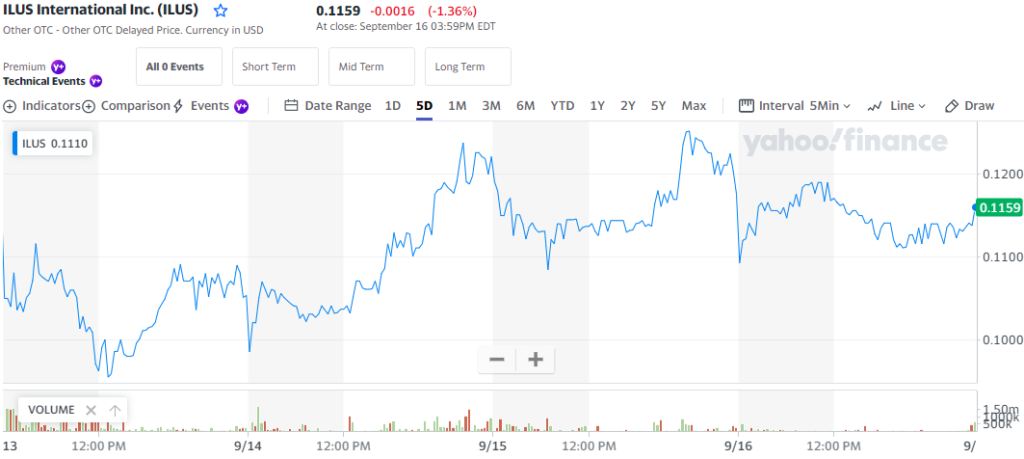

Ilustrato Pictures ILUS Stock Price went Up BIG Monday but WHY?

On Monday September 12th Ilustrato Pictures ILUS Stock Price went Up BIG and in this article I am going to explain why!

Before we do, remember to stop what you are doing and 👇 Sign up for our newsletter to get the latest breakout stocks and trending stocks!

[thrive_leads id=’14274′]

Ilustrato Pictures Company Information

Company Name: Ilustrato Pictures International INc.

Ticker: ILUS

Exchange: OTC

Website: https://ilus-group.com/

Ilustrato Pictures Company Summary:

Ilustrato Pictures International, Inc. is an investment company, which focuses on acquiring businesses in the technology, engineering & manufacturing sector. The company was founded on April 27, 2010 and is headquartered in New York, NY.

ILUS stock price is due to News?

Sept. 15, 2022

With signed Letters of Intent to acquire two wildfire equipment manufacturers, and in line with upcoming subsidiary up list plans, the company is gearing up extensive manufacturing facilities for wildland firefighting equipment and specialist vehicles in Serbia.

In 2022, extreme wildfires have swept across huge swathes of land all over the world, destroying homes and threatening livelihoods. The frequency and severity of wildfires has increased and with globally increasing temperatures and an increased onslaught of droughts; the momentum is showing no signs of slowing. Some reports show that annually, wildfires cause as many as 400,000 global deaths, millions of injuries and billions in property and business costs. It is estimated that the cost of damage from wildfires is as much as 1-2% of GDP in some high-income countries.

ILUS’ emergency response subsidiary, Emergency Response Technologies (ERT), is rolling out acquisition and manufacturing plans which will soon make it the leading global wildland firefighting technology manufacturer and solution provider. As part of several acquisitions which are underway for the subsidiary, the company is in the process of completing the acquisition of two companies which specialize in the manufacture of wildland firefighting equipment. Both companies are already prominent wildfire equipment manufacturers and together, they hold the most extensive global distribution network.

Sept. 09, 2022

Given the substantial progress that has been made by the company in the third quarter, it recently confirmed that it will be making important announcements on the following milestones during the month of September 2022:

- Filing of its Form 10-12G Registration Statement with the U.S. Securities and Exchange Commission (the “SEC”)

- Investment Bank which the company is working with to complete its first planned subsidiary up list to a major stock exchange

- Announcement regarding planned Share lock-up and Share buy-back

- First site which the company is acquiring in Serbia and details on the Investment Project and its incentives

- $100m Revenue acquisition by the company’s industrial subsidiary, Quality Industrial Corp. (OTCQB: QIND)

- Further acquisitions which are in their final stages

In order to become fully reporting, change its name, and up list to the OTCQB, ILUS underwent the audit of its 2020 and 2021 financials, the completion of which was announced on the 30th of August 2022. ILUS is now in the final stages of preparing its Form 10-12G Registration Statement, which it expects to file during September 2022.

