1

1

1

If you are looking for a lucrative investment opportunity in the lithium sector, you need to act fast and start your research on Recharge Resources Ltd. (RR:CSE) (RECHF:OTC) before it’s too late.

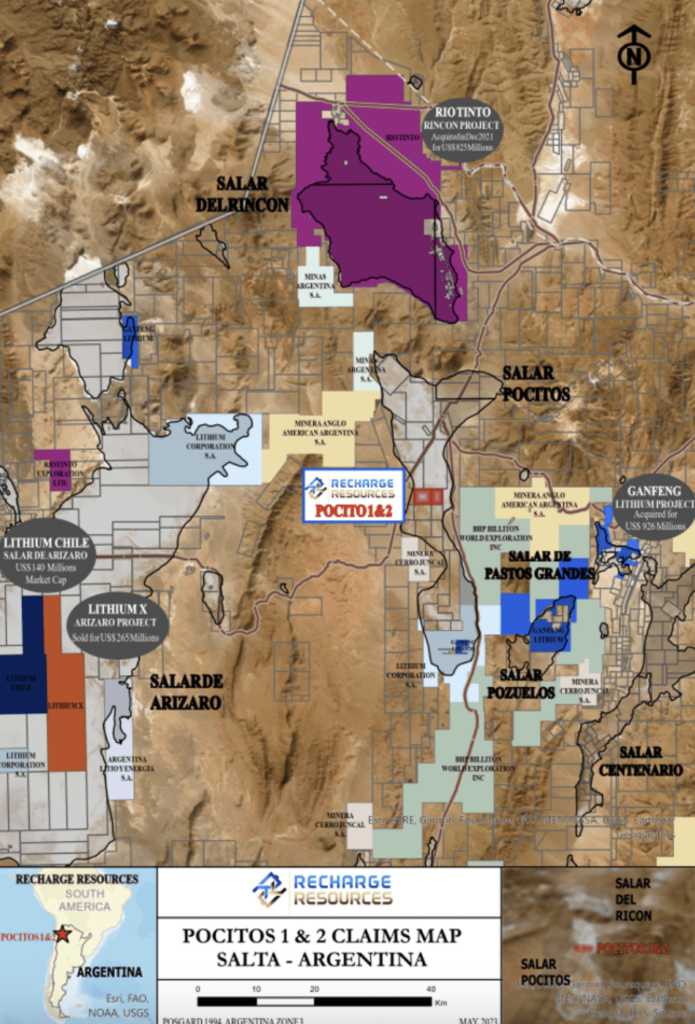

Recharge Resources is a Canadian company with a 100% interest in the Pocitos 1 Lithium Brine Project in Salta, Argentina, one of the most promising and advanced lithium projects in the world.

Take a look at his price target issued by Intela Research

There is so much buzz about Recharge Resources Ltd. (RR:CSE) (RECHF:OTC), take a peek at this article!

I will be covering THREE catalysts that could make demand for RECHF increase massively, but there are so many reasons to turn your attention to Recharge Resources Ltd. Here are a few notable aspects that should not be overlooked:

Diversification – As a diversified battery metals company Recharge Resources focuses on all 3 elements of battery metals, not just one, including lithium, nickel, cobalt. As each element works in tandem with another to power lithium-ion batteries (LIBs), Recharge Resources believes it is imperative to optimize each area of the battery metals sector.