ILUS has been in talks with a major investment bank regarding the planned up-list of a subsidiary to a major stock exchange. During this month, the company will make an announcement confirming the investment bank and its associated plans. Linked to the investment bank confirmation, ILUS will make an announcement regarding its planned Share lock-up and Share buy-back.

ILUS 5 Day Chart

6 Reasons Why ILUS Stock Price skyrocketed Monday, here is why!

- The Filing of its Form 10-12G Registration Statement with the U.S. Securities and Exchange Commission (the “SEC”) is a huge announcement and a key contributor to Mondays explosion and subsequent rally.

2. The up list to a major stock exchange is exciting and noteworthy.

3. Announcement regarding planned Share lock-up and Share buy-back is another planned objective which historically reaps PPS increases.

4. First site which the company is acquiring in Serbia and details on the Investment Project and its incentives is driving demand for the stock.

5. $100m Revenue acquisition by the company’s industrial subsidiary, Quality Industrial Corp. (OTCQB: QIND) never hurts!

6. Moreover, ILUS has further acquisitions which are in their final stages

[thrive_leads id=’14274′]

Accelerated Technologies Holding Corp. (OTC:ATHC) is the Momentum, Low Float Play for Next Week?

Let’s take a look at 4 reasons why Accelerated Technologies should be on your HOT list today

#1 Their Proprietary Technology Can Revolutionize The GIG Economy

#2 ATHC Has Less Than 1 Million Shares In The FLOAT!

#3 The Chart Looks GREAT, ATHC Is Up 130% In The Last 10 Days! #4 Accelerated Technologies Issued Incredible News This Year!

#4 Accelerated Technologies Issued Incredible News This Year!

Before we go over the top 4 reasons, let’s get acquainted with Accelerated Technologies.

Company Name: Accelerated Technologies Holding Corp

Ticker: ATHC

Exchange: Fully Reporting on the OTC

Website: https://athc.com/ & https://instamaven.com/

Accelerated Technologies Holding Corp ATHC Company Summary:

Accelerated Technologies Holding Corp. is a technology-driven enterprise specializing in providing user friendly and affordable business processes solutions. Across a broad spectrum of industries, we power business intelligence, efficiency systems, payment processing, A.I. driven marketing, and value-added transactional services, health and wellness apparatuses and technologies.

#1 Reason – Their Proprietary Technology Could Revolutionize The GIG Economy

Take a Look at This Massive Innovation!

Their app Instamaven could revolutionize the “Gig Economy”!

“By 2027 more than 50% of the US, the workforce will participate in the gig economy according to a study by Upwork and Freelancers Union.” Take a look at this research!

Many experts believe we are on the brink of a massive shift away from a 9-5 traditional work schedule to a multi-stream income approach where you can monetize your time and knowledge!

The Projected Market Value of the Giig Economy is $455 BILLION by 2023!

This app is exciting! These are my top 4 favorite features of Instamaven

- Users pay advisors for specialized advice from the available specialists

- You can get paid for your ADVICE! Plus, you can attract clients from countries around the world and earn from your professional experience!

- You can actually exchange funds between InstaMaven users

- All correspondence can be received through push notifications

- Could you imagine if INSTAmaven was bought out by Instagram?

It is clear by the name choice that Accelerated Technologies is positioning Instamaven for a possible buyout by IG!

#2 Reason – ATHC Has Less Than 1 Million Shares In The FLOAT!

There are only 758,000 shares in the FLOAT! That is tiny! You could breathe on it and it should skyrocket!

In fact, on 4/14/22 there were a little over 200,000 shares traded and exploded with 25% GAINS in one trading day!

As most readers are aware, stocks with a low float are the of great interest for day traders as they are often a great vehicle to earning continuous profits in just one trading day or over a few weeks. Due to the fact that low float stocks are very short numbered, they tend to go up in price when demand is increased due to the lack of supply of shares in the public float!