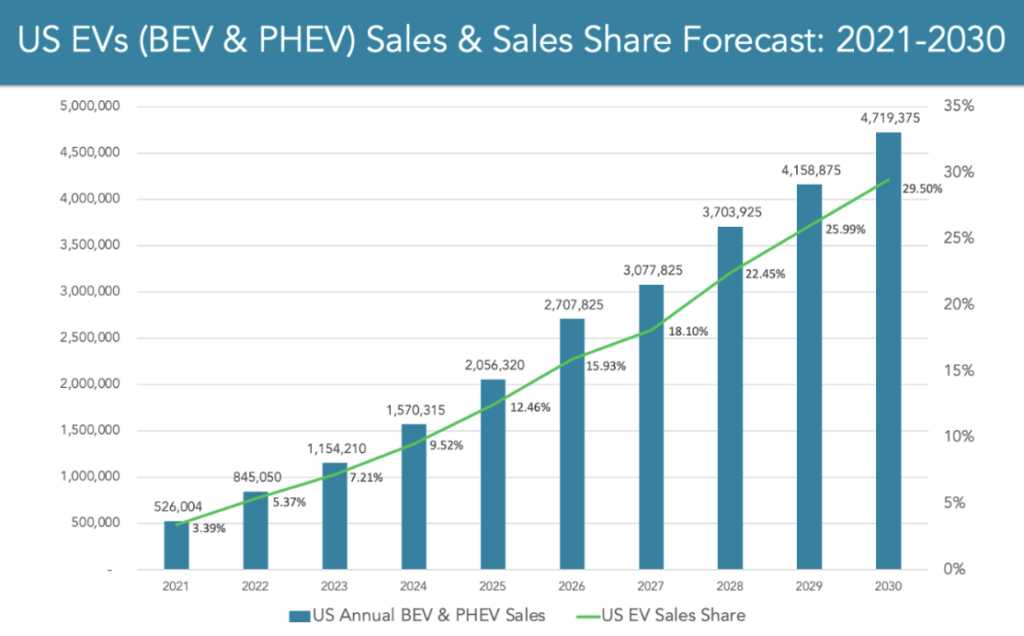

Lithium Battery Segment – Total annual demand for batteries in 2030 is now 35% higher than originally forecasted in 2020. This shift can be attributed to the increase in demand for passenger electric vehicles, according to BloombergNEF Analysts.

Clean Energy – Green, renewable energy is the key to a more sustainable future. Driven by the electrifying race to meet the increasing demand of battery powered vehicles, Recharge Resources is dedicated to meet the needs of this rapidly growing market.

Press Release:

October 4, 2023 – Recharge Resources Ltd. (“Recharge” or the “Company”) (RR:CSE) (RECHF:OTC) (SL5:Frankfurt) is pleased to provide the following update on the company’s Pocitos One Lithium Brine Project (“Pocitos 1” or “the project”) in Salta, Argentina.

Acquisition of 100% interest in Pocitos 1

As announced on August 15th, 2023 the company entered in to an agreement to acquire a 100% interest in the 800 Has Pocitos 1 Lithium Brine Project free of royalty payments previously contemplated under the company’s Spey Resources option agreement.

The company is pleased to announce the Pocitos 1 exploration licence was paid for and the public deed noting the transfer of ownership to the company’s 100% owned subsidiary Recharge Resources Argentina S.A.U. has been signed by all parties, notarised and lodged with the Mining Court in Salta, Argentina. All canon payments were up-to-date for ownership transfer to Recharge. link

Here are three catalysts that make Recharge Resources RECHF a possible – investment for savvy investors:

#1 Argentina Could Be The Future of Energy and Mobility

Argentina as a new possible epicenter of lithium. Argentina has the third-largest lithium reserves in the world, after Chile and Australia, and is part of the so-called “lithium triangle” that encompasses Bolivia and Chile as well. KEY STATISTIC: Argentina holds over 21% 1 of the world’s lithium resources. Argentina has favorable geology, climate, infrastructure and government support for lithium development. Argentina is also strategically located near major lithium markets such as China, Europe and the US. Recharge Resources is well-positioned to capitalize on Argentina’s lithium potential, as it owns a large and high-grade lithium brine project in the Salar de Pocitos, a prolific salt flat in the lithium-rich Puna region of northwestern Argentina.

Argentina is a country with vast natural resources and a strategic location in South America. Among its many assets, one of the most promising is its lithium potential. Lithium is a key element for the production of batteries, electric vehicles, renewable energy and other technologies that are shaping the future of the world. Argentina’s lithium sector is growing rapidly, attracting investments from global companies and generating employment and development opportunities for its people. In this article, we will explore the reasons why Argentina is a significant player in the lithium market and why you should consider investing in this emerging industry.

#2 RECHF– Lithium Is Booming

Lithium is a key element in the transition to a low-carbon economy. It is used in batteries for electric vehicles, renewable energy storage, and consumer electronics. The demand for lithium is expected to grow exponentially in the next decade, as more countries adopt policies to reduce greenhouse gas emissions and promote clean energy sources. However, the supply of lithium is not keeping up with the demand, creating a gap that offers a unique opportunity for investors who want to capitalize on this emerging market.

The lithium demand worldwide. Lithium is a key component of batteries for electric vehicles (EVs), renewable energy storage, consumer electronics and other applications. The demand for lithium is expected to grow exponentially in the coming years, as the world transitions to a low-carbon economy and adopts clean energy technologies. According to BloombergNEF, the global demand for lithium could increase by more than 10 times by 2030, reaching over 1.8 million tonnes per year. Recharge Resources is poised to meet this surging demand, as it aims to produce up to 20,000 tonnes of lithium chloride/carbonate per year from its Pocitos 1 project,(2) under a letter of intent with Richlink Capital Pty Ltd.

The lithium sector is composed of three main segments: mining, processing, and battery manufacturing. Each segment has its own challenges and opportunities, but they are all interconnected and dependent on each other. Mining involves extracting lithium from brine or hard rock deposits, which are distributed unevenly across the globe. Processing involves refining the raw material into lithium carbonate or hydroxide, which are the main inputs for battery production. Battery manufacturing involves assembling the lithium-ion cells into packs that can power various applications.

The lithium sector is still in its early stages of development and has a high potential for growth and innovation. Investors who can identify the best opportunities and partner with the best companies will be able to reap the benefits of this exciting and rewarding sector.

#3 Strategic Acquisitions

The value and importance of their acquisition of Pocitos Project 1 in Argentina. Recharge Resources acquired a 100% interest in the Pocitos 1 project in August 2023, through a direct deal with Ekeko SA, the previous property owner. This acquisition was a strategic move that eliminated any royalty payments and gave Recharge Resources full control over the project’s development and production. The project also has high lithium grades, low impurities, excellent porosity and permeability, and proven extraction methods that achieved over 94% recovery of lithium from the brine. (3)