BOOM, low float stocks historically have gone up 100%, 200%, 300% in just a few days!

#3 Reason – The Chart Looks GREAT, ATHC Is Up 130% In The Last 10 Days!

I hate to beat a dead horse but this is how super low float plays look, the smallest amount of volume can have MASSIVE results!

On 6/24 it was trading at $.12 and on 7/5 it closed at $.35 representing a 130% GAIN and this can be the start of something massive!

I don’t like being speculative but I have been diligently following tech companies for the last TWO decades and this feels like insider accumulation to me. Can’t prove it but all the signs are there!

HENCE, there should be BIG news coming and if it does, BOOM there is nothing holding this back!

I’m issuing an immediate ALERT on ATHC!

Traders have an opportunity to be an early investor in a blossoming tech powerhouse because of InstaMaven!

Don’t look back at it like Tesla or Amazon, do your research NOW!

#4 Reason – Accelerated Technologies Issued Incredible News This Year!

Company aims for a $4.00 PPS to uplist to NASDAQ!

Check out this news!

Damiano Coraci will join the Company as Chief Financial Officer and Co-Chairman of the Board of Directors. Mr. Coraci will oversee finance, accounting, and reporting functions. In addition, Mr. Coraci will begin implementing changes to corporate governance and internal audits and establish a Compensation Committee. As a priority, Mr. Coraci will immediately begin internal audits to accommodate ATHC’s up listing efforts to NASDAQ.

To uplist to the NASDAQ the regular bid price of shares of the company’s stock at the time of listing must be at least $4.00.

The company is currently trading at $.26 and needs to reach $4.00 to be uplisted, that would represent a gain of 1,438%!

That would be like investing $10,000 and it turns into $143,800!!

Accelerated Technologies announced on April 14th that they are now “Current” with the OTC Pink Markets!

This OTC “Pink Current” status provides greater insight and transparency as to the Company’s structure and financial health.

They go on to say, “Accelerated continues to explore upgrading more accessible exchanges as soon as it can meet all up listing criteria.”

I find it very interesting that they are making all of these moves while quietly their share price is up 130%!

Accelerated Technologies adds five million ($5,000,000) in annual revenue!

On January 18th they announced a letter of intent to acquire a company with exclusive importation rights, distribution, and sales of food and beverage products.

The intended strategic acquisition will fast-track ATHC’s deployment of its ROMPOS small business solution while adding in excess of five million ($5,000,000) in annual revenue. Here is the press release

Let me REPEAT, $5 million in revenue added through the acquisition!

Let’s review the 4 reasons why Accelerated Technologies could be the FinTech Play of the Week!

#1 Their Proprietary Technology Could Revolutionize The GIG Economy

#2 ATHC Has Less Than 1 Million Shares In The FLOAT!

#3 The Chart Looks GREAT, ATHC Is Up 130% In The Last 10 Days!

#4 Accelerated Technologies Issued Incredible News This Year!

DISCLAIMER

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation has been compensated $5,400 by Awareness Consulting Network for profiling ATHC. We own ZERO shares in ATHC.

We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

CXKJ Stock Price is up over 44%, is it over? Exclusive Report

CX Network Group CXKJ stock price is up 44 YTD & volume is up 22%, but can this breakout stock go even higher?

There is an old adage, “two heads are better than one”, so let’s collaborate on CXKJ and compare notes.

In this in depth report, I look at 5 KPIs: Technical Analysis, Volume, News Cycle, Fundamentals & awareness campaigns. I believe the stock market is not gambling, it is also not fool proof, but I have developed a dependable system. I have found some critical components to success for CXKJ, tell me what you think.

Before we get started, I like being methodical and easy to understand so I have developed a ranking system for my stocks. I call it, Alexander Goldman’s “HOT Stock Ranking!”

The official heat level for CXKJ is, a 🔥🔥 2 out of 4

Before I get ahead of myself and just jump right into this exciting breakout stock, I wanted to introduce myself.