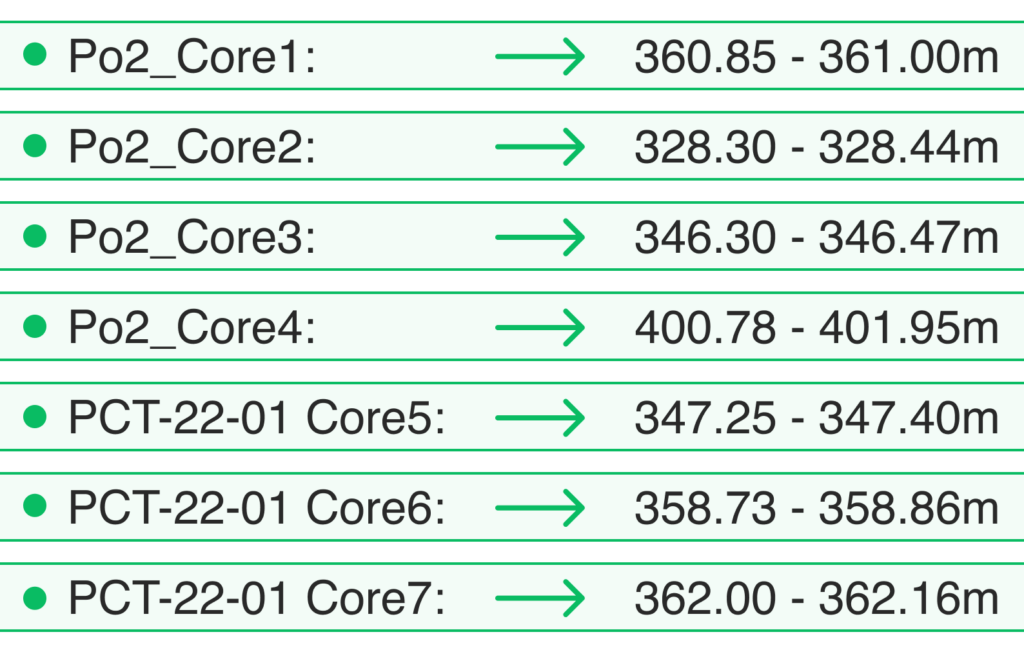

Recharge has recently taken a significant step towards unlocking the potential of the Pocitos 1 Lithium Brine Project in Salta, Argentina. The company announced that it has successfully sourced drilling core samples from three drill holes in this promising lithium-rich region. These core samples have now made their way to Core Laboratories in Perth, Australia, where they will undergo crucial testing for porosity and transmissivity. The results of these tests will be integrated into the resource estimate calculations currently being prepared by WSP, a prominent player in the industry. (4)

Core Laboratories is a globally recognized leader in providing proprietary and patented reservoir description and production enhancement services. They are renowned for their technology-driven solutions that enhance production capabilities. Core Laboratories consistently seeks to develop and acquire technologies that complement their existing offerings, disseminating these innovations throughout their global network.

Depth Information

Let’s recap the 3 catalysts that could make (RR:CSE) (RECHF:OTC) a real player in the booming Lithium market!

#1 Argentina Could Be The Future of Energy and Mobility

#2 Lithium Is Booming

#3 Strategic Acquisitions

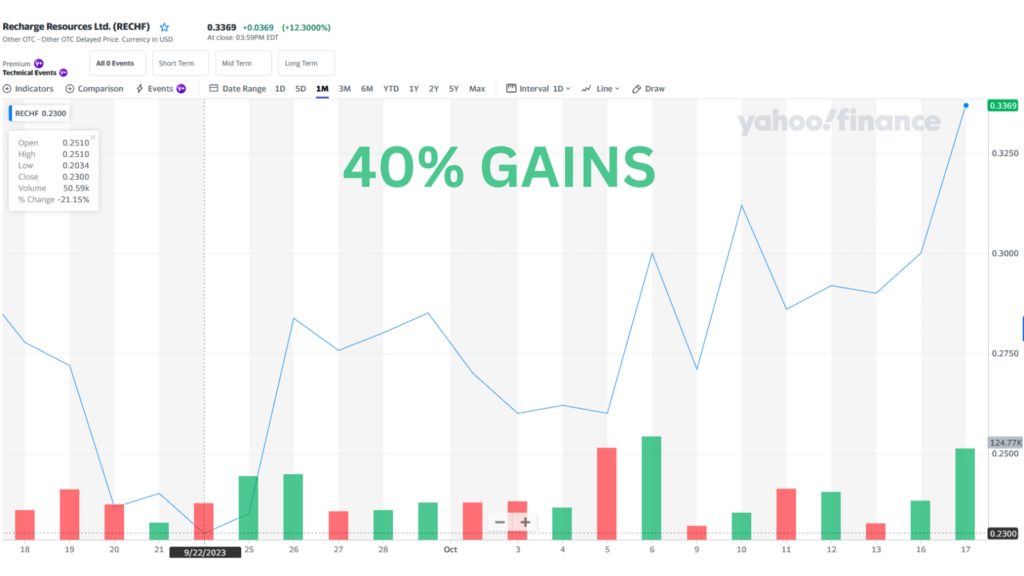

These three catalysts make Recharge Resources RECHF an attractive investment opportunity that you should start your research tonight. The company has a strong management team with extensive experience in the lithium sector, a solid financial position with over $10 million in cash and no debt, and a clear vision to become a leading producer of low-cost and high-quality lithium products. The company’s share price has already increased by over 40% in the last month, but there may be plenty of room for growth as the company advances its Pocitos 1 project towards production.

Take a look at the chart!

Don’t wait any longer. Start researching Recharge Resources RECHF today and you may just reap the rewards of the lithium boom tomorrow.

Condensed Disclaimer

Small Cap Exclusive is owned and operated by King Tide Media, LLC, which is a US based corporation & has been compensated up to $10,000 from RECHF for profiling Life Water Media with coverage beginning 10/17/23-10/18/23. We own ZERO shares in RECHF.