Hello 🙋♂️ My name is Alexander Goldman. I have been trading small cap stocks, breakout stocks and trending stocks for 20 years now. I’m accredited for establishing the coveted HOT Stock Reporting system for breakout stocks.

To find out more about my story, CLICK HERE

[thrive_leads id=’28419′]

CX Network Group Company Information

Company Name: CX Network Group Inc.

Ticker: CXKJ

Exchange: OTC

Website: https://www.cxnetwork.com/

CX Network Group Company Summary:

CX Network Group, Inc. focuses on development and operation of online dating and mobile gaming products. Its online dating products are Little Love and Hotchat. The company mobile applications helps users to search and communicate with other like-minded individuals. CX Network Group was founded by Edward Sanders on September 3, 2010 and is headquartered in Dongguan, China.

CXKJ stock price is due to News?

No relevant news

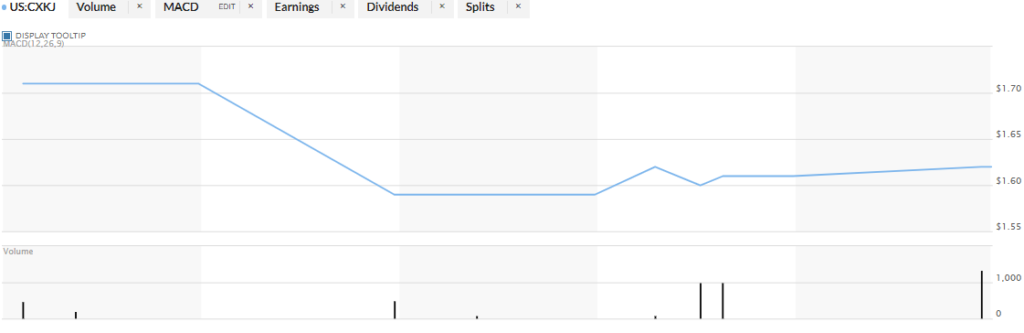

Trending Stock CXKJ 5 Day Chart

CXKJ Stock Price HOT Stock Grade:

The official heat level for CXKJ is, a 🔥🔥 2 out of 4 . Here are my takeaways on it and why it is just a 3 out of 4. Do you agree?

CXKJ Trading Volume

The volume, is trading at an increase of 25% over the average which indicates a higher demand in the stock.

Trading 101: volume is measured in the number of shares traded. Traders look to volume to determine liquidity and combine changes in volume with technical indicators to make trading decisions. So, let’s take a look at the technical indicators.

CXKJ Technicals

The technical analysis “chart reading”, it is bullish and has been that way since the early part of this month with a steady ascending channel. It is bullish but what goes up must come down! Be careful

Trading 101: Technical indicators are technical tools that help in analyzing the movement in the stock prices whether the ongoing trend is going to continue or reverse. It helps the traders to make entry and exit decisions of a particular stock. Technical indicators can be leading or lagging indicators.

CXKJ News Cycle

The news, there is no significant news.

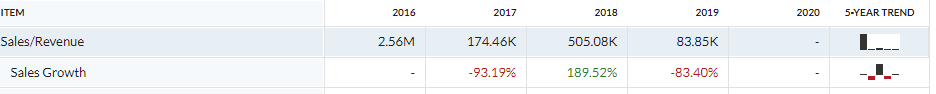

CXKJ Fundamentals

The fundamentals, there is exciting financial filings associated with this stock, “265% growth”!

Trading 101: Fundamental trading is a method where a trader focuses on company-specific events to determine which stock to buy and when to buy it. Trading on fundamentals is more closely associated with a buy-and-hold strategy rather than short-term trading.

CXKJ Awareness

Marketing efforts “Awareness Campaigns”, I have not found marketing efforts around the investor awareness of this company. Hence the 3 out of 4. Do you agree? Write me a line at [email protected]

Again, two heads are better than one, let’s work together to have the best trading year of our lives!

To receive my 🔥🔥🔥🔥 HOT stock as a thank you for joining our FREE newsletter, sign up today.

To find out more about my story, CLICK HERE

👇 Sign up for our newsletter to get the latest 🔥🔥🔥🔥 HOT stocks and we can compare notes!👇

[thrive_leads id=’28419′